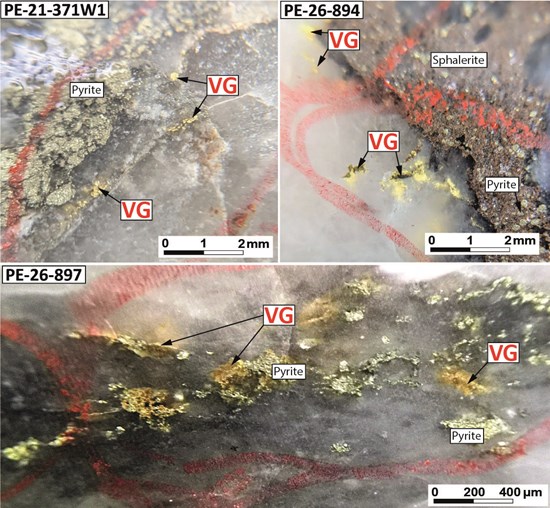

Montreal, Quebec--(Newsfile Corp. - February 26, 2026) - Amex Exploration Inc. (TSXV: AMX) (FSE: MX0) (OTCQX: AMXEF) ("Amex" or "the Company") is pleased to announce further results from the ongoing grade control program designed for the bulk sample ("bulk sample" or "bulk") of the Champagne Zone (see Figures 1-3). As the program continues, visuals from logged holes awaiting assay results remain positive, with visible gold ("VG") being regularly noted. The main objective of the program is to reconcile the existing block model through infill drilling while further derisking the stopes to be extracted for the bulk sample. See Table 1 for assay results and Figure 4 for photos of visible gold mineralization in today's drilling.

Champagne Zone Grade Control Drill Results:

-

110.05 g/t Au and 7.20 g/t Ag over 2.15 m, including 233.96 g/t Au and 14.90 g/t Ag over 1.00 m at a vertical depth of ~145 m in hole PE-26-894

-

52.36 g/t Au and 8.90 g/t Ag over 0.5 m at a vertical depth of ~130 m in hole PE-21-371W1

Aaron Stone, VP Exploration of Amex Exploration commented, "Today's results once again display the robustness and continuity of high-grade mineralization within the Champagne Zone and the overall accuracy of our existing block model. Based on last years Preliminary Economic Assessment ("PEA"), the economics of this zone are impressive at a range of gold prices. The Champagne Zone will be the main focus of not only the bulk sample but also Phase 1 of operations at Perron, as outlined in our updated PEA (see press release dated September 4, 2025). Concentrations of gold mineralization such as the Champagne Zone are rare in our industry. The Amex geological team strives to apply our knowledge on our recently expanded land package (see press release dated December 1, 2025) in the search for another gem on our prosperous yet underexplored greenstone belt."

Victor Cantore, President and CEO of Amex Exploration added, "The feasibility study ("FS") for Phase 1 is advancing well and remains on track for the end of Q1. We look forward to releasing the economics on the toll milling phase of the operation. The Champagne Zone is not only unique for its high-grade, but its near vertical geometry which facilitates underground mining in a very economic manner. The Amex team is excited to continue to deliver on our development plan for Perron."

Bulk Sample Grade Control Drill Program

A grade control drill program is a short-spaced, high-detail drilling program carried out to guide mine production to precisely define ore and waste boundaries before mining. It is more detailed than exploration or resource drilling and is primarily used to improve short-term resource models and production planning.

The grade control drill program is essential to mining the bulk sample and was designed to further increase confidence in the existing block model at Perron. The program aims to confirm that the ideal stopes have been selected for the bulk operation. The existing drill spacing in the area chosen for the bulk sample was between 12-20 metres, meaning the selected stopes were already containing M&I (measured and indicated) ounces within the existing resource model. Upon completion of the program, the drill spacing will be brought down to approximately 5-10 metres and positively reduce the geological risk associated to upgrading indicated resources to measures resources.

While the drill holes for the grade control program are relatively shallow in nature, directional drilling technology is being utilised to ensure the targets are hit with precision.

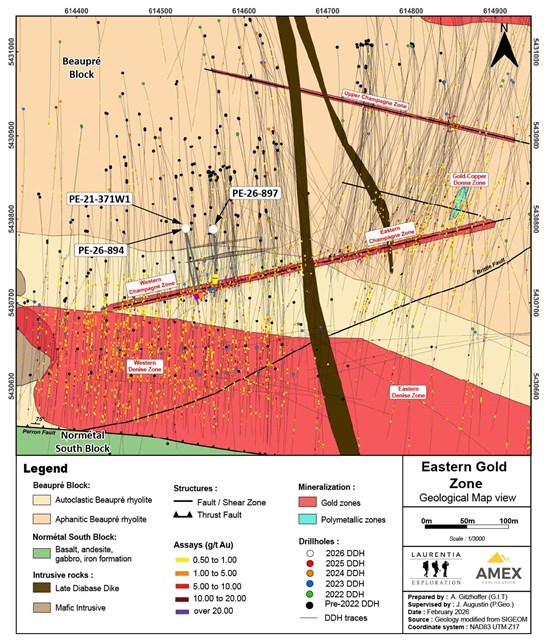

Figure 1: Geological map of the Champagne Zone displaying today's diamond holes drilled as a part of the grade control program.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2667/285453_a9dd5b6884580929_002full.jpg

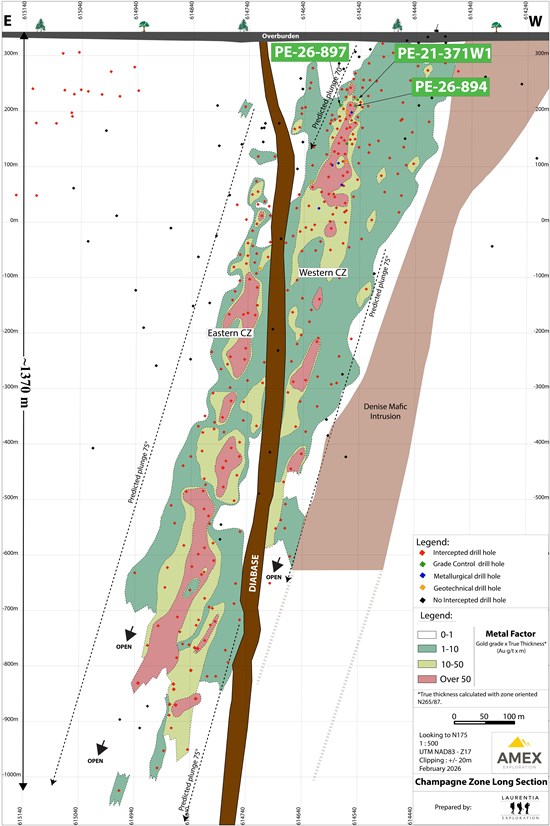

Figure 2: Longitudinal of the Champagne Zone looking to the south displaying the pierce points of today's grade control holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2667/285453_a9dd5b6884580929_003full.jpg

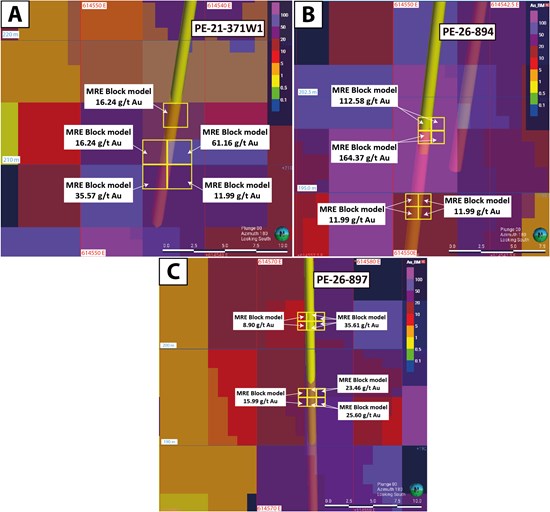

Figure 3: Screenshot from Perron Leapfrog Geo project showing the intercepts of grade control holes into the existing block model: A) PE-21-371W1 with assay results of up to 52.36 g/t Au; B) PE-26-894 with assay results of up to 233.96 g/t Au; C) PE-26-897 with assay results of up to 12.03 g/t Au.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2667/285453_a9dd5b6884580929_004full.jpg

*Note - the existing block model is overall performing well against the current infill grade control drilling. While some holes may contain higher grade assays against the block model, others may come in below. However, the overall performance of the existing estimate appears to be strong. Readers are caution that this assumption will not be confirmed until the remodelling of the area surrounding the bulk sample, which will begin upon completion of the grade control drill program.

Figure 4: Photos of visible gold in the Champagne Zone from drill holes, PE-21-371W1, PE-26-894 and PE-26-897. Mineralization is represented by gold bearing quartz-carbonate-sulfide veins with visible gold hosted in the aphanitic Beaupré rhyolite. Abbreviation: VG - Visible Gold.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2667/285453_a9dd5b6884580929_005full.jpg

As the grade control program advances, positive visuals on mineralization are continuing to be logged in current drill holes. Samples are currently being processed at the laboratory and should be received shortly. The Company will announce further results once they have been received, compiled and QA/QC is validated.

Table 1: Precious metal assay results from the Bulk Sample Grade Control Program on the Champagne Zone.

| Hole ID | From (m) | To (m) | Core Length (m) | True Thickness (m) | Au (g/t) | Ag (g/t) | Vertical Depth (m) | Zone |

| PE-21-371W1 | 151.20 | 156.70 | 5.50 | 3.25 | 5.06 | 1.45 | ~130 | Western Champagne Zone |

| Including | 151.20 | 151.70 | 0.50 | 0.28 | 1.92 | 1.10 | ||

| Including | 156.20 | 156.70 | 0.50 | 0.28 | 52.36 | 8.90 | ||

| PE-26-894 | 162.50 | 170.00 | 7.50 | 4.28 | 32.47 | 2.35 | ~145 | Western Champagne Zone |

| Including | 163.75 | 164.40 | 0.65 | 0.37 | 8.63 | 0.90 | ||

| And | 167.85 | 170.00 | 2.15 | 1.23 | 110.05 | 7.20 | ||

| Including | 167.85 | 168.85 | 1.00 | 0.57 | 233.96 | 14.90 | ||

| Including | 168.85 | 170.00 | 1.15 | 0.66 | 2.31 | 0.50 | ||

| PE-26-897 | 147.70 | 162.00 | 14.30 | 6.72 | 1.47 | 0.14 | ~140 | Western Champagne Zone |

| Including | 147.70 | 149.30 | 1.60 | 0.75 | 0.57 | 0.10 | ||

| Including | 158.70 | 160.20 | 1.50 | 0.71 | 12.03 | 0.43 |

Table 2: Drillhole coordinates for today's results.

| Hole ID | Azimut (°) | Dip (°) | From (m) | To (m) | Length (m) | Easting (m) | Northing (m) | Elevation (m) |

| PE-21-371W1 | 170 | -58 | 80.00 | 172.00 | 92.00 | 614530 | 5430789 | 342 |

| PE-26-894 | 166 | -62 | 0.00 | 179.00 | 179.00 | 614530 | 5430789 | 342 |

| PE-26-897 | 173 | -69 | 0.00 | 202.00 | 202.00 | 614562 | 5430778 | 342 |

Qualified Person and QA&QC

Jérôme Augustin P.Geo. Ph.D., (OGQ 2134), an Independent Qualified Person as defined by Canadian NI 43-101 standards, has reviewed and approved the geological information reported in this news release. The drilling campaign and the quality control program have been planned and supervised by Jérôme Augustin. Core logging and sampling were completed by Laurentia Exploration.

The quality assurance and quality control protocols include insertion of blank or standard samples every 10 samples on average, in addition to the regular insertion of blank, duplicate, and standard samples accredited by Laboratoire Expert and ALS Canada Ltd, during the analytical process.

For all analyses targeting gold mineralization, gold values are estimated by fire assay with finish by atomic absorption. Values over 3 ppm Au are reanalyzed by fire assay with finish by gravimetry by Laboratoire Expert Inc, Rouyn-Noranda. Samples containing visible gold mineralization are analyzed by metallic sieve. For additional quality assurance and quality control, all samples were crushed to 90% less than 2 mm prior to pulverization, in order to homogenize samples which may contain coarse gold.

About Amex

Amex Exploration Inc. has made significant high-grade gold discoveries, along with copper-rich volcanogenic massive sulphide (VMS) zones, at its 100%-owned Perron Gold Project, located approximately 110 kilometres north of Rouyn-Noranda, Quebec. The Perron Project in Quebec consists of 183 contiguous claims for a surface area of 65.75 km². The project hosts both bulk-tonnage and high-grade gold mineralization styles.

When combined with the adjacent and contiguous Perron West Project and Abbotsford and Hepburn Projects (including additional claims acquired through staking) in Ontario, the consolidated land package spans a district-scale 501.08 km². This extensive property lies within highly prospective geology favourable for both high-grade gold and VMS mineralization.

The Project benefits from excellent infrastructure: it is accessible by a year-round road, located just 30 minutes from an airport, and approximately 6.5 km from the Town of Normétal. It is also in close proximity to several process plants owned by major gold producers.

For further information please contact:

Victor Cantore

President and Chief Executive Officer

Amex Exploration: +1-514-866-8209

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-looking statements

This news release contains forward-looking statements. All statements, other than of historical facts, that address activities, events or developments that the Company believes, expects or anticipates will or may occur in the future including, without limitation, planned exploration programs, the expected positive exploration results, the extension of mineralized zones, the timing of the exploration results, the ability of the Company to continue with exploration programs, the availability of the required funds to continue with the exploration and the potential mineralization or potential mineral resources are forward-looking statements. Forward-looking statements are generally identifiable by use of the words "will", "should", "continue", "expect", "anticipate", "estimate", "believe", "intend", "to earn", "to have", "plan" or "project" or the negative of these words or other variations on these words or comparable terminology. Forward-looking statements are subject to a number of risks and uncertainties, many of which are beyond the Company's ability to control or predict, that may cause the actual results of the Company to differ materially from those discussed in the forward-looking statements. Factors that could cause actual results or events to differ materially from current expectations include, among other things, failure to meet expected, estimated or planned exploration expenditures, failure to establish estimated mineral resources, the possibility that future exploration results will not be consistent with the Company's expectations, general business and economic conditions, changes in world gold markets, sufficient labour and equipment being available, changes in laws and permitting requirements, unanticipated weather changes, title disputes and claims, environmental risks as well as those risks identified in the Company's annual Management's Discussion and Analysis. Should one or more of these risks or uncertainties materialize, or should assumptions underlying the forward-looking statements prove incorrect, actual results may vary materially from those described and accordingly, readers should not place undue reliance on forward-looking statements. Although the Company has attempted to identify important risks, uncertainties and factors which could cause actual results to differ materially, there may be others that cause results not to be as anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements except as otherwise required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285453