Vancouver, British Columbia--(Newsfile Corp. - October 24, 2025) - Bravada Gold Corporation (TSXV: BVA) (FSE: BRTN) (the "Company" or "Bravada") reports today that it has filed a technical report (the "Report") prepared in accordance with Canadian Securities Administrators' National Instrument 43-101 ("NI 43-101"). The Report may be found under the Company's profile at https://www.sedarplus.ca and on Bravada's website https://bravadagold.com.

The Report dated October 23, 2025 and entitled "Updated Technical Report and Preliminary Economic Assessment, Wind Mountain Gold-Silver Project", located in Washoe County, Nevada, was prepared by RESPEC Company LLC ("RESPEC", formerly Mine Development Associates), and Woods Process Services. The Report presents an updated, independent In-pit Resource as part of its on-going Pre-Feasibility Study (PFS).

Highlights compared to Bravada's 2022 Resource:

- Indicated Resources increased by 15% for gold and 20% for silver.

- Inferred Resources increased by 292% for gold and 490% for silver. The large percentage increase is in part due to much of the overlying low-grade gold and silver mineralization that was in 2022 considered waste now being considered profitable to mine and leach.

- Strip ratio of waste to mineralization decreased from 0.58:1 to 0.36:1.

- Potential mine life of the In-pit Resource for a mining operation similar to that modeled as Phase I in the 2022 PEA increased from 4.2 years to over 10 years.

Note - Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability. Readers are reminded that the preliminary economic assessment is preliminary in nature and includes inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them, which would enable them to be categorized as mineral reserves. There is no certainty that the preliminary economic assessment will be realized, and the reader is advised to read notes from the qualified persons regarding the Resource Update, which are provided below the pit-constrained Resource table.

In addition to the updated Pit-constrained Resource, other potential resources might be developed with additional drilling at the North End target, the South End target, and within historic leach pads and waste rock piles, where the Company has identified potentially recoverable gold and silver.

President Joe Kizis commented, "Bravada's 2022 Preliminary Economic Assessment ("PEA") demonstrated favorable economics for an open-pit mining operation utilizing a small heap-leach pad site directly downhill from the Breeze Open Pit. With increased prices in precious metal prices and additional leach pad sites now identified, the current Report indicates potential for significantly extending mine life to over 10 years. The Company's updating of the In-pit Resource and ultimate advancement of Wind Mountain through the PFS stage are important steps in Wind Mountain's development."

There are no material differences in the Mineral Resource or the Phase I PEA results contained in the Report from those disclosed in the September 9, 2025 news release.

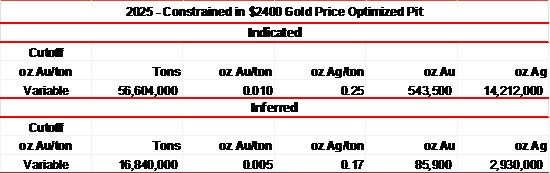

Total Pit-constrained Resource

RESPEC Company, LLC utilized the approximate 3-year trailing-average, base-case price of US$2,400 per ounce of gold and $28.80 per ounce of silver to update the pit-constrained resource tabulated below.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5343/271844_5e375577045a281b_001full.jpg

Notes:

- The Effective Date of the Wind Mountain mineral resources is September 03, 2025.

- The estimate of mineral resources was done by RESPEC in Imperial tons.

- Mineral Resources comprised all model blocks at a 0.004oz Au/ton cut-off for Oxide, 0.008oz Au/ton for Mixed, and 0.009 oz Au/ton for Unoxidized material within an optimized pit.

- The project mineral resources are block-diluted Mineral Resources potentially amenable to open pit mining methods and reported within optimized pits using a gold price of US$2,400/oz, a silver price of US$28.80/oz and a throughput rate of 20,000 tons/day resulting in a potential mine life of 11 years with a potential strip ratio of 0.36:1 waste:mineralization.

- Assumed metallurgical recoveries for gold are 62% for oxide, 20% for mixed and 15% for unoxidized. Assumed mining costs are US$3.00/ton mined, heap leach processing costs of US$3.29/ton processed, general and administrative costs of $0.66/ton processed. Gold and silver commodity prices were selected based on analysis of the approximate three-year running average.

- Material in waste dumps and heap leach pads are NOT included in the current model and resource.

- Mineral Resources that are not Mineral Reserves do not have demonstrated economic viability.

- The estimate of mineral resources may be materially affected by geology, environmental, permitting, legal, title, taxation, sociopolitical, marketing, or other relevant issues.

- Rounding may result in apparent discrepancies between tonnes, grade, and contained metal content.

RESPEC notes that additional studies such as further metallurgical studies to evaluate crushing higher-grade portions of the deposit and grid drilling to delineate economic portions of the previously mined "waste rock", which are given no value in the current model, could further enhance the economics. For example, RESPEC notes that in the 2022 PEA, 1.1million tons of historic mine waste is currently classified as "waste" and must be removed during Phase I mining; however, results of limited drilling, surface sampling, and trenching by Bravada suggest the material contains potentially recoverable gold.

The majority of the technical report dated January 20, 2023 is unchanged, including results of the Preliminary Economic Assessment, except for Sections 1 (Summary) and 14 (Mineral Resources). RESPEC, Woods Process Services, and Debra Struhsacker, Bravada's Environmental Permitting and Government Relations Consultant, compiled the technical report. Thomas Dyer, P.E. is a Principal Engineer for RESPEC and is responsible for sections of the technical report involving mine designs and the economic evaluation; Michael Lindholm, C.P.G., is a Principal Geologist for RESPEC, and is responsible for the sections involving the Mineral Resource estimate; Jeffery Woods, SME MMSA QP, is an independent Principal Consulting Metallurgist with Woods Process Services and is responsible for the sections on process 13, 17 and 21. The PEA relies on Debra Struhsacker as an expert in permitting. Thomas Dyer, Michael Lindholm and Jeffery Woods are the Qualified Persons of the technical report for the purpose of Canadian NI 43-101, Standards of Disclosure for Economic Analyses of Mineral Projects.

About Wind Mountain

The past-producing Wind Mountain gold/silver project is located approximately 160km northeast of Reno, Nevada in a sparsely populated region with excellent logistics, including county-maintained road access and a power line to the property. AMAX Gold/Kinross Gold recovered nearly 300,000 ounces of gold and over 1,700,000 ounces of silver between 1989 and 1999 from two small open pits and a heap-leach operation (reported data based on Kinross Gold files). Rio Fortuna Exploration (U.S.) Inc., a wholly owned US subsidiary of Bravada Gold Corporation, acquired 100% of the property through an earn-in agreement with Agnico-Eagle (USA) Limited, a subsidiary of Agnico-Eagle Mines Limited, which retains a 2% NSR royalty interest, of which 1% may be purchased for $1,000,000 at any time prior to commencement of production. The resource and PEA for Wind Mountain were updated in April 2012 and further updated in November 2022, and herein in September 2025.

About Bravada

Bravada is a long-established exploration and development company with a portfolio of high-quality properties in Nevada, one of the best mining jurisdictions in the world. Utilizing a modified joint-venture business model, Bravada has successfully identified and advanced properties with the potential to host high-margin deposits while successfully attracting partners to fund later stages of project development. Bravada's value is underpinned by a substantial gold and silver resource with a positive PEA study conducted in 2022 on a Phase I portion of the Wind Mountain deposit, and additional Phases are being evaluated for the project as part of an ongoing Pre-Feasibility Assessment. In addition, the Company has significant upside potential from possible new discoveries at its other exploration properties.

Since 2005, the Company has signed 33 earn-in joint-venture agreements for its properties with 20 publicly traded companies, as well as a similar number of property-acquisition agreements with private individuals. Bravada currently has eight projects in its portfolio, consisting of 756 claims for approximately 5,600 ha in two of Nevada's most prolific gold trends. Most of the projects host encouraging drill intercepts of gold and already have drill targets developed.

Several videos are available on the Company's website that describe Bravada's major properties, answering investors commonly asked questions. Simply click on this link https://bravadagold.com/projects/project-videos/ .

Joseph Anthony Kizis, Jr. (AIPG CPG-11513), the President and a Director of Bravada Gold Corporation, is the qualified person responsible for reviewing and preparing the technical data presented in this release and has approved its disclosure.

On behalf of the Board of Directors

Joseph A. Kizis, Jr., Director, President, Bravada Gold Corporation

For further information, please visit Bravada Gold Corporation's website at bravadagold.com; or contact us at 604.641.2759 or by email at corpdev@mnxltd.com.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This news release may contain forward-looking statements including but not limited to comments regarding the timing and content of upcoming work programs, geological interpretations, receipt of property titles, potential mineral recovery processes, etc. Forward-looking statements in this news release include conducting a PFS for the Wind Mountain project. Forward-looking statements address future events and conditions and therefore involve inherent risks and uncertainties. Actual results may differ materially from those currently anticipated in such statements. These statements are based on a number of assumptions, including, but not limited to, assumptions regarding general economic conditions, interest rates, commodity markets, regulatory and governmental approvals for the company's projects, and the availability of financing for the company's development projects on reasonable terms. Factors that could cause actual results to differ materially from those in forward looking statements include market prices, exploitation and exploration successes, the timing and receipt of government and regulatory approvals, and continued availability of capital and financing and general economic, market or business conditions. Bravada Gold Corporation does not assume any obligation to update or revise its forward-looking statements, whether as a result of new information, future events or otherwise, except to the extent required by applicable law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/271844