Vancouver, British Columbia--(Newsfile Corp. - February 4, 2026) - Bayhorse Silver Inc, (TSXV: BHS) (OTCQB: BHSIF) (FSE: 7KXN) (the "Company" or "Bayhorse") is pleased to announce results from the recently completed IP Survey over its Idaho Pegasus Porphyry Copper Project, adjacent to its Bayhorse Mine Property that was completed in January 2026.

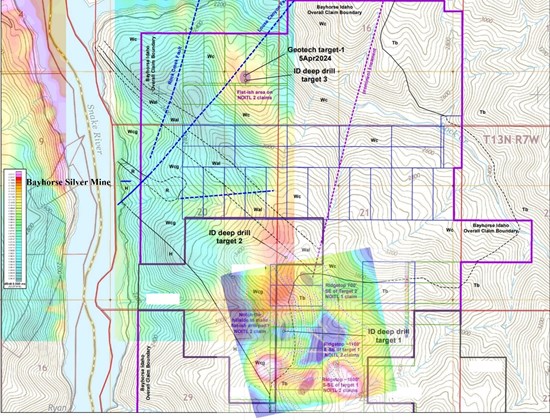

Figure 1. Pegasus IP/AMT chargeability inversion model at 300m below topography overlaid on the 2024 VTEM survey showing the claim boundaries and its proximity to the Bayhorse Silver Mine (center left).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_001full.jpg

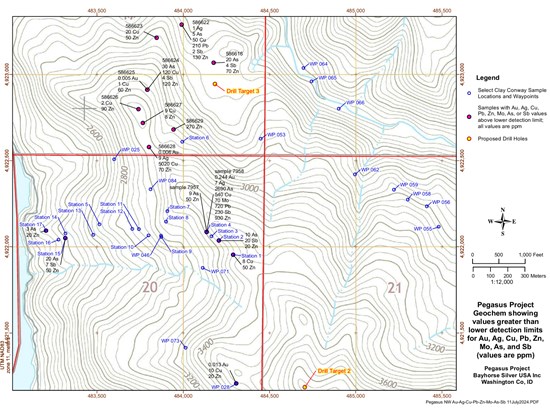

These results follow up the VTEM results announced in March 2024 (BHS2024-06) and the subsequent geological mapping program (figure 6) conducted by Dr. Clay Conway, P.Geol., on the porphyry copper potential of Pegasus, announced in September 2024 (BHS2024-18).

Bayhorse CEO Graeme O'Neill comments, "We are very excited to receive the results of the Pegasus IP survey. These confirm the presence of high chargeability, highly conductive and low resistivity targets lying in the southern half of the almost 4 square miles Pegasus Property. The area mapping by Dr. Conway showed the expected silver/antimony/copper/zinc mineralization as well as anomalous gold." He further comments, "Based on the characteristic of the silver mineralization and the hydrothermal breccia intercepts encountered in the Bayhorse Mine 335 m drill hole in 2024, Dr. G.E Ray, P. Geol, believes that the Bayhorse Mine mineralization is epithermal in nature and that as gold values associated with the silver up to 10 g/t were reported during prior mining operations at the Bayhorse Mine, (Silver King Mines, 1984), gold values may increase at depth.

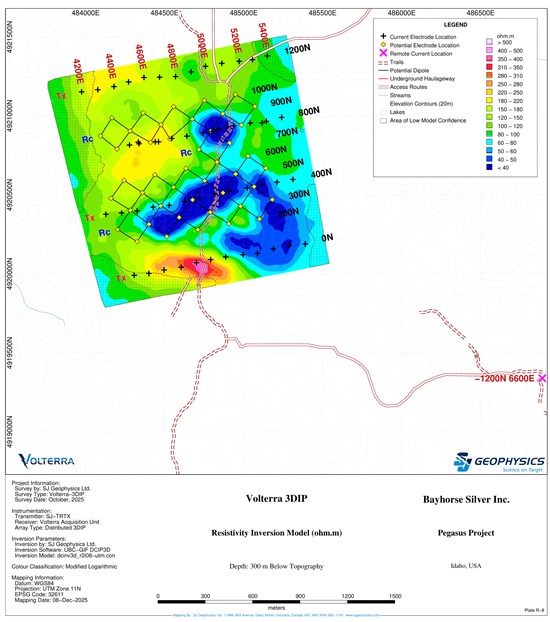

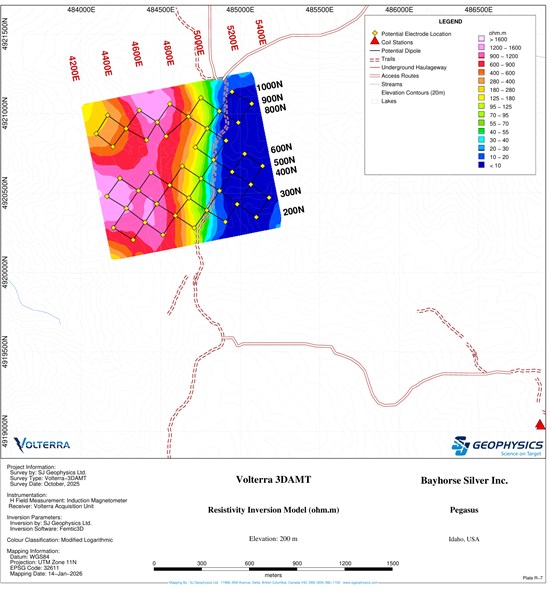

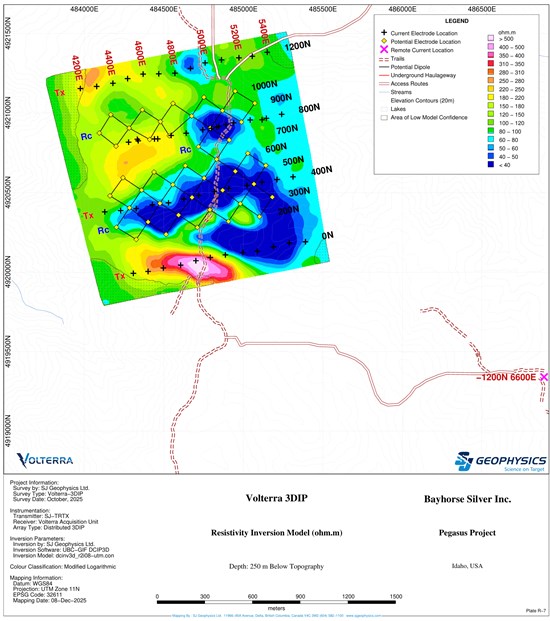

The Pegasus IP/AMT results compare favorably with the earlier VTEM results showing the low resistivity areas in blue (figures 2-5) that extend 1 km or more along strike and at least 550 m down to sea level. This anomaly may mark an eastward extension of the Bayhorse Mine silver-rich mineralization because initial indications from the IP/AMT survey show strong similarities to that at the Bayhorse Mine (BHS2026-03).

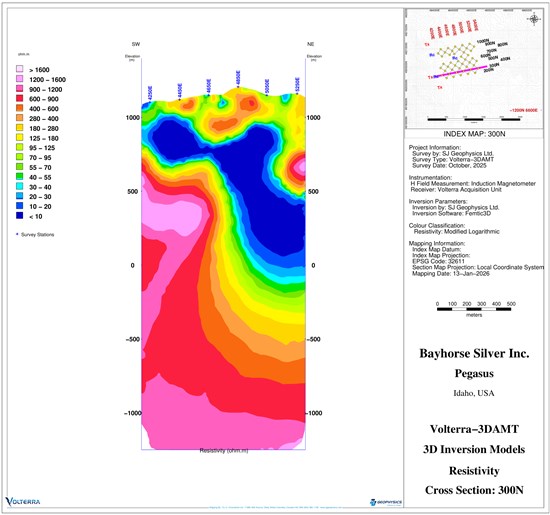

The SJV Geophysicists Interpretation Report states that the AMT model shows conductive zones extending beneath a conductive surface layer that is approximately 300 m thick. Beneath this layer, discontinuous north-south-trending resistive zones occur in the central grid area. Of particular interest is the southern central area, where a resistive surface zone overlies elevated chargeability at depth, forming a geophysical configuration analogous to the Bayhorse Mine mineralized response.

Thus, the Pegasus grid exhibits several geophysical features analogous to those observed at the Bayhorse Mine, including similarly oriented resistivity lineaments and chargeability anomalies beneath resistive surface zones.

Figure 2. Pegasus chargeability depth slice at 300 m below topography highlighting moderate chargeability anomalies (blue) at depth.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_002full.jpg

A further IP survey will be conducted on the northern section of the Pegasus Property as soon as weather permits. Initial exploration drilling is planned on the five identified Pegasus drill targets, and further drilling will occur following positive results.

Recommended follow-up work at Pegasus includes:

-

Explore the southern-central target area, where resistive surface units overlie elevated chargeability at depth.

-

Extend DCIP and AMT survey coverage to better constrain the significant anomalies at the current grid boundaries and expand the grid to search for additional targets.

-

Integrate structural interpretation to identify thrusts, splays, and potential rhyolite-related structures.

-

Complete the remaining part of the planned grid to the north.

The Bayhorse Mine Rhyolite, that hosts the Bayhorse Mine mineralization, extends from the Bayhorse Mine on the west bank of the Snake River in Oregon, across to the Pegasus Property into Idaho and extends a minimum 45 km to Cuddy Mountain in the north, where Hercules Metals recently announced significant gold values when drilling on their porphyry copper discovery.

The Pegasus exploration model holds that the mineralized rhyolite could have its source in underlying shallow granites that may have porphyry copper potential as reflected by the low-resistivity anomalies. Pronounced low-resistivity anomalies lie beneath the mineralized rhyolite at both the Bayhorse Mine and at the Hercules Metals Corp's property lying 45 km north of Pegasus. On January 15, 2025, Hercules reported drilling into a similar breccia in hole HER-24-20, which intersected rich copper-gold porphyry-style mineralization.

Figure 3. Pegasus 3D AMT resistivity model showing a conductive surface layer and resistive central zones, viewed from the south and looking north.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_003full.jpg

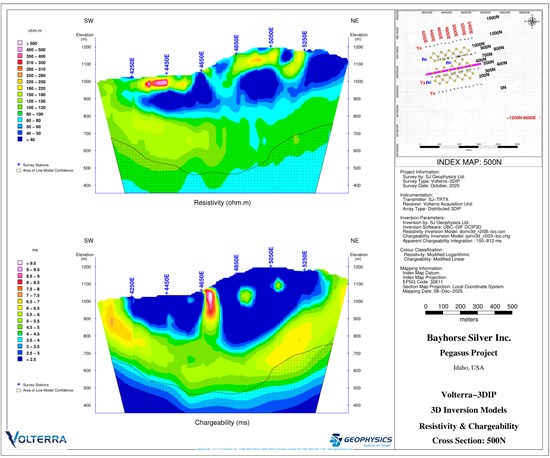

Figure 4. Section showing 3D inversion models resistivity extending from sea level to + 1,000 m.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_004full.jpg

Figure 5. Resistivity and chargeability cross section.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_005full.jpg

Figure 6. Pegasus 3D AMT resistivity model showing resistive features, with areas of elevated chargeability.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_006full.jpg

Figure 7. Mapping conducted by Dr. Clay Conway, P.Geol, 2024 showing surface sampling of anomalous gold, silver, copper, antimony, zinc on the northern section of the Pegasus Project. Also shown are initial drill targets.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5015/282789_ffb4d1e8e4e1f8be_007full.jpg

This News Release has been prepared on behalf of the Bayhorse Silver Inc. Board of Directors, which accepts full responsibility for its content. Mark Abrams, AIPG, a Qualified Person and Director of the Company has prepared, supervised the preparation of, or approved the technical content of this news release.

On Behalf of the Board.

Graeme O'Neill, CEO

866-399-6539, 604-684-3394

About Bayhorse Silver Inc.

Bayhorse Silver Inc. is an exploration and production company with a 100% interest in the historic Bayhorse Silver Mine located in Oregon, USA with a National Instrument 43-101 inferred resource of 292,300 tons at a grade of 21.65 opt (673 g/t) for 6.3 million ounces of silver. (Turner et al. 2018) and the Pegasus Project, in Washington County, Idaho. The Bayhorse Silver Mine and the Pegasus Project are 44 km southwest of Hercules Metals' porphyry copper discovery. The Bayhorse Mine is a minimum environmental impact facility capable of processing at a mining rate up 200 tons/day that includes a state of the art 40 ton per hour Steinert Ore-Sorter that reduces waste rock entering the processing stream by up to 85%. The Company has established an up to 60 ton/day mill and standard flotation processing facility in nearby Payette County, Idaho, USA with an offtake agreement in place with Ocean Partners UK Limited. The Company has an experienced management and technical team with extensive mining expertise in both exploration and building mines.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS:

This news release includes certain statements that may be deemed "forward-looking statements". All statements in this news release, other than statements of historical facts, that address events or developments that the Company expects to occur, are forward-looking statements. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words "expects", "plans", "anticipates", "believes", "intends", "estimates", "projects", "potential" and similar expressions, or that events or conditions "will", "would", "may", "could" or "should" occur. Although the Company believes the expectations expressed in such forward-looking statements are based on reasonable assumptions, such statements are not guarantees of future performance and actual results may differ materially from those in the forward-looking statements. In particular, these forward-looking statements are based on assumptions regarding: (i) stability in precious metals markets and silver prices; (ii) no further significant macroeconomic shocks or disruptions; (iii) continued market liquidity and investor access to capital; (iv) recovery of investor sentiment in the junior mining sector; and (v) timely receipt of required regulatory approvals. Factors that could cause the actual results to differ materially from those in forward-looking statements include: fluctuations in metal and commodity prices; continued availability of equity capital and financing; extreme market volatility and changes in investor sentiment; general economic, market, and business conditions; macroeconomic shocks and trade policy uncertainty; market liquidity constraints; timing and receipt of regulatory approvals (including from the TSXV); and risk that market recovery timing may differ materially from management expectations. Readers are cautioned not to place undue reliance on forward-looking statements. For a complete discussion of risk factors affecting the Company, please refer to the "Risks and Uncertainties" section of the Company's most recent Management's Discussion and Analysis available on SEDAR+ at www.sedarplus.ca. Investors are cautioned that any forward-looking statements are not guarantees of future performance and actual results or developments may differ materially from those projected in the forward-looking statements. Forward-looking statements are based on the beliefs, estimates and opinions of the Company's management on the date the statements are made. Except as required by applicable securities laws, the Company undertakes no obligation to update these forward-looking statements in the event that management's beliefs, estimates or opinions, or other factors, should change.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282789