Vancouver, British Columbia--(Newsfile Corp. - January 27, 2026) - Founders Metals Inc. (TSXV: FDR) (OTCQX: FDMIF) (FSE: 9DL0) ("Founders" or the "Company") is pleased to announce the successful consolidation of a cumulative 102,360 ha contiguous land package in Southeastern Suriname. The expansion comprises a 36,360-ha exploration concession granted by the Suriname GMD and a 10,000-ha exploitation concession acquired separately by the Company. Founders is the most advanced gold explorer in Suriname and now controls the largest uninterrupted package of highly prospective greenstone belt geology in the Guiana Shield.

Colin Padget, President & CEO, commented: "These acquisitions mark a major milestone for Founders. We have effectively consolidated an entire gold district covering over 100,000 hectares of Guiana Shield greenstone geology proven to host multi-million-ounce gold deposits. From historical exploration, artisanal mining activity, and our own drilling, it is clear the area is underlain by a world-class gold system. Founders is now uniquely positioned to systematically explore this entire land package while advancing our most promising targets toward resource definition."

Highlights

-

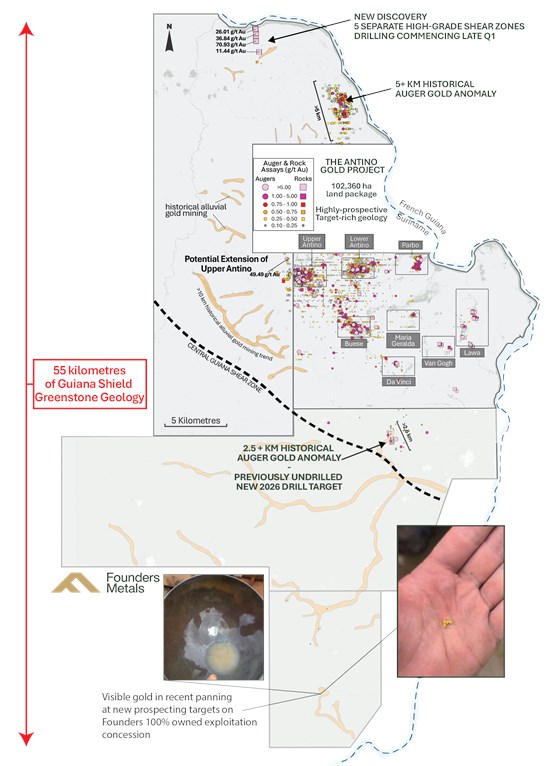

Strategic Expansion: The 46,360-ha combined acquisitions expand the Company's total concession area to 102,360 ha, making Founders the largest publicly traded gold exploration company in the Guiana Shield by land area.

-

World-Class Scale: The Antino property spans approximately 55 kilometres of Greenstone-hosted gold mineralization— comparable in scale to Kirkland Lake in Canada's Abitibi or Ghana's Ashanti Belt, both among the world's most endowed Archean gold systems.

-

Compelling Historical Data: Historical 2,100 m by 800 m gold anomaly adjacent to the Central Guiana Shear Zone — a district-scale target that has never been drill tested (Figure 1)

-

Multiple Target Areas: Several identified prospect areas share similar characteristics to drill-confirmed targets at Antino, including folded volcano-sedimentary rock packages, strongly veined and deformed intrusive bodies, and secondary structures with coincident gold anomalies.

-

Expanded Survey Programs: The Company has expanded its ongoing high-resolution airborne geophysics survey and regional auger geochemical sampling program to cover the entire consolidated land package. LiDAR and orthoimagery surveys to follow in H1 2026.

-

Near-Term Production Potential: The 10,000 ha Okasi exploitation concession is 100% owned by Founders, independent of the Antino option agreement. The Company is exploring potential revenue opportunities from small-scale mining.

Concession Details

The newly acquired concessions share the same geology that hosts gold mineralization at Antino and the 1.65-million-ounce Yaou deposit in neighboring French Guiana. The area is cut by the Central Guiana Shear Zone (CGSZ), a major regional structure that controls gold mineralization throughout the district. Multiple secondary structures branch off the CGSZ, creating additional exploration targets confirmed by geophysical surveys and field mapping.

Historical data compilation has identified several high-priority gold anomalies aligned with these structures, providing compelling early-stage exploration targets across the expanded land package.

Antino Expansion (36,360 ha Exploration Concession)

On January 13, 2026, the Suriname Ministry of Natural Resources (GMD No. 669/25) granted Lawa Gold N.V. a three-year exploration right for gold and other minerals covering 36,360 ha in the District of Sipaliwini. The concession is contiguous with and immediately adjacent to the existing Antino Gold Project. Founders currently holds a 70% interest in Lawa Gold N.V. pursuant to its option agreement with Nana Resources N.V.

Okasi Exploitation Concession (10,000 ha)

The Company acquired 100% of Mine Rehab N.V., the holder of a 10,000-ha exploitation concession ("Okasi") in the District of Sipaliwini. The concession is contiguous with and south of the Antino Gold Project. The exploitation right was granted by the Suriname Ministry of Natural Resources for a ten-year term. The Okasi concession is held by FDR Suriname Holding N.V., a wholly owned subsidiary of Founders, independent of the Company's option agreement with Nana Resources N.V.

About Founders Metals Inc.

Founders Metals is a Canadian-based exploration company focused on advancing the Antino Gold District located in Suriname, South America, in the heart of the Guiana Shield. The Company controls a contiguous 102,360 ha land package that has produced over 500,000 ounces of gold from historical surface and alluvial mining to date1. Founders is systematically advancing one of Suriname's most promising gold exploration and development opportunities with drill-confirmed, district-scale potential. The Company is committed to responsible exploration, community engagement, and delivering long-term value to shareholders through technical excellence and strategic growth in the Guiana Shield.

12022 Technical Report - Antino Project; Suriname, South America. K. Raffle, BSc, P. Geo & Rock Lefrançois, BSc, P.Geo.

ON BEHALF OF THE BOARD OF DIRECTORS,

Per: "Colin Padget"

Colin Padget

President, Chief Executive Officer, and Director

Contact Information

Katie MacKenzie, Vice President, Corporate Development

Tel: 306 537 8903 | katiem@fdrmetals.com

Cautionary Statement Regarding Forward-Looking Information

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation, including statements regarding the Company's exploration plans, the potential for near-term gold production, and the Company's prospects. Forward-looking information can generally be identified by words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", "believes", or variations indicating that certain actions, events or results "may", "could", "would", "might" or "will" occur or be achieved.

Forward-looking statements are based on management's current expectations and reasonable assumptions but are subject to business, market, and economic risks, uncertainties, and contingencies that may cause actual results to differ materially from those expressed or implied, including: general business and economic uncertainties; exploration results; mining industry risks; and other factors described in the Company's most recent annual management discussion and analysis. Although the Company has attempted to identify important factors that could cause actual results to differ materially, other factors may cause results not to be as anticipated. There can be no assurance that forward-looking information will prove accurate, as actual results and future events could differ materially from those anticipated. Accordingly, readers should not place undue reliance on forward-looking information. The Company does not undertake to update any forward-looking information except in accordance with applicable securities laws. Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

All material information on Founders Metals can be found at www.sedarplus.ca.

Quality Assurance and Control

Samples were analyzed at FILAB Suriname, a Bureau Veritas Certified Laboratory in Paramaribo, Suriname (a commercial certified laboratory under ISO 9001:2015). Samples are crushed to 75% passing 2.35 mm screen, riffle split (700 g) and pulverized to 85% passing 88 µm. Samples were analyzed using a 50 g fire assay (50 g aliquot) with an Atomic Absorption (AA) finish. For samples that return assay values over 5.0 grams per tonne (g/t), another cut was taken from the original pulp and fire assayed with a gravimetric finish. Founders Metals inserts blanks and certified reference standards in the sample sequence for quality control. External QA-QC checks are performed at ALS Global Laboratories (Geochemistry Division) in Lima, Peru (an ISO/IEC 17025:2017 accredited facility). A secure chain of custody is maintained in transporting and storing of all samples. Drill intervals with visible gold are assayed using metallic screening. Rock chip samples from outcrop/bedrock are selective by nature and may not be representative of the mineralization hosted on the project.

Qualified Persons

The technical content of this news release has been reviewed and approved by Michael Dufresne, M.Sc., P.Geol., P.Geo., an independent qualified person as defined by National Instrument 43-101.

Figure 1: Consolidated Antino Concession Map

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7574/281769_789bc02494a8b9bd_001full.jpg

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281769