- Drilling supports down-plunge continuity of the BA mineralization and confirms multiple high-grade intercepts

TORONTO, ON / ACCESS Newswire / March 2, 2026 / Jaguar Mining Inc. ("Jaguar" or the "Company") (TSX:JAG)(OTCQX:JAGGF) today reported results from its ongoing drilling at the BA Zone, an area within the Pilar Mine in Minas Gerais, Brazil. The results support the down-plunge continuity of gold mineralization and include multiple high-grade intercepts.

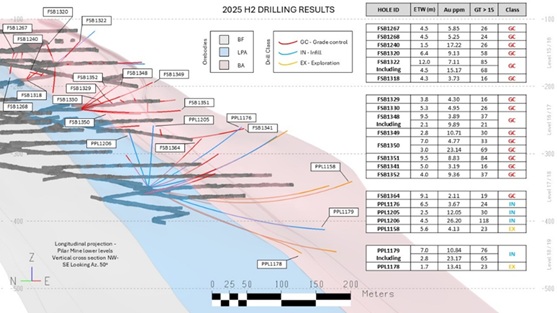

Jaguar has advanced its drilling program at the BA Zone (Pilar Mine) since the publication of its last results (see press release dated August 5, 2025). The latest results further validate continuity of the BA Zone along plunge and demonstrate continued grade and thickness consistent with Jaguar's geological interpretation. Results are summarized below, highlighting select intercepts (see Figure 1). Table 1 provides the main intercepts.

-

PPL1205 - 2.50 m @ 12.05 g/t Au (GT: 30)

-

PPL1206 - 4.50 m @ 26.20 g/t Au (GT: 118)

-

PPL1158 - 5.60 m @ 4.13 g/t Au (GT: 23)

-

PPL1176 - 6.50 m @ 3.67 g/t Au (GT: 24)

-

PPL1178 - 1.70 m @ 13.41 g/t Au (GT: 23)

-

PPL1179 - 2.00 m @ 5.84 g/t Au (GT: 12) from 200.90 m to 205.90 m, and 7.00 m @ 10.84 g/t Au (GT: 76) from 216.75 m to 233.90 m, including 2.80 m @ 23.17 g/t Au (GT: 65) from 220.75 m to 227.60 m.

Figure 1: Section illustrating the drill holes completed in the BA Zone during the second half of 2025 (since the last press release dated August 5, 2025).

"The results demonstrate both the geometric and grade continuity of the BA Zone along the down-plunge direction at depth, enabling consistent and sustainable long-term exploration and mine planning," commented Armando Massucatto, Exploration General Manager. "The 2025 results support the decision to undertake a directional drilling program, scheduled to commence in Q2 2026, which is designed to test and potentially expand the down-plunge extent of BA Zone and support the Company's previously outlined exploration of investigating and defining a projected endowment of over 500,000 ounces of gold. (see November 3, 2025 news release). This work reinforces the long-term potential of the Pilar mine."

"The ongoing exploration drilling at the Pilar mine reflects Jaguar's focus on disciplined exploration to support mine planning, extend visibility on mineralized continuity, and advance organic growth opportunities consistent with our five-year exploration plan," commented Luis Albano Tondo, CEO of Jaguar Mining.

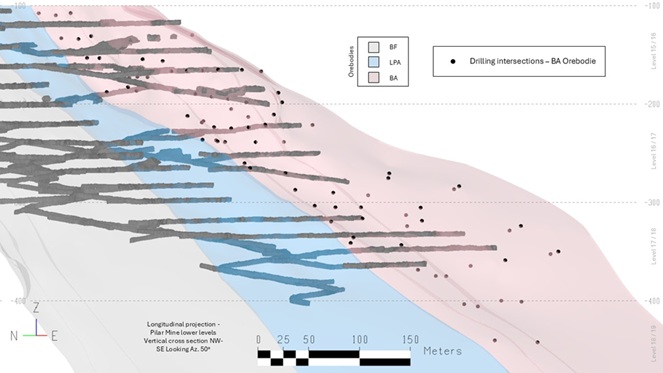

A total of 9,493.50 meters was drilled, distributed as follows: 3,618.60 meters for grade control, 3,696.00 meters for infill, and 2,178.90 meters for exploration. The complete results of the drill holes are presented in the table below (see Figure 2 and Table 1).

Figure 2: Pierce points of all drill holes completed in the BA Zone during the second half of 2025.

The new resource estimate for the BA Zone (Pilar Mine) is in the final stages of review and is expected to be disclosed in a Technical Report targeted in the first quarter of 2026.

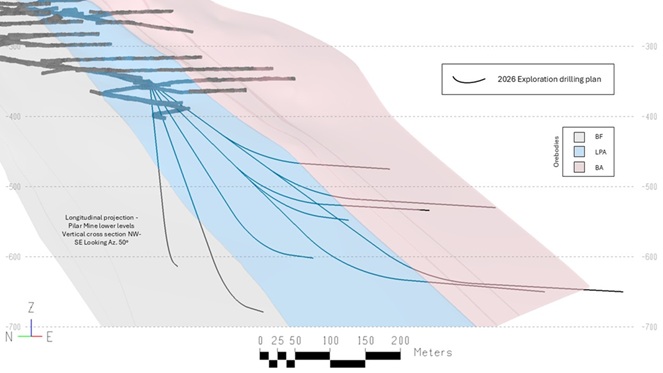

The results of 2025 drilling activities at the BA Zone highlight the opportunity for a directional drilling campaign to more effectively test extensions at depth and improve targeting efficiency. Jaguar is in the final stages of contracting a drilling company and is expected to commence the campaign during Q2 2026 (see Figure 3).

Figure 3: Long drill holes projected to test the BA Zone in depth.

Table 1: Diamond drill hole collars in BA Zone in the second half of 2025.

|

HOLE ID |

Easting (m) |

Northing (m) |

Elevation (m) |

Total Depth (m) |

Collar Dip (°) |

Collar Azimuth (°) |

Zone |

|

FSB1364 |

7788013.5 |

663014.2 |

-349.0 |

125.3 |

32.64 |

180.39 |

BA |

|

FSB1356 |

7788023.3 |

662959.2 |

-266.1 |

52.6 |

-3.96 |

16.71 |

BA |

|

FSB1346 |

7788015.4 |

662960.5 |

-265.5 |

11.3 |

20.16 |

192.83 |

BA |

|

FSB1345 |

7788006.9 |

662976.1 |

-267.7 |

26.7 |

21.31 |

190.16 |

BA |

|

FSB1353 |

7788068.0 |

662925.8 |

-234.4 |

83.5 |

-9.95 |

96.25 |

BA |

|

FSB1343 |

7787983.6 |

663006.6 |

-273.6 |

29.8 |

20.20 |

235.37 |

BA |

|

FSB1337 |

7787998.4 |

662997.4 |

-272.0 |

33.7 |

-0.52 |

51.26 |

BA |

|

FSB1344 |

7787996.3 |

662992.1 |

-270.6 |

29.4 |

21.22 |

190.57 |

BA |

|

FSB1336 |

7788005.5 |

662986.1 |

-269.7 |

36.0 |

-0.15 |

23.04 |

BA |

|

FSB1338 |

7787986.3 |

663010.5 |

-273.9 |

42.8 |

10.21 |

50.99 |

BA |

|

FSB1361 |

7788013.3 |

663014.6 |

-350.0 |

124.9 |

13.94 |

164.91 |

BA |

|

FSB1339 |

7787977.5 |

663023.9 |

-276.1 |

40.7 |

0.07 |

57.03 |

BA |

|

FSB1352 |

7788068.7 |

662926.6 |

-233.2 |

88.9 |

21.80 |

76.00 |

BA |

|

FSB1351 |

7788067.3 |

662925.6 |

-234.3 |

147.7 |

-4.95 |

126.66 |

BA |

|

FSB1350 |

7788067.6 |

662925.7 |

-234.4 |

94.8 |

-6.97 |

116.79 |

BA |

|

FSB1341 |

7787959.4 |

663032.6 |

-277.9 |

117.8 |

4.39 |

95.90 |

BA |

|

PPL1205 |

7788014.2 |

663012.7 |

-349.1 |

155.5 |

32.32 |

225.29 |

BA |

|

FSB1349 |

7788067.5 |

662925.8 |

-233.8 |

120.3 |

14.74 |

115.64 |

BA |

|

FSB1335 |

7788012.5 |

662972.3 |

-267.6 |

54.2 |

0.35 |

18.74 |

BA |

|

FSB1324 |

7788009.5 |

663015.2 |

-222.5 |

80.5 |

-0.07 |

75.21 |

BA |

|

FSB1348 |

7788067.8 |

662926.2 |

-233.3 |

86.6 |

24.11 |

101.15 |

BA |

|

FSB1334 |

7788076.4 |

662984.1 |

-227.8 |

26.5 |

10.38 |

49.76 |

BA |

|

FSB1330 |

7788070.8 |

662979.2 |

-227.5 |

36.1 |

14.09 |

245.80 |

BA |

|

FSB1332 |

7788041.2 |

662992.4 |

-224.5 |

23.5 |

10.43 |

47.91 |

BA |

|

FSB1329 |

7788053.8 |

662981.8 |

-226.9 |

41.3 |

14.99 |

245.76 |

BA |

|

FSB1333 |

7788056.5 |

662986.4 |

-227.2 |

19.9 |

9.93 |

47.09 |

BA |

|

FSB1328 |

7788038.4 |

662988.4 |

-224.4 |

38.5 |

6.84 |

239.15 |

BA |

|

FSB1340 |

7787961.0 |

663031.4 |

-277.9 |

53.4 |

0.56 |

60.63 |

BA |

|

FSB1331 |

7788026.3 |

663000.6 |

-222.5 |

22.9 |

10.34 |

39.66 |

BA |

|

FSB1323 |

7788009.5 |

663005.6 |

-223.2 |

37.9 |

-24.89 |

51.63 |

BA |

|

PPL1203A |

7788135.2 |

662949.8 |

-165.5 |

87.9 |

31.14 |

100.23 |

BA |

|

FSB1325 |

7788004.7 |

663008.5 |

-222.3 |

23.4 |

9.97 |

151.33 |

BA |

|

FSB1327 |

7788023.6 |

662995.9 |

-222.7 |

32.3 |

10.09 |

234.54 |

BA |

|

FSB1326 |

7788006.8 |

663000.2 |

-222.5 |

20.5 |

5.77 |

205.58 |

BA |

|

FSB1318 |

7788149.5 |

662949.6 |

-167.1 |

41.4 |

-31.95 |

346.22 |

BA |

|

FSB1322 |

7788127.7 |

662947.8 |

-165.7 |

68.1 |

27.43 |

200.90 |

BA |

|

FSB1321 |

7788133.8 |

662945.4 |

-167.4 |

72.6 |

-36.00 |

230.03 |

BA |

|

FSB1320 |

7788134.0 |

662945.0 |

-165.6 |

49.9 |

32.79 |

245.54 |

BA |

|

PPL1204 |

7788013.7 |

663015.8 |

-350.4 |

201.8 |

8.19 |

143.15 |

BA |

|

PPL1203 |

7788134.5 |

662949.9 |

-165.3 |

4.4 |

31.44 |

101.33 |

BA |

|

FSB1319 |

7788142.4 |

662946.5 |

-167.4 |

26.4 |

-43.05 |

281.19 |

BA |

|

PPL1159A |

7788014.0 |

663015.4 |

-351.2 |

269.4 |

-12.66 |

148.05 |

BA |

|

PPL1200 |

7788071.0 |

662982.9 |

-165.1 |

92.3 |

-3.72 |

89.70 |

BA |

|

PPL1159 |

7788014.0 |

663015.4 |

-351.2 |

93.4 |

-16.36 |

149.59 |

BA |

|

FSB1304 |

7788056.1 |

662981.0 |

-165.3 |

16.9 |

-0.14 |

216.42 |

BA |

|

FSB1306 |

7788062.0 |

662984.4 |

-165.4 |

59.4 |

-0.53 |

101.14 |

BA |

|

FSB1303 |

7788070.3 |

662977.9 |

-165.1 |

25.7 |

0.17 |

225.06 |

BA |

|

FSB1307A |

7788078.0 |

662981.2 |

-165.0 |

11.4 |

0.89 |

81.37 |

BA |

|

FSB1307 |

7788077.5 |

662981.8 |

-165.7 |

14.2 |

1.22 |

51.30 |

BA |

|

FSB1302 |

7788080.1 |

662964.8 |

-165.9 |

44.1 |

-0.13 |

235.76 |

BA |

|

FSB1308 |

7788087.4 |

662968.3 |

-165.8 |

20.3 |

-0.05 |

51.36 |

BA |

|

FSB1301 |

7788091.4 |

662955.5 |

-166.5 |

17.0 |

-0.22 |

243.57 |

BA |

|

FSB1309 |

7788107.7 |

662960.4 |

-166.8 |

20.1 |

2.01 |

76.47 |

BA |

|

FSB1300 |

7788109.0 |

662953.4 |

-166.8 |

26.3 |

0.04 |

245.54 |

BA |

|

PPL1158 |

7788014.0 |

663015.4 |

-351.2 |

299.5 |

-15.27 |

143.80 |

BA |

|

PPL1157 |

7788014.0 |

663016.2 |

-350.3 |

221.5 |

9.74 |

128.97 |

BA |

|

FSB1283 |

7787961.4 |

662941.5 |

-358.9 |

110.4 |

12.14 |

144.82 |

BA |

|

PPL1179 |

7788013.8 |

663014.9 |

-351.3 |

293.5 |

-22.09 |

158.31 |

BA |

|

PPL1178 |

7788013.9 |

663014.5 |

-351.3 |

335.7 |

-23.86 |

169.78 |

BA |

|

PPL1177 |

7788013.8 |

663014.8 |

-351.4 |

332.7 |

-26.76 |

159.75 |

BA |

|

FSB1281 |

7787960.7 |

662942.5 |

-359.1 |

108.8 |

9.89 |

154.59 |

BA |

|

FSB1242 |

7788193.1 |

662950.4 |

-190.5 |

35.6 |

15.25 |

218.48 |

BA |

|

FSB1240 |

7788161.6 |

662963.6 |

-185.1 |

39.8 |

8.95 |

273.18 |

BA |

|

FSB1270 |

7788186.8 |

662961.4 |

-188.6 |

11.7 |

4.49 |

67.19 |

BA |

|

FSB1268 |

7788210.7 |

662939.9 |

-163.4 |

44.5 |

-25.47 |

232.78 |

BA |

|

FSB1267 |

7788210.5 |

662940.2 |

-161.5 |

25.1 |

38.94 |

216.74 |

BA |

|

PPL1176 |

7788013.1 |

663015.2 |

-349.3 |

167.2 |

26.14 |

158.76 |

BA |

|

FSB1266 |

7788199.0 |

662947.3 |

-161.7 |

26.0 |

39.33 |

225.08 |

BA |

|

PPL1175 |

7788013.9 |

663014.2 |

-351.4 |

252.7 |

-27.84 |

176.21 |

BA |

|

FSB1254 |

7788202.3 |

662936.3 |

-161.0 |

30.8 |

25.93 |

61.71 |

BA |

|

FSB1253 |

7788202.1 |

662937.2 |

-163.2 |

43.9 |

-34.90 |

74.25 |

BA |

|

FSB1251 |

7788181.9 |

662948.6 |

-160.6 |

54.7 |

21.90 |

138.94 |

BA |

|

FSB1371 |

7788003.6 |

663009.3 |

-251.2 |

40.1 |

28.14 |

-0.46 |

BA |

|

FSB1358 |

7788050.1 |

662944.3 |

-262.6 |

59.6 |

147.05 |

4.49 |

BA |

|

FSB1365 |

7788013.4 |

663014.6 |

-348.9 |

62.9 |

171.65 |

33.61 |

BA |

|

FSB1363 |

7788014.0 |

663011.0 |

-349.0 |

119.1 |

246.49 |

24.86 |

BA |

|

PPL1207 |

7788013.8 |

663014.0 |

-351.3 |

269.4 |

177.70 |

-20.63 |

BA |

Geological Context: Understanding the BA Zone Mineralization

The BA Zone's geological structure, observed in existing underground galleries, consists of a series of overturned folds. The fold axes generally plunge southeast at moderate to low angles, while their axial surfaces dip eastward at moderate to steep angles, mirroring the direction of Banded Iron Formation (BIF) bedding. Notably, high-grade gold is found within these well-developed BIF layers.

Gold-rich zones are marked by pronounced hydrothermal alteration and minerals like quartz and chlorite, as well as sulfide mineralization dominated by pyrrhotite. Both pyrrhotite and pyrite appear regularly-filling the bedding and edges of veins-and act as reliable indicators.

All these features, from stable structural controls to confirmation of folded mineralized zones deep underground and distinctive mineral associations, increase confidence in the structural continuity of the mineralized system along plunge. This predictability in structure and mineralogy supports ongoing exploration targeting and longer-term planning for the BA Zone. From Level 1 to Level 6 the BA Zone supplied the majority of the production at the Pilar Mine to date. From Level 4 onward, the Zone gradually narrowed as it became deeper, making it less profitable until Level 12.

QAQC

For all drill holes the geological team takes photos of all core drill boxes to preserve a record. The grade control drillholes (prefix FSB) are drilled using LTK diameter and all drill cores are submitted to the internal laboratory for chemical assaying by the fire assay method. Infill and exploration drillholes (prefix PPL) are drilled in BQ diameter, longitudinally sawn, and the entire half-core is submitted for analysis at the internal laboratory. Additionally, the part of pulp generated from PPL drillhole assays is often sent to ALS Brazil, (laboratory with international certificate practice, located in Vespasiano, Minas Gerais state, Brazil) for external check assaying. The remaining unsampled half-core from PPL drillholes is retained and archived as permanent geological reference material.

Qualified Person

The scientific and technical information contained in this press release has been reviewed and approved by Armando José Massucatto, PhD FAusIMM, Jaguar Mining General Manager of Exploration and a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

The Iron Quadrangle

The Iron Quadrangle has been an area of active mineral exploration dating back to the 16th century. The discovery in 1699-1701 of gold associated with iron and platinum-group metals in the southeastern corner of the Iron Quadrangle gave rise to the name of the town Ouro Preto (Black Gold). The Iron Quadrangle contains world-class multi-million-ounce gold deposits such as Morro Velho, Cuiabá, and São Bento. Jaguar holds the second largest gold land position in the Iron Quadrangle with over 46,000 hectares.

About Jaguar Mining Inc.

Jaguar Mining Inc. is a Canadian-listed junior gold mining, development, and exploration company operating in Brazil with three gold mining complexes and a large land package with significant upside exploration potential from mineral claims. The Company's principal operating assets are located in the Iron Quadrangle, a prolific greenstone belt in the state of Minas Gerais and include the MTL complex (Turmalina mine and plant) and Caeté complex (Pilar and Roça Grande mines, and Caeté plant). The Roça Grande mine has been on temporary care and maintenance since April 2019. The Company also owns the Paciência complex (Santa Isabel mine and plant), which had been on care and maintenance since 2012 and is under review to restart in 2026. Additional information is available on the Company's website at www.jaguarmining.com.

For further information please contact:

Luis Albano Tondo

Chief Executive Officer

Jaguar Mining Inc.

investors@jaguarmining.com

Naomi Nemeth

Vice President Investor Relations

Jaguar Mining Inc.

investors@jaguarmining.com

+1 647 465 2470

or

+1 416 567 5151

Forward-Looking Statements

Certain statements in this news release constitute "forward-looking information" within the meaning of applicable Canadian securities legislation. Forward-looking statements and information are provided for the purpose of providing information about management's expectations and plans relating to the future. All of the forward-looking information made in this news release is qualified by the cautionary statements below and those made in our other filings with the securities regulators in Canada. Forward-looking information contained in forward-looking statements can be identified by the use of words such as "are expected," "is forecast," "is targeted," "approximately," "plans," "anticipates," "projects," "anticipates," "continue," "estimate," "believe" or variations of such words and phrases or statements that certain actions, events or results "may," "could," "would," "might," or "will" be taken, occur or be achieved. All statements, other than statements of historical fact, may be considered to be or include forward-looking information. This news release contains forward-looking information regarding, among other things, drill results from the Pilar BA Zone, any information and statements related to expected growth, sales, production, results and achievements of the Company. the success of the Company's exploration, development and mining activities. The Company has made numerous assumptions with respect to forward-looking information contained herein, including, among other things, the estimated timeline for the development of the Company's mineral properties; the supply and demand for, and the level and volatility of the price of, gold; the accuracy of reserve and resource estimates and the assumptions on which the reserve and resource estimates are based; the receipt of necessary permits; market competition; ongoing relations with employees and impacted communities; political and legal developments in any jurisdiction in which the Company operates being consistent with its current expectations including, without limitation, the impact of any potential power rationing, tailings facility regulation, exploration and mine operating licenses and permits being obtained and renewed and/or there being adverse amendments to mining or other laws in Brazil and any changes to general business and economic conditions. Forward-looking information involves a number of known and unknown risks and uncertainties, including among others: the risk of Jaguar not meeting the forecast plans regarding its operations and financial performance; uncertainties with respect to the price of gold, labour disruptions, mechanical failures, increase in costs, environmental compliance and change in environmental legislation and regulation, weather delays and increased costs or production delays due to natural disasters, power disruptions, procurement and delivery of parts and supplies to the operations; uncertainties inherent to capital markets in general (including the sometimes volatile valuation of securities and an uncertain ability to raise new capital) and other risks inherent to the gold exploration, development and production industry, which, if incorrect, may cause actual results to differ materially from those anticipated by the Company and described herein. In addition, there are risks and hazards associated with the business of gold exploration, development, mining and production, including environmental hazards, tailings dam failures, industrial accidents and workplace safety problems, unusual or unexpected geological formations, pressures, cave-ins, flooding, chemical spills, procurement fraud and gold bullion thefts and losses (and the risk of inadequate insurance, or the inability to obtain insurance, to cover these risks). Accordingly, readers should not place undue reliance on forward-looking information.

For additional information with respect to these and other factors and assumptions underlying the forward-looking information made in this news release, see the Company's most recent Annual Information Form and Management's Discussion and Analysis, as well as other public disclosure documents that can be accessed under the issuer profile of "Jaguar Mining Inc." on SEDAR+ at www.sedarplus.com. The forward-looking information set forth herein reflects the Company's reasonable expectations as at the date of this news release and is subject to change after such date. The Company disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by law. The forward-looking information contained in this news release is expressly qualified by this cautionary statement.

SOURCE: Jaguar Mining, Inc.

View the original press release on ACCESS Newswire