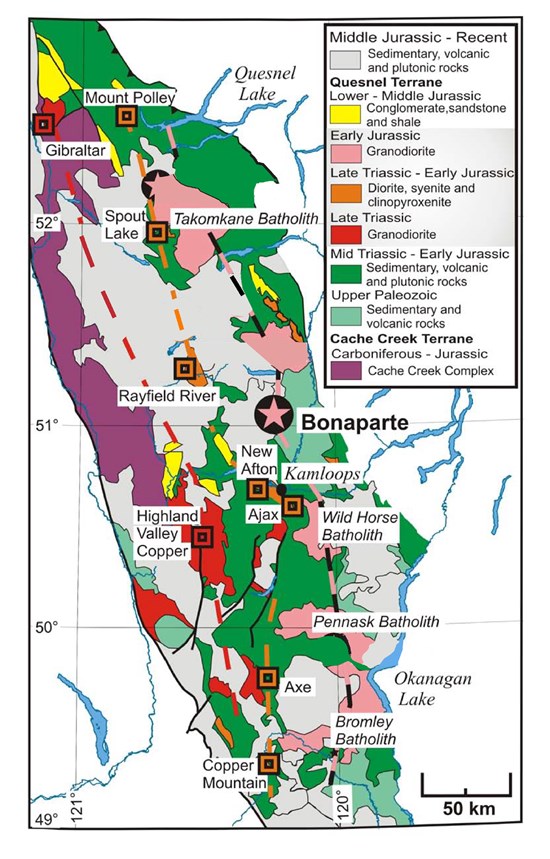

Stewart, British Columbia--(Newsfile Corp. - February 10, 2026) - Decade Resources Ltd. (TSXV: DEC) ("Decade" or the "Company") announces that it plans a drill program on the Bonaparte copper-gold property, located approximately 50km north of Kamloops, B.C., within the Kamloops Mining Division. Drilling will commence once permits are in place and weather conditions allow.

The property has different target areas including:

- Cu/Au/Mo porphyry potential

- Bulk-tonnage RIRGS target with high grade gold results in historic drilling, trenching, underground exploration

- High grade gold-copper low sulphidation epithermal veins system.

Ed Kruchkowski, President of Decade Resources, stated:

"The Bonaparte Gold project is an exciting property located in an area well accessed by a network of logging roads. The presence of gold bearing low sulphidation epithermal quartz veins open to extension along strike and to depth where multi-ounce gold assays have been intersected in historic drilling presents a large exploration target. The underlying IP anomaly presents a compelling target and this first drill hole will not only test a wider area for gold bearing veins but also test to depth. In addition, the presence of historical copper and gold soil geochemical results extending to the southeast from the "Discovery Zone" approximately 1 km away are also above indicated IP anomalies. Gold in soil results are reported with up to 3,270ppb Au as well as prospecting uncovered a quartz vein float sample which assayed 73.03g/t Au extending the exploration area even farther south. Gold-rich epithermal vein systems are somewhat unique, projects like Sleeper and Midas in Nevada, and Hishikari in Japan are examples and we are excited to have a project to drill for this kind of system. We are also delighted to have what appears to be an entire epithermal vein system and porphyry system completely in tact at Bonaparte and look forward to drilling both targets."

Discussion of Bonaparte

In 1994, from within the property area, a 3,700 metric ton bulk sample of mineralized vein material from surface trenching to a vertical depth of 12.2m from an open cut on the Nutcracker, Owl, Grey Jay and Crow vein systems, with an average grade of 25.4 g/t Au produced 3,160 ounces of gold. In 2010 a small bulk sample from the Crow Vein was shipped to the Kinross Mill in Republic, Washington. The 364-ton sample assayed 16.3 g/t Au (0.475 oz/t Au), yielding 161.95 troy ounces of gold. The above results are both from the BC Minfile and a 43-101 report by R. Kemp. The Company thinks that these results can be relied on.

In 2013 to 2014, historic IP surveys indicated Resistive (IP) anomalies which are considered high-priority drill targets that may indicate the presence of silicification, quartz veining, or potassic alteration—features that commonly host disseminated gold or copper mineralization. These Resistivity anomalies coincide with High Chargeability anomalies, suggesting a silica-rich, resistive host rock containing disseminated conductive sulphides. This interpretation is in line with comments from geological examinations by geologists from the British Columbia Geological Survey, Ministry of Energy, Mines and Natural Gas state: "We speculate that the Bonaparte deposit represents an upper level of a buried porphyry system." Reference for this is located in: Bonaparte gold: another 195 Ma porphyry Au-Cu deposit in southern British Columbia? James M. Logan and Mitchell G. Mihalynuk, British Columbia Geological Survey, Ministry of Energy, Mines and Natural Gas, page 71, 2013.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3615/283388_40611c6c740359fd_001full.jpg

The IP anomalies appear to start at approximately 300m depth and extend beyond 500m in depth as per the 43-101 report by R. Kemp. The Company plans a minimum of 3000m of drilling consisting of 5 holes, each 500m in length. The first target area will be the anomaly beneath the mined zone as shown in the following map.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3615/283388_40611c6c740359fd_002full.jpg

Qualified Person

Ed Kruchkowski, P.Geo., President of Decade Resources Ltd., is a Qualified Person as defined by National Instrument 43-101 and has reviewed and approved the technical contents of this news release.

About Decade Resources Ltd.

Decade Resources Ltd. is a Canadian based mineral exploration company actively seeking opportunities in the resource sector. Decade holds numerous properties at various stages of development and exploration from basic grass roots to advanced ones. Its properties and projects are mostly located in the "Golden Triangle" area of northern British Columbia. For a complete listing of the Company assets and developments, visit the Company website at www.decaderesources.ca. For investor information please call the Company at 250- 636-2264 or Gary Assaly at 604-377-7969.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, that the Company will receive regulatory approval of the Option, the exercise of the Option, exploration plans for the Property and the use of funds for the recently completed private placement are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should" or "would" or occur.

Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including that Company will be able to receive regulatory approval for the Option, that the Company will be able or willing to make the Option Payments in order to exercise the Option, that the Company will have the necessary funds and resources to conduct its exploration plans on the Property and that the Company will use the proceeds from the private placement as anticipated.

These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important risks that may cause actual results to vary, include, without limitation, the risk that the Company is unable to receive regulatory approval for the Option Agreement; that the Company may be unable or unwilling to make all Option Payments and exercise the Option; that the Company may be unable to conduct its exploration plans on the Property as anticipated, or at all; and that the Company may not use the proceeds from the private placement as anticipated.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws.

References

Logan, J.M., and Mihalynuk, M.G., 2013. Bonaparte gold: another 195 Ma Au-Cu porphyry deposit in southern British Columbia? In: Geological Fieldwork 2012, British Columbia Ministry of Energy, Mines and Natural Gas. British Columbia Geological Survey Paper 2013-1, 71-80.

Minfile BC

NI 43-101 Technical Report on the Bonaparte Gold Project by R. Kemp, P.Geo.

**Reduced intrusion-related gold systems (RIRGS) are characterized by widespread arrays of sheeted auriferous quartz veins that preferentially form in the brittle carapace at the top of small plutons, where they form bulk-tonnage, low-grade Au deposits characterized by a Au-Bi-Te-W metal assemblage, such as the Fort Knox and Dublin Gulch deposits. https://www.researchgate.net/publication/277131625_Reduced_Intrusion-related_Gold_Systems

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283388