- Drilling confirms continued gold mineralisation within established Jagger and Road Cut Zone structures, including at depth with intersections of 8.0 m at 3.02 g/t Au at the Jagger Zone (KDD0129) and along the Contact Zone Fault with 6.0 m at 2.59 g/t Au at the Road Cut Zone (KDD0135)

- New gold-bearing structures were identified both in the footwall of the main Jagger shear toward the Contact Zone Fault (Structure 7, KDD0134) and along strike at Jagger South (KDD0127), expanding mineralisation beyond previously defined zones

- Results continue to reinforce the scale of the Kossou&s gold targets as drilling advances toward resource definition while generating additional high-priority targets

Kobo Resources Inc. ("Kobo& or the "Company") (TSX.V: KRI) is pleased to report results from 15 diamond drill holes completed as part of its ongoing drill program at the 100%-owned Kossou Gold Project (“Kossou&) in Côte d&Ivoire. The latest results confirm continued gold mineralisation within known structures at the Jagger and Road Cut Zones while also identifying new gold-bearing structures that expand the mineralised footprint of the project.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20260114191786/en/

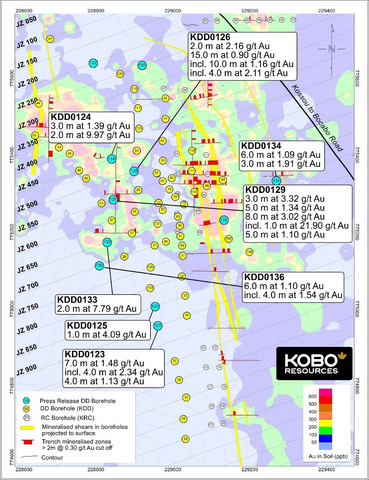

Figure 1: Jagger Zone Drill Hole Locations and Simplified Geology

Diamond Drill Results – Highlights:

Jagger Zone:

- KDD0129

- 3.0 metres ("m&)at 3.32 g/t Au from 62 .0 m

- 5.0 m at 1.34 g/t Au from 275.0 m

- 8.0 m at 3.02 g/t Au from 285.0 m

- 5.0 m at 1.10 g/t Au from 364.0m

- KDD0124

- 2.0 m at 9.97 g/t Au from 297.0 m

- KDD0133

- 2.0 m at 7.79 g/t Au from 314.0 m

- KDD0126

- 15.0 m at 0.90 g/t Au from 189.0 m, incl. 10.0 m at 1.16 g/t Au

- KDD0134

- 6.0 m at 1.09 g/t Au from 11.0 m, incl. 3.0 m at 1.91 g/t Au

Road Cut Zone :

- KDD0131

- 6.0 m at 2.55 g/t Au from 165.0 m,incl. 2.0 m at 5.27 g/t Au

- KDD0135

- 7.0 m at 1.11 g/t Au from 23.0 m

- 12.0 m at 0.62 g/t Au from 36.0 m, incl. 6.0 m at 1.00 gt Au

- 6.0 m at 2.59 g/t Au from 202.0 m

Edward Gosselin, CEO and Director of Kobo commented: “These results continue to confirm the strength and continuity of gold mineralisation within the established Jagger and Road Cut Zone structures, including meaningful intersections at depth and along the Contact Zone Fault. Importantly, this phase of drilling has also identified new gold-bearing structures both in the footwall of the main Jagger shear and along strike to the south, demonstrating that mineralisation at Kossou goes beyond previously defined zones. Total drilling reported to date at Kossou now exceeds 34,800 m across 192 drill holes, including diamond and RC drilling. Together, these results expand our target inventory and further support the scale and growth potential of the Kossou system as we continue advancing toward the resource definition stage.&

Jagger Zone: Continued Drilling Confirms Mineralisation at Depth and Along Strike

Drilling at the Jagger Zone continued with 11 additional holes completed across approximately 700 m of strike, testing continuity within the main Jagger structural corridor and mineralisation at depth.

Deeper drilling continues to confirm gold mineralisation well below previously tested levels. On section JZ650, KDD0133 intersected 2.0 m at 7.79 g/t Au approximately 200 m below surface, while KDD0136 on Section JZ700 returned 6.0 m at 1.10 g/t Au at a depth of approximately 210 m, confirming continuity of mineralised structures at depth.

Along strike, KDD0129 on Section JZ550 returned multiple intersections, including 8.0 m at 3.02 g/t Au from 285.0 m, extending mineralisation within the core of the Jagger Shear Zone. Additional intersections, including 5.0 m at 1.10 g/t Au from 364.0 m, confirm that Structure 6 extends to depths exceeding 250 m below surface. Further confirmation of depth continuity was provided by KDD0126 on Section JZ500, which intersected 15.0 m at 0.90 g/t Au from 189.0 m, including 10.0 m at 1.16 g/t Au. All mineralised zones remain open to depth within the Jagger Shear system.

Drill hole KDD0134(section JZ650) tested a gold in soil geochemical target on the east of the main drill area, footwall to the Jagger Shear structure and successfully intersected 6.0 m at 1.09 g/t Au from 11.0 m, including 3.0 m at 1.91 g/t Au, tentatively named “Structure 7& (see Figure 1). This suggests additional gold bearing shear zones are present towards the Contact Zone Fault(“CZ Fault&). Based on successful drilling of this contact in the Road Cut Zone, this hole provides confirmation of gold mineralisation in a similar stratigraphic location and will require additional drilling to advance this concept.

Road Cut Zone: Drilling Confirms Depth Extension and Contact Zone Fault Mineralisation

Drilling at the Road Cut Zone focused on two priority targets: the main shear previously intersected on section RCZ700 and gold mineralisation associated with the Contact Zone Fault and adjacent shear structures on section RCZ300.

Two drill holes are reported from this phase. In the southern portion of the zone, KDD0131 (section RCZ650), intersected 6.0 m at 2.55 g/t Au from 165.0 m, extending mineralisation to depth.

Further north, KDD0135 (section RCZ300) was drilled to test the northern extension of mineralisation along the Contact Zone Fault. In addition to near-surface intersections, the hole intersected 6.0 m at 2.59 g/t Au from 202.0 m, including 3.0 m at 4.48 g/t Au, confirming strong gold mineralisation associated with the fault. This intersection extends known mineralisation by approximately 150 m to the north and supports the Contact Zone Fault as a significant mineralised control at Road Cut, with additional drilling planned to define its extent (see Figures 4 and 5).

Jagger South Zone: Drilling Confirms Along-Strike Continuity of the Jagger Shear System

Two drill holes, KDD0127 and KDD0128, were completed to test gold-in-soil anomalies and Trench KTR110, located approximately 1 km south of the main Jagger Zone. Trench KTR110 previously returned 14.0 m at 0.75 g/t Au.

Drill hole KDD0127 intersected 5.0 m at 0.35 g/t Au from 25.0 m and 3.0 m at 2.25 g/t Au from 48.0 m. The mineralisation is associated with quartz feldspar porphyry intrusions, similar to those observed in the central Jagger Zone, indicating regional continuity to the Jagger Shear system in southern parts. Additional work is planned to further evaluate this target area.

Table 1: Summary of Significant Diamond Drill Hole Results

|

BHID |

East |

North |

Elev. |

Az. |

Dip |

Length |

|

From

|

To

|

Int. (m) |

Au g/t |

Target |

|

KDD0122 |

228793 |

775639 |

264 |

70 |

-50 |

308.40 |

|

217.00 |

219.00 |

2.00 |

0.33 |

Jagger |

|

KDD0123 |

228961 |

774956 |

370 |

70 |

-50 |

275.30 |

|

173.00 |

177.00 |

4.00 |

0.58 |

Jagger |

|

|

|

|

|

|

|

|

|

182.00 |

189.00 |

7.00 |

1.48 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

185.00 |

189.00 |

4.00 |

2.34 |

Jagger |

|

|

|

|

|

|

|

|

|

193.00 |

197.00 |

4.00 |

1.31 |

Jagger |

|

|

|

|

|

|

|

|

|

201.00 |

204.00 |

3.00 |

0.70 |

Jagger |

|

|

|

|

|

|

|

|

|

208.00 |

214.00 |

6.00 |

0.30 |

Jagger |

|

|

|

|

|

|

|

|

|

259.00 |

262.00 |

3.00 |

1.49 |

Jagger |

|

KDD0124 |

228841 |

775390 |

332 |

70 |

-50 |

380.40 |

|

78.00 |

81.00 |

3.00 |

1.39 |

Jagger |

|

|

|

|

|

|

|

|

|

208.00 |

211.00 |

3.00 |

1.14 |

Jagger |

|

|

|

|

|

|

|

|

|

234.00 |

235.00 |

1.00 |

1.30* |

Jagger |

|

|

|

|

|

|

|

|

|

281.00 |

282.00 |

1.00 |

1.39* |

Jagger |

|

|

|

|

|

|

|

|

|

297.00 |

299.00 |

2.00 |

9.97 |

Jagger |

|

|

|

|

|

|

|

|

|

348.00 |

354.00 |

6.00 |

0.69 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

352.00 |

354.00 |

2.00 |

1.47 |

Jagger |

|

KDD0125 |

228954 |

775006 |

377 |

70 |

-50 |

272.30 |

|

42.00 |

43.00 |

1.00 |

4.09* |

Jagger |

|

|

|

|

|

|

|

|

|

174.00 |

177.00 |

3.00 |

0.70 |

Jagger |

|

KDD0126 |

228899 |

775358 |

338 |

70 |

-50 |

330.40 |

|

85.00 |

87.00 |

2.00 |

2.16 |

Jagger |

|

|

|

|

|

|

|

|

|

152.00 |

153.00 |

1.00 |

4.11* |

Jagger |

|

|

|

|

|

|

|

|

|

189.00 |

204.00 |

15.00 |

0.90 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

194.00 |

204.00 |

10.00 |

1.16 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

194.00 |

198.00 |

4.00 |

2.11 |

Jagger |

|

|

|

|

|

|

|

|

|

240.00 |

244.00 |

4.00 |

0.54 |

Jagger |

|

|

|

|

|

|

|

|

|

265.00 |

267.00 |

2.00 |

1.91 |

Jagger |

|

KDD0127 |

228778 |

773771 |

345 |

70 |

-50 |

149.30 |

|

25.00 |

30.00 |

5.00 |

0.35 |

Jagger Sth. |

|

|

|

|

|

|

|

|

|

48.00 |

51.00 |

3.00 |

2.25 |

Jagger Sth. |

|

KDD0128 |

228738 |

773756 |

335 |

70 |

-50 |

215.30 |

|

43.00 |

45.00 |

2.00 |

0.50 |

Jagger Sth. |

|

KDD0129 |

228845 |

775284 |

369 |

70 |

-50 |

392.40 |

|

62.00 |

65.00 |

3.00 |

3.32 |

Jagger |

|

|

|

|

|

|

|

|

|

236.00 |

239.00 |

3.00 |

1.22 |

Jagger |

|

|

|

|

|

|

|

|

|

252.00 |

257.00 |

5.00 |

0.84 |

Jagger |

|

|

|

|

|

|

|

|

|

263.00 |

268.00 |

5.00 |

0.55 |

Jagger |

|

|

|

|

|

|

|

|

|

275.00 |

280.00 |

5.00 |

1.34 |

Jagger |

|

|

|

|

|

|

|

|

|

285.00 |

293.00 |

8.00 |

3.02 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

285.00 |

286.00 |

1.00 |

21.90 |

Jagger |

|

|

|

|

|

|

|

|

|

364.00 |

369.00 |

5.00 |

1.10 |

Jagger |

|

|

|

|

|

|

|

|

|

380.00 |

384.00 |

4.00 |

0.99 |

Jagger |

|

KDD0130 |

228920 |

775633 |

279 |

70 |

-50 |

188.30 |

|

162.00 |

164.00 |

2.00 |

1.69 |

Jagger |

|

|

|

|

|

|

|

|

|

171.00 |

172.00 |

1.00 |

1.73* |

Jagger |

|

KDD0131 |

228423 |

776036 |

283 |

70 |

-50 |

281.40 |

|

89.00 |

92.00 |

3.00 |

0.54 |

RCZ |

|

|

|

|

|

|

|

|

|

118.00 |

119.00 |

1.00 |

1.36* |

RCZ |

|

|

|

|

|

|

|

|

|

165.00 |

171.00 |

6.00 |

2.55 |

RCZ |

|

|

|

|

|

|

|

|

incl. |

169.00 |

171.00 |

2.00 |

5.27 |

RCZ |

|

KDD0132 |

229133 |

775231 |

337 |

70 |

-50 |

137.30 |

|

0.00 |

4.00 |

4.00 |

0.80 |

Jagger |

|

|

|

|

|

|

|

|

|

49.00 |

50.00 |

1.00 |

1.28* |

Jagger |

|

KDD0133 |

228829 |

775173 |

395 |

70 |

-50 |

362.30 |

|

16.00 |

21.00 |

5.00 |

0.72 |

Jagger |

|

|

|

|

|

|

|

|

|

81.00 |

82.00 |

1.00 |

1.26 |

Jagger |

|

|

|

|

|

|

|

|

|

255.00 |

256.00 |

1.00 |

1.08 |

Jagger |

|

|

|

|

|

|

|

|

|

280.00 |

281.00 |

1.00 |

1.56 |

Jagger |

|

|

|

|

|

|

|

|

|

314.00 |

316.00 |

2.00 |

7.79 |

Jagger |

|

|

|

|

|

|

|

|

|

355.00 |

356.00 |

1.00 |

1.13 |

Jagger |

|

KDD0134 |

229269 |

775333 |

275 |

70 |

-50 |

191.40 |

|

11.00 |

17.00 |

6.00 |

1.09 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

11.00 |

14.00 |

3.00 |

1.91 |

Jagger |

|

KDD0135 |

228374 |

776445 |

256 |

70 |

-50 |

236.40 |

|

9.00 |

10.00 |

1.00 |

1.49 |

RCZ |

|

|

|

|

|

|

|

|

|

23.00 |

30.00 |

7.00 |

1.11 |

RCZ |

|

|

|

|

|

|

|

|

incl. |

23.00 |

26.00 |

3.00 |

2.15 |

RCZ |

|

|

|

|

|

|

|

|

|

36.00 |

48.00 |

12.00 |

0.62 |

RCZ |

|

|

|

|

|

|

|

|

incl. |

38.00 |

44.00 |

6.00 |

1.00 |

RCZ |

|

|

|

|

|

|

|

|

|

79.00 |

81.00 |

2.00 |

0.98 |

RCZ |

|

|

|

|

|

|

|

|

|

125.00 |

129.00 |

4.00 |

1.78 |

RCZ |

|

|

|

|

|

|

|

|

|

202.00 |

208.00 |

6.00 |

2.59 |

RCZ |

|

|

|

|

|

|

|

|

incl. |

205.00 |

208.00 |

3.00 |

4.48 |

RCZ |

|

KDD0136 |

228809 |

775112 |

404 |

70 |

-50 |

413.30 |

|

92.00 |

93.00 |

1.00 |

2.53 |

Jagger |

|

|

|

|

|

|

|

|

|

232.00 |

233.00 |

1.00 |

3.05 |

Jagger |

|

|

|

|

|

|

|

|

|

267.00 |

271.00 |

4.00 |

0.48 |

Jagger |

|

|

|

|

|

|

|

|

|

297.00 |

299.00 |

2.00 |

1.05 |

Jagger |

|

|

|

|

|

|

|

|

|

347.00 |

353.00 |

6.00 |

1.10 |

Jagger |

|

|

|

|

|

|

|

|

incl. |

349.00 |

353.00 |

4.00 |

1.54 |

Jagger |

|

|

|

|

|

|

|

|

|

392.00 |

393.00 |

1.00 |

2.28 |

Jagger |

|

Notes:

|

||||||||||||

An accurate dip and strike and controls of mineralisation are unconfirmed and mineralised zones are reported as downhole lengths. Drill holes are planned to intersect mineralised zones perpendicular to interpreted targets. All intercepts reported are downhole distances, true widths are unknown.

Sampling, QA/QC, and Analytical Procedures

Drill core was logged and sampled by Kobo personnel at site. Drill cores were sawn in half, with one half remaining in the core box and the other half secured into new plastic sample bags with sample number tickets. Core samples are drilled using HQ core barrels to below the level of oxidation and then reduced to NQ core barrels for the remainder of the bore hole. Samples are transported to the SGS Côte d&Ivoire facility in Yamoussoukro by Kobo personnel where the entire sample was prepared for analysis (prep code PRP86/PRP94). Sample splits of 50 grams were then analysed for gold using 50g Fire Assay as per SGS Geochem Method FAA505. QA/QC procedures for the drill program include insertion of a certificated standards every 20 samples, a blank every 20 samples and a duplicate sample every 20 samples. All QAQC control samples returned values within acceptable limits.

Review of Technical Information

The scientific and technical information in this press release has been reviewed and approved by Paul Sarjeant, P.Geo., who is a Qualified Persons as defined in National Instrument 43-101. Mr. Sarjeant is the President and Chief Operating Officer and Director of Kobo.

About Kobo Resources Inc.

Kobo Resources is a growth-focused gold exploration company with a compelling gold discovery in Côte d'Ivoire, one of West Africa&s most prolific gold districts, hosting several multi-million-ounce gold mines. The Company&s 100%-owned Kossou Gold Project is located approximately 20 km northwest of the capital city of Yamoussoukro and is directly adjacent to one of the region&s largest gold mines with established processing facilities.

With over 29,000 metres of diamond drilling, nearly 5,887 metres of reverse circulation (RC) drilling, and 7,100+ metres of trenching completed since 2023, Kobo has made significant progress in defining the scale and prospectivity of its Kossou&s Gold Project. Exploration has focused on multiple high-priority targets within a 9+ km strike length of highly prospective gold-in-soil geochemical anomalies, with drilling confirming extensive mineralisation at the Jagger, Road Cut, and Kadie Zones. The latest phase of drilling has further refined structural controls on gold mineralisation, setting the stage for the next phase of systematic exploration and resource development.

Beyond Kossou, the Company is advancing exploration at its Kotobi Permit and is actively expanding its land position in Côte d'Ivoire with prospective ground, aligning with its strategic vision for long-term growth in-country. Kobo remains committed to identifying and developing new opportunities to enhance its exploration portfolio within highly prospective gold regions of West Africa. Kobo offers investors the exciting combination of high-quality gold prospects led by an experienced leadership team with in-country experience. Kobo&s common shares trade on the TSX Venture Exchange under the symbol "KRI&. For more information, please visit www.koboresources.com.

NEITHER THE TSXV NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSXV) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE.

Cautionary Statement on Forward-looking Information:

This news release contains “forward-looking information& and “forward-looking statements& (collectively, “forward-looking statements&) within the meaning of the applicable Canadian securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as at the date of this news release. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (often but not always using phrases such as “expects&, or “does not expect&, “is expected&, “anticipates& or “does not anticipate&, “plans&, “budget&, “scheduled&, “forecasts&, “estimates&, “believes& or “intends& or variations of such words and phrases or stating that certain actions, events or results “may& or “could&, “would&, “might& or “will& be taken to occur or be achieved) are not statements of historical fact and may be forward-looking statements Forward-looking statements are necessarily based upon a number of estimates and assumptions that, while considered reasonable, are subject to known and unknown risks, uncertainties, and other factors which may cause the actual results and future events to differ materially from those expressed or implied by such forward-looking statements. Such factors include, but are not limited to: general business, economic, competitive, political and social uncertainties; and the delay or failure to receive board, shareholder or regulatory approvals. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on the forward-looking statements and information contained in this news release. Except as required by law, Kobo assumes no obligation and/or liability to update the forward-looking statements of beliefs, opinions, projections, or other factors, should they change, except as required by law.

View source version on businesswire.com: https://www.businesswire.com/news/home/20260114191786/en/