(TheNewswire)

|

|||||||||

|

|

|

|

||||||

Calgary, Alberta – TheNewswire – July 9, 2025 - Ashley Gold Corp. (CSE: “ASHL&) (“Ashley&or the “Company&) is pleased to announce receipt of assays from a ground sampling and mapping program, announced June 6th, 2025.

Highlights:

Omega Extension Discovery: A continuation of the Omega Zone, 25-50 meters inland from the shoreline, was discovered with a 10-meter wide altered tuff unit hosting quartz veinlets and up to 3% pyrite. These findings are consistent with previous core results from BH-01, which returned up to 3 g/t Au over 2m.

Inland Mineralization: The inland areas along the Omega, Alpha, and Oro Grande West zones show promising gold potential, with altered tuff and pyrite concentrations observed. This could signify a continuous gold-bearing system extending inland from the shoreline.

Big Zone Discovery: A 20-30 meter wide deformation zone was identified on the west side of the peninsula, with a 1-meter wide quartz vein and significant pyrite and malachite mineralization. The zone's severe shearing and quartz vein presence suggest the area could be host to substantial mineralization.

These encouraging results highlight the strong potential for further gold discoveries, and the exploration team is excited to continue advancing these findings with follow-up work.

Figure 1: Burnthut, North-East Peninsula

"We are very encouraged by the recent exploration results from the Burnthut Peninsula," states President Noah Komavli. "The discovery of the Omega Extension, with significant pyrite and quartz veinlets, further supports the potential of the area. Additionally, the identification of the Big Zone on the west side of the peninsula, assaying with 0.7 g/t gold content even in highly weathered rock where sulphides have been leached out, is particularly significant. These findings, along with the inland mineralization observed, are strong indicators that we&re on the right track."

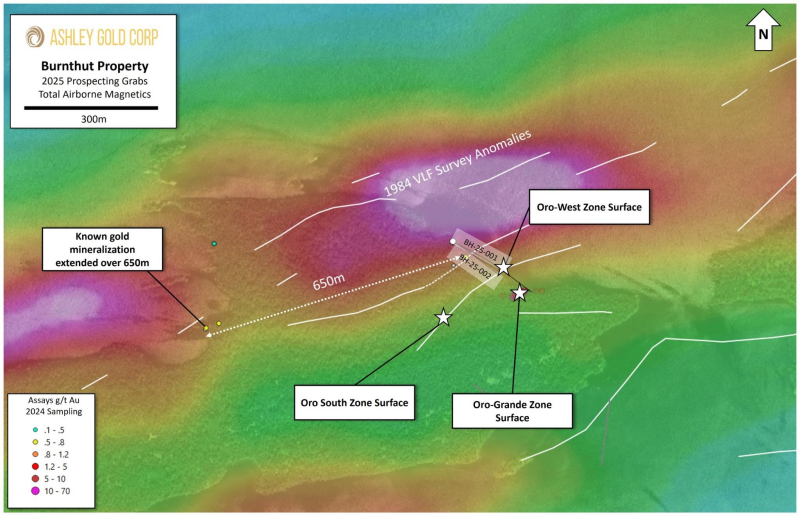

"Burnthut is showing early hallmarks of scale, with our exploration uncovering another parallel, stacked structure that adds width from 400 meters to 150 meters away from the original Oro Grande South zone. Further grab samples have extended the prospective strike to 650 meters. This project remains an important asset, with the exploration team currently focused on just 1/15th of the overall prospective strike along the Ruby Island fault system. These claims remain open for further discovery, and we will now focus on permitting for shallow drilling as well as conducting induced polarization (IP) surveys to guide future exploration programs. Due to the thick moss cover across the area, IP will be critical to guiding our exploration efforts moving forward."

|

Sample # |

Sample Description |

Sample Type |

Result (g/t Au) |

|

346515 |

0.3 m chip of grey quartz vein in 1 m wide sheared tuff. Trace py in 1 mm wide cubes. |

Chip |

0.03 |

|

346514 |

Quartz float, trace py cubes with black tarnish. |

Grab |

0.33 |

|

346507 |

Altered tuff, similar to Omega Zone in core. 2-3 % py in 1-3 mm cubes. |

Grab |

0.59 |

|

346508 |

Altered tuff, similar to Omega Zone in core. 2-3 % py in 1-3 mm cubes. |

Grab |

0.69 |

|

346516 |

3 m north of # 346515 - grab of 6 inch wide quartz vein similar to Oro Grande South. 1-3 % py, 2mm py cubes. |

Grab |

0.69 |

|

346517 |

Parallel QV - grab of 6 inch wide quartz vein similar to Oro Grande South. 1-3 % py, 2mm py cubes. |

Grab |

0.69 |

|

346509 |

Big Zone- 1 m wide white quartz vein, trace 1-2 mm cubic py with black tarnish. |

Grab |

0.72 |

Table 1: Assay Results and Description

Omega Extension

An inland continuation of altered tuff resembling the Omega Zone was discovered approximately 25 - 50 m inland from the shoreline. The surface expression corresponds well to where BH – 01 cored anomalous, up to 3 g/t Au over 2m approximately 40 m down hole. Although no wide quartz veining was seen, the tuff hosts multiple quartz veinlets up to 5 mm in width. The wall rock itself contains up to 3 % pyrite as cubes. The altered unit is approximately 10 m in width.

Figure 02: Inland Omega Extension

Omega Zone

The inland extension of the Oro Grande West and Alpha Zones in terms of quartz veining was not seen inland, however a prominent ridge approximately 50 m inland provides good bedrock exposure. Altered tuff is seen for approximately 25 m in width along this exposure. The tuff unit is well silicified and in places carries py up to 2 % as cubes.

Multiple traverses inland on strike of the Omega, Alpha and Oro Grande West were carried out to prospect for mineralized rocks that may be responsible for the VLF conductors. The inland area hosts numerous outcrops, however very little to no bedrock exposure exists due to a thick moss carpeting the outcrops. Many showings could exist inland.

Figure 03: Omega Zone Samples returned 590-690 ppb Au

Big Zone

An effort was made to discover parallel mineralized deformation zones on the west side of the peninsula and on strike to the west of the eastern zones (Alpha, Omega, Oro West, and Oro South).

A 20-30 m wide deformation zone hosted in a tuff unit trends 260 degrees and dips to north at 60-70 degrees. The zone is intensely sheared, more so than any other deformation zone thus far located on the Burnthut Peninsula. A 1 m wide quartz vein was discovered in the centre of the shear zone; the vein is white in color and contains chloritic wall rock wisps and selvages. Trace pyrite and malachite are randomly distributed as coarse cubes that have a distinct black tarnish. A few large quartz blocks were spotted on strike underwater.

A few slabs of rock were dug out going uphill which displayed a rotten appearance. The rock is severely weathered and brittle. 1-inch-wide sugary quartz veins are dispersed through the rock which contains what would appear to be 5-10 pyrite cube remnants.

Again, the pyrite cubes that are in place are tarnished black.

Two other narrow 6-inch-wide quartz veins were located along the shore further south on the west side of the peninsula. They are hosted in narrow shear zones (approximately 1 m wide) in tuff units. The quartz veins are identical in appearance to the Oro South showing.

Figure 04: Big Zone Vein - Samples Returned up to 720 ppb Au

Figure 05: Big Zone Vein

About the Burnthut

The Burnthut Property is one of Ashley&s promising Dryden Area assets. Sporadic exploration has occurred for over a century, being kicked off by a 50ft shaft being sunk in the late 1800&s. Ashley Gold completed many milestones in 2024, with a discovery, permitting, and funding aimed at testing the system at depth. Ashley has continued exploration into 2025, focused on deepening an understanding of the geological system.

-

Property Acquisition:

-

Ashley successfully acquired 100% ownership of the Burnthut Property, located southwest of Sioux Lookout, Ontario, on trend with the Treasury Metals (now NexGold) Goliath-Goldlund deposit.

-

-

Oro Grande Zone Discovery:

-

Spring 2023 sampling led to the discovery of the Oro Grande Zone, where high-grade sampling results were achieved up to 59.5 g/t Au from grab samples*.

-

The Oro Grande Zone extends for 75 meters on the mainland before trending under cover. This mineralized zone is now associated with a VLF anomaly that spans 700 meters to the west, enhancing its potential for further exploration.

-

-

New Parallel Zone (Oro-Grande West):

-

A new parallel deformation zone, dubbed Oro Grande West, was discovered in 2024. Grab samples from this zone returned grades of up to 31.9 g/t Au*.

-

The high-grade parallel nature of the Oro and Oro West zones, along with the expanded strike length of the Oro Grande system, has positioned Burnthut as a major exploration target for the company.

-

Further VLF anomalies exist across the property and warrant follow up based on the grab sample values.

-

-

Burnthut Expansion:

-

Expanded to the North-East on March 18, 2025, capturing a regional fault convergence.

-

Consolidated possible down dip with follow up transaction.

-

-

New Parallel Zone (Big Zone):

-

During mapping and sampling initiated June 6th, 2025, the team identified another parallel zone. This weathered vein assayed up to 0.72 g/t Au from grab samples*.

-

The Company has issued a release settlement with San Rafael LLC pertaining to the Sahara Option Agreement. In connection with the release, Ashley will issue 2,631,838 common shares of the Corporation for gross proceeds of USD $84,427.61. The settlement is pending exchange approval, and the securities will be subject to a customary 4 month 1 day hold.

*Grab samples are selective samples, and the assay results may not necessarily represent true underlying mineralization.

Qualified Person

The technical and scientific information in this news release has been reviewed and approved by Darcy Christian, P.Geo., CEO of Ashley, who is a Qualified Person as defined by NI 43-101.

About Ashley Gold Corp.

Ashley Gold Corp. is focused on discovering world-class gold deposits through innovative and efficient exploration.

In the Dryden area of Ontario, the Company holds 100% interest in the Burnthut Property (1.5% NSR), Tabor Lake Lease (1.5% royalty), Howie Lake Project (0.5% royalty), Alto-Gardnar Project (0.5% royalty), and Santa Maria Project (1.75% royalty), with an option to earn 100% of the Sakoose claims (1.5% NSR). In BC, Ashley holds the Icefield Portfolio, a group of three highly prospective claim packages along the BC/Alberta border. Each project is highly prospective for polymetallic systems.

Operating in mining-friendly jurisdictions, Ashley is dedicated to creating long-term value for shareholders.

For more information, visit: www.ashleygoldcorp.com.

Contact Information

On behalf of the Board of Directors,

Noah J. Komavli, President, Director

C: (647) 567-9840

E: info@ashleygoldcorp.com

X: KKomavli

-Or-

Darcy Christian, P.Geo, CEO

C: (587) 777-9072

E: dchristian@ashleygoldcorp.com

Connect With Ashley:

X: https://x.com/AshleyGoldCorp

Forward-Looking Statements

This news release includes certain “forward-looking statements& which are not comprised of historical facts. Forward-looking statements are based on assumptions and address future events and conditions, and by their very nature involve inherent risks and uncertainties. Although these statements are based on currently available information, Ashley Gold Corp. provides no assurance that actual results will meet management&s expectations. Factors which cause results to differ materially are set out in the Company&s documents filed on SEDAR+ (www.sedarplus.ca) (www.sedarplus.ca). Undue reliance should not be placed on “forward-looking statements.&

Copyright (c) 2025 TheNewswire - All rights reserved.