Highlights:

- Hole LMD-121: 3.1 metres grading 1,286 g/t silver and 9.0 g/t gold including

- 0.9 metres grading 3,102 g/t silver and 25.1 g/t gold

- Hole LMD-118: 1.4 metres grading 16.4 g/t gold and 81g/t silver including

- 0.6 metres grading 34.7 g/t gold and 180 g/t silver

- Confirmation of high-grade mineralization in the northwest extension of the West Feeder Zone - five additional step-out holes pending along northwest strike

- Confirmation of high-grade veins hosted in andesitic sills, previously interpreted to be a barren host rock

Vancouver, British Columbia--(Newsfile Corp. - February 10, 2026) - Astra Exploration Inc. (TSXV: ASTR) (OTCQB: ATEPF) (FSE: S3I) ("Astra" or the "Company") is pleased to announce the first batch of assays consisting of six DDH holes from the Phase II drill program at the La Manchuria Gold and Silver Project in Santa Cruz, Argentina. Assays remain pending for 19 holes.

Astra's CEO, Brian Miller, commented:

"New sources of high-grade veins continue to emerge at La Manchuria. Drilling has revealed the system is open along strike in both directions, at depth below previous drilling, laterally in new parallel structures, and now we can definitively add additional host rock units to that list. We've proven that high-grade gold and silver exist beyond nearly every previously interpreted constraint, which bolsters our original thesis that La Manchuria has the potential to host a multi-million-ounce high-grade deposit."

Miller continues:

"It is important to keep in mind that these results are from a small portion of the property, which itself now has unconstrained potential - and there are numerous regional targets which show potential for expansion, all centralized within a large project area of spectacular fertility. We are eager to commence with the fully-funded second half of Phase II to further expand the system. Applying the knowledge we've gained by opening the system locally will improve our odds of success and reduce dilution as we grow the system regionally."

Program Details

A total of 25 drill holes were completed in late 2025 totaling 5,119 metres (see Dec 1, 2025 news release, "Astra Provides Progress Update on Phase II Drill Program at La Manchuria Gold and Silver Project, Argentina"). The drill program focused on expanding the near-surface footprint of the system with shallow (<200m vertical depth) drill holes. The Company plans to commence geophysical surveys in February and commence with the second half of Phase II (~5,000 metres) in March 2026.

Drill Results and Discussion

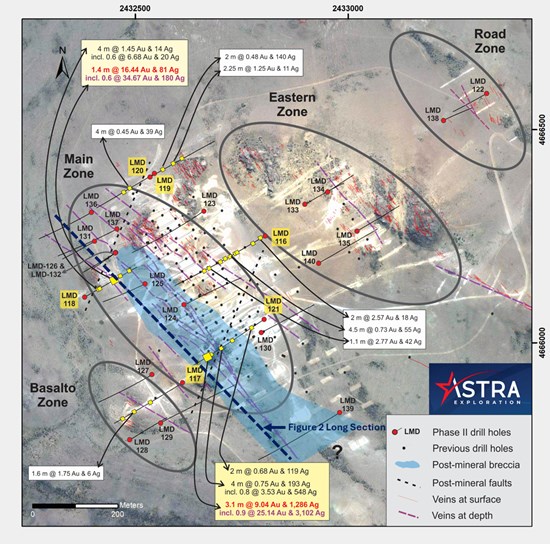

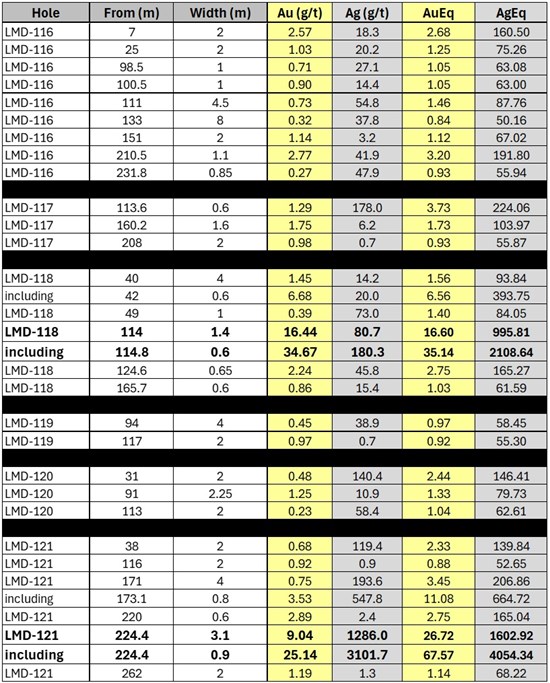

The six drill holes reported herein were focused primarily on the Main Zone area (Figure 1), each of which intersected at least one noteworthy gold and/or silver interval (Table 1). The regular occurrence of both gold and silver grade demonstrates the fertility of the system even at shallow system depths.

Figure 1: Phase II holes drilled to date with assays for the first six holes highlighted in yellow. Dashed line in dark blue shows approximate location of long section in Figure 2.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8951/283339_728d2a28c447b9eb_002full.jpg

West Feeder at Main Zone

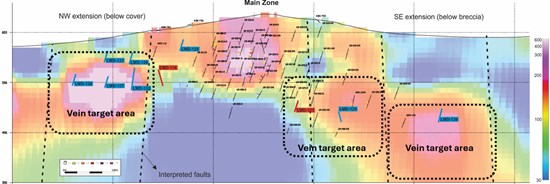

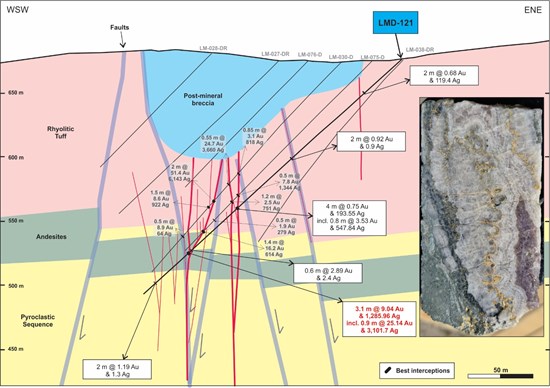

The West Feeder contains some of the thickest veins and highest grades currently known at La Manchuria. LMD-121 and LMD-118 extended the high-grade vein at depth and along strike to the northwest, respectively (Figure 2). LMD-121 returned a significant mineralized interval, beginning at 224.4m downhole (~170m vertically below surface) of 3.1 metres grading 9.04 g/t Au and 1,286 g/t Ag, including a higher-grade sub-interval of 0.9 metres grading 25.14 g/t Au and 3,102 g/t Ag. The interval is comprised of two, banded, quartz-adularia-sulphide veins hosted within an andesitic sill. This interval is of particular importance, being the first intercept of vein hosted, high grade gold and silver intersected within andesitic host rocks. The andesitic sill is approximately 25 metres thick and is underlaid by a pyroclastic sequence (Figure 3) which is a common host to high-grade veins. This revelation adds new potential for high-grade veins at depth.

Figure 2: Long section of the West Feeder in the Main Zone (location shown in Figure 1 by dark blue dashed line) with interpreted downthrown target areas. Completed Phase II holes in blue pending assay results. LMD-118 and LMD-121 in red. Resistivity values expressed in ohm-m.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8951/283339_728d2a28c447b9eb_003full.jpg

Figure 3: Cross section of LMD-121 showing the depth extension of the veins at the West Feeder. Gold and silver results are in grams per tonne (g/t). Photo is the sample with 0.9m grading 25.14 g/t Au & 3,101.7 g/t Ag. Hole LMD-121 deviated upwards and intersected the vein approximately 25m above the targeted depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8951/283339_728d2a28c447b9eb_004full.jpg

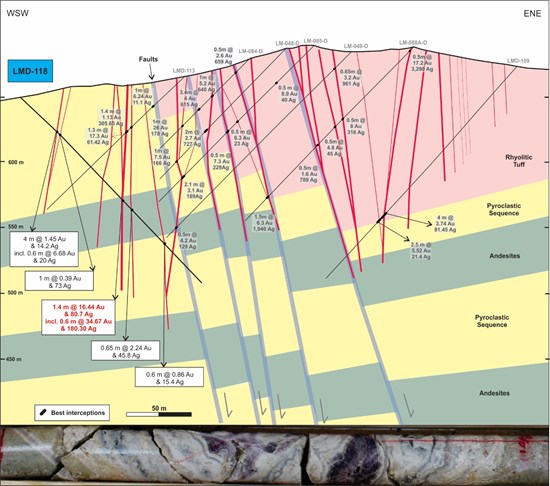

LMD-118 intersected several quartz-adularia-sulphide banded veins and veinlets hosted within pyroclastic rocks and an andesitic sill (Figure 4) located in an upthrown structural block west of the Main Zone (Figure 2). The most significant interval was hosted in an andesitic sill underlain by pyroclastic sequence (similar to LMD-121) and returned 1.4 metres grading 16.44 g/t Au and 81 g/t Ag, including a higher-grade interval of 0.6 metres grading 34.67 g/t Au and 180 g/t Ag within a quartz-adularia-amethyst banded vein (see Figure 4 photograph). This structure represents a 60 metre down dip step out of mineralization intersected in LMD-113 which returned 1.3 metres grading 17.3 g/t Au and 61 g/t Ag.

Figure 4: Cross section of LMD-118 showing the depth extension of the veins at the West Feeder. Gold and silver results are in grams per tonne (g/t). Photo is the sample with 0.6m grading 34.67 g/t Au & 180.30 g/t Ag.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8951/283339_728d2a28c447b9eb_005full.jpg

East Feeder at Main Zone

LMD-119, LMD-120 and LMD-116 were designed to test, from north to south, the eastern portion of the Main Zone, referred to as the East Feeder, which is now interpreted to dip toward the southwest. All holes intersected low-sulphidation epithermal (LSE) veins and veinlets, returning multiple gold and silver intervals along their lengths (Figure 1 and Table 1). These results further support and refine the shallow bulk disseminated mineralization model for the Main Zone.

LMD-120 and LMD-119 tested the northern extension of the East Feeder beneath post mineral cover and intersected at least three zones of shallow LSE-style mineralization with anomalous precious metal values (>1 g/t AuEq). These results indicate that the mineralized system remains open to the north within a downthrown structural block and warrants further drill testing at depth, particularly within underlying pyroclastic host rocks.

LMD-116 intersected multiple massive to banded quartz-chalcedony-sulphide veins and veinlets between 7 metres and 211 metres downhole, all hosted within rhyolitic tuffs. The most significant intersection of 1.1 metres grading 2.77 g/t Au and 41.9 g/t Ag corresponds to the down-dip projection of the Argentum vein at approximately 150 metre vertical depth. LMD-116 demonstrates that shallow disseminated mineralization within the East Feeder remains open in all directions.

Basalto Zone

LMD-117 was the first drill hole of the current program to test the structurally complex Basalto Zone and was designed to evaluate mineralization below Phase I drill hole LMD-105. LMD-117 intersected two zones of mineralization associated with shallow-level banded quartz-chalcedony-amethyst veins and veinlets hosted within an andesitic sill. Anomalous grades within the andesitic sills are encouraging, giving the possibility for higher grades in the underlying pyroclastic host rocks.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8951/283339_astratbl1.jpg

Table 1: Assays from the first six holes of Phase II drilling at La Manchuria using cutoff grade of 0.5 g/t AuEq. Ag:Au ratio of 60 using $3,600 Au and $60 Ag. Recoveries of 94% for Au and 85% for Ag is an average based on three regional mine operations1 and are reflected in AuEq and AgEq values above. Table shows results greater than 1 g/t AuEq. Estimated true widths are approximately 85% of widths reported herein.

Sampling Procedures

Drill samples consisted of HQ core which were split in half, sampled, bagged, and tagged by Astra's geological team and then delivered to the Alex Stewart International Argentina laboratory in Mendoza. Drill samples were prepared with P5 code and then analyzed with fire assay for gold (Au4-50) and multi-elements by ICP (ICP-AR 39). Silver (>200 g/t) over-limits were analyzed by gravity method (Ag4A-50). A total of 131 Blanks and 154 standards (4 different Au and Ag grades) were used as QAQC for the group of 2,831 samples.

About the Company

Astra Exploration Inc. is a precious metals exploration company based out of Vancouver, BC that is actively building a portfolio of high-quality projects in some of the most important mining jurisdictions in Latin America.

The La Manchuria gold-silver project in Santa Cruz, Argentina, over which Astra has an option to acquire 90% interest from the owner, Patagonia Gold Corp, is a high-grade gold and silver low sulphidation epithermal (LSE) deposit located in the prolific Deseado Massif which hosts multiple world-class LSE precious metals deposits including Cerro Vanguardia and Cerro Negro, Santa Cruz, Argentina.

The 100% owned Pampa Paciencia gold and silver project in northern Chile is located in the Paleocene mineral province in proximity to such major operating mines as Spence and Sierra Gorda. The project shares several important geological similarities to other Paleocene LSE gold-silver deposits including Faride and El Peñón.

The 100% owned Cerro Bayo project in northern Chile is located in the Maricunga belt approximately 20 km from the Refugio Mine. The project hosts a high sulphidation epithermal (HSE) +/- porphyry gold system with similarities to the Salares Norte deposit to the north in the same belt. The Maricunga belt is one of the most endowed regions in the world for gold and copper deposits.

Qualified Person

The technical data and information as disclosed in this news release has been reviewed and approved by Darcy Marud, who is an Independent Director of Astra. Mr. Marud is a Practicing Member of the Association of Professional Geoscientists of Ontario and is a qualified person as defined under the terms of National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

For further information, please contact:

Brian Miller

Chief Executive Officer

Tel. 604.428.0939

Email: brian.miller@astra-exploration.com

References:

1 Sources:

Steinmann, Michael, March 2006

Manantial-Espejo Project Canadian Standard NI 43-101, Santa Cruz Province, Argentina Prepared for Minera Triton Argentina, S.A.

https://panamericansilver.com/wp-content/uploads/2022/04/Manantial-Espejo-Technical-Report.pdf

Goldcorp - Third Quarter Report, September 30, 2017

https://s24.q4cdn.com/382246808/files/doc_financials/mda/2017/MD-A-FS-2017Q3-Website.pdf

AngloGoldAshanti - Technical Report Summary, Cerro Vanguardia, A Life of Mine Summary Report, December 31, 2021

https://www.sec.gov/Archives/edgar/data/1067428/000162828022007855/a2021_-xcerroxvanguardia.htm

Neither the TSXV nor its Regulation Services Provider (as that term is defined in the policies of the TSXV) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When or if used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan", "forecast", "may", "schedule" and similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to the Company's business activities; exploration on the Company's properties including drilling at the La Manchuria project. Such statements represent the Company's current views with respect to future events and are necessarily based upon a number of assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political and social risks, contingencies and uncertainties. Many factors, both known and unknown, could cause results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. Such factors include, without limitation: development of the industry in which the Company operates; risks associated with the conduct of the Company's business activities; risks relating to reliance on the Company's management team and outside contractors; currency fluctuations; risks regarding the failure to generate sufficient cash flow from operations; laws and regulations governing the industry in which the Company operates; the ability of the communities in which the Company operates to manage and cope with the implications of COVID-19; the economic and financial implications of COVID-19 to the Company; operating or technical difficulties; employee relations, labour unrest or unavailability; stock market volatility; conflicts of interest among certain directors and officers; lack of liquidity for shareholders of the Company; litigation risk; and other risk factors disclosed in the Company's public disclosure documents available on the Company's profile at www.sedarplus.ca. Readers are cautioned against attributing undue certainty to forward-looking statements or forward-looking information. Although the Company has attempted to identify important factors that could cause actual results to differ materially, there may be other factors that cause results not to be anticipated, estimated or intended. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283339