MONTRÉAL, Feb. 24, 2026 (GLOBE NEWSWIRE) -- OR Royalties Inc. (“OR Royalties& or the “Company&) (OR: TSX & NYSE) is pleased to announce that it has entered into a definitive agreement to acquire Terraco Gold Corp. (“Terraco&), a wholly-owned subsidiary of Sailfish Royalty Corp., which indirectly owns net smelter return (“NSR&) royalty assets (the “NSR Royalties&), largely consisting of royalties that cover Solidus Resources LLC&s (“Solidus&) Spring Valley Gold Project (“Spring Valley& or the “Project&) located in Pershing County, Nevada, USA. OR Royalties is acquiring Terraco and the NSR Royalties for total cash consideration of $168 million (the “Transaction&). The Transaction is subject to the approval of the TSX Venture Exchange and other customary closing conditions, and is expected to be completed in the first half of 2026. Amounts presented are in United States dollars, except where otherwise noted.

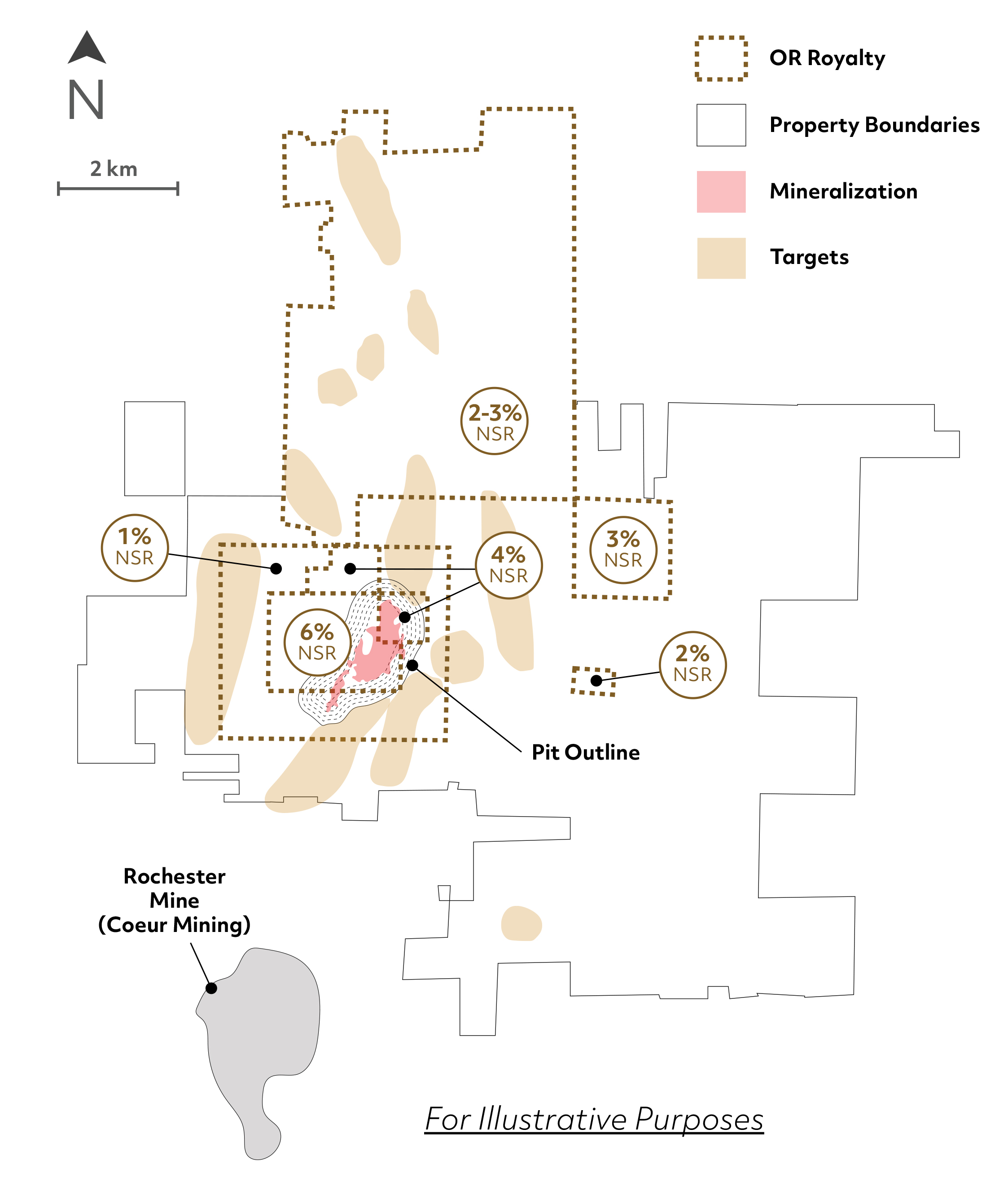

OR Royalties is acquiring the following NSR Royalties, three of which cover Spring Valley (please refer to Figure 1 below):

- An effective 3.0% NSR1 royalty on the Schmidt Claim Block (“Schmidt Claims&) which covers the majority of the acres included in Solidus& proposed open-pit at Spring Valley (royalty shown as 6% pro-forma the Figure 1);

- A 1.0% NSR royalty on a portion of the proposed open pit at Spring Valley (the “Additional Royalty Areas&) (royalty shown as 4% pro-forma in Figure 1);

- A 0.5% NSR royalty on a portion of the proposed open pit at Spring Valley (the “Perimeter Royalty Area&) (royalty shown as 1% pro-forma in Figure 1); and,

- A 2.0% NSR royalty on the Moonlight Property, which is an adjacent land package to Spring Valley, and is owned by Waterton Gold Corp., a subsidiary of Waterton Gold LP (“Waterton Gold&) (royalty shown as 2-3% pro-forma in Figure 1).

TRANSACTION HIGHLIGHTS

- Tier-1 Mining Jurisdiction: All the NSR Royalties being acquired as part of the Transaction cover projects located in Nevada, which is ranked 4th globally as a mining jurisdiction in the Annual Survey of Mining Companies, 2024 completed by The Fraser Institute2. The United States is defined by OR Royalties as a Tier-1 Mining Jurisdiction, along with Canada and Australia;

- Addition of Complementary Royalty Assets on a Familiar Project Now Entering Construction: The NSR Royalties being acquired complement those already owned by OR Royalties at Spring Valley. Following the closing of the Transaction, OR Royalties will own, on a combined basis: a 6.0% NSR royalty on the Schmidt Claims, a 4.0% NSR royalty on the Additional Royalty Areas, and a 1.0% NSR royalty on the Perimeter Royalty Area;

- Adds to Peer-Leading 5-Year Gold Equivalent Ounce (“GEO3&) Growth Profile: The Transaction, anchored by the NSR royalties covering Solidus& Spring Valley, is expected to add GEOs over-and-above OR Royalties& recently released 2030 5-yr outlook range of 120,000-135,000 GEOs. Spring Valley is construction-ready and Solidus expects to achieve first gold production in the first half of 20281;

- Maintains Precious Metals Focus: The NSR Royalties being acquired in the Transaction consist entirely of gold assets, providing OR Royalties with additional exposure to precious metals.

Figure 1 – OR Royalties& Updated Royalty Pro-Forma Coverage at Spring Valley Upon the Closing of the Transaction4

SPRING VALLEY PROJECT

Solidus Resources is on the verge of advancing Spring Valley in Pershing County, Nevada, USA, through construction and eventually into operations. Solidus is a wholly-owned subsidiary of Waterton Gold, a private mining company. Since consolidating 100% ownership of Spring Valley in 2015, Solidus has substantially de-risked the project through extensive technical work programs, including drilling, metallurgical testwork, hydrological studies, and geotechnical analyses and a Feasibility Study completed in 2025. With all major federal permits in place, Spring Valley is now entering the construction phase, marking a key milestone in its path toward first gold production in the first half of 2028; as such, Spring Valley represents Nevada's next large-scale, low-cost, heap-leach gold mine.

Asset Highlights:

- Large, heap leach gold project with Mineral Reserves of 3.88 million ounces gold (“Au&) (306.9 million short tons grading 0.013 troy oz per short ton) (the Mineral Reserve Estimate was prepared in accordance with the 2014 CIM Definition Standards and is contained within pit designs using Indicated Mineral Resources only and a gold price of $1,800/oz);

- Run of mine design gold recovery: 79% for oxide; 70% for transition; 56% for sulfide. Crushed design gold recovery: 88% for oxide; 80% for transition; 74% for sulfide;

- 10-year plus life-of-mine averaging production of over 300 thousand ounces (“koz&) Au per year, with an average of 348koz Au per year over the first five years;

- Life-of-mine (LOM) all-in sustaining costs (AISC) of ~$1,103/oz Au; and,

- Fully-Permitted: US BLM positive Record of Decision announced July 15, 2025.

Jason Attew, President & CEO of OR Royalties commented: “Consolidating our royalty interest in Spring Valley, a fully permitted, multi-million-ounce gold project in Nevada, is a high-conviction move for OR Royalties. This acquisition enhances our peer-leading growth profile by adding significant, long-life gold production starting in 2028 (with GEOs to OR Royalties starting as early as 2029), further validating our strategy of acquiring top-tier assets in the world&s best mining jurisdictions.&

Sources for Technical Information:

https://solidus-resources.com/spring-valley-project/technical-report/

https://solidus-resources.com/solidus-resources-llc-announces-positive-feasibility-study-results-for-its-spring-valley-gold-project-in-nevada/

https://s203.q4cdn.com/976005377/files/doc_financials/2025/q3/Q3-25-Conference-call-slides-final.pdf

https://www.wheatonpm.com/news/news-details/2025/Wheaton-Precious-Metals-Announces-the-Acquisition-of-a-Gold-Stream-on-the-Spring-Valley-Project-Located-in-Nevada/default.aspx

https://sailfishroyalty.com/index.php/projects/spring-valley-royalties/

Qualified Person

The scientific and technical content of this news release has been reviewed and approved by Guy Desharnais, Ph.D., P.Geo., Vice President, Project Evaluation at OR Royalties Inc., who is a “qualified person& as defined by National Instrument 43-101 – Standards of Disclosure for Mineral Projects (“NI 43-101&).

About OR Royalties Inc.

OR Royalties is a precious metals royalty and streaming company focused on Tier-1 mining jurisdictions defined as Canada, the United States, and Australia. OR Royalties commenced activities in June 2014 with a single producing asset, and today holds a portfolio of over 195 royalties, streams and similar interests. OR Royalties& portfolio is anchored by its cornerstone asset, the 3-5% net smelter return royalty on Agnico Eagle Mines Ltd.&s Canadian Malartic Complex, one of the world&s largest gold mines.

OR Royalties& head office is located at 1100 Avenue des Canadiens-de-Montréal, Suite 300, Montréal, Québec, H3B 2S2.

| For further information, please contact OR Royalties Inc.: | |

| Grant Moenting

Vice President, Capital Markets Cell: (365) 275-1954 Email: gmoenting@ORroyalties.com |

Heather Taylor

Vice President, Sustainability and Communications Tel: (647) 477-2087 Email: htaylor@ORroyalties.com |

Forward-Looking Statements

Certain statements contained in this press release may be deemed “forward-looking statements& within the meaning of the United States Private Securities Litigation Reform Act of 1995 and “forward-looking information& within the meaning of applicable Canadian securities legislation. Forward-looking statements are statements other than statements of historical fact, that address, without limitation, future events, achievement of all conditions precedent to close the Transaction in a timely manner, guidance as to GEO outlook and deliveries and that production at the Spring Valley Gold Project will enhance the Company&s growth profile in a timely manner, that construction, development and ramp-up of the Spring Valley Gold Project, and expected timing and volume of production will be met in a timely manner, and development and growth catalysts will be achieved by the operators of the properties in which the Company holds interest. Forward-looking statements are statements that are not historical facts and are generally, but not always, identified by the words “expects&, “plans&, “anticipates&, “believes&, “intends&, “estimates&, “projects&, “potential&, “scheduled& and similar expressions or variations (including negative variations), or that events or conditions “will&, “would&, “may&, “could& or “should& occur. Forward-looking statements are subject to known and unknown risks, uncertainties and other factors, most of which are beyond the control of OR Royalties, and actual results may accordingly differ materially from those in forward-looking statements. Such risk factors include, without limitation, (i) with respect to properties in which OR Royalties holds a royalty, stream or other interest (collectively an “Interest&); risks related to: (a) the operators of the properties, (b) timely development, permitting, construction, commencement of production, ramp-up (including operating and technical challenges), (c) differences in rate and timing of production from Mineral Resource Estimates or production forecasts by operators, (d) differences in conversion rate from Mineral Resources to Mineral Reserves and ability to replace Mineral Resources, (e) the unfavorable outcome of any challenges or litigation relating title, permit or license, (f) hazards and uncertainty associated with the business of exploring, development and mining including, but not limited to unusual or unexpected geological and metallurgical conditions, slope failures or cave-ins, flooding and other natural disasters or civil unrest or other uninsured risks, (ii) with respect to other external factors: (a) fluctuations in the prices of the commodities that drive royalties, streams, offtakes and investments held by OR Royalties, (b) a trade war or new tariff barriers, (c) fluctuations in the value of the Canadian dollar relative to the U.S. dollar, (d) regulatory changes by national and local governments, including permitting and licensing regimes and taxation policies, regulations and political or economic developments in any of the countries where properties in which OR Royalties holds an Interest are located or through which they are held, (e) continued availability of capital and financing and general economic, market or business conditions, and (f) responses of relevant governments to infectious diseases outbreaks and the effectiveness of such response and the potential impact of such outbreaks on OR Royalties& business, operations and financial condition; (iii) with respect to internal factors: (a) business opportunities that may or not become available to, or are pursued by OR Royalties, (b) the integration of acquired assets or (c) the determination of OR Royalties& PFIC status. The forward-looking statements contained in this press release are based upon assumptions management believes to be reasonable, including, without limitation: the absence of significant change in OR Royalties& ongoing income and assets relating to determination of its PFIC status, and the absence of any other factors that could cause actions, events or results to differ from those anticipated, estimated or intended and, with respect to properties in which OR Royalties holds an Interest, (i) the ongoing operation of the properties by the owners or operators of such properties in a manner consistent with past practice and with public disclosure (including forecast of production), (ii) the accuracy of public statements and disclosures made by the owners or operators of such underlying properties (including expectations for the development of underlying properties that are not yet in production), (iii) no adverse development in respect of any significant property, (iv) that statements and estimates relating to mineral reserves and resources by owners and operators are accurate and (v) the implementation of an adequate plan for integration of acquired assets.

For additional information on risks, uncertainties and assumptions, please refer to the most recent Annual Information Form of OR Royalties filed on SEDAR+ at www.sedarplus.ca and EDGAR at www.sec.gov which also provides additional general assumptions in connection with these statements. OR Royalties cautions that the foregoing list of risk and uncertainties is not exhaustive. Investors and others should carefully consider the above factors as well as the uncertainties they represent and the risk they entail. OR Royalties believes that the assumptions reflected in those forward-looking statements are reasonable, but no assurance can be given that these expectations will prove to be accurate as actual results and prospective events could materially differ from those anticipated such the forward-looking statements and such forward-looking statements included in this press release are not guarantee of future performance and should not be unduly relied upon. In this press release, OR Royalties relies on information publicly disclosed by other issuers and third parties pertaining to its assets and, therefore, assumes no liability for such third-party public disclosure. These statements speak only as of the date of this press release. OR Royalties undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, other than as required by applicable law.

___________________________

1 For clarity, the up to 3.0% NSR royalty being acquired by OR Royalties is part of a total 6.0% NSR royalty above $700 per ounce gold (“/oz Au&), the other 3.0% portion of which is already owned by OR Royalties. The sliding scale NSR royalty is not payable on the first 500,000 ounces of gold recovered from commercial production on the Schmidt Claim Block.

2https://www.fraserinstitute.org/studies/annual-survey-mining-companies-2024

3 For a definition of GEOs, please refer to the Management&s Discussions and Analysis for the year ended December 31, 2025, filed on www.sedarplus.ca.

4https://sailfishroyalty.com/index.php/projects/spring-valley-royalties/;

https://s203.q4cdn.com/976005377/files/doc_financials/2025/q3/Q3-25-Conference-call-slides-final.pdf;

OR&s acquired interest in the Moonlight property (identified as 2–3% and 2% in Figure 1) consists of a 2% NSR on the Claims and an up to 2% NSR on Fee Lands owned by a wholly-owned subsidiary of Terraco at the time of creation (prorated for proportional ownership). This interest is in addition to OR&s pre-existing 1% NSR on the Claims and some other holdings within the identified area.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/bc9ec5d0-e2d0-4876-b56f-3ef89ce3b86e