Vancouver, British Columbia--(Newsfile Corp. - February 24, 2026) - Kodiak Copper Corp. (TSXV: KDK) (OTCQX: KDKCF) (FSE: 5DD1) (the "Company" or "Kodiak") today reports soil geochemical and prospecting results from the 2025 exploration program on its 100% owned MPD copper-gold porphyry project in southern British Columbia.

Highlights

-

Kodiak's 2025 regional exploration program confirms numerous historic high-grade targets, identifies new targets and highlights the potential to expand the recent Mineral Resource Estimate reported for the Ketchan deposit.

-

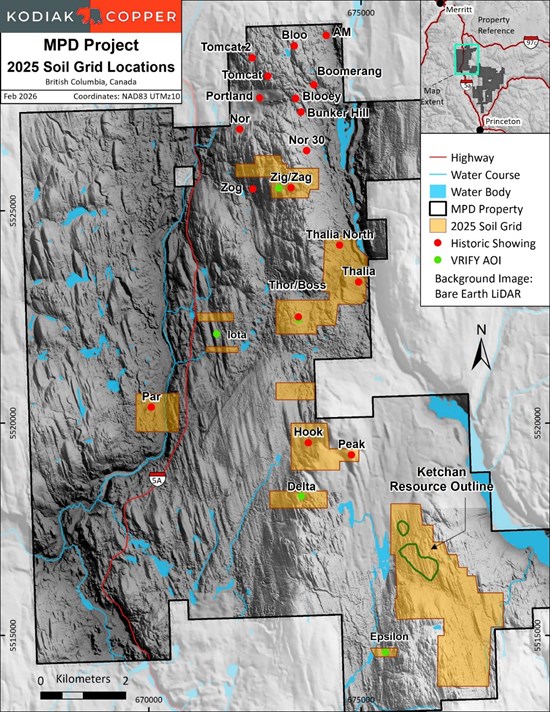

The 2025 soil geochemical program included the collection of 2,415 soil samples and focussed on historical targets, areas with perspective geology and VRIFY artificial intelligence (AI) Areas of Interest at MPD Northwest. Figure 1

-

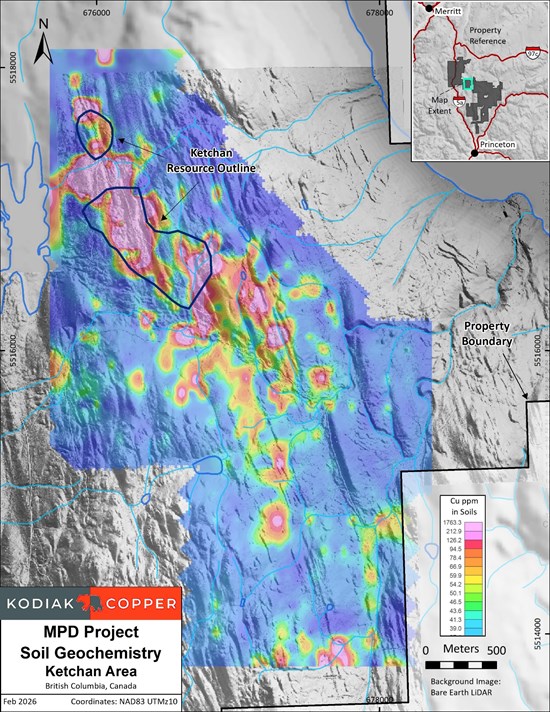

At the Ketchan deposit, a well-defined copper-in-soil trend over two kilometres suggeststhe deposit could be larger than the 1.4 kilometres of strike currently defined by resource drilling. Figure 2

-

Anomalous soil results were also coincident with prospective geology at the Thor/Boss, Thalia, Zig, Par, Hook and Delta targets.

-

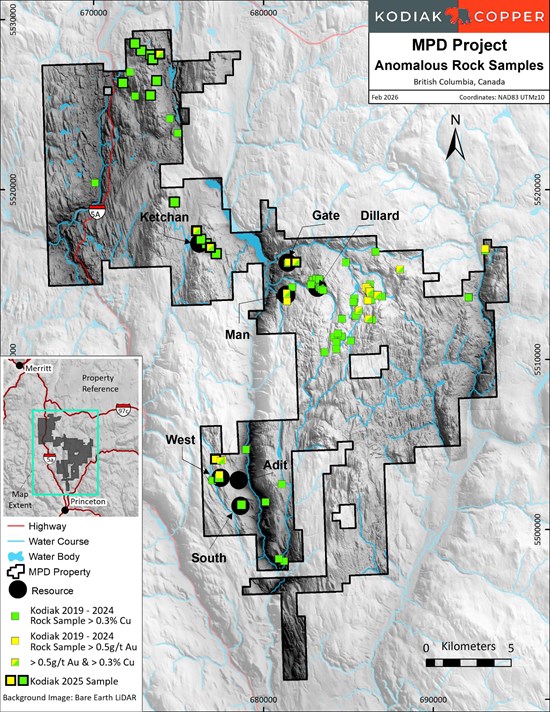

Prospecting in 2025 included 112 rock samples which confirmed historic showings and discovered a new copper-gold-silver target near the West deposit. Figure 3

-

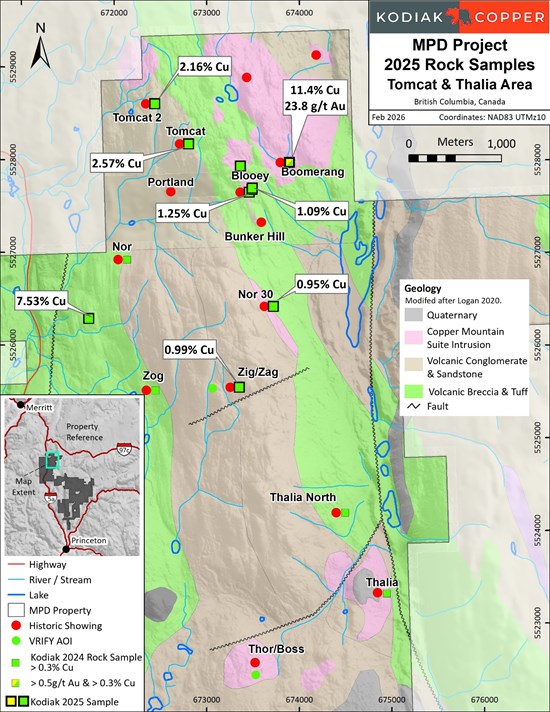

The best prospecting grab sample assayed 11.4 % Cu, 23.8 g/t Au and 43.6 g/t Ag and was from historic workings at the Tomcat area in MPD Northwest. Figures 3 & 4

-

Regional results from 2025 are being used to prioritise target and Resource drilling in 2026, with plans to be announced in the near future.

Claudia Tornquist, President and CEO of Kodiak, said, "The results from our 2025 regional program once again underscore the exceptional prospectivity of our MPD project. The planning for this year's exploration program is well underway, with a clear objective to significantly increase our recent maiden Resource estimate by expanding several of the deposits. The soil results presented today impressively show the strong expansion potential of the Ketchan deposit. In addition, we are prioritizing numerous untested targets that may represent the next discovery and intend to drill several of them in the upcoming campaign. We are preparing for an extensive 2026 field program, with work planned to commence in the spring and continue through most of the year."

2025 Soil Geochemical Surveys

The 2025 soil geochemical program was comprised of 2,415 samples collected in nine prospective areas across the MPD Northwest claims (see Figure 1). Samples of "B" horizon weighing 300 to 500 grams were collected at nominal intervals of 50 metres along east-west lines using 100 or 200 metre spacing. Soil grids targeted historic showings, prospective geology and VRIFY AI Areas of Interest. The largest grid covered seven square kilometers in the Ketchan deposit area.

The 2025 soil results highlight a number of areas for follow up in 2026, particularly at Ketchan where a well-defined copper-in-soil anomaly over two kilometres in length suggest this deposit may extend beyond the current 1.4 kilometre strike defined by resource drilling.

Figure 1: Soil Geochemical Survey Areas - MPD Northwest

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/285012_765a43b79479e800_002full.jpg

Figure 2: Copper-in-Soil Geochemical Trend associated with the Ketchan Deposit

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/285012_765a43b79479e800_003full.jpg

Anomalous copper values up to 2,030 ppm and gold values up to 0.21 ppm were returned from the 2025 soil sampling. Result thresholds and percentiles are included as Table 1.

Table 1: 2025 Soil Geochemical Sampling - Value Ranges and Anomalous Thresholds for

Copper-Gold-Silver

| Percentile | Cu

(ppm) |

n* | Percentile | Au

(ppm) |

n* | Percentile | Ag

(ppm) |

n* |

| MPD Northwest | ||||||||

| 75 | 43.8 | 605 | 75 | 0.002 | 617 | 75 | 0.119 | 607 |

| 90 | 67.4 | 242 | 90 | 0.004 | 252 | 90 | 0.198 | 242 |

| 95 | 99.6 | 121 | 95 | 0.006 | 122 | 95 | 0.272 | 122 |

| 98 | 172.4 | 49 | 98 | 0.010 | 49 | 98 | 0.381 | 49 |

| Min | 3.2 |

|

Min | 0.00025 |

|

Min | 0.012 |

|

| Max | 2030 |

|

Max | 0.21 |

|

Max | 29.4 |

|

| Mean | 41.2 |

|

Mean | 0.002 |

|

Mean | 0.12 |

|

*Number of samples

2025 Prospecting Results

Kodiak collected 112 rock samples from prospecting traverses in 2025 of which 66 were from MPD Northwest and 56 from other parts of the property (Figure 3). Rock sample results from the 2025 program continue to demonstrate the potential for additional discoveries at MPD. More follow-up work is planned in 2026. Select highlight assays from prospecting in 2025 are included in Table 2 and Figure 4.

Prospecting in 2025 focused primarily on historic showings. The best sample in 2025 assayed 11.4 % Cu, 23.8 g/t Au and 43.6 g/t Ag (sample 222381) from mineralized veins at the Boomerang showing on the Tomcat claims at MPD Northwest. The Tomcat area hosts a number of high-grade showings. The best sample in the southern part of the property assayed 0.23% Cu and 1.56 g/t Au (sample 222257) from a new copper-gold-silver discovery named Nebula located approximately 500 metres north of the West deposit. The mineralization is associated with a monzodiorite/conglomerate unit similar to the geology seen at West.

Figure 3: 2025 Rock Sample Locations - MPD Property

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/285012_765a43b79479e800_004full.jpg

Figure 4: 2025 Prospecting Results - Tomcat & Thalia Targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3803/285012_765a43b79479e800_005full.jpg

Table 2: 2025 Prospecting Result Highlights

| Sample

ID |

Easting | Northing | Target | Cu

% |

Au

g/t |

Ag

g/t |

Pd

g/t |

Pt

g/t |

Host Rock

Type |

| (UTM Z10) | (UTM Z10) | ||||||||

| 222267 | 676644 | 5516806 | Ketchan | 0.5 | 0.14 | 1.2 | - | - | Monzonite |

| 222295 | 674754 | 5519275 | Ketchan | 3.56 | 0.01 | 34.7 | - | - | Tuff

(historical trench) |

| 222297 | 676888 | 5516599 | Ketchan | 0.67 | 0.62 | 13.3 | - | - | Monzonite |

| 252861 | 676324 | 5517081 | Ketchan | 0.32 | 0.03 | 2.6 | - | - | Monzonite |

| 222373 | 671729 | 5526285 | - | 7.53 | 0.01 | 68.6 | - | - | Contact

(historical pit) |

| 222368 | 672442 | 5528602 | Tomcat 2 | 2.16 | 0.21 | 4.2 | - | - | Vein

(historical pit) |

| 222378 | 673460 | 5527647 | Blooey | 1.25 | 0.01 | 12 | - | - | Sandstone |

| 222381 | 673894 | 5527968 | Boomerang | 11.4 | 23.8 | 43.6 | 7.31 | 1.12 | Vein (historical trench) |

| 222395 | 672806 | 5528170 | Tomcat | 2.57 | 0.01 | 7.3 | - | - | Conglomerate

(historical shaft) |

| 222387 | 673354 | 5525543 | Zig | 0.99 | 0.01 | 6.3 | - | - | Conglomerate

(historical shaft) |

| 222388 | 673721 | 5526416 | Nor 30 | 0.95 | 0.003 | 4 | - | - | Tuff

(historical trench) |

| 222257 | 677476 | 5504041 | Nebula | 0.23 | 1.56 | 1.8 | - | - | Contact |

QA/QC Procedures

All rock samples are picked up from Kodiak's field office in Merritt, BC by Activation Laboratories Ltd. (Actlabs) and delivered to their accredited laboratory in Kamloops, BC, for preparation and Fire Assay prior to being shipped to their Ancaster, Ontario Laboratory for Multi-element analysis. The rock samples are analyzed for gold by fire assay fusion with an AA finish. If samples return gold values over 10ppm, samples are reanalysed by fire assay with gravimetric finish. Samples then undergo four acid digestion and ICP-OES and ICP-MS analysis for 48 elements. Samples that return copper values above 10,000 ppm are further analysed using a "near-total" digestion, ICP-OES package.

All soil samples are picked up from Kodiak's field office in Merritt, BC by Activation Laboratories Ltd. (Actlabs) and delivered to their accredited laboratory in Kamloops, BC, for preparation and analysis. The soil samples are analysed for gold by cyanide extraction and ICP-MS, and for 63 elements using Aqua Regia (partial) digestion and ICP-MS.

Actlabs meets all requirements of International Standards ISO/IEC 17025:2015 and ISO 9001:2015 for analytical procedures. In addition to Actlabs quality assurance-quality control (QA/QC) protocols, Kodiak implements an internal QA/QC program for samples that includes the insertion of sample blanks, duplicates, and certified reference materials, at a rate of one per ten samples.

Dave Skelton, P.Geo., Vice President Exploration and the Qualified Person as defined by National Instrument 43-101, has approved and verified the technical information in this news release.

On behalf of the Board of Directors

Kodiak Copper Corp.

Claudia Tornquist

President & CEO

For further information, contact:

Nancy Curry, VP Corporate Development

ncurry@kodiakcoppercorp.com

+1 (604) 646-8362

About Kodiak Copper Corp.

Kodiak is focused on advancing its copper porphyry projects in Canada and the USA, which host known mineral discoveries with the potential to hold large-scale deposits. Kodiak Copper's most advanced asset is the 100% owned MPD copper-gold porphyry project in the prolific Quesnel Terrane in south-central British Columbia, Canada, an established mining region with producing mines and excellent infrastructure. MPD exhibits all the hallmarks of a large, multi-centered porphyry district with the potential for future economic development. The initial Mineral Resource Estimate published in 2025 outlines seven substantial deposits and underscores the scale and potential of the project. All known deposits remain open to expansion, and numerous targets across the property have yet to be tested. Kodiak continues to systematically explore MPD's district-scale potential with the goal of delivering new discoveries and building further critical mass toward being the region's next mine.

Kodiak's founder and Chairman is Chris Taylor who is well-known for his gold discovery success with Great Bear Resources. Kodiak is also part of Discovery Group led by John Robins, one of the most successful mining entrepreneurs in Canada.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward-Looking Statement (Safe Harbor Statement): This press release contains forward-looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward-looking statements. In particular, this press release contains forward-looking statements concerning the Company's exploration plans. Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward-looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with conditions in the equity financing markets, and assumptions and risks regarding receipt of regulatory and shareholder approvals.

Management has provided the above summary of risks and assumptions related to forward-looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285012