Calgary, Alberta--(Newsfile Corp. - January 30, 2026) - North Peak Resources Ltd. (TSXV: NPR) (the "Company" or "North Peak") announces results from the first 6 holes totaling 807m (2650ft) drilled at the Wabash and Industry Tunnel targets (Areas 1 and 2 in Figure 3) on their 100% owned Prospect Mountain property, Nevada (the "Property").

Highlights of the program to date include:

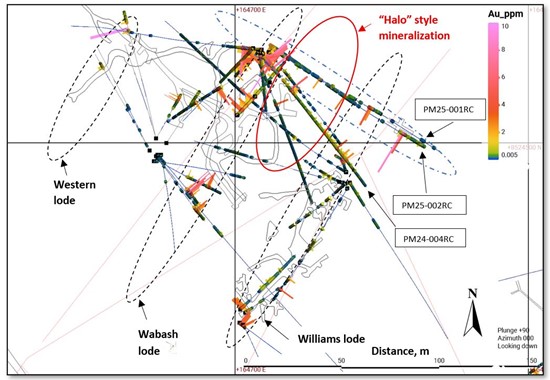

- Expanding the halo mineralization between the Wabash and Williams high grade gold lodes northwards with intersections of 42.67m (140 ft) @ 0.82 g/t Au, 9.43 g/t Ag and 2.57% Zn in PM25-001RC incl.12.192m (40ft) @ 2.56g/t Au, 25.9 g/t Ag, 1.79% Zn and 99.06 m (325ft) @ 0.56 g/t Au, 5.13 g/t Ag in PM25-002RC incl.13.716m (45ft) @ 2.52g/t Au, 15.7 g/t Ag.

- Discovery of new zone along the Silver Connor fault of 24.38m (80ft) @ 1.14 g/t Au, 10.76 g/t Ag incl. 4.57 m (15ft) @ 4.67g/t Au, 21.02 g/t Ag, 1.38% Zn in PM25-002 RC (see Table 1 for details).

"We are pleased to have hit the target and continued to expand the potential for low grade bulk tonnage mineralization between the previously reported high grade zones at the Wabash and Williams Lodes," commented Rupert Williams, CEO. "While the area is structurally complex and we continue to test new areas of cross faults, it shows considerable potential and remains open in all directions."

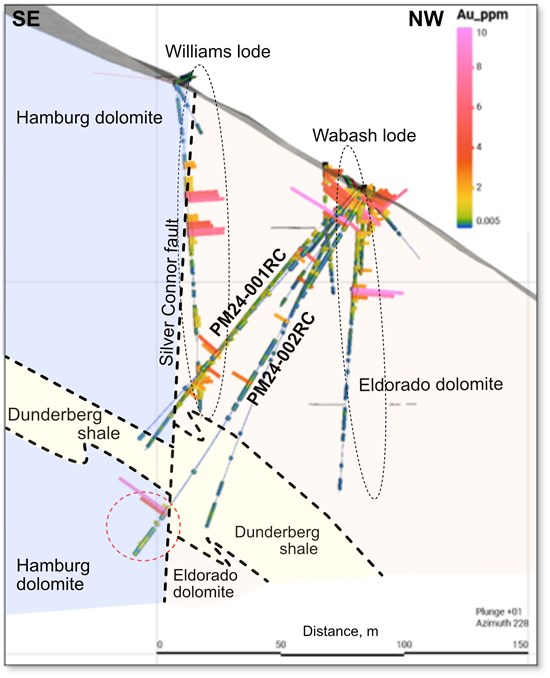

Area 1: Wabash/Williams extensions - PM25-001RC and 002RC were aimed at extending the previously unknown lower grade "halo" style mineralization encountered between the high-grade Wabash and Williams Lodes exemplified by PM24-04RC that intersected 126.5m (415ft) @ 1.06 g/t Au (previously announced 14th August 2024). Both holes successfully intercepted lower grade mineralization between the two lodes. The holes were collared on the Wabash lode and were drilled towards the Williams lode. The intersections in both holes were interrupted by a shaley unit suspected to be the Dunderberg shale, indicating fault complications (see Figure 2 for a possible interpretation). The holes extended the mineralization of both the Williams Lode, and the lower grade halo a further 30 m (98 ft) to the north.

Furthermore, a new zone was encountered at the bottom of hole PM25-002RC, from 146 m downhole, on the east side of the Silver Connor fault, where drilling intersected 24.38m (80ft) @ 1.14 g/t Au, 10.76 g/t Ag incl. 4.57m (15ft) @ 4.67g/t Au, 21.02 g/t Ag, 1.38% Zn. This zone is important as it is the first significant mineralization encountered east of the Silver Connor fault in this area. The zone is still open at the end of the hole (red circle Figure 2).

Further drilling is planned to follow-up on the current results and the high-grade Western Lode drilled in 2024 where PM24-039 intersected 85.7 g/t Au over 3.0m (10ft) within 12.0 g/t Au over 22.9m (75ft) (see the Company's news release dated 12th Nov 2024).

| Hole ID | from (m) | to (m) | interval (m) | interval (ft) | Au g/t | Ag g/t | Pb % | Zn % |

| PM25-001RC | 0 | 42.672 | 42.672 | 140 | 0.82 | 9.43 | 0.06 | 2.57 |

| incl. | 0 | 12.192 | 12.192 | 40 | 2.56 | 25.89 | 0.15 | 1.79 |

| PM25-001RC | 70.104 | 97.536 | 27.432 | 90 | 0.37 | 21.54 | 0.55 | 1.68 |

| incl. | 86.868 | 89.916 | 3.048 | 10 | 3.21 | 147.5 | 4.3 | 10.9 |

| PM25-002RC | 0 | 99.06 | 99.06 | 325 | 0.56 | 5.13 | 0.03 | 0.18 |

| incl. | 0 | 13.716 | 13.716 | 45 | 2.52 | 15.66 | 0.97 | 0.36 |

| incl. | 33.528 | 35.052 | 1.524 | 5 | 1.01 | 2.1 | 0.04 | 0.03 |

| incl. | 56.388 | 57.912 | 1.524 | 5 | 2.15 | 39.6 | 0.12 | 0.29 |

| incl. | 83.82 | 88.392 | 4.572 | 15 | 1.23 | 5.19 | 0.04 | 0.15 |

| PM25-002RC | 146.304 | 170.688 | 24.384 | 80 | 1.14 | 10.76 | 0.07 | 0.41 |

| incl. | 146.304 | 150.876 | 4.572 | 15 | 4.67 | 21.02 | 0.12 | 1.38 |

Table 1: Significant assay intervals, reported with a 0.1 g/t Au cutoff and 10m internal dilution. True widths are unknown but expected to be >70 of the intervals.

Figure 1: Wabash area (Area 1 in Fig. 3). Significant assay intervals in PM25-001RC and PM25-002RC, reported with a 0.1 g/t Au cutoff and 10m internal dilution. True widths are unknown, but expected to be >70% of the intervals. Blue dashed ellipse encompasses data shown in cross section (Fig. 2).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9875/282166_northpeakfig1.jpg

Figure 2: Hypothetical Wabash drill hole cross section looking southwest. Dotted red circle is the new mineralization zone on the east side of the Silver Connor fault.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9875/282166_78c40146845e1b76_036full.jpg

Area 2: Industry Tunnel

Drilling in the Industry Tunnel target consisted of four holes following up on a 10,000m2 area of >0.1 g/t Au in soil anomaly in the Eldorado dolomite, and a second target of surface workings in the area of the Industry Tunnel-- Silver Connor fault intersection. The holes failed to intersect significant mineralization, with only sporadic low grade gold mineralization encountered. Possible explanations for the soil anomaly are contamination from the old mule train ore haulage route, or that the mineralization follows the dip of the El Dorado dolomite, which due to the location of the drill pads, was sub-parallel to the hole orientation. The holes drilled into the fault intersection area encountered a structurally complex zone and failed to hit the target zone. As our understanding of the complex structural story grows, our drillhole targeting will be refined and further drilling is planned into the area, to ensure the targets are properly tested.

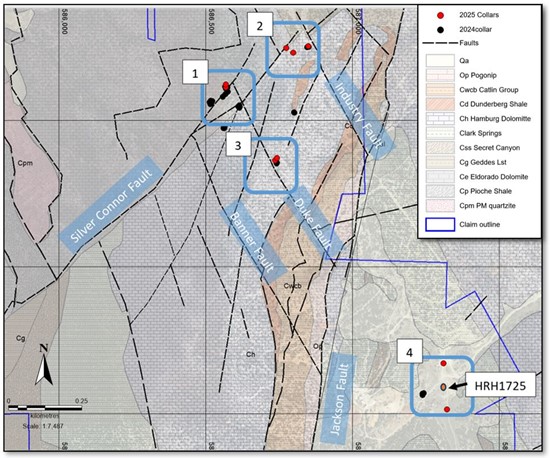

Figure 3. Geology map showing drill areas for 2025 campaign (numbered light blue boxes), and their geologic context. 1) Wabash/Williams, 2) Industry Tunnel, 3) Dean Cave, 4) Lower Prospect Mountain East (LPME).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9875/282166_northpeakfig3.jpg

| Hole ID | Total Depth

(m) |

Total Depth

(ft) |

Easting | Northing | Azimuth | Dip |

| PM25-001RC | 149.4 | 490 | 164718 | 8524549 | 123.6 | -48.5 |

| PM25-002RC | 170.7 | 560 | 164718 | 8524550 | 123.3 | -58.4 |

| PM25-003RC | 77.7 | 255 | 164922 | 8524676 | 287.1 | -43.4 |

| PM25-004RC | 100.6 | 330 | 164946 | 8524664 | 295.2 | -44.6 |

| PM25-005RC | 102.1 | 335 | 164996 | 8524681 | 330.8 | -44.1 |

| PM25-006RC | 166.1 | 545 | 164996 | 8524683 | 45.6 | -48.0 |

| PM25-006RCA | 41.2 | 135 | 164994 | 8524682 | 40.0 | -50.0 |

| EPSG: 32107, Nevada East grid, NAD83 m | ||||||

Table 2: Drill hole coordinates and data.

Review by Qualified Person, Quality Control and Reports

Mr. David Pym, CGeol., independent Consulting Geologist for the Company, is the Qualified Person, as defined under National Instrument 43-101 - Standards of Disclosure for Mineral Projects, who reviewed and approved scientific and technical disclosure in this press release. The Qualified Person has not reviewed the mineral tenure, nor independently verified the legal status and ownership of the Property or any underlying property agreements.

Drilling and sampling: Drilling was carried out using a Canadian built tracked MultiPower Explorer RC drilling unit, the rig has jacks and a blade and is capable of working on small pads on steep ground to minimise ground prep. It is capable of drilling to 609m (2000ft) using 4-inch pipe and a 51/4 inch bit. Holes were cased down to 5-30ft with 8-inch steel casing drifted in using a tricone bit. RC drilling uses a hammer, that is not face sampling but samples 4ft away from the hammer. A face sampling hammer was also used in areas of expected grade. Under Nevada law dry sampling is not allowed due to dust restrictions so RC drilling is done wet, with water actively pumped down the hole mixing with pulverised sample and coming through the cyclone to an 8-compartment rotary fan wet splitter. Each compartment can be shut off giving control of the amount of split material. Rotary splitter was setup with 1:4 split, with the quarter split going into two calico bags housed in buckets, for an assay sample and a field duplicate for permanent reference. The remainder of the sample falls to the ground and runs into the sump. Each assay sample is for a 5ft (1.52m) interval. The splitter and cyclone are flushed every 4 samples or on noticing a change in colour. Chips were collected from the splitter reject and put into chip trays for reference. Calico bags are pre-labelled with hole number and footage, with an FD for field duplicate added to the sample number for the field duplicate. The drilling team are responsible for changing the bags and the clearly labelled footage intervals on the bags avoids sample mix-ups. Filled sample bags are laid on the ground in order so a visual check can be easily performed when collecting samples. Samples are loaded into a plastic crate and dispatched daily to the ALS Global prep-lab in Elko, Nevada. A standard, a blank and a field duplicate were inserted after every 20 samples, for a QA/QC rate of 15%. Six standards from CDN Resource Laboratories were rotated through the samples. The standards had gold values ranging from 0.433 to 7.34 ppm. Samples are dried crushed and pulverised and assayed for gold with a 30g fire assay and a 44 element ICP MS suite. Overlimit samples for gold, silver, lead, zinc and copper are automatically re-assayed by suitable methods.

Market Awareness Program

The Company also announces it has engaged the services of Marcus Brummell (the "Consultant") to conduct a 38-day market awareness program, aimed at enhancing the Company's market visibility and engagement. Services will include the production and publication of investor bulletins, distribution of investor bulletins to the Consultant's e-mail list, and posts via the Consultant's electronic and social media accounts.

The Consultant will be paid a one-time fee of C$10,000. There are no performance factors contained in the agreement and no stock options or other compensation in connection with the engagement. The Consultant is arm's length to the Company, and his clients may acquire an interest in the securities of the Company in the future. The engagement with the Consultant is subject to acceptance by the TSX Venture Exchange.

About North Peak

The Company is a Canadian based gold exploration and development company listed on the TSX Venture Exchange under the symbol "NPR" and the OTCQB under the symbol "NPRLF". Launched by the founding team behind both Kirkland Lake Gold and Rupert Resources, the team has a strong track record of acquiring mining assets, applying modern exploration techniques and taking them into operational mines.

North Peak's flagship property is the Prospect Mountain Mine complex which lies in the Battle Mountain Eureka trend, in an area known as the Southern Eureka Gold Belt, where three styles of mineralization have been identified, gold, silver Carlin style mineralization, Carbonate Replacement gold, silver, lead, zinc mineralization (CRD) and carbonate hosted Porphyry Related Skarn lead, zinc and gold mineralization associated with cretaceous intrusions. At the Property, the CRD mineralization is heavily oxidized to depths of at least 610m (2,000ft) below the top of the ridge line.

A Plan of Operations is in place which covers part of the Property and entitles an operator to pursue surface exploration (totaling 189 acres), underground mining of up to 365,000 tons per annum and certain infrastructural works. A more complete description of the Property's geology and mineralization, including at the Wabash area, can be found in the NI 43-101 Technical Report (the "Technical Report") on the Prospect Mountain Property, Eureka County, Nevada, USA dated and with an effective date April 10, 2023, prepared by David Pym (Msc), CGeol. of LTI Advisory Ltd. and Dr Toby Strauss, CGeol, EurGeol., of Merlyn Consulting Ltd., which has been filed on SEDAR+ at www.sedarplus.ca under the profile of the Company and on the Company's website.

For further information, please contact:

| Rupert Williams, CEO

Phone: +1-647-424-2305 Email: info@northpeakresources.com Website: www.northpeakresources.com |

Chelsea Hayes, Director

Phone: +1-647-424-2305 Email: info@northpeakresources.com |

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING STATEMENTS:This press release includes certain "forward-looking statements" under applicable Canadian securities legislation. Forward-looking statements include, but are not limited to, timing and completion of any drilling and work programs on the Property, estimates of mineralization from drilling, sampling and geophysical surveys, geological information projected from drilling and sampling results and the potential quantities and grades of the target zones, the potential for minerals and/or mineral resources and reserves, the approval from the TSX Venture Exchange for the market awareness program and statements regarding the plans, intentions, beliefs, and current expectations of the Property and the Company that may be described herein. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations or intentions regarding the future. Such information can generally be identified by the use of forwarding-looking wording such as "may", "expect", "estimate", "anticipate", "intend", "believe" and "continue" or the negative thereof or similar variations. Readers are cautioned not to place undue reliance on forward-looking statements, as there can be no assurance that the plans, intentions or expectations upon which they are based will occur.

By their nature, forward-looking statements involve numerous assumptions, known and unknown risks and uncertainties, both general and specific, that contribute to the possibility that the predictions, estimates, forecasts, projections and other forward-looking statements will not occur. These assumptions, risks and uncertainties include, among other things, the state of the economy in general and capital markets in particular, accuracy of assay results, geological interpretations from drilling results, timing and amount of capital expenditures; performance of available laboratory and other related services, future operating costs, and the historical basis for current estimates of potential quantities and grades of target zones, as well as those risk factors discussed or referred to in the Company's Management's Discussion and Analysis for the year ended December 31, 2024 and the quarter ended September 30, 2025, available at www.sedarplus.ca, many of which are beyond the control of the Company. Forward-looking statements contained in this press release are expressly qualified by this cautionary statement.

The forward-looking statements contained in this press release are made as of the date of this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of, or statements made by, third parties in respect of the matters discussed above.

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/282166