Ruth Pegmatite Highlights:

- Exposed over a 233 m strike length, open in all directions

- Channel sample results include:

- 1.34% Li2O over 9.10 m in channel RCH25-06

- 1.15% Li2O over 7.70 m in channel RCH25-05

- 1.11% Li2O over 6.35 m in channel RCH25-08

- 1.44% Li2O over 4.85 m in channel RCH25-01

- 0.89% Li2O over 11.70 m in channel RCH25-04

- Including 1.38% Li2O over 5.95 m

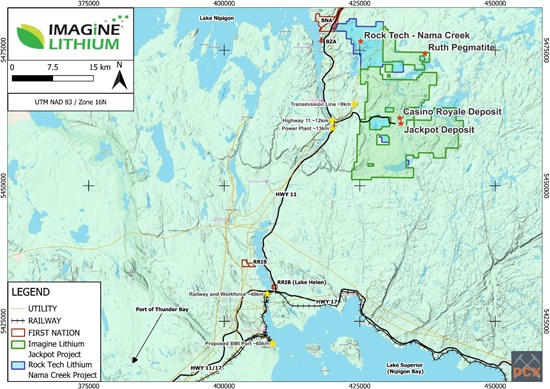

Vancouver, British Columbia--(Newsfile Corp. - January 19, 2026) - IMAGINE LITHIUM INC. (TSXV: ILI) (OTCQB: ARXRF) (the "Company" or "Imagine") is pleased to report the results of the 2025 bedrock stripping and channel sampling program on their 100% owned Foster-Lew claims. The Foster-Lew claims are part of the Jackpot lithium project in the Georgia Lake Pegmatite Field, approximately 140 km northeast of Thunder Bay, Ontario. The Jackpot property is characterized by swarms of mineralized lithium-bearing granitic pegmatite dikes distributed throughout the 27,597 ha land package (Figure 1).

Simone Suen, President of Imagine, commented:"The addition of the Ruth Pegmatite highlights the scale of the discovery potential for lithium resources at the Jackpot project. The fall channel sampling program at Ruth shows exceptional dike continuity along the 233m exposed strike length with significant mineralized widths. We are encouraged that the Ruth Pegmatite will add to our resource inventory, putting Imagine in an excellent position to build upon our 3.1 Mt indicated and 5.3 Mt inferred (grading 0.85% and 0.91% Li2O, respectively) Mineral Resource Inventory on the Project. With nearby infrastructure and ports, the Project's proximity to a skilled workforce is also a major advantage."

Figure 1:Jackpot property located next to Trans-Canada Highway, power, port, railroad, and workforce.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/280798_b8b79db0747b09c4_001full.jpg

The Ruth Pegmatite was discovered during the 2024 field season and Imagine Lithium exposed a total of 0.157 ha over a 233 m strike length along the ESE trending Ruth Pegmatite, in the fall of 2025 (Figure 2). Exposed bedrock consists of Quetico metasedimentary rocks cut by polymetallic smoky quartz veins that host molybdenum (mo) + chalcopyrite (cpy) ± bismuthinite (bis) sulphides. Those rocks were then cut by the younger, spodumene bearing Ruth pegmatite. Bedrock stripping was completed under exploration permit PR-25-000064. The Ruth Pegmatite remains untested along strike and to depth.

Figure 2: Ruth Pegmatite bedrock stripping and channel sample locations.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2962/280798_imaglithfig02.jpg

A total of 112 channel samples were collected from ten channels (RCH25-01 - RCH25-10) on the stripped bedrock exposure (Figure 2). The channel samples were submitted to AGAT Laboratories' Thunder Bay facility for analysis. Assay highlights from Ruth channel samples include 1.34% Li2O over 9.10 m in RCH25-06 and 1.15% Li2O over 7.70 m in RCH25-05 (Table 1). The results announced today continue to demonstrate the potential for new discoveries on the Jackpot property.

Table 1. Significant Li2O (%) intervals from the Ruth Channel Sampling program.

| Channel ID | From | To | Li2O% | Interval | Exposure |

| RCH25-01 | 1.00 | 5.85 | 1.439 | 4.85 | Western Trench |

| RCH25-04 | 5.75 | 11.70 | 1.380 | 5.95 | Western Trench |

| RCH25-05 | 7.80 | 15.50 | 1.150 | 7.70 | Western Trench |

| RCH25-06 | 0.00 | 9.10 | 1.342 | 9.10 | Middle Trench |

| RCH25-08 | 5.00 | 11.35 | 1.105 | 6.35 | Eastern Trench |

| RCH25-09 | 1.00 | 6.60 | 0.991 | 5.60 | Eastern Trench |

In the eastern stripped area, polymetallic quartz veins range from 5-30 cm wide, strike 270 degrees and dip steeply to the north, conformable to sedimentary bedding. The quartz veins host a sulphide assemblage of mo+cpy±bis along the vein margins with the host rock and are cut by the 285-degree trending Ruth Pegmatite. The highest molybdenum sample was from channel RCH25-10 cut along the vein contact with the host metasedimentary rocks on the north side of the Ruth Pegmatite. This 25 cm sample host 10-15% mo+cpy±bis and returned 1.8% Mo, 0.67% Bi and 0.19% Cu (Table 2).

Table 2. Significant Mo + Bi + Cu (%) intervals in polymetallic quartz veins.

| Channel ID | Mo (%) | Bi (%) | Cu (%) | Interval | From | To |

| RCH25-10 | 1.83 | 0.674 | 0.199 | 0.25 | 0 | 0.25 |

| RCH25-08 | 0.201 | 0.036 | 0.011 | 1.00 | 11.35 | 12.35 |

| RCH25-09 | 0.178 | 0.004 | 0.005 | 0.90 | 6.6 | 7.5 |

| RCH25-09 | 0.179 | 0.008 | 0.002 | 0.50 | 12 | 12.5 |

| RCH25-09 | 0.086 | 0.017 | 0.009 | 0.40 | 13.2 | 13.6 |

| RCH25-05 | 0.083 | 0.004 | 0.004 | 0.60 | 15.5 | 16.1 |

Scale (m)QA/QC Protocol

Imagine Lithium implemented a strict QA/QC protocol in processing all rock samples collected from the stripped outcrops. The protocol included the insertion and monitoring of appropriate reference materials. High and low concentration certified lithium standards, blanks and duplicates are used to validate the accuracy and precision of the assay results.

All collected rock samples were put in sturdy plastic bags, tagged, and stored in the core shack under the supervision of a professional geologist. The sample number, distance and brief description of each sample is logged and entered to a digital database. Rock samples were cut using a 14" diamond saw and placed in a labelled sample bag. Duplicate samples were halved and placed into unique sample bags with a separate sample identifier.

All sample bags were put into rice bags and stored securely before being delivered to AGAT Laboratories in Thunder Bay, Ontario. Samples are processed and shipped to be crushed at the AGAT facility in Vancouver, BC. Lithium was analyzed by Sodium Peroxide Fusion with ICP-OES and ICP-MS Finish.

Qualified Person

The technical content of this news release was reviewed and approved by Jason Arnold, P.Geo., an Independent Qualified Person as defined by the National Instrument 43-101.

About Imagine Lithium Inc.

Imagine is a junior mining exploration company focused on seeking and acquiring world-class mineral projects. The company holds the Jackpot lithium property located in the Georgia Lake area about 140 km NNE of Thunder Bay, Ontario, is approximately 12 km by road from the Trans-Canada Highway (Hwy 11), and is in proximity to sources of power, railroads, and ports. The Jackpot Property consists of 322 mineral claims covering 27,597 hectares. The Property contains NI 43-101 compliant Mineral Resources of 3.1 Mt grading 0.85% Li2O in the indicated category and 5.3 Mt grading 0.91% Li2O in the inferred category, as well as several other known pegmatite showings.

ON BEHALF OF THE BOARD

Simone Sze Man Suen, President

FOR FURTHER INFORMATION, PLEASE CONTACT:

Telephone: +1-807-355-5405

Toll Free: 1-888-945-4770

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD LOOKING STATEMENTS: This news release contains forward-looking statements, which relate to future events or future performance and reflect management's current expectations and assumptions. Such forward-looking statements reflect management's current beliefs and are based on assumptions made by and information currently available to the Company. Investors are cautioned that these forward-looking statements are neither promises nor guarantees and are subject to risks and uncertainties that may cause future results to differ materially from those expected. These forward -looking statements are made as of the date hereof and, except as required under applicable securities legislation, the Company does not assume any obligation to update or revise them to reflect new events or circumstances. All the forward-looking statements made in this press release are qualified by these cautionary statements and by those made in our filings with SEDAR in Canada (available atwww.sedarplus.ca).

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280798