Vancouver, British Columbia--(Newsfile Corp. - February 26, 2026) - Graphano Energy Ltd. (TSXV: GEL) (FSE: 97G0) (OTC Pink: GELEF) ("Graphano" or the "Company") reports that it has received the final report for its helicopter-borne airborne magnetic ("MAG") and time-domain electromagnetic ("TDEM") survey completed over the Black Pearl claims in Québec. Preliminary results from the program were previously announced on January 16, 2026 (Graphano news release dated January 16, 2026).

Highlights:

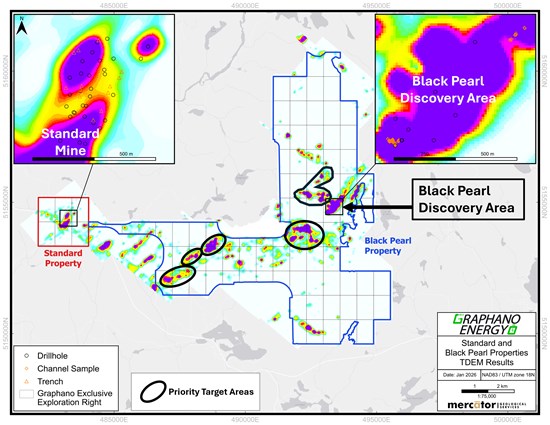

- Final interpretation outlines an approximately 6.5-kilometre conductive trend across the survey area, with five (5) distinct conductive target areas prioritized for initial follow-up exploration (Figure 1).

- The airborne results expand and refine the conductive footprint previously reported at Black Pearl, including a dominant conductor previously interpreted over ~1.2 kilometres in the discovery area.

- Prior drilling (Graphano news release dated October 14, 2025) within the discovery area returned multiple near-surface graphite zones (core lengths), including:

- 11.33% Cg over 8.61 m (BP25-01)

- 4.81% Cg over 12.25 m including 6.63% Cg over 7.07 m (BP25-06)

- 7.37% Cg over 4.70 m (BP25-03)

- Surface work at Black Pearl has included strong channel sample results, including 15.1% Cg over 14 m and 17.9% Cg over 9 m (previously reported).

Dr. Luisa Moreno, CEO of Graphano, commented: "Getting the final airborne report is a turning point for Black Pearl. We now have a clear, property-scale picture of conductivity and structure, including a 6.5-kilometre trend with five discrete target corridors. When you pair that with the high-grade surface channels and the near-surface drill intersections we have already delivered, it gives us a compelling roadmap to go straight to the most prospective ground and start building momentum with systematic prospecting and follow-up work."

Airborne MAG-TDEM Survey and Results

The final report provides a complete set of processed MAG and TDEM products and an updated interpretation to support target selection and field follow-up. The interpreted results define an approximately 6.5-kilometre conductive trend and identify five priority conductive target areas for further exploration.

Graphano will integrate the final interpretation with existing geology, trenching/channel sampling, and drilling information to refine target ranking and guide next-stage work.

Follow-Up Exploration Plans

The Company plans to initiate prospecting and field reconnaissance over the five priority target areas, including mapping and sampling, with the objective of confirming the source of conductivity and advancing the highest-priority targets toward additional ground geophysics and/or drill testing.

Indication of Prospectivity

Black Pearl is a large property (previously reported as 84 claims covering ~4,149 hectares) and remains largely unexplored outside the current drill-tested area. The Company has also noted that the mineralization occurs within a geological setting considered comparable to major graphite deposits in the Lac des Iles region, supporting the potential for continued discovery along conductive trends.

Figure 1 - Black Pearl Property with Airborne TDEM Results

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8293/285409_f11c1408749a6a32_002full.jpg

Qualified Person

The scientific and technical content disclosed in this press release has been reviewed and approved by Roger Dahn, B.Sc., P.Geo., a director of the Company and a "Qualified Person" as defined in National Instrument 43-101 – Standards of Disclosure for Mineral Projects.

About Graphano Energy

Graphano Energy Ltd. is an exploration and development company focused on evaluating, acquiring, and developing energy metals resources from exploration to production.

Graphite is one of the most in-demand technology minerals that is required for a green and sustainable world. The Company's Lac Aux Bouleaux property, situated adjacent to Canada's only producing graphite mine, in Québec, Canada, has historically been an active area for natural graphite. With the demand for graphite growing in some of the most prominent and cutting-edge industries, such as lithium batteries in electric cars and other energy storage technologies, the Company is developing its project to meet the demands of the future.

ON BEHALF OF THE BOARD OF DIRECTORS

Luisa Moreno

Chief Executive Officer and Director

E: info@graphano.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Note Regarding Forward-Looking Statements:

This news release contains certain "forward-looking information" and "forward-looking statements" (collectively "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, included herein, without limitation, are forward-looking statements. Forward-looking statements are frequently, but not always, identified by words such as "expects", "anticipates", "believes", "intends", "estimates", "potential", "possible", and similar expressions, or statements that events, conditions, or results "will", "may", "could", or "should" occur or be achieved. Forward-looking statements in this news release relate to, among other things, integrating the final interpretation with existing geology, trenching/channel sampling, and drilling information to refine target ranking and guide next-stage work, as well as future exploration on the Black Pearl claims. There can be no assurance that such statements will prove to be accurate and actual results and future events could differ materially from those anticipated in such statements. Forward-looking statements reflect the beliefs, opinions and projections on the date the statements are made and are based upon a number of assumptions and estimates that, while considered reasonable by Graphano, are inherently subject to significant business, economic, competitive, political and social uncertainties and contingencies. Many factors, both known and unknown, could cause actual results, performance or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements and the parties have made assumptions and estimates based on or related to many of these factors. Such factors include, without limitation, risks associated with possible accidents and other risks associated with mineral exploration operations, the risk that the Company will encounter unanticipated geological factors, risks associated with the interpretation of exploration results, the possibility that the Company may not be able to secure permitting and other governmental clearances necessary to carry out the Company's exploration plans, the risk that the Company will not be able to raise sufficient funds to carry out its business plans, and the risk of political uncertainties and regulatory or legal changes that might interfere with the Company's business and prospects. These risks, as well as others, are disclosed within the Company's filings available under the Company's profile on SEDAR+ at www.sedarplus.ca, which investors are encouraged to review prior to any transaction involving the securities of the Company. Readers should not place undue reliance on the forward-looking statements and information contained in this news release concerning these items. Graphano does not assume any obligation to update the forward-looking statements should beliefs, opinions, projections, or other factors, change, except as required by applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285409