CALGARY, AB / ACCESS Newswire / January 6, 2026 / Aurwest Resources Corporation ("Aurwest" or the "Company") (CSE:AWR) is pleased to announce that the Company has entered into a non-binding Letter of Intent with Pacific Bay Minerals Ltd. (TSXV:PBM) whereby Aurwest can earn a 50% interest in Pacific Bay's 100% owned Weaver Gold Project over three years (the "LOI").

Weaver Gold Project

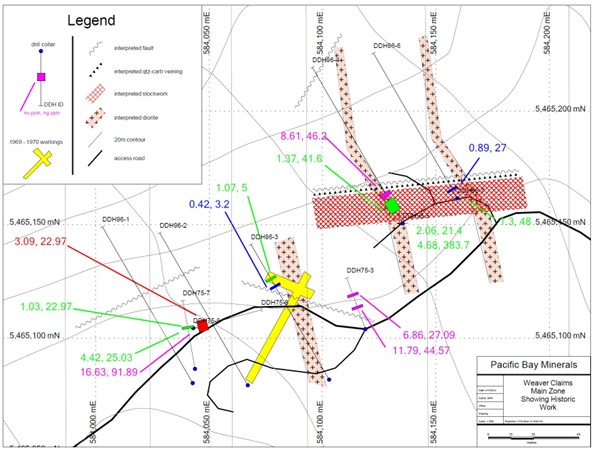

Located in southwestern British Columbia's prolific East Harrison Lake Belt, the Property hosts strong potential for orogenic gold-silver mineralization hosted in structurally controlled quartz-carbonate vein systems, with historical exploration yielding impressive high-grade results, including up to 63.77 g/t gold and 2,009.44 g/t silver from trench sampling, and multiple drill intercepts with multi-gram gold and silver over metre-scale widths.

Situated near excellent infrastructure with year-round access via paved highways and forestry roads, the 725-hectare Property also offers secondary upside for magmatic nickel-copper sulphide mineralization, drawing parallels to the nearby Pacific Nickel (Giant Mascot) Mine. The Whitehead report concludes that Weaver Lake is a property of merit warranting continued exploration, supported by its favorable geological setting, confirmed mineralization continuity, and untapped potential along strike and at depth.

|

|

"The Weaver Gold Project represents an exciting opportunity for Aurwest to get into the gold exploration sector in B.C.," said Aurwest CEO Cameron MacDonald. "We're looking forward to getting to work on this high-potential project."

Terms of the Option

Under the LOI, Aurwest can earn a 50% interest in the Property by making cash and share payments over three years and completing exploration work as follows:

-

Upon signing of this Agreement, $10,000 and 500,000 shares of Aurwest

-

Upon receipt of regulatory approval, payment to PBM of $20,000 worth of common shares of Aurwest based on the 20-day Volume Weighted Average Price of Aurwest ("VWAP")

-

On or before the first anniversary of the LOI: $15,000 cash; $25,000 worth of Aurwest shares based on the VWAP; and $75,000 in exploration work on the Property

-

On or before the second anniversary of the LOI: $20,000 cash; $75,000 worth of Aurwest shares based on the VWAP; and an additional $100,000 in exploration work on the Property.

-

On or before the third anniversary of the LOI: $25,000 cash; and $75,000 worth of Aurwest shares based on the VWAP; and an additional $150,000 in exploration work on the Property.

The historical exploration data and analytical results reported in this news release were taken from assessment reports prepared by an independent Technical Report on the Weaver Lake property by Pacific Bay. Neither Aurwest nor a qualified person has verified the historical sampling, analytical, and test data contained in this news release. The historical grab sampling results reported in this news release are selected samples and are not necessarily indicative of the mineralization hosted on the property.

On Behalf Of Aurwest resources Corporation

"Cameron MacDonald"

Interim President and Chief Executive Officer

For Additional Information Please Contact

Cameron MacDonald

Telephone: (403) 585-9875

Email: cmacdonald@aurwestresources.com

Website: www.aurwestresources.com

About Aurwest Resources Corporation

Aurwest is a Canadian-based junior resource company focused on the acquisition, exploration, and development of gold properties in Canada.

Forward-Looking Information

Statements included in this announcement, including statements concerning our plans, intentions, and expectations, which are not historical in nature are intended to be, and are hereby identified as "forward-looking statements". Forward looking statements may be identified by words including "anticipates", "believes", "intends", "estimates", "expects" and similar expressions. The Company cautions readers that forward-looking statements, including without limitation: the Acquisition and closing of such, certain regulatory, exchange and/or shareholder approvals for the Acquisition, and certain risks and uncertainties that could cause actual results to differ materially from those indicated in the forward-looking statements. Readers are advised to rely on their own evaluation of such risks and uncertainties and should not place undue reliance on forward-looking statements. Any forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update the forward-looking statements, except in accordance with the applicable laws.

The Canadian Securities Exchange has not reviewed and does not accept responsibility for the adequacy or accuracy of this release.

SOURCE: Aurwest Resources Corporation

View the original press release on ACCESS Newswire