Highlights:

-

Gold mineralization confirmed to be directly linked to altered syenite intrusions at Wolverine Bend, validating KLDC's exploration model.

-

KLD25-39 - 6.3 m at 0.62 g/t Au from 43.1 m down hole

-

KLD25-40 - 8.3 m at 0.86 g/t Au from 24.9 m down hole

including: 5.5 m at 1.21 g/t Au from 26.0 m

-

-

Drilling has identified multiple gold- and copper-bearing mineralizing systems over a 2-km span within a 17-km mineralized corridor (see Figure 1)

-

Results indicate a large, long-lived Archean hydrothermal system with potential for both bulk-tonnage gold and copper-rich zones

-

25,000-m fully funded drill program underway, now operating with two drill rigs

Toronto, Ontario--(Newsfile Corp. - January 22, 2026) - Kirkland Lake Discoveries Corp. (TSXV: KLDC) (OTCID: KLKLF) ("KLDC" or the "Company") is pleased to provide an update on its ongoing, fully funded 25,000-m diamond drilling program at its KL West Property in the Kirkland Lake region of Ontario.

Recent drilling and associated geochemical results have confirmed altered syenite intrusions as a primary control on gold mineralization at the Wolverine Bend target (see Figures 2 and 3). These results validate the Company's exploration model and significantly expand the interpreted scale and style of intrusion-related gold mineralization along the Winnie Lake Stock ("WLS") contact corridor.

Multiple Mineralizing Systems Confirmed

At the Winnie Lake target, drilling has intersected a vertically zoned (see Figure 4), structurally controlled hydrothermal system, characteristic of long-lived Archean mineralizing events. This system supports a gold-copper mineralization style developed within and below the massive sulphide horizon, indicating prolonged and multi-phase hydrothermal activity.

Taken together, results from Wolverine Bend and Winnie Lake demonstrate that multiple gold-bearing and polymetallic mineralizing systems are present within a two-kmsegment of the 17-km-long WLS contact corridor, underscoring the district-scale exploration potential of KL West.

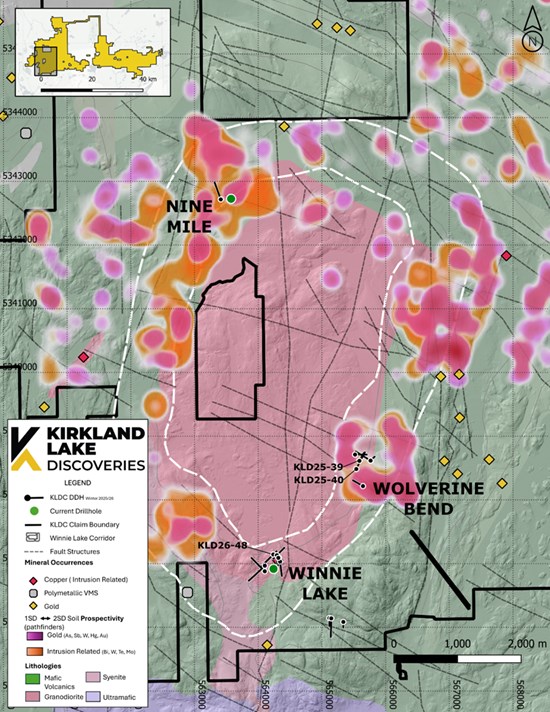

Figure 1 - KL West Property overview showing syenite intrusion, soil geochemistry, and key target areas

Plan-view map of the KL West Property highlighting the Winnie Lake Stock syenite intrusion (pink shading) and its associated 17-km-long contact corridor (white dashed outline). Coloured contours represent B-horizon soil geochemistry, with elevated gold-related element responses defining multiple anomalous zones along the intrusion margin. The map illustrates the spatial relationship between intrusion-related gold soil anomalies at Nine Mile, Wolverine Bend, and Winnie Lake, historical mineral occurrences, interpreted fault structures, and completed drill holes. The clustering of geochemical anomalies along the syenite contact and structural corridors supports the interpretation of a large, intrusion-centered mineralizing system with multiple gold- and copper-bearing targets distributed over a district scale.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5701/281208_29bc890444a84810_001full.jpg

Drilling Highlights

Wolverine Bend

-

Broad, low-grade gold mineralization accompanied by elevated bismuth and copper, consistent with system-scale mineralization

-

Confirmation of gold vectoring within visually altered syenite, supported by elevated geochemical elements characteristic of fertile intrusion-related gold systems

-

Results reinforce potential for both large-volume and low-grade gold mineralizationtargets.

Winnie Lake

-

Intersections of a vertically zoned hydrothermal architecture, ranging from copper-rich breccias to altered volcanic root zones

-

Strong hematite alteration associated with peak sulphide emplacement, interpreted as representing zones of enhanced metal deposition

"Drilling is consistently showing that gold and copper mineralization at KL West is closely linked to syenite intrusions and the structures they exploit within the Blake River Group. This is significant because parts of the Blake River Group become most prospective where early volcanic-hosted sulphide systems are later overprinted by intrusion-related hydrothermal activity. At KL West, we are seeing that overlap expressed through copper-rich breccias, gold-bearing alteration, and strong structural control. Although we are still early in this 25,000-m program, this emerging geological framework gives us confidence that we are vectoring toward more concentrated zones of mineralization as drilling continues." - Stefan Sklepowicz, Chief Executive Officer

Program Overview and Progress

Since mobilization in late November, drilling has progressed steadily along the WLS contact corridor, targeting structurally controlled zones interpreted to host both intrusion-related gold mineralization and copper-rich massive sulphide systems.

Drilling metrics to January 17, 2026 include:

-

Total metres drilled: 4,409 m

-

Number of completed holes: 13

-

Average hole depth: 340 m

-

Drill rigs active: One rig active since early December 2025; a second rig commenced January 12, 2026

Core logging, geological interpretation, and sampling are ongoing, with samples being prepared for submission to accredited laboratories. The Company will report analytical results once received and validated.

Target Area Updates

Wolverine Bend

Drilling at Wolverine Bend is designed to follow up on previously identified mineralization and to test structural and lithological controls along the WLS margin. Initial drilling has confirmed the presence of altered syenite intrusions, mafic volcanic units, and intrusive-volcanic contact zones affected by silica, hematite, carbonate, and localized potassic alteration (see Figure 2).

Geochemical results demonstrate widespread low-level gold values accompanied by elevated bismuth and copper, a signature consistent with the outer to intermediate zones of a fertile intrusion-related gold system. The spatial association of gold with hematite alteration (see Figure 3) further supports a magmatic-hydrothermal contribution to mineralization and highlights the potential for a larger alteration-hosted system.

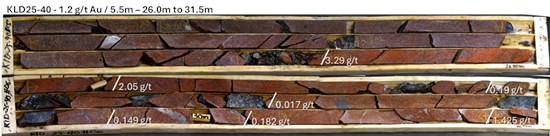

Figure 2 - KLD25-40 - Core Photo - Drill hole KLD25-40 intersected a broad zone of hematite- and potassic-altered syenite from approximately 22.6 m to 31.0 m depth, characterized by pervasive red to maroon colouration, localized brecciation, and fracture-controlled quartz-hematite veining. Gold mineralization is spatially associated with the most intensely altered portions of the intrusive unit and occurs with minimal sulphide content, consistent with an oxidized intrusion-related gold system. The interval demonstrates a clear relationship between alteration intensity and elevated gold values, supporting the potential for a larger, alteration-hosted mineralized system.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5701/281208_29bc890444a84810_002full.jpg

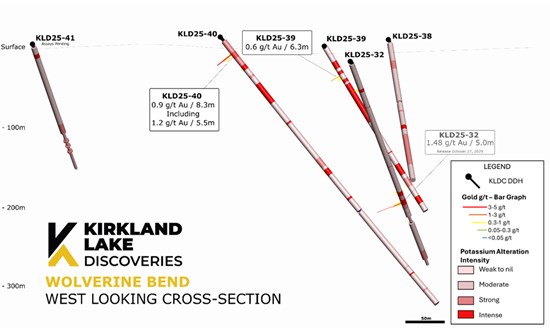

Figure 3 - Wolverine Bend - West-looking cross-section - Hematite and potassium alteration intensity with gold value histogram

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5701/281208_29bc890444a84810_003full.jpg

Table 1 - Wolverine Bend Geochemical Results

| Drill Hole | From (m) | To (m) | Interval (m) | Au (g/t) | Ag (g/t) | Cu (ppm) | Bi (ppm) | W (ppm) | Mo (ppm) | As (ppm) | Sb (ppm) | Pb (ppm) | Zn (%) | K (%) | S (%) | Zone |

| KLD25-39 | 43.06 | 49.34 | 6.28 | 0.617 | 0.47 | 7 | 6.8 | 12.5 | 5.8 | 0.2 | 0.1 | 33.4 | 0.005 | 1.12 | 0.15 | Wolverine Bend |

| KLD25-40 | 24.95 | 33.2 | 8.25 | 0.863 | 0.36 | 175.3 | 18.8 | 8.7 | 45.9 | 0.7 | 0.2 | 18.9 | 0.002 | 4.57 | 0.13 | Wolverine Bend |

| Including | 26 | 31.5 | 5.5 | 1.213 | 0.41 | 244 | 24.2 | 9.4 | 49.2 | 0.7 | 0.1 | 19.7 | 0.002 | 4.91 | 0.14 | Wolverine Bend |

Winnie Lake Target Area

Drilling at the Winnie target area is focused on testing the WLS contact corridor and following up on previously identified quartz-sulphide veining and geophysical anomalies.

Recent drilling has intersected a vertically zoned hydrothermal system, with upper intervals characterized by brecciated and silica-flooded intrusive-volcanic contact zones hosting chalcopyrite-dominant sulphide mineralization and associated hematite alteration (see Figures 4 and 5). These zones are interpreted to represent peak metal deposition and remobilisation within a copper-rich hydrothermal breccia system.

Down-hole, mineralization transitions into brecciated chlorite-epidote altered mafic intrusive with quartz-carbonate veining and reduced sulphide content, interpreted as deeper brittle structural and alteration system. This vertical architecture is consistent with multi-phase Archean hydrothermal systems observed elsewhere in the Kirkland Lake camp.

These results complement previously reported syenite-hosted contact mineralization intersected in drill hole KLD25-31 (released October 27, 2025), and surface sampling returned 0.035 g/t Au, 12.75 g/t Ag, 1,395 ppm Cu, and 1,235 ppm Bi (released July 9, 2025). Collectively, drilling and geochemical results reinforce the interpretation of a fertile intrusive-contact-controlled mineralizing system with potential for copper-rich mineralization and associated gold along favourable structural corridors.

Figure 4 - KLD26-48 - 378.0 m to 378.5 m - Winnie Lake Area - An interval of a quartz-carbonate vein hosted within altered gabbro, with visible wall-rock interaction and brecciation. The vein is composed of massive to brecciated white quartz and carbonate, with fragments of altered gabbro and syenite host rock incorporated into the vein margins. Surrounding the vein is a pronounced alteration halo marked by chlorite-carbonate alteration and localized hematite staining, indicating strong hydrothermal overprinting of the gabbro.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5701/281208_29bc890444a84810_004full.jpg

Figure 5 - KLD26-48 - 377.8m to 378.0m - Winnie Lake Area - close-up of the upper portion of the same vein, highlighting coarse chalcopyrite mineralization hosted within the quartz-carbonate matrix. Chalcopyrite occurs as irregular blebs and fracture-controlled patches, locally concentrated along brecciated zones within the vein. The sulphide mineralization is spatially associated with iron-oxide-rich selvages and late quartz, indicating deposition during a late hydrothermal phase. These textures are consistent with structurally focused sulphide mineralization within a reactivated vein system.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5701/281208_29bc890444a84810_005full.jpg

Nine Mile Area

KLDC plans to drill-test a 1.5 km² intrusion-related gold soil anomaly along the northwestern margin of the WLS. This anomaly is characterized by elevated Au-Bi-Cu-Mo-W values and is coincident with electromagnetic conductivity anomalies and zones of magnetic destruction, geophysical signatures commonly associated with hydrothermal alteration surrounding mineralized intrusive systems.

Next Steps

The Company has received all required drilling permits for the Kirkland Lake West (KLW) region, allowing drilling to proceed across multiple high-priority geophysical and geochemical targets, including the Amikougami Lake Shear Zone and the Leahy-Queenston target area. Concurrently, drilling will continue at the Nine Mile and Winnie Lake target areas to further evaluate and refine the extent of mineralization. The Company also plans to return to the Wolverine Bend area to follow up on and extend previously identified mineralization.

Quality Control Statement

True widths are estimated at approximately 65-80% of the reported core length intervals. Assays are uncut except where indicated. All NQ drill core samples were analyzed at ALS Laboratories in Ontario, Québec and British Columbia.

Gold analyses were completed using industry-standard fire assay methods with atomic absorption finish, with selected samples re-analyzed using gravimetric methods where warranted. Multi-element analyses were conducted using industry-standard ICP-AES and ICP-MS techniques. Selected intervals were also analyzed using portable X-ray fluorescence (pXRF) for rapid multi-element screening and geological interpretation; pXRF results are considered semi-quantitative and are not used for reporting compliant assay results.

Drill program design, Quality Assurance/Quality Control ("QA/QC"), and interpretation of results were conducted by qualified persons employing a QA/QC program consistent with National Instrument 43-101 and industry best practices. Certified reference standards and blanks were inserted into the sample stream at regular intervals, approximately one control sample per 20 samples, to monitor analytical accuracy and precision.

Video Footage

Cannot view this video? Visit:

https://www.youtube.com/watch?v=u9jQXuid6LQ

The latest episode of KLDC's Treasure Hunters YouTube series features video of the core and discussions with senior geologist Mike Kilbourne.

Qualified Person

The technical information contained in this news release has been reviewed and approved by Benjamin Cleland, P.Geo., Vice-President Exploration, who is a Qualified Person as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Kirkland Lake Discoveries Corp.

Kirkland Lake Discoveries Corp. (TSXV: KLDC) has assembled a 400-km2 exploration portfolio in the Kirkland Lake region of Ontario's Abitibi Greenstone Belt, one of the most prolific mining districts in the world. The Company's properties span key fault zones, geophysical anomalies, and volcanic-sedimentary contacts within the Blake River Group, a highly prospective assemblage known to host both gold and polymetallic massive-sulphide deposits.

With exploration permits now in place, KLDC is positioned to advance a strong pipeline of drill-ready targets at KL East and KL West, supported by multiple anomalous soil trends, historical mineral showings, and structurally controlled intersections. The team combines strong technical experience with a focus on smart, efficient exploration designed to deliver results.

For additional information, please contact:

Stefan Sklepowicz

Chief Executive Officer

www.kirklandlakediscoveries.com

+1 226 979 3515

stefan@kirklandlakediscoveries.com

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statements

This news release contains "forward-looking statements" within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements. Forward-looking statements in this news release relate to, among other things, future drill programs, the results thereof, and the potential for new discoveries. There can be no assurance that such statements will prove to be accurate, and actual results and future events could differ materially from those anticipated in such statements. The Company does not assume any obligation to update forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by applicable securities laws. Mineralization hosted on adjacent and/or nearby properties is not necessarily indicative of mineralization hosted on the Company's property.

The TSX Venture Exchange Inc. has in no way passed upon the merits of the proposed Transaction and has neither approved nor disapproved the contents of this news release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281208