HIGHLIGHTS

-

On February 5th , 2026, the Company completed two financings totaling CAD ~$63M ( See News Release ), including a strategic investment by Queens Road Capital;

-

The quantum and strong institutional support of the combined financings is recognition of the highly impactful results and project de-risking achieved during the 2025 Angilak Exploration Program;

-

ATHA is now one of the best capitalized uranium explorers globally, with funding secured for multiple exploration campaigns focused at its 100%-owned Angilak Uranium Project;

-

2026 Angilak Exploration Program will be the largest to date on the project, following up on the highly successful 2025 campaign, which resulted in the discovery of five new uranium showings - the new discoveries are within the Angikuni Basin and are in addition to the Lac 50 Deposit;

-

An additional diamond drill is being prepared for mobilization to Angilak by Base Diamond Drilling Ltd. - ATHA's drilling service provider since 2024. The owner of Base along with ATHA's CEO Troy Boisjoli led the ramp up in drilling activities at NexGen's Rook I Project to ten diamond drills;

-

Full mobilization to Angilak will commence in March with exploration activities beginning in late April to early May;

-

2026 Exploration will focus on:

-

Expanding the footprint of mineralization at the Lac 50 Deposit Corridor - which hosts the Lac 50 Deposit with a 2024 Exploration Target * ranging from 60.8 M lbs to 98.2 M lbs with an average grade range from 0.37% U 3 O 8 to 0.48% U 3 O 8 , and remains open and unconstrained.

-

*The stated potential quantity and grade is conceptual in nature, and there has been insufficient exploration to define a mineral resource, and it is uncertain if further exploration will result in the target being delineated as a mineral resource. The conceptual target for further exploration is based on available diamond drillhole data including the 2024 drill program results, and the ranges of potential quantity and grade were derived from conceptual vein wireframes, drill core assays, grade interpolation and applied uncertainty ranges. The Angilak Project technical report can be accessed on the Company's SEDAR+ profile at www.sedarplus.ca;

-

-

Mineralized RIB Corridor: Additional discoveries and expansion;

-

KU-Nine Iron Corridor: Additional discoveries and expansion;

-

Angilak greenfields: Acquiring full suit of geophysics coverage across the Angikuni Basin, identifying and de-risking additional targets using ATHA's proven exploration approach.

-

-

Additional detailed information regarding the 2026 Angilak Exploration Program will be provided in Q1 2026.

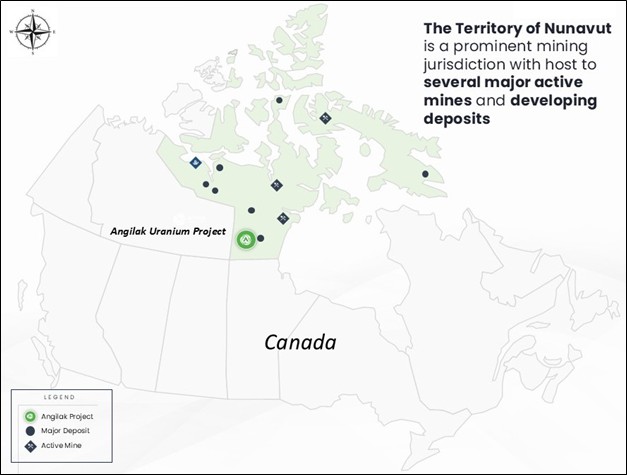

VANCOUVER, BRITISH COLUMBIA / ACCESS Newswire / February 9, 2026 / ATHA Energy Corp. (TSX.V:SASK)(FRA:X5U)(OTCQB:SASKF) ("ATHA" or the "Company"), is pleased to announce use of proceeds from its recently completed combined financing totaling approximately ~CAD $63 Million will focus on advancing its 100%-owned Angilak Uranium Project in Nunavut, Canada (Figure 1). Planning for the 2026 Angilak Exploration Program is underway, focusing on continued discovery and expansion along the MRC, KU-Nine Iron, and Lac 50 Deposit Corridors.

Additionally, ATHA will advance complete geophysical coverage across the entire Angikuni Basin utilizing its systematic derisking approach that resulted in the discovery of five new uranium showings within the Angikuni Basin. With complete coverage across the Angikuni, ATHA anticipates adding numerous additional derisked targets to its growing portfolio of drill ready areas.

The Company anticipates that the 2026 Angilak Exploration Program will be the largest to date at the project; the program will combined diamond drilling, aerial geophysics and surficial mapping - focused on discovery and expansion of known zones of mineralization. 2026 mobilization is scheduled to commence in March, including the arrival of an additional diamond drill. Exploration activities are slated to kick off the end of April to early May.

References for Historic Diamond Drilling Results and Surficial Sampling

1 For additional information regarding ATHA's Angilak Project please refer to the Technical Report entitled "Technical Report on the Angilak Property, Nunavut, Canada" with an effective date of October 14, 2025, prepared by Matt Batty, MSc, P. Geo, who is a "qualified person" under NI 43-101, available under ATHA's SEDAR+ profile at www.sedarplus.ca.

Qualified Person

The scientific and technical information contained in this news release have been reviewed and approved by Cliff Revering, P.Eng., Vice President, Exploration of ATHA, who is a "qualified person" as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About ATHA Energy

ATHA Energy is a uranium mineral exploration Company focused on advancing exploration at scale at its flagship Angilak Project in southern Nunavut, where ATHA controls 100% of the Angikuni Basin. ATHA offers significant exposure to uranium discovery, controlling the largest cumulative prospective exploration land package (>7 million acres) across Canada's most prominent basins for uranium discoveries, and 10% carried interest exposure in key Athabasca Basin exploration projects operated by NexGen Energy Ltd. (TSX: NXE) and IsoEnergy Ltd. (TSX: ISO). ATHA is institutionally backed, led by a strategic investment from Queens Road Capital Investment (TSX: QRC).

For more information visit www.athaenergy.com and review ATHA's company profile on SEDAR+ at www.sedarplus.ca.

On Behalf of the Board of Directors

Troy Boisjoli, CEO, ATHA Energy Corp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

For more information, please contact:

Troy Boisjoli

Chief Executive Officer

Email: info@athaenergy.com

Website: www.athaenergy.com

Phone: 1-(236)-521-0526

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. Generally, forward-looking information can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved". These forward-looking statements or information may relate to ATHA's proposed exploration program, including statements with respect to the expected benefits of ATHA's proposed exploration program, any results that may be derived from ATHA's proposed exploration program, the timing, scope, nature, breadth and other information related to ATHA's proposed exploration program, any results that may be derived from the diversification of ATHA's portfolio, the prospects of ATHA's projects, including mineral resources estimates and mineralization of each project, the prospects of ATHA's business plans and any expectations with respect to defining mineral resources or mineral reserves on any of ATHA's projects, and any expectation with respect to any permitting, development or other work that may be required to bring any of the projects into development or production.

Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management at the time, are inherently subject to business, market and economic risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements. Such assumptions include, but are not limited to, assumptions that the anticipated benefits of ATHA's proposed exploration program will be realized, that no additional permit or licenses will be required in connection with ATHA's exploration programs, the ability of ATHA to complete its exploration activities as currently expected and on the current anticipated timelines, including ATHA's proposed exploration program, that ATHA will be able to execute on its current plans, that ATHA's proposed explorations will yield results as expected, and that general business and economic conditions will not change in a material adverse manner. Although ATHA has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking information.

Such statements represent the current view of ATHA with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by ATHA, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Risks and uncertainties include, but are not limited to the following: inability of ATHA to realize the benefits anticipated from the exploration and drilling targets described herein or elsewhere; in ability of ATHA to complete current exploration plans as presently anticipated or at all; inability for ATHA to economically realize on the benefits, if any, derived from the exploration program; failure to complete business plans as it currently anticipated; overdiversification of ATHA's portfolio; failure to realize on benefits, if any, of a diversified portfolio; unanticipated changes in market price for ATHA shares; changes to ATHA's current and future business and exploration plans and the strategic alternatives available thereto; growth prospects and outlook of the business of ATHA; and the ability to advance the Company projects and its proposed exploration program; risks inherent in mineral exploration including risks related worker safety, weather and other natural occurrences, accidents, availability of personnel and equipment, and other factors; aboriginal title; failure to obtain regulatory and permitting approvals; no known mineral resources/reserves; reliance on key management and other personnel; competition; changes in laws and regulations; uninsurable risks; delays in governmental and other approvals, community relations; stock market conditions generally; demand, supply and pricing for uranium; and general economic and political conditions in Canada, Australia and other jurisdictions where ATHA conducts business. Other factors which could materially affect such forward-looking information are described in the filings of ATHA with the Canadian securities regulators which are available on ATHA's profile on SEDAR+ at www.sedarplus.ca. ATHA does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

SOURCE: ATHA Energy Corp.

View the original press release on ACCESS Newswire