Thunder Bay, Ontario--(Newsfile Corp. - March 2, 2026) - Benton Resources Inc. (TSXV: BEX) ("Benton" or the "Company") is pleased to announce its participation at this year's PDAC Convention, where it will host a booth at the Investors Exchange, booth #2117.

In addition, Company President and CEO Stephen Stares will be presenting at the Atlantic Canada Day Session on Tuesday, March 3, 2026, at 3:50pm EST at the InterContinental Toronto Centre Hotel - Ontario & Niagara Rooms, located at 225 Front Street West. Benton will be presenting on its highly prospective projects, its success to date, and its future plans.

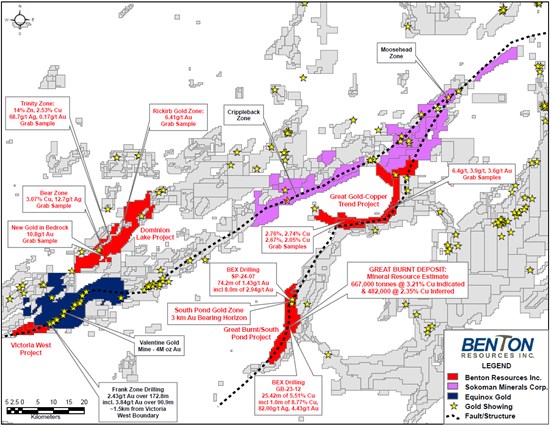

Figure 1: Benton Resources Central Newfoundland Properties

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3657/285918_17fe1aeff4362ac6_002full.jpg

QP

Stephen House (P.Geo.), Vice President of Exploration for Benton Resources Inc., the 'Qualified Person' under National Instrument 43-101, has approved the scientific and technical disclosure in this news release and prepared or supervised its preparation.

QA/QC Protocols

Core and rock samples, including standards, blanks and duplicates, are submitted to Eastern Analytical Ltd., Springdale, Newfoundland for preparation and analysis. All samples were acquired by saw-cut (channels/drill core) with one-half submitted for assay and one-half retained for reference, or hand (rocks) and delivered, by Benton personnel, in sealed bags, to the Springdale lab of Eastern Analytical, which is an accredited assay lab that conforms to the requirements of ISO/IEC 17025. Samples are analyzed using Eastern's Au (Fire assay) @ 30g + ICP-34 method that delivers a 34-element package utilizing a 200 mg subsample totally dissolved in four acids and analyzed by ICP-OES analytical technique. Overlimits are analysed with Eastern's atomic absorption method, using a 0.200 g to 2.00 g of sample, digested with three acids. All reported assays are uncut. Eastern Analytical Ltd. achieved ISO 17025 accreditation in February 2014 (for more details on the scope of accreditation visit the CALA website). Grab samples are selective in nature and may not represent the average mineralization of a bedrock exposure.

About Benton Resources Inc.

Benton Resources is a well-financed mineral exploration company listed on the TSX Venture Exchange under the symbol BEX. Benton has a diversified, highly prospective property portfolio and holds large equity positions in other mining companies that are advancing high-quality assets. Whenever possible, BEX retains net smelter return (NSR) royalties with potential long-term cash flow.

Benton is focused on advancing its high-grade Copper-Gold Great Burnt Project in central Newfoundland, which has a Mineral Resource estimate of 667,000 tonnes @ 3.21% Cu Indicated and 482,000 @ 2.35% Cu Inferred. The Project has an excellent geological setting covering 25km of strike and boasts six known Cu-Au-Ag zones over 15km that are all open for expansion. Further potential for discovery is excellent given the extensive number of untested geophysical targets and Cu-Au soil anomalies. Phase 1 and 2 drill programs returned impressive results including 25.42 m of 5.51% Cu, including 9.78 m of 8.31% Cu, and 1.00 m of 12.70% Cu. Drilling at the South Pond Gold Zone, approximately 7.5 km north of the Great Burnt Copper-Gold Zone, has confirmed a robust gold-mineralized system over 2.5 km with results of 74.20 m of 1.43g/t Au and 43.75 m of 1.62g/t Au and is open for expansion in all directions.

On behalf of the Board of Directors of Benton Resources Inc.,

"Stephen Stares"

Stephen Stares, President

Parties interested in seeking more information about properties available for option can contact Mr. Stares at the number below.

For further information, please contact:

Stephen Stares, President & CEO

Phone: 807-474-9020

Email:sstares@bentonresources.ca

Nick Konkin, Investor Relations

Phone: 647-249-9298 ext. 322

Email: nick@grovecorp.ca

Website: www.bentonresources.ca

Twitter: @BentonResources

Facebook: @BentonResourcesBEX

THE TSX VENTURE EXCHANGE HAS NOT REVIEWED AND DOES NOT ACCEPT RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements."

Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: risks related to failure to obtain adequate financing on a timely basis and on acceptable terms; risks related to the outcome of legal proceedings; political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to gold price and other commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof and the Company does not assume any obligation to update or revise them to reflect new events or circumstances. Actual events or results could differ materially from the Company's expectations or projections.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285918