THUNDER BAY, ON / ACCESS Newswire / January 12, 2026 / Clean Air Metals Inc. ("Clean Air Metals" or the "Company") (TSXV:AIR)(FRA:CKU0(OTCQB:CLRMF) is pleased to provide an overview of its 2026 objectives and highlights of 2025, for its 100%-owned Thunder Bay North ("TBN") Critical Minerals Project in Northwestern Ontario.

Critical Project Advancement Objectives

Spot prices for platinum, copper and palladium have appreciated by 70% (1000 $/oz), 25% (1.20 $/lb) and 50% 624($/oz) respectively versus study prices, since the results of the Preliminary Economic Assessment (PEA) were announced in the October 9th release. Using the financial model published in the PEA and applying current spot metal prices (as of January 6th), the TBN project shows a $708M1 NPV8 and a pre-tax IRR of 100% (post-tax NPV8 = $494M1 and IRR = 84%).This is a significant improvement in the project outlook in comparison to the PEA results that featured a $219.4M2 pre-tax NPV8 and a pre-tax IRR of 39%. This year, considering the recent record prices attained by both platinum and copper and the positive market outlook for platinum, palladium and copper, the company is committed to taking the following critical steps to advance the project, including:

-

Update and advance the stand-alone mill case for Thunder Bay North that will create a parallel development path to become a regional processing centre for Copper-PGE feed.

-

Develop and implement a new metallurgical test program to confirm the potential toll milling performance.

-

Complete the early design for the site access road and power infrastructure, with the active participation of First Nations communities

-

Complete Advanced Exploration permitting that includes approvals for a future ramp and bulk sample. The Notice of Project Change was filed in early 2025 in anticipation of improving market conditions.

-

Continuation of the collection and analysis of environmental baseline studies in support of permitting.

Notes:

1January 6, 2026 Spot pricing is as follows (USD) Pt $2424/oz, Pd $1849/oz, Cu $6.00/lb, Ni $8.36/lb, Au $4489/oz, Ag $81.00/oz

2Study pricing is as follows (USD) Pt $1425/oz, Pd $1225/oz, Cu $4.80/lb, Ni $6.80/lb, Au $2800/oz, Ag $30/oz

2026 Exploration Objectives

The Thunder Bay North project updated resource was released in November 2025 (see November 24 Release). The deposit now boasts a 14.9M tonne indicated resource grading 2.66 g/t 2PGE (Pt+Pd), 0.40% Cu and 0.24% Ni, with 2.49M tonnes of inferred resource grading 1.62 g/t 2PGE (Pt+Pd), 0.31% Cu and 0.19% Ni. On a contained basis, the asset holds a combined 1.39Moz (Pt+Pd) including 67kt of copper and 41kt of nickel in resource.

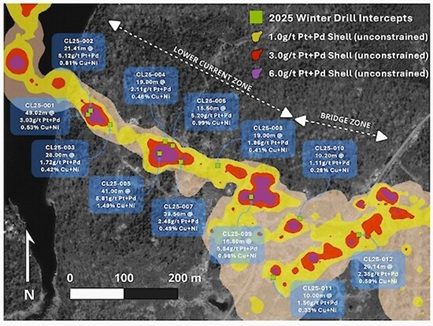

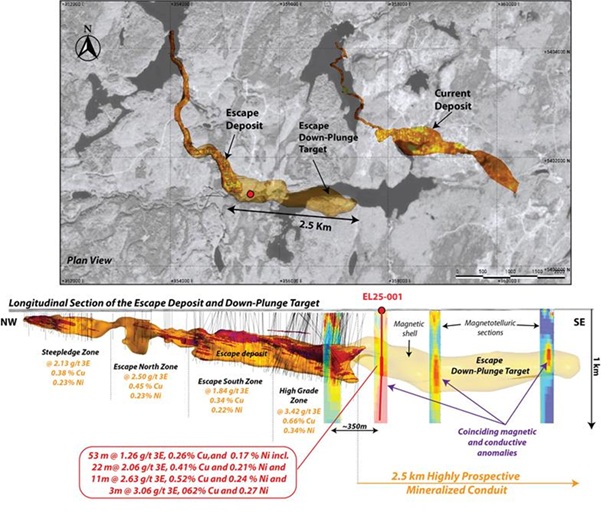

The Company plans to build on the success of the 2025 programs which featured the successful expansion of high-grade ballrooms at Current (Figure 1 and April 15 release) and the initial step-out hole 53m intersection at the Escape deposit down-plunge target (Figure 2 and October 20 release). In 2026, the Company intends to focus on refining remaining targets in the down-plunge extension of the Escape Deposit with a magnetotelluric survey and launch a follow-up drilling program to demonstrate the significant resource upscale potential over the 2.5km strike.

Figure 1. Plan view map showing locations of high-grade intercepts of the 2025 Winter Drilling Program at the Current Deposit.

Figure 2. Drill hole EL25-001 relative to the modelled extension of the known resource drilled as the initial step-out target at Escape Down-Plunge

Mike Garbutt, President and CEO, commented, "2026 will be a pivotal year for Clean Air Metals building on the tremendous successes achieved in 2025. Our primary objective now is to advance the Thunder Bay North project technical studies with urgency, building on the PEA completed in late 2025. The significant improvement in PGE and Copper markets adds to the potential value of this asset and with the team in place, creates an environment and opportunity for the company to create real value."

Regional Strategy and Financing

Clean Air Metals continues to utilize the team's best-in-class technical capabilities in PGE resource development to identify and evaluate regional opportunities, with an intent to becoming a leading PGE focused explorer and developer in Canada. Recent changes to federal and provincial support for critical mineral development, in conjunction with supportive First Nation partners, make the region a tier-one jurisdiction for mineral development. To drive this initiative, the company has started outreach with key federal and provincial funding agencies including the Critical Minerals Infrastructure fund, the Critical Minerals Innovation Fund, Export Development Canada and the Critical Minerals Sovereign Fund, to set the stage for rapid project development. In parallel, the Company is working to attract strategic partners that share our view on continued and long-term strength in PGM and copper markets.

Qualified Person

Dr. Lionnel Djon, Ph.D., P.Geo., a Qualified Person under National Instrument 43-101 and Vice President of Exploration for the Company, has reviewed and approved all technical information in this press release.

About Clean Air Metals

Clean Air Metals is a development and exploration company advancing its flagship, 100% owned Thunder Bay North Critical Minerals ("TBN") project, 40 km northeast of Thunder Bay, Ontario. The TBN project, accessible by road and next to established infrastructure, hosts two (2) deposits - the Current and Escape deposits, only 2.5 km apart. Together, the deposits host a 14.9 Mt indicated mineral resource grading 2.66 g/t (Pt+Pd), 0.40% Cu and 0.24% Ni (NI 43-101 PEA Technical Report, Thunder Bay North Project, Ontario, Canada SLR Consulting Canada Ltd, November 21, 2025,) with significant potential for expansion down-plunge.

One of the rare primary platinum resources outside of South Africa, the TBN project is in a stable and mining-friendly jurisdiction and benefits from longstanding relationships with local First Nations. The TBN project has the potential to develop into a secure source of rare platinum metals, as well as other critical metals such as copper, nickel, and cobalt, for the North American manufacturing sector. Ongoing concerns over future platinum supply are driving prices to historic highs, with obvious benefits for a future TBN mining operation. With its proven technical team, Clean Air Metals is committed to advancing the TBN project and creating long-term value for shareholders.

Social Engagement

Clean Air Metals Inc. acknowledges that the Thunder Bay North Critical Minerals Project is located within the area encompassed by the Robinson-Superior Treaty of 1850 and includes the territories of the Fort William First Nation, Red Rock Indian Band, Biinjitiwabik Zaaging Anishinabek and Kiashke Zaaging Anishinaabek. Clean Air Metals also acknowledges the contributions of the Métis Nation of Ontario, Region 2 and the Red Sky Métis Independent Nation to the rich history of our area.

The Company appreciates the opportunity to work in these territories and remains committed to the recognition and respect of those who have lived, travelled, and gathered on the lands since time immemorial. Clean Air Metals is committed to stewarding Indigenous heritage and to building, fostering, and encouraging a respectful relationship with First Nations, Métis, and Inuit peoples, based upon principles of mutual trust, respect, reciprocity, and collaboration, in the spirit of reconciliation.

ON BEHALF OF THE BOARD OF DIRECTORS

"Mike Garbutt"

Mike Garbutt, CEO of Clean Air Metals Inc.

Connect with us on X/ Facebook/ Instagram.

Visit www.cleanairmetals.ca for more information or contact:

Mia Boiridy

Director of Communications and Investor Relations

250-575-3305

mboiridy@cleanairmetals.ca

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note

The information contained herein contains "forward-looking statements" within the meaning of applicable securities legislation. Forward-looking statements relate to information that is based on assumptions of management, forecasts of future results, and estimates of amounts not yet determinable. Any statements that express predictions, expectations, beliefs, plans, projections, objectives, assumptions or future events or performance are not statements of historical fact and may be "forward-looking statements." Forward-looking statements are subject to a variety of risks and uncertainties which could cause actual events or results to differ from those reflected in the forward-looking statements, including, without limitation: political and regulatory risks associated with mining and exploration; risks related to the maintenance of stock exchange listings; risks related to environmental regulation and liability; the potential for delays in exploration or development activities or the completion of feasibility studies; the uncertainty of profitability; risks and uncertainties relating to the interpretation of drill results, the geology, grade and continuity of mineral deposits; risks related to the inherent uncertainty of production and cost estimates and the potential for unexpected costs and expenses; results of prefeasibility and feasibility studies, and the possibility that future exploration, development or mining results will not be consistent with the Company's expectations; risks related to commodity price fluctuations; and other risks and uncertainties related to the Company's prospects, properties and business detailed elsewhere in the Company's disclosure record. Should one or more of these risks and uncertainties materialize, or should underlying assumptions prove incorrect, actual results may vary materially from those described in forward-looking statements. Investors are cautioned against attributing undue certainty to forward-looking statements. These forward-looking statements are made as of the date hereof, and the Company does not assume any obligation to update or revise them to reflect new events or circumstances except in accordance with applicable securities laws. Actual events or results could differ materially from the Company's expectations or projections.

SOURCE: Clean Air Metals, Inc.

View the original press release on ACCESS Newswire