(TheNewswire)

|

|||||||||

|

|

||||||||

Vancouver, British Columbia – TheNewswire - February 18, 2026 – Adamera Minerals Corp. (TSX-V: ADZ;OTC: DDNFF) (“Adamera& or the “Company&) has identified a large-scale copper-gold target on its 100% owned, South Hedley Copper Gold Project. The target has the potential to transform the Max prospect into a district-scale copper-gold porphyry opportunity.

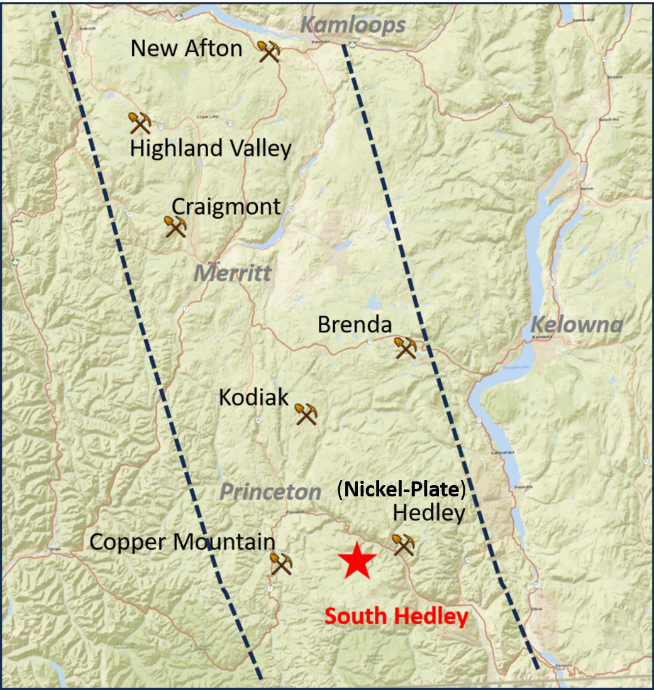

The project is located between the historic Nickel Plate gold mine and the active Copper Mountain mine in southern B.C. (See Figure 1). A Notice of Work has been submitted to facilitate induced polarization surveys and a subsequent drilling program later in 2026.

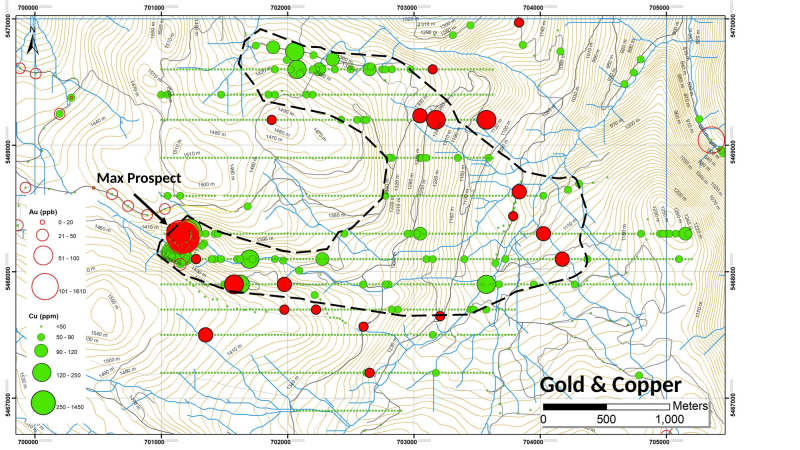

Adamera previously reported on the Max and Glix Prospects at South Hedley (see News Releases dated Nov. 12, 2025, Nov. 26, 2025 and Dec.16, 2025). To date, work has primarily consisted of geophysical surveying, geochemical sampling and prospecting that defined two gold and base metal targets. Combining the data from the Max prospect with surrounding data indicates that Max falls on the edge of a horseshoe-shaped geochemical anomaly (See Figure 2). Within the horseshoe-shaped feature is a 2 square kilometre magnetic anomaly that suggests a possible buried diorite intrusion and potentially a large-scale mineralized system (see Figure 4). Geological mapping indicates that the target appears to be covered by a barren volcanic tuff.

“The coincidence of strong copper-gold geochemistry and a 3-D inversion magnetic feature within a copper-gold prospective corridor is precisely what we look for in a tier-1 exploration target,& stated Mark Kolebaba, President and CEO of Adamera Minerals. “We have moved beyond the isolated ‘Max Prospect' to identifying a 2 square kilometre target with a geophysical signature suggestive of a buried dioritic intrusive. We will now apply more detailed prospecting and an induced polarization survey to define the distribution of sulphides beneath the barren tuff. This marks a technical turning point for the project.&

The 20,000-hectare South Hedley property is situated within the Quesnel Trough, which is a fertile crustal-scale structure hosting several major deposits such as New Afton, Highland Valley, and Copper Mountain. The Max anomaly has a north-northwest trend, aligning with the regional magmatic axis that controls mineralization at the nearby Copper Mountain and Nickel Plate camps (See Figure 1).

Figure 1 — South Hedley is located between the Nickel Plate Gold Copper Skarn and Copper Mountain Mine and falls within one of Canada&s most productive mineral corridors, the Quesnel Trough regional porphyry belt which contains several other copper-gold deposits including New Afton, Highland Valley, Craigmont and Brenda.

Technical Interpretation

Below are a series of maps and observations that led to this current interpretation.

-

Geochemical Zonation Intensity: The survey defined a marked zonation pattern typical of porphyry-style copper-gold systems. Copper values reach up to 1,450 ppm, while gold values peak at 1.61 g/t (1,610 ppb). The gold anomalies are spatially associated with copper highs but display a more structurally focused distribution along internal corridors and margins of the broader copper footprint.

Click Image To View Full Size

Figure 2 - Integrates gold (red) and copper (green) soil geochemistry to define a 3 kilometre horseshoe-shaped anomaly consistent with the outer expression of a large hydrothermal system. The data reveals a zonation pattern typical of a porphyry system. The Max Prospect, situated on the southwest margin, represents the strongest coincidence of these metals, identifying a high-priority target area within the broader footprint.

-

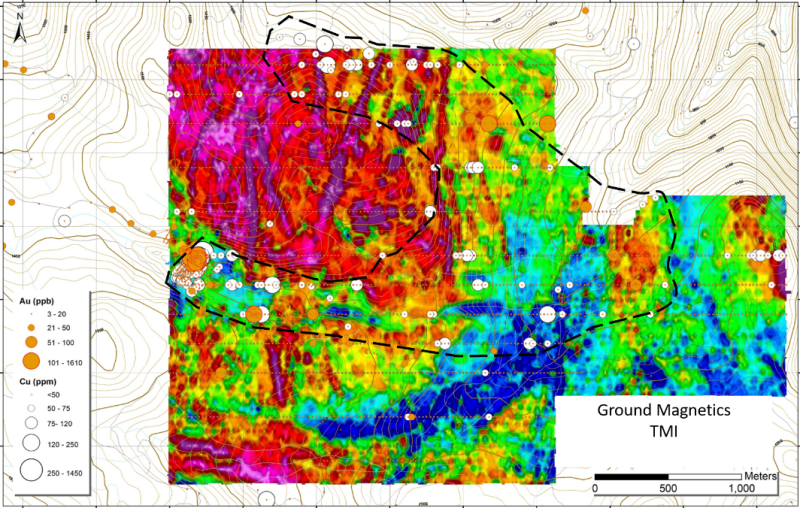

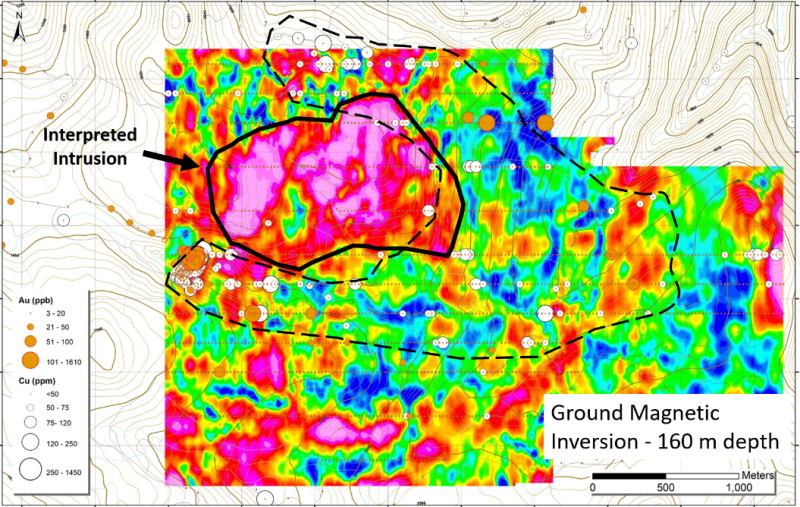

Ground Magnetic Data: Total magnetic Intensity (TMI) ground survey data shows high frequency responses over the area of increased volcanic cover thickness (see Figure 3). A 3D inversion of the data reveals a persistent magnetic high feature that becomes coherent at depths below 110 metres. This feature is approximately 1 X 2 kilometers in size and is interpreted as a possible buried diorite intrusion, which is a recognised source for mineralization in the Hedley and Copper Mountain districts.

Figure 3 – Ground magnetic data – TMI shows shallow high frequency magnetic high response of near surface rocks in the area in relation to the copper gold in soil anomalies. The black dash line outlines the general extent of the copper (white) and gold (orange) in soil. Figure 4. below shows inversion data whereby the high frequency shallow response is essentially stripped away to expose underlying lower frequency deeper response.

Figure 4 – Presents the ground magnetic inversion at a depth of 160 m and shows a coherent magnetic high feature measuring 1 x 2 km (outlined by solid black line). It is surrounded by the copper (white) and gold (orange) soil anomaly (black dash line) and is interpretated as a possible porphyry intrusion.

Target Model: The strongest gold and copper anomalies are at the margins of this buried magnetic high, suggesting a classic skarn or porphyry contact setting. The Company interprets the observed "horseshoe" geochemical anomaly as the outer expression of a “blind& intrusive system. The magnetic feature outlined by a black line in Figure 4 is the target hydrothermal system.

Expansion of the Max Prospect

The Max Prospect, which is a recent discovery of high gold and copper values in soil and rock, is now interpreted as the exposed southwest margin of a larger copper – gold system. The high gold and copper values are situated in a steeply incised valley that suggest underlying mineralized rocks associated to an intrusive are exposed at lower topographic levels.

Rocks with alteration and sulphides (see Photo 1 below) located below the barren volcanic tuffs have been identified during soil sampling. The distribution of these rocks will be mapped and sampled once the snow melts in the spring.

Photo 1. Rock Outcrop at Max Prospect showing brecciation, alteration, veining and inclusion of sulphides below the volcanic tuff cover. The photo was taken on a steep slope near high gold and copper values in soil.

Next Steps

The Company has defined a clear path to drill testing:

-

Drill Permitting: A Notice of Work (permit application) for drilling has been submitted. This diamond drill program will test high-priority target areas.

-

Geophysics: An Induced Polarization (IP) survey Notice of Work (permit application) has been submitted. This survey will map chargeability and resistivity at depth, aiding in defining the distribution of sulphide mineralization and alteration within the system.

-

Expanded Geochemistry: Further analyses on existing samples and infill sampling surveys will be completed in order to assist in vectoring within the mineralised system.

In addition to the expanded South Hedley target, the Company has identified a second prospect on the property called the Glix Prospect. This target is located approximately 15 kilometres from the Max target. Based on recent geological, geochemical and geophysical data. the Glix target is considered to be comparable to a gold bearing skarn environment, similar to the Nickel Plate Mine. Results from the November program are expected soon.

Qualified Person Martin St-Pierre, P.Geo., a Qualified Person as defined by National Instrument 43-101, has reviewed and approved the technical data in this release.

About Adamera Minerals Corp. Adamera Minerals Corp. is exploring for high-grade gold silver and copper deposits in areas of Washington State and British Columbia with well developed infrastructure.

On behalf of the Board of Directors,

Mark Kolebaba

President & CEO

For additional information please contact:

Email: info@Adamera.com

Website: www.Adamera.com

Phone: (604) 307-6450

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release. The TSX Venture Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release. Statements in this press release, other than purely historical information, including statements relating to the Company&s future plans and objectives or expected results, may include forward-looking statements. Forward-looking statements are based on numerous assumptions and are subject to all of the risks and uncertainties inherent in resource exploration and development. As a result, actual results may vary materially from those described in the forward-looking statements.

Copyright (c) 2026 TheNewswire - All rights reserved.