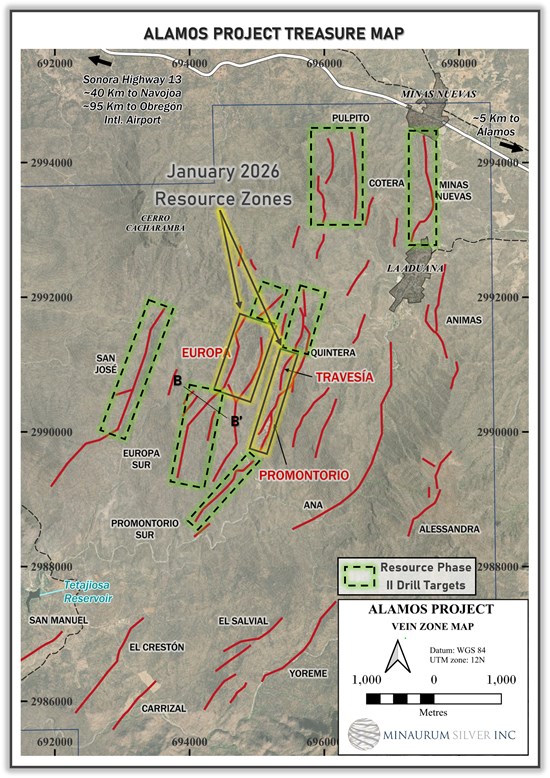

Vancouver, British Columbia--(Newsfile Corp. - February 10, 2026) - Minaurum Silver Inc. (TSXV: MGG) (OTCQX: MMRGF)("Minaurum") is pleased to report results from the first holes of its Phase 2, 50,000-meter resource-expansion drill program at the Alamos Silver Project ("Alamos") in Sonora, Mexico. The program is targeting the Europa, Promontorio, and Travesia vein zones and has returned multiple high-grade silver intersections (Table 1, Figures 1-4).

Highlights include:

- 12.35 m of 408 g/t silver equivalent ("AgEq"), including 3.20 m of 1,277 g/t AgEq (Hole AL25-163)

- 2.35 m of 374 g/t AgEq (Hole AL25-153)

"Hole AL25-163 confirms the continuity of high-grade silver mineralization well beyond the current inferred resource in the Europa Vein Zone," said Darrell Rader, President and CEO of Minaurum Silver. "Stepping out 250 metres and intersecting strong grades and widths demonstrates the scale of the system. With the mineralization remaining open both down dip and along strike, these results support our strategy to significantly expand the Alamos resource with continued drilling."

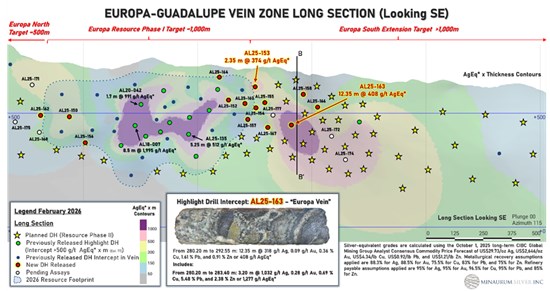

Europa Vein Zone

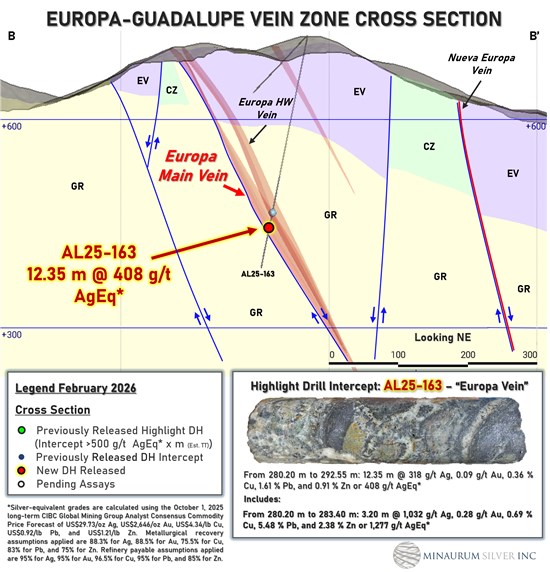

The defined resource of the Europa vein zone occupies about 1 km of its surface-traced 3-km strike length. Recent assay results extend high-grade mineralization along strike, particularly the 1 km extension to the south at Europa. Hole AL25-163 intersected a significant wide interval of 12.35 m zone averaging 408 g/t AgEq, including 3.20 m of 1,277 g/t AgEq (1,032 g/t Ag, 0.278 g/t Au, 0.692% Cu, 5.477% Pb, 2.379% Zn). Hole AL25-154 returned 1.05 m of 231 g/t AgEq, including 0.25 m of 700 g/t AgEq (355 g/t Ag, 1.86 g/t Au, 1.45% Cu, 0.77% Pb, 1.89% Zn) (See Table 1, Figures 2 and 3).

Figure 1. Plan view showing locations of Travesia, Quintera, Promontorio, and Europa vein zones. Click to enlarge.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/283231_figure%201%20-%20plan%20view%20vein%20zones.png

Figure 2. Longitudinal section of Europa vein zone, showing locations of highlighted mineralized intersections. Click to enlarge.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/283231_96b44d1b04e0a91d_004full.jpg

Figure 3. Cross section of Europa and Nueva Europa vein zones, showing hole AL25-163. EV=volcanic rocks, CZ=marble and skarn, GR=granodiorite. Click to enlarge.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/283231_figure%203%20-%20cross%20section%20europa.png

Table 1. Assay Highlights for Europa Vein Zone - Europe Sur, Europa and Europa Norte. Hole locations are shown in Figure 2 and 3.

Weight-averaged silver-equivalent grades are based on 1) October 1, 2025 Long-term CIBC Global Mining Group Analyst Consensus Commodity Price Forecast: Ag $29.73/tr oz, Au $2,646/tr oz, Cu $4.34/lb, Pb $0.92/lb, Zn $1.21/lb; 2) Metallurgical recovery assumptions:88.3% for Ag, 88.5% for Au, 75.5% for Cu, 83% for Pb, and 75% for Zn; and 3) Refinery payable assumptions: 95% for Ag, 95% for Au, 96.5% for Cu, 95% for Pb, and 85% for Zn.

| EUROPA SUR | |||||||||

| Hole | From

(m) |

To

(m) |

Interval

(m) |

Ag

g/t |

Au

g/t |

Cu

% |

Pb

% |

Zn

% |

AgEq

g/t |

| AL25-154 | 99.50 | 100.65 | 1.15 | 95 | 0.01 | 0.19 | 0.32 | 1.11 | 143 |

| 131.55 | 131.75 | 0.20 | 349 | 0.05 | 0.31 | 0.48 | 1.58 | 425 | |

| 220.20 | 221.25 | 1.05 | 132 | 0.45 | 0.44 | 0.25 | 0.69 | 231 | |

| including | |||||||||

| 220.20 | 220.45 | 0.25 | 355 | 1.86 | 1.45 | 0.67 | 1.89 | 700 | |

| 263.70 | 265.20 | 1.50 | 4 | 0.87 | 0.01 | 0.02 | 0.20 | 89 | |

| AL25-155 | 174.25 | 175.35 | 1.10 | 57 | 0.09 | 0.12 | 0.74 | 1.59 | 125 |

| AL25-156 | 440.30 | 441.00 | 0.70 | 35 | 0.00 | 0.09 | 0.40 | 1.13 | 75 |

| AL25-157 | 245.10 | 248.45 | 3.35 | 43 | 0.02 | 0.11 | 0.30 | 0.90 | 80 |

| including | |||||||||

| 247.15 | 248.10 | 0.95 | 107 | 0.07 | 0.16 | 0.89 | 2.22 | 193 | |

| AL25-158 | 45.75 | 47.30 | 1.55 | 41 | 0.00 | 0.02 | 0.12 | 0.11 | 49 |

| AL25-163 | 280.20 | 292.55 | 12.35 | 318 | 0.09 | 0.35 | 1.60 | 0.90 | 408 |

| including | |||||||||

| 280.20 | 287.20 | 7.00 | 523 | 0.14 | 0.44 | 2.78 | 1.36 | 659 | |

| which includes | |||||||||

| 280.20 | 283.40 | 3.20 | 1032 | 0.27 | 0.69 | 5.47 | 2.37 | 1277 | |

| and | |||||||||

| 285.80 | 287.20 | 1.40 | 149 | 0.05 | 0.38 | 0.90 | 0.68 | 220 | |

| and | |||||||||

| 289.80 | 292.55 | 2.75 | 85 | 0.02 | 0.39 | 0.05 | 0.42 | 132 | |

| AL25-164 | 121.45 | 123.00 | 1.55 | 41.2 | 0.00 | 0.02 | 0.08 | 0.03 | 46 |

| AL25-166 | 255.35 | 255.70 | 0.35 | 46.4 | 0.00 | 0.23 | 0.47 | 1.19 | 102 |

| 280.30 | 281.35 | 1.05 | 110 | 0.05 | 0.85 | 0.14 | 0.36 | 199 | |

| including | |||||||||

| 281.00 | 281.35 | 0.35 | 155 | 0.12 | 2.41 | 0.31 | 0.92 | 402 | |

| AL25-167 | 289.40 | 289.75 | 0.35 | 64 | 0.02 | 0.18 | 0.10 | 0.75 | 101 |

| 298.35 | 298.85 | 0.50 | 236 | 0.05 | 0.27 | 0.78 | 1.77 | 318 | |

| EUROPA | |||||||||

| Hole | From

(m) |

To

(m) |

Interval

(m) |

Ag

g/t |

Au

g/t |

Cu

% |

Pb

% |

Zn

% |

AgEq

g/t |

| AL25-150 | 368 | 370.25 | 2.25 | 107 | 0.02 | 0.20 | 1.61 | 1.55 | 193 |

| including | |||||||||

| 368.5 | 369.05 | 0.55 | 272 | 0.03 | 0.26 | 4.72 | 1.84 | 432 | |

| AL25-152 | 161.5 | 166.1 | 4.6 | 77 | 0.07 | 0.32 | 0.39 | 1.15 | 144 |

| including | |||||||||

| 164.5 | 165.45 | 0.95 | 90 | 0.11 | 0.63 | 0.49 | 1.74 | 202 | |

| AL25-153 | 129.05 | 131.4 | 2.35 | 240 | 0.06 | 0.70 | 1.76 | 1.46 | 374 |

| including | |||||||||

| 130.85 | 131.4 | 0.55 | 487 | 0.16 | 0.95 | 4.25 | 2.09 | 714 | |

| AL25-164 | 121.45 | 123.00 | 1.55 | 41.2 | 0.00 | 0.02 | 0.08 | 0.03 | 46 |

| EUROPA NORTE | |||||||||

| HoleID | From

(m) |

To

(m) |

Interval

(m) |

Ag

g/t |

Au

g/t |

Cu

% |

Pb

% |

Zn

% |

AgEq

g/t |

| AL25-162 | 450.00 | 450.40 | 0.40 | 48 | 0.01 | 0.17 | 0.47 | 0.68 | 88 |

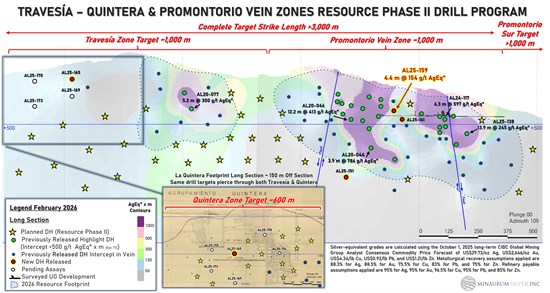

Promontorio Vein Zone

The 1 km-long Promontorio vein zone consists of multiple veins including the Veta Grande and Veta Las Guijas veins. Drilling to date at Promontorio and Promontorio Sur has intersected mineralization in epithermal vein-hosted cutting volcanic and intrusive rocks in addition to skarn/carbonate-replacement (CRD) mineralization hosted by limestone in the footwall of the vein zones. Hole AL25-159 continued mineralization and intersected 4.40 m of 154 g/t AgEq including 1.35 m of 189 g/t AgEq in an epithermal vein (Table 2, Figure 4).

Travesia - La Quintera Vein Zones

The Travesia vein zone lies to the north of the Promontorio zone and continues north in the hanging wall of the La Quintera vein zone. Hole AL25-165 aimed at the Travesia and La Quintera vein zones in the northern part of the Travesia-Quintera zone, and intersected narrow but encouraging mineralization of 0.95 m of 148 g/t AgEq, including 0.40 m of 221 g/t AgEq in the extension of the Travesia vein.

Figure 4. Longitudinal section of Travesia-Promontorio vein zones, showing locations of highlighted mineralized intersections. Click to enlarge.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/3455/283231_figure%204%20-%20traves%C3%ADa-promontorio%20long%20section.png

Table 2. Assay Highlights for Travesia-Promontorio Vein Zone. Hole locations are shown in Figure 4.

Weight-averaged silver-equivalent grades are based on October 1, 2025 Long-term CIBC Global Mining Group Analyst Consensus Commodity Price Forecast: Ag $29.73/tr oz, Au $2,646/tr oz, Cu $4.34/lb, Pb $0.92/lb, Zn $1.21/lb. Metallurgical recovery assumptions applied are 88.3% for Ag, 88.5% for Au, 75.5% for Cu, 83% for Pb, and 75% for Zn. Refinery payable assumptions applied are 95% for Ag, 95% for Au, 96.5% for Cu, 95% for Pb, and 85% for Zn.

| PROMONTORIO | |||||||||

| Hole | From

(m) |

To

(m) |

Interval

(m) |

Ag

g/t |

Au

g/t |

Cu

% |

Pb

% |

Zn

% |

AgEq

g/t |

| AL25-151 | 390.85 | 391.35 | 0.5 | 32 | 0.00 | 0.03 | 0.23 | 0.02 | 40 |

| AL25-159 | 102.35 | 106.75 | 4.40 | 28 | 0.04 | 0.32 | 1.03 | 3.43 | 154 |

| including | |||||||||

| 104.60 | 105.95 | 1.35 | 35 | 0.03 | 0.37 | 1.01 | 4.62 | 189 | |

| AL25-161 | 182.30 | 182.80 | 0.50 | 96.3 | 0.16 | 0.18 | 0.22 | 0.63 | 145 |

| AL25-162 | 450.00 | 450.40 | 0.40 | 48 | 0.01 | 0.17 | 0.47 | 0.68 | 88 |

| TRAVESIA | |||||||||

| Hole | From

(m) |

To

(m) |

Interval

(m) |

Ag

g/t |

Au

g/t |

Cu

% |

Pb

% |

Zn

% |

AgEq

g/t |

| AL25-165 | 72.80 | 73.75 | 0.95 | 105 | 0.00 | 0.37 | 0.23 | 0.24 | 148 |

Share Issuance Update

The Company wishes to clarify its news release filed on December 11, 2025 and material change report filed on December 18, 2025. The aggregate number of units issued pursuant to the Company&s brokered private placement which closed on December 11, 2025 was understated by one unit and the Company now wishes to correct this disclosure to reference a total of 69,444,443 units (previously disclosed as 69,444,442 units). In addition, insider participation was understated by one unit and should be corrected to a total of 191,223 units (previously disclosed as 191,222 units). Please refer to the Company&s December 11, 2025 news release for additional details relating to the private placement.

Follow us and stay updated:

YouTube: @MinaurumSilver

X: @MinaurumSilver

LinkedIn: MinaurumSilverInc

Subscribe to our email list at www.minaurum.com

Minaurum Silver Inc. (TSXV: MGG) (OTCQX: MMRGF) (FSE: 78M) is focused on advancing and expanding its high-grade, 100% owned, production-permitted Alamos Silver Project in southern Sonora, Mexico. The Alamos Project hosts a National Instrument 43-101-compliant inferred mineral resource of 55 million ounces of silver equivalent, grading 320 g/t AgEq. Led by a team of proven silver-mine builders with a track record of advancing projects from discovery through development, Minaurum has assembled a strong pipeline of exploration and development assets across Mexico and the United States.

ON BEHALF OF THE BOARD

"Darrell A. Rader"

Darrell A. Rader

President and CEO

For more information, please contact:

Sunny Pannu - Investor Relations and Corporate Development Manager

(778) 330 0994 or via email at pannu@minaurum.com

The TSX Venture Exchange does not accept responsibility for the adequacy or accuracy of this news release.

1570– 200 Burrard Street

Vancouver, BC V6C 3L6

Telephone: 1 778 330-0994

www.minaurum.com

info@minaurum.com

Data review and verification: Stephen R. Maynard, Vice President of Exploration of Minaurum and a Qualified Person (QP) as defined by National Instrument 43-101, reviewed and verified the assay data, and has approved the disclosure in this News Release. Verification was done by visual inspection of core samples and comparison to assay results. Assay results have not been checked by re-analysis. No factors were identified that could materially affect the accuracy or reliability of the data presented in this news release.

Analytical Procedures and Quality Assurance/Quality Control: Preparation and assaying of drilling samples from Minaurum's Alamos project are done with strict adherence to a Quality Assurance/Quality Control (QA/QC) protocol. Core samples are sawed in half and then bagged in a secure facility near the site and then shipped either by a licensed courieror by Company personnel to ALS Minerals' preparation facility in Hermosillo, Sonora, Mexico. ALS prepares the samples, crushing them to 70% less than 2mm, splitting off 250g, and pulverizing the split to more than 85% passing 75 microns. The resulting sample pulps are prepared in Hermosillo, and then shipped to Vancouver for chemical analysis by ALS Minerals. In Vancouver, the pulps are analyzed for gold by fire assay and ICP/AES on a 30-gram charge. In addition, analyses are done for silver, copper, lead, and zinc using 4-acid digestion and ICP analysis. Samples with silver values greater than 100 g/t; and copper, lead, or zinc values greater than 10,000 ppm (1%) are re-analyzed using 4-acid digestion and atomic absorption spectrometry (AAS).

Quality-control (QC) samples are inserted in the sample stream every 20 samples on average, and thus represent 5% of the total samples. QC samples include standards, blanks, and duplicate samples. Standards are pulps that have been prepared by a third-party laboratory; they have gold, silver, and base-metal values that are established by an extensive analytical process in which several commercial labs (including ALS Minerals) participate. Standards test the calibration of the analytical equipment. Blanks are rock material known from prior sampling to contain less than 0.005 ppm gold; they test the sample preparation procedure for cross-sample contamination. In the case of duplicates, the sample interval is cut in half and then quartered. The first quarter is the original sample, the second becomes the duplicate. Duplicate samples provide a test of the reproducibility of assays in the same drilled interval. When final assays are received, QC sample results are inspected for deviation from accepted values. To date, QC sample analytical results have fallen in acceptable ranges on the Alamos project.

When final assays are received, QC sample results are inspected for deviation from accepted values by the QP. To date, QC sample analytical results have fallen in acceptable ranges on the Alamos project.

ALS Minerals is independent of Minaurum Silver and is independent of the Qualified Person.

Cautionary Note Regarding Forward-Looking Information: This news release contains "forward-looking information" within the meaning of applicable Canadian securities legislation. "Forward-looking information" includes, but is not limited to, statements with respect to activities, events or developments that the Company expects or anticipates will or may occur in the future. Generally, but not always, forward-looking information and statements can be identified by the use of words such as "plans", "expects", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates", or "believes" or the negative connotation thereof or variations of such words and phrases or state that certain actions, events or results "may", "could", "would", "might" or "will be taken", "occur" or "be achieved" or the negative connotation thereof.

In making the forward-looking information in this release, Minaurum has applied certain factors and assumptions that are based on Minaurum's current beliefs as well as assumptions made by and information currently available to Minaurum. Although Minaurum considers these assumptions to be reasonable based on information currently available to it, they may prove to be incorrect, and the forward-looking information in this release are subject to numerous risks, uncertainties and other factors that may cause future results to differ materially from those expressed or implied in such forward-looking information.

Readers are cautioned not to place undue reliance on forward-looking information. Minaurum does not intend, and expressly disclaims any intention or obligation to, update or revise any forward-looking information whether as a result of new information, future events or otherwise, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283231