Stock Chart Banyan Gold

Writer: Kevin Dwyer CEO,Head Trader

October 23, 2023

BANYAN GOLD CORP STRIKES GOLD IN YUKON: SIGNIFYING A BRIGHT FUTURE FOR THE CANADIAN GOLD MINING INDUSTRY

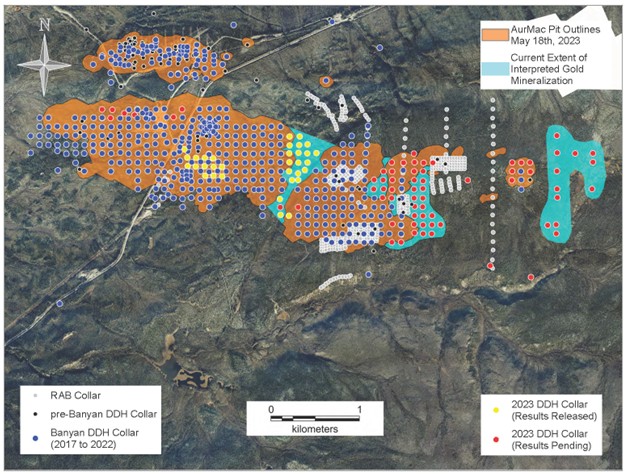

Banyan Gold Corp (now referred to as 'Banyan') stands as an exemplar in recent developments in Canada's gold mining industry, having made striking revelations about their ongoing drill operations in Yukon Territory. The exciting analytical findings come from the Powerline deposit, an imperative component of Banyan's AurMac Project.

OVERVIEW

The stimulating report illuminated the results of diligent exploration on thirteen diamond drill holes, intersecting approximately 1.66 grams per tonne (g/t) of gold across 16 metres. The southern fraction of the Powerline deposit, where these holes were strategically bored, had hitherto only been examined to a 100-metre depth. Banyan's latest exploration phase managed to mine an average of 235 metres from each drill hole.

Banyan's current exploration efforts have unearthed additive gold mineralization within confines previously untested, thereby establishing a new benchmark for the potential of the AurMac Project. This prominent discovery demonstrates the resilience of Banyan's exploration strategy and the understanding of the deposit while effortlessly proving the southern section of the Powerline deposit's capacity for gold mineralization.

Although previously overlooked in earlier exploration attempts, these encouraging findings hold remarkable prospective implications for Banyan's stakeholders. It also paves the way for further exploration and development opportunities within the Canadian gold mining industry.

THE AURMAC PROJECT

The AurMac Project stalled in the Mayo Mining District of central Yukon, is perceived as Canada's rapidly expanding mining district. With a location merely 40 km north of the Mayo community in Yukon, the AurMac Project sits adjacent to the Keno Hill Silver District, run by Hecla Mining Company, and approximately 25 km from the open-pit heap leach Eagle Gold mine managed by Victoria Gold Corp.

Covering approximately 173 km² and comprising 988 claims, the AurMac Project hosts intrusion-related, structurally controlled gold mineralization across its three main zones: the Airstrip, Powerline, and Aurex Hill. The project area boasts exceptional infrastructure, including the renowned Yukon highway parallel to the main access road, a 3-phase powerline, an existing Yukon Energy Corp. switching power station, and mobile network coverage.

Under the National Instrument 43-101 standards, a Mineral Resource Estimate ('MRE') was launched on May 24, 2023, for the highly accessible AurMac Property. The MRE reported an inferred mineral resource of over 6 million ounces of gold at 0.61 g/t Au (News Release of May 24, 2023).

CONCLUSION

In conclusion, Banyan's sterling breakthrough exemplifies the company's commitment to systematic exploration, contributing substantially to the landscape of the burgeoning Canadian gold mining industry. The future of the AurMac Project looks optimistically bright, and the recent success in intersecting gold corroborates that Banyan's meticulous efforts are genuinely the beacon heralding a golden era for Canadian gold miners.

Full disclosure: MineStocker trades the stock and is a minority shareholder.

Investment Disclosure

The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada