Vancouver, British Columbia--(Newsfile Corp. - December 22, 2025) - LithiumBank Resources Corp. (TSXV: LBNK) (OTCQX: LBNKF) ("LithiumBank" or the "Company") is pleased to announce it has entered into a Development Agreement ("DA") dated December 21st, 2025, with a Leading Energy Services and Technology Supplier ("LESTS") (together the "Parties") to provide technical services required to bring the Boardwalk lithium brine project ("Boardwalk"), located in northwest Alberta, Canada, to production with project execution targeted for 2027. The DA envisions the Parties collaborating in developing the Boardwalk asset using licensed modular Direct Lithium Extraction ("DLE") technology, and includes commissioning a Feasibility Study, front-end engineering design, and engineering procurement and construction activities. The feasibility study envisions two initial DLE modules together capable of up to 10,000 tonne per annum ("tpa") Lithium Carbonate ("LCE").

"We are pleased to have reached this juncture in Boardwalk's development, where we have a distinct path toward commercial production," remarked Rob Shewchuk, CEO and Director of LithiumBank. "We are confident in LESTS's proven track record as the primary development contractor for the Boardwalk project. Their extensive experience in both subsurface and lithium processing technologies empowers LithiumBank to expedite our development process. We anticipate a feasibility study to be completed in 2026, which will significantly reduce our development timeline and costs compared to alternative strategies. Furthermore, we anticipate that Boardwalk will generate minimal new surface disturbance while simultaneously benefiting local communities. Additionally, our license with LESTS's comprehensive proven DLE solution and modular approach is projected to scale production by 5,000 tpa LCE increments with a capital intensity that we believe is more advantageous than comparable brine projects in North America."

The DA is the culmination of 3 years of collaboration on LithiumBank's Alberta lithium brine assets that includes detailed subsurface modelling (as announced February 20, 2025) and extensive DLE testing (as announced April 14, 2025). The flexible commercialisation approach with 5,000 tpa DLE modules significantly reduces the financial and technical risk in commercializing production of a battery grade lithium carbonate.

Part of the development funding will be provided by the Alberta government through Emissions Reduction Alberta ("ERA") for:

- Re-entering and deepening a 2nd past producing, suspended, oil and gas well of the Leduc formation (as announced Nov, 20, 2025);

- Conducting concentration and conversion testing of 114,320 Liters (30,200 gallons) raw brine to a battery grade lithium carbonate, and;

- Completing a Feasibility Study.

The funding will refund LithiumBank up to 50% of each milestone up to a total of $3.9M.

During the DA Term, the Company agrees to collaborate exclusively with LESTS with respect to proposed work contemplated by the DA, until the earlier of (i) such time as the Parties execute a definitive agreement; or (ii) such time as the Parties abandon negotiations by mutual written consent.

The DA includes the terms for the licensing of LESTS's proven technology at Boardwalk for the full processing flow sheet, from brine pretreatment all the way to a battery grade product that is transferrable. The license fee is payable from the proceeds of production by way of a gross overriding royalty that LithiumBank deems favourable to Boardwalk. The solution also uses significantly less water, energy and fewer chemical reagents in comparison to other DLE-based offerings.

Key milestones for the partnership with LESTS include:

-

DLE Testing Eluate Treatability & Concentration Study, and Conversion Testing

-

Feasibility Study / DFS / Subsurface Modelling

-

Detailed Engineering and AACE Class 2 Estimate for Financial Investment Decision

-

Procurement

-

Phased Commercial Production Plant Construction

-

Commissioning, and Startup

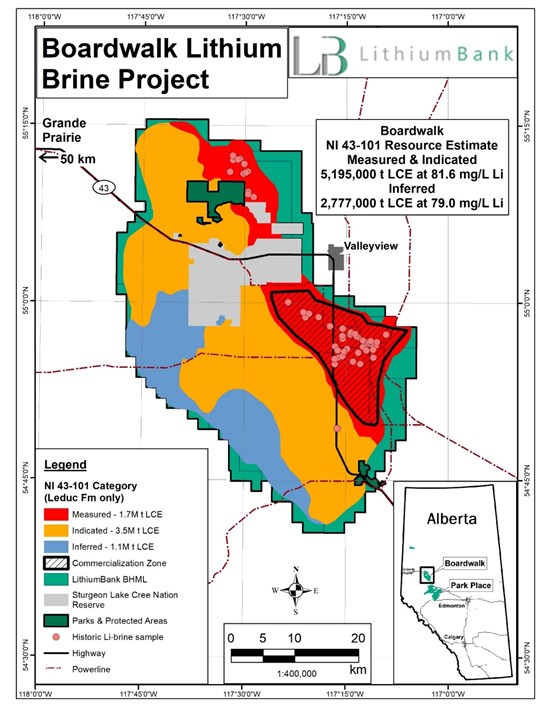

Boardwalk's NI 43-101 resource estimate entitled "LithiumBank Resources Corp. Boardwalk NI 43-101 Technical Report" reported Indicated resources of 5.2 million tonnes LCE at 81.6 mg/L lithium within 11.96 cubic kilometres (km3) of brine and 2.8 million tonnes LCE inferred at 79 mg/L lithium within 6.56 km3 of brine with an effective date of February 20, 2025 (as announced Feb. 20, 2025).

Figure 1. Map of Boardwalk Brine Hosted Mineral Licenses and NI 43-101 Resource Estimate

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10140/278791_f6e3b10a1427cb78_001full.jpg

Notes

1: Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no guarantee that all or any part of the mineral resource will ever be upgraded to a higher category. The estimate of mineral resources may be materially affected by geology, environment, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

2: The weights are reported in metric tonnes (1,000 kg or 2,204.6 lbs).

3: Tonnage numbers are rounded to the nearest 1,000 unit.

4: In a 'confined' aquifer (as reported herein), effective porosity is an appropriate parameter to use for the resource estimate.

5: The resource estimation was completed and reported using a cut-off of 50 mg/L Li.

6: To describe the resource in terms of industry standard, a conversion factor of 5.323 is used to convert elemental Li to Li2CO3, or Lithium Carbonate Equivalent (LCE).

Qualified Person

The information that forms the basis for the scientific and technical information disclosed in this news release was prepared and approved by Kevin Piepgrass, P.Geo, who is a Qualified Person (QP) for the purposes of National Instrument 43-101. Mr Kevin Piepgrass consents and approves of the inclusion of the data in the form and context in which it appears. Mr. Kevin Piepgrass is the Chief Operating Officer for LithiumBank and is non-independent.

About LithiumBank Resources Corp.

LithiumBank Resources Corp. (TSXV: LBNK) (OTCQX: LBNKF) is a publicly traded lithium company that is focused on developing its two flagship projects, Boardwalk and Park Place, in Western Canada. These projects host some of the largest lithium brine resources in North America (Figure 1). The Company holds 1,240,140 acres of brown-field brine hosted mineral licenses across three districts in Alberta and Saskatchewan. The Company has pilot tested multiple mature Direct Lithium Extraction ("DLE") technologies and has signed a Development Agreement for the Boardwalk project. This agreement includes binding DLE licensing terms with a Leading Energy Services and Technology Supplier to provide a cost-effective and commercially viable end-to-end solution. The Company is now working toward establishing commercial lithium production using a modular scale-up approach.

Contact:

Rob Shewchuk Director & CEO

rob@lithiumbank.ca

(778) 987-9767

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Cautionary Statement Regarding Forward-Looking Statements

This release includes certain statements and information that may constitute forward-looking information within the meaning of applicable Canadian securities laws. All statements in this news release, other than statements of historical facts, including statements regarding future estimates, plans, objectives, timing, assumptions or expectations of future performance, including without limitation, statements regarding the Parties collaborating in developing the Boardwalk asset using licensed modular DLE technology; the Company commissioning a Feasibility Study and the anticipated timing thereof; the first phase of development involving two initial DLE modules capable of 10,000 tpa per annum LCE; the Company having a clear sight to commercial production on the Boardwalk Project; the Company saving significant time and costs compared to alternative development strategies; Boardwalk creating limited new surface disturbance and benefiting local communities; The Leading Energy Technology Supplier's end to end DLE solution and modular approach scaling up production by 5,000 tpa LCE increments with a capital intensity that is more favourable than comparable brine projects in North America; the flexible commercialization approach significantly reducing the financial and technical risk in commercializing production of a battery grade lithium carbonate; Leading Energy Technology Supplier and the Company entering into definitive agreements with respect to the DA; Leading Energy Technology Supplier's technology producing high-purity lithium carbonate or hydroxide; and the Company accomplishing any of the key milestones of the partnership with Leading Energy Technology Supplier, are forward-looking statements and contain forward-looking information. Generally, forward-looking statements and information can be identified by the use of forward-looking terminology such as "intends" or "anticipates", or variations of such words and phrases or statements that certain actions, events or results "may", "could", "should" or "would" or occur.

Forward-looking statements are based on certain material assumptions and analysis made by the Company and the opinions and estimates of management as of the date of this press release, including that the Parties will collaborate in developing the Boardwalk asset using licensed modular DLE technology on the terms set out in the DA, or at all; that the Company will commission a Feasibility Study that will be completed in 2026; that the first phase of development will involve two initial DLE modules capable of 10,000 tpa per annum LCE; that the Company will have a clear sight to commercial production on the Boardwalk Project; that the Company will save significant time and costs compared to alternative development strategies; that Boardwalk will create limited new surface disturbance and benefit local communities; that the Leading Energy Technology Supplier's end to end DLE solution and modular approach will scale up production by 5,000 tpa LCE increments with a capital intensity that is more favourable than comparable brine projects in North America; that the flexible commercialization approach will significantly reduce the financial and technical risk in commercializing production of a battery grade lithium carbonate; that the Leading Energy Technology Supplier and the Company will enter into definitive agreements with respect to the DA; that the Leading Energy Technology Supplier's technology produces high-purity lithium carbonate or hydroxide; that the Company will accomplish the key milestones of the partnership with the Leading Energy Technology Supplier; and that the Company will be able to raise the capital required in connection with accomplishing the key milestones.

These forward-looking statements are subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of the Company to be materially different from those expressed or implied by such forward-looking statements or forward-looking information. Important risks that may cause actual results to vary, include, without limitation, the risk that the Parties will not collaborate in developing the Boardwalk asset using licensed modular DLE technology on the terms set out in the DA, or at all; that the Company will not commission a Feasibility Study that will be completed in 2026; that the first phase of development will not be on the terms anticipated; that the Company will not have a clear sight to commercial production on the Boardwalk Project; that the Company will not save significant time and costs compared to alternative development strategies; that Boardwalk will create new surface disruptions; that Boardwalk will not benefit local communities as anticipated, or at all; that the Leading Energy Technology Supplier's end to end DLE solution and modular approach will not scale up production as anticipated; that financial and technical risk will be reduced; that the Leading Energy Technology Supplier and the Company will not enter into a definitive agreement; that the Leading Energy Technology Supplier's technology will not produce high-purity lithium carbonate or hydroxide; that the Company will not accomplish the key milestones of the partnership with the Leading Energy Technology Supplier'; that North America's demand for lithium does not continue to grow; the possibility that any future development results will not be consistent with the Company's expectations; risks related to commodity price and foreign exchange rate fluctuations; the cyclical nature of the industry in which the Company operates; risks related to global financial markets, including the trading price of the Company's shares and the Company's ability to raise capital may also result in additional and unknown risks or liabilities to the Company.

Although management of the Company has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking statements or forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements and forward-looking information. Readers are cautioned that reliance on such information may not be appropriate for other purposes. The Company does not undertake to update any forward-looking statement, forward-looking information or financial outlook that are incorporated by reference herein, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278791