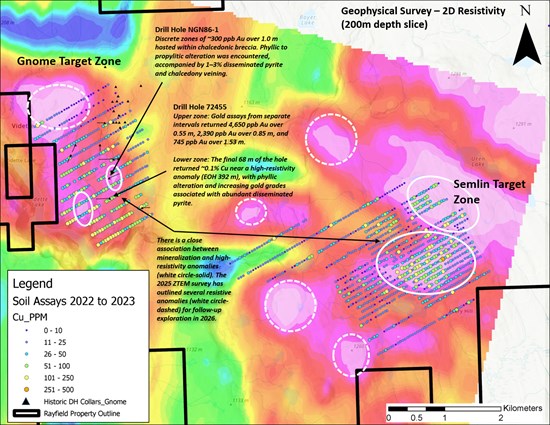

Vancouver, British Columbia--(Newsfile Corp. - January 7, 2026) - Golden Sky Minerals Corp. (TSXV: AUEN) (OTC Pink: LCKYF) ("Golden Sky" or "The Company") is pleased to announce that it has received its permit to drill at the Gnome and Semlin Target zones on the Rayfield-Gjoll Copper-Gold Property in south-central British Columbia, Canada (Figure 1). Phase 1 of the program is proposed to begin in early 2026 with an Induced Polarization (IP) geophysical survey to test the geochemical and geophysical anomalies outlined from previous exploration programs (Figure 2). Phase 2 will comprise up to 3,000 metres of diamond drilling to test geochemical and geophysical anomalies identified by the IP survey.

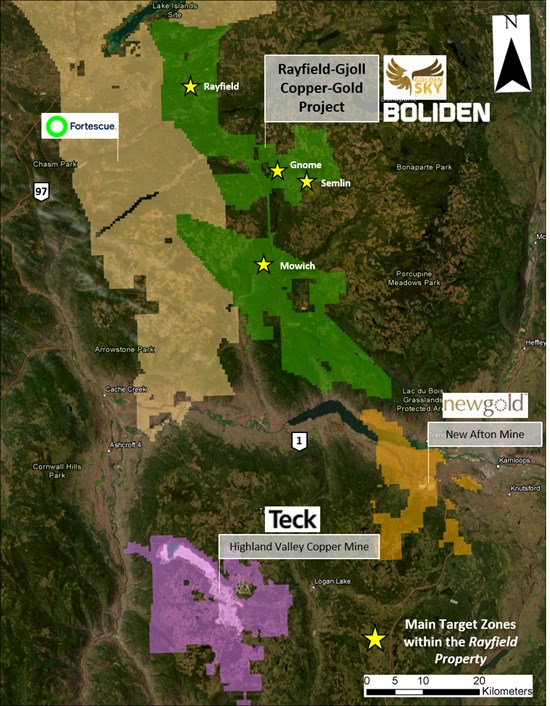

The contiguous Rayfield-Gjoll Property, located less than 60 km northwest of Kamloops, British Columbia, encompasses 87,660 hectares within the prolific Quesnel Trough, one of Canada's premier porphyry copper belts. This metallogenic corridor hosts several major mining operations, including Teck's Highland Valley Copper Mine, Taseko's Gibraltar Mine, New Gold's New Afton Mine, Hudbay Minerals' Copper Mountain Mine, and Imperial Metals' Mount Polley Mine. The Quesnel Trough is characterized by significant metal endowment and a well-established production history; however, vast areas remain underexplored by modern, systematic exploration methodologies. The region benefits from robust infrastructure and all-season access which support efficient exploration and development activities.

John Newell, President and CEO of Golden Sky Minerals, states: "Receiving this second drill permit from the British Columbia Ministry of Mining and Critical Minerals is a significant milestone for Golden Sky. It enables us to expand exploration at the highly prospective Gnome and Semlin target areas, which exhibit compelling geochemical and geophysical signatures consistent with porphyry-style copper-gold systems. With our first permit now active and this second one in hand, we are well-positioned to advance systematic exploration across the Rayfield-Gjoll property. This progress also strengthens our collaboration with Boliden as part of the earn-in agreement, and we look forward to an active and results-driven 2026 exploration season."

Gnome Target

- Large-scale ~1.8 km x 1.5 km geochemical copper-gold-zinc-arsenic-molybdenum (Cu-Au-Zn-As-Mo) soil anomaly (see December 6, 2022 news release) with limited historical drilling.

- The ZTEM geophysical survey identified a major resistive anomaly dipping to the northeast, interpreted as a buried porphyry system (see July 23, 2025 news release).

- Historical surface sample assays up to 0.22% Cu and 1.02 g/t Au (Morin, 1988).

- Favourable alteration: widespread phyllic and propylitic zones across the target are consistent with surface exposures of the upper zones of an underlying porphyry system.

- Historical drill hole 72455 intersected 0.1% Cu over the final 68 m (Brauset, 1998), with increasing gold grades associated with abundant disseminated pyrite. This has been interpreted as the inner portions of the pyrite halo, which may grade into the main porphyry-style mineralized zone with depth.

- Coincident magnetic, gravity & radiometric anomalies aligned with alkalic Cu-Au porphyry signatures in the Quesnel terrane.

Semlin Target

- Large-scale ~1.4 km x 0.9 km geochemical soil anomaly (Cu-Au-Zn-As-Mo) (see December 6, 2022 news release)

- Located along the edge of a high-resistivity batholith - interpreted to be a favourable porphyry setting.

- Surface samples assayed up to 0.2% Cu, 135 ppm Mo, 55 ppb Au (2022), highlighting the potential for a mineralized copper-gold porphyry system.

- Dioritic-monzonitic intrusion mapped along edge of geophysical and geochemical anomaly is associated with disseminated pyrite & quartz veining.

Figure 1: The combined >87,000-hectare Rayfield-Gjoll Property is located in a highly prospective "gap" in the Quesnel Trough, where major companies have active mines and are exploring for new Cu-Au porphyry deposits.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11793/279727_c683c4b294b348c0_004full.jpg

Figure 2: Copper-in-soil assays (2022-2023) overlying Geophysical ZTEM survey. Elevated copper values closely correlate with high-resistivity anomalies identified by the survey, enhancing the prospectivity of underexplored geophysical targets.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/11793/279727_c683c4b294b348c0_005full.jpg

References

Brauset, R.U. 1998. Assessment Report on Geological and Geochemical Surveys of the South-East Quadrant of Gnome. BC Geological Survey Assessment Report 25996.

Koffyberg, A. 2008. Assessment Report on a Diamond Drill Program, Rayfield River Program. BC Geological Survey Assessment Report 30271.

Morin, J.A. 1988. Geological and Geochemical Report on the Epi Claim Group. BC Geological Survey Assessment Report 17810.

About Golden Sky Minerals Corp.

Golden Sky Minerals Corp. is a well-funded junior grassroots explorer engaged in the acquisition, assessment, exploration, and development of mineral properties located in highly prospective areas and mining-friendly districts. Golden Sky's mandate is to develop its portfolio of properties to the mineral resource stage through systematic exploration.

Its portfolio includes the Rayfield-Gjoll Copper-Gold Project in British Columbia, the Hotspot and Luckystrike gold projects in Yukon, and the Auden Gold Project in Ontario's Timmins camp. The company was incorporated in 2018 and is headquartered in Vancouver, British Columbia, Canada.

More information can be found at the Company's website at www.goldenskyminerals.com.

About Boliden

Boliden contributes to a sustainable future by extracting, producing and recycling metals that are essential to improve society for generations to come. With care for people and the environment, combined with experience gathered over a century and cutting-edge technology, Boliden's 8,000 employees have achieved leading productivity and one of the lowest carbon footprints in the industry.

ON BEHALF OF THE BOARD

John Newell, President and Chief Executive Officer

Carl Schulze, P. Geo., Consulting Geologist with Aurora Geosciences Ltd, is a qualified person as defined by National Instrument 43-101 for Golden Sky's British Columbia exploration projects, and has reviewed and approved the technical information in this release.

For new information from the Company's programs, please visit Golden Sky's website at www.GoldenSkyMinerals.com or contact John Newell by telephone (604) 568-8807 or by email at info@goldenskyminerals.com or john.newell@goldenskyminerals.com.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

Statements contained in this news release that are not historical facts are "forward-looking information" or "forward-looking statements" (collectively, "Forward-Looking Information") within the meaning of applicable Canadian securities legislation. In certain cases, Forward-Looking Information can be identified by the use of words and phrases such as "anticipates", "expects", "understanding", "has agreed to" or variations of such words and phrases or statements that certain actions, events or results "would", "occur" or "be achieved". Although Golden Sky has attempted to identify important factors and risks that could affect Golden Sky and may cause actual actions, events or results to differ materially from those described in Forward-Looking Information, there may be other factors and risks that cause actions, events or results not to be as anticipated, estimated or intended, including, without limitation: inherent risks involved in the exploration and development of mineral properties; the uncertainties involved in interpreting drill results and other exploration data; the potential for delays in exploration or development activities; the geology, grade and continuity of mineral deposits; the possibility that future exploration, development or mining results will not be consistent with Golden Sky's expectations; accidents, equipment breakdowns, title and permitting matters; labour disputes or other unanticipated difficulties with or interruptions in operations; fluctuating metal prices; unanticipated costs and expenses; uncertainties relating to the availability and costs of financing needed in the future, including to fund any exploration programs on its projects; that Golden Sky may not be able to confirm historical exploration results and other risks set forth in Golden Sky's public filings at www.sedar.com. In making the forward-looking statements in this news release, Golden Sky has applied several material assumptions, including the assumption that general business and economic conditions will not change in a materially adverse manner. There can be no assurance that Forward-Looking Information will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on Forward-Looking Information. Except as required by law, Golden Sky does not assume any obligation to release publicly any revisions to Forward-Looking Information contained in this news release to reflect events or circumstances after the date hereof or to reflect the occurrence of unanticipated events.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/279727