Toronto, Ontario--(Newsfile Corp. - February 26, 2026) - C3 Metals Inc. (TSXV: CCCM) (OTCQB: CUAUF) ("C3 Metals" or the "Company") is pleased to announce drill results at its 100%-owned Khaleesi copper project ("Khaleesi" or "the Project") in southern Peru. The Company has completed 12 diamond drill holes for 6,300 metres ("m"). Copper mineralization has been observed in all 12 completed drill holes within a footprint measuring 1,000m by 500m. Step outs are up to 300m.

Khaleesi is a greenfield copper project undergoing drill testing for the first time in the project's history. Assay results from the first two holes were previously reported (see press releases dated December 15, 2026 and January 21, 2026). Assays have now been received from an additional four holes. Multiple holes intercepted broad intervals of skarn and diorite hosted copper mineralization, including:

-

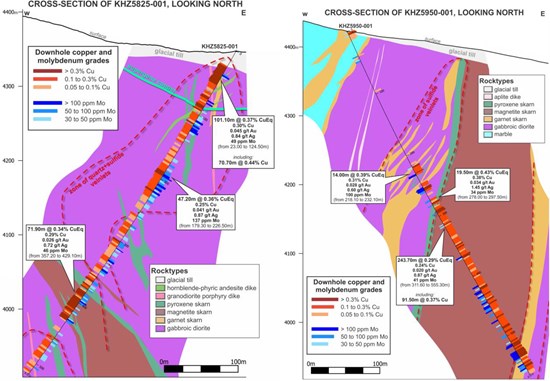

KHZ5825-001 intersected 101.1m at 0.30% copper, 0.045 g/t gold, 0.84 g/t silver and 48 ppm molybdenum (0.37% CuEq) from 23.4m downhole depth;

-

including 70.7m at 0.37% copper, 0.049 g/t gold, 0.96 g/t silver and 24 ppm molybdenum (0.44% CuEq);

-

another 71.9m intercept of 0.29% copper, 0.026 g/t gold, 0.72 g/t silver and 46 ppm molybdenum was encountered at 357.2m downhole depth;

-

KHZ5825-001 was collared approximately 500m east of the first drill hole. That hole, KHZ5800-001, intersected 269.0m at 0.30% copper, including 60.4m at 0.41% copper (see press release dated December 15, 2025).

-

-

KHZ5950-001 intersected 243.7m at 0.24% copper, 0.020 g/t gold, 0.87 g/t silver and 41 ppm molybdenum (0.29% CuEq) from approximately 200m vertical depth (311.6m downhole depth);

-

including 91.5m at 0.30% copper, 0.024 g/t gold, 1.16 g/t silver and 60 ppm molybdenum (0.37% CuEq);

-

KHZ5950-001 was collared 150m north of KHZ5800-001.

-

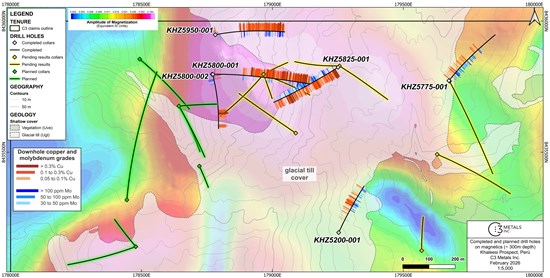

Figure 1: Plan view map of MVI Magnetic Inversion: Amplitude of Magnetization, depth slice 300m showing a large irregular shaped magnetic anomaly that is coincident with a zone of outcropping skarn. Downhole assay results are shown along trace of drillhole for copper and molybdenum. Yellow drill traces indicate completed or in-progress drill holes with assays pending, and green drill traces indicated the locations of planned drill holes.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/285355_e21b0117b477d924_001full.jpg

Figure 2: Cross sections through KHZ5825-001 on the left and KHZ5950-001 on the right.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/285355_e21b0117b477d924_002full.jpg

Dan Symons, President and CEO, stated, "We have intersected copper mineralization in 12 holes drilled within a 1,000m by 500m footprint. This a tremendous result for a greenfield project undergoing initial drill testing and demonstrates the large scale of the hydrothermal system. Results from the first six holes assayed and visual observations for the remaining six holes demonstrate potential for higher grade mineralization in the western and southwestern project area. Mineralization in the east and northeast project area appears to be more distal from the 'heat engine' of the system. With more drilling, we will be able to define the geometry of the system and vector into the higher-grade zones. We plan to drill an additional 15,000m in 2026 beyond the first 6,300m completed, for a total 21,300m drilled at Khaleesi by the end of this year."

Table 1: Significant assays in four Khaleesi drill holes

| Hole ID | From

(m) |

To

(m) |

Length

(m) |

Cu

(%) |

Au

(g/t) |

Ag

(g/t) |

Mo

(ppm) |

CuEq*

(%) |

| KHZ5200-001 | 274.50 | 320.43 | 45.93 | 0.18 | 0.059 | 0.72 | 141 | 0.31 |

|

|

348.00 | 361.00 | 13.00 | 0.23 | 0.040 | 0.62 | 82 | 0.31 |

| KHZ5775-001 | 8.60 | 17.00 | 8.40 | 0.17 | 0.036 | 0.64 | 4 | 0.21 |

|

|

76.00 | 97.50 | 21.50 | 0.17 | 0.028 | 0.69 | 147 | 0.28 |

| KHZ5825-001 | 23.40 | 124.50 | 101.10 | 0.30 | 0.045 | 0.84 | 47 | 0.37 |

| Including | 23.40 | 94.10 | 70.70 | 0.37 | 0.049 | 0.96 | 24 | 0.44 |

|

|

179.30 | 226.50 | 47.20 | 0.25 | 0.041 | 0.87 | 137 | 0.36 |

|

|

357.20 | 429.10 | 71.90 | 0.29 | 0.026 | 0.72 | 45 | 0.34 |

| KHZ5950-001 | 218.10 | 232.10 | 14.00 | 0.31 | 0.028 | 0.60 | 100 | 0.39 |

|

|

278.00 | 297.50 | 19.50 | 0.38 | 0.034 | 1.45 | 23 | 0.43 |

|

|

311.60 | 555.30 | 243.70 | 0.24 | 0.020 | 0.87 | 40 | 0.29 |

| Including | 445.50 | 537.00 | 91.50 | 0.30 | 0.024 | 1.16 | 59 | 0.37 |

| Notes

*Copper Equivalent (CuEq) for drill intersections is calculated based on three-year trailing average for each commodity (2023, 2024 and 2025) which equates to US$ 4.18/lb Cu, US$ 2,600/oz Au, US$ 30.54/oz Ag and US$ 21.46/lb Mo, with 80% metallurgical recoveries assumed for all metals. The formula is: CuEq % = Cu % + (0.907 x Au g/t) + (0.0107 x Ag g/t) + (0.00051 x Mo ppm). Since it is unclear what metals will be the principal products and as Khaleesi is an early-stage greenfield project with no metallurgical test work completed, assuming different recoveries is premature at this stage. As such an 80% recovery rate is justified. Composite intervals are calculated using length weighted averages based on a combination of lithological breaks and copper assay values according to a 0.15% Cu cutoff and include a maximum of 12 meters of internal dilution. All intervals reported in this table are down hole core lengths, and true thicknesses have yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated. |

||||||||

Next Steps

The Company is planning up to 15,000m of drilling comprising 25 to 30 holes in 2026. The drill program will focus on testing:

-

The strike and depth potential of the mineralized garnet and magnetite skarn;

-

The source of the intense quartz veining observed in KHZ5800-002 (see press release dated January 21, 2026), which intersected 51.1m at 0.54% copper, 0.31 g/t gold, 3.21 g/t silver, and 6 pp molybdenum (0.86% CuEq), including 18.0m at 1.08% copper, 0.76 g/t gold, 7.62 g/t silver and 7 ppm molybdenum (1.85% CuEq); and

-

Further skarn and porphyry potential below the glacial till and along the prosperous limestone-diorite contact.

Results indicate real potential for a large-scale skarn system with alteration-mineralization vectors suggesting a potential causative porphyry system. The Company is continually updating its geological model and identifying vectors to better target the skarn and potential porphyry system. With the initial Phase 1 drilling program of 6,300m now completed, and the potential for a mineral system confirmed, the Company has initiated an aggressive drill strategy in 2026.

For additional information, contact:

Dan Symons

President and CEO

+1 416 716 6466

dsymons@c3metals.com

ABOUT C3 METALS INC.

C3 Metals Inc. is a mineral exploration company focused on creating substantive value for its shareholders through the discovery and development of large copper and gold deposits. The Company holds approximately 31,000 hectares located in the prolific high-grade Andahuaylas-Yauri Porphyry-Skarn belt of Southern Peru, which contain the Company's Jasperoide and Khaleesi projects. Mineralization at Jasperoide and Khaleesi is hosted in a similar geological setting to the nearby major mining operations at Las Bambas (MMG), Constancia (Hudbay) and Antapaccay (Glencore). At Jasperoide, the Company has identified 13 skarn prospects a 28km belt. The Company has published a maiden resource estimate on the first of these skarn targets, which contained Measured & Indicated Resources of 52Mt at 0.5% copper and 0.2 g/t gold1. The Company is also actively exploring in Jamaica where it has identified 16 porphyry, 40 epithermal and multiple volcanic redbed copper prospects over a 30km strike extent. The Company holds a 100% interest in 17,855 hectares of exploration licenses, of which Freeport-McMoRan Exploration Corporation, a wholly-owned affiliate of Freeport-McMoRan Inc. (NYSE: FCX), has the option on 13,020 hectares to earn up to a 75% interest by funding up to US$75 million of exploration and project related expenditures. The Company also holds a 50% interest in 9,870 hectares in a joint venture with Geophsyx Jamaica Ltd, the largest mineral tenure holder in the country. Barrick Mining Corp. announced on May 1, 2024 that it had entered into an earn-in agreement with Geophysx Jamaica Ltd. on approximately 400,000 hectares of exploration licenses, several of which surround C3 Metals' mineral concessions. Mining is currently the second largest industry in Jamaica, and historical mining dates back to the colonial eras of the 1500s (Spanish) and 1800s (British).

Related Link: www.c3metals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

QP Statement

Stephen Hughes, P.Geo. is Vice President Exploration and a Director for C3 Metals and is a Qualified Person as defined by National Instrument 43-101. Mr. Hughes has reviewed the technical information in this news release and approves the written disclosure contained herein.

Copper Equivalent Formula

Copper Equivalent (CuEq) for drill intersections is calculated based on three-year trailing average for each commodity (2023, 2024 and 2025) which equates to US$ 4.18/lb Cu, US$ 2,600/oz Au, US$ 30.54/oz Ag and US$ 21.46/lb Mo, with 80% metallurgical recoveries assumed for all metals. The formula is: CuEq % = Cu % + (0.907 x Au g/t) + (0.0107 x Ag g/t) + (0.00051 x Mo ppm). Since it is unclear what metals will be the principal products and as Khaleesi is an early-stage greenfield project with no metallurgical test work completed, assuming different recoveries is premature at this stage. As such an 80% recovery rate is justified.

Technical Program

C3 Metals adheres to a strict QA/QC protocol for handling, sampling, sample transportation and analyses. Chain-of-custody protocols are designed to ensure security of samples until their delivery at the laboratory.

Samples were cut at C3 Metals' Khaleesi Project camp, Cusco Region, Perú, by Company personnel. Before entering the cutting room, the drill core samples are marked lengthwise with a yellow line, and the core saw followed these lines to cut each sample. Diamond drill core was sampled in maximum 3-metre intervals, stopping at geological boundaries, and using a rock saw. Core diameter is a mix of PQ3 and HQ3, depending on the depth of the drill hole. Samples were bagged, tagged and packaged for shipment via local freight transport service to the ALS preparation laboratory in Arequipa, Arequipa Region, Perú. Entire samples were dried and weighed, then crushed to 85% passing 10 mesh (2mm). From this, a 1.5 kg split was pulverized to 90% passing 200 mesh (75µm).

The prepared, pulp samples were sent via ALS to the ALS assay laboratory in Lima, Lima Region, Perú, for copper, gold and multi-element analysis. ALS is an accredited laboratory which is independent of the Company. Gold assays were done by fire assay fusion (Au-AA23) with AAS finish on a 30g sample. Copper was assayed by ICP-AES following a 4-acid digestion via the ME-MS61r package for a suite of 60 elements. Any copper sample over detection limit (i.e., greater than 10,000ppm or 1% Cu) was additionally assayed via ICP-AES using the package ME-OG62. High and low copper, gold and iron standards, as well as blanks and duplicates (coarse crush split and pulp), were randomly inserted into the sampling sequence for quality control. On average, 11% of the submitted samples are quality control samples. No data quality problems were indicated by the QA/QC program.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. Although such statements are based on reasonable assumptions of the Company's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this release is made as of the date hereof, and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

________________________

1 Based on the assumptions and parameters outlined in the NI 43-101 Technical Report titled Jasperoide Copper-Gold Project Cusco Region, Peru dated July 5, 2023.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285355