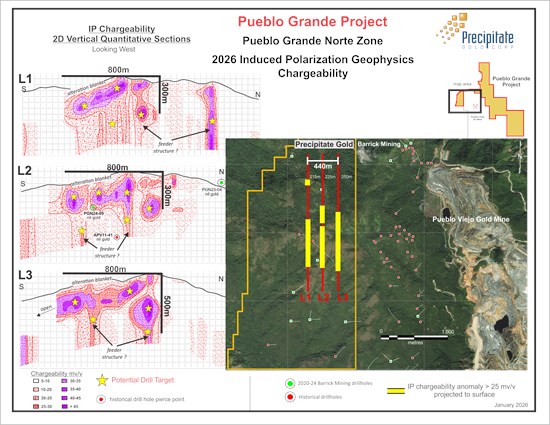

Vancouver, British Columbia--(Newsfile Corp. - January 22, 2026) - Precipitate Gold Corp. (TSXV: PRG) (OTCQB: PREIF) (the "Company" or "Precipitate") is pleased to announce that it has completed an extensive technical review and evaluation of exploration data primarily generated by Barrick Mining Corporation ("Barrick") between 2020 and 2025, as part the now annulled earn-in agreement (the "Earn-In") related to Precipitate's 100%-owned Pueblo Grande Project (the "Project"), located immediately adjacent to the Pueblo Viejo gold-silver mine operated by Barrick in the Dominican Republic. As a follow up to the data review, the Company conducted and completed an Induced Polarization ("IP") geophysical survey that revealed significant and previously untested high chargeability anomalies at the Pueblo Grande Norte zone, located immediately west of the Pueblo Viejo mining operation. See accompanying Figure 1 and Figure 2 below.

Highlights:

-

Precipitate's technical team completed an extensive review of all data and past work conducted on the project by various prior operators, including 5 years and US$7.2 million in exploration expenditures by Barrick;

-

The data review identified possible untested IP chargeability features within the Project's Pueblo Grande Norte zone (also known as Loma la Cuaba or Lithocap Zone);

-

As follow up to the data review, Precipitate conducted a focused 3-line deep-penetrating two-dimensional ("2D") IP survey at the Pueblo Grande Norte zone, specifically designed to test and confirm the presence, depth, and extent of the inferred chargeability features;

-

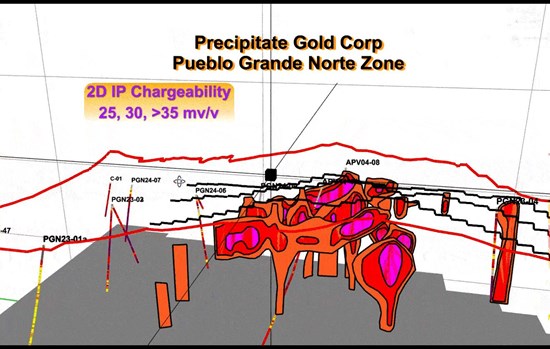

The results of Precipitate's new IP survey confirmed and refined the presence of a sizeable cluster of IP chargeability high anomalies collectively measuring about 800 metres north-south by more than 450 metres east-west, loosely centred at depths that range from 100 to 330 metres from surface. The chargeability anomaly remains open in both the east and west directions. See Figure 1 and Figure 2 below;

-

Using 2D Quantitative Vertical IP Sections, the interpreted shape of the chargeability high anomalies suggests an epithermal alteration system having a shallow south dipping alteration blanket or 'lithocap' (> 25 mv/v chargeability threshold), with perhaps up to three semi-discrete strong internal east-west tending sub-horizontal lobes (> 30 mv/v readings, up to 50 mv/v locally) and possible underlying vertical 'feeder structures' (as delineated by both moderate to strong chargeability and resistivity readings);

-

Importantly, no historical or recent drill holes have tested the newly identified priority chargeability high anomalies; and

-

The new IP priority area is underlain by favourable Los Ranchos formation volcanic host rocks, exhibiting strong local silica + advanced argillic alteration and weak to modest strength geochemical rock and soil sample pathfinder data.

CEO Commentary

Jeffrey Wilson, President and CEO of Precipitate Gold, commented: "We're very excited with the outcome of our extensive data review and follow up IP geophysical survey at Pueblo Grande. Credit to our technical team for conducting such an exhaustive and detailed review which led to the recognition of a previously unidentified opportunity that has now been confirmed by our follow up geophysical survey. The delineation of a number of compelling and untested new high chargeability geophysical anomalies located in close proximity to the world-class Pueblo Viejo gold mine offers the Company and its shareholders an exciting new drill target. Given the target area's relative ease of access and existing drill permits, we are keen to rapidly advance this target to a drill stage. Though the existing and emerging targets at our flagship Juan de Herrera project remain a top priority for the Company, the emergence of these previously unknown and untested anomalies at Pueblo Grande provides an exciting new addition to Company's near-term drill plans."

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1718/281178_d8f1ee0fe4dd7b7f_003full.jpg

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/1718/281178_d8f1ee0fe4dd7b7f_004full.jpg

Summary of Notable Data Review Findings & Follow-Up Precipitate IP Geophysical Survey

Precipitate's comprehensive Pueblo Grande Project data review incorporated US$7.2 million in exploration work conducted by Barrick during the Earn-In period, as well as preceding historical work conducted by Precipitate and other prior operators. At the Project's principal target area, the Pueblo Grande Norte zone (also known as Loma la Cuaba or the Lithocap zone), Barrick completed, among other exploration, 3D induced polarization geophysical surveying, which was then followed up with nine exploration drill holes designed to test various geological and geophysical characteristics. Precipitate's technical team, in collaboration with Matrix GeoTechnologies Ltd. ("Matrix"), an integrated geoscience solution provider, completed a detailed review of this and other historical airborne geophysical datasets and, through extensive review, identified an overlooked chargeability feature not considered by earlier explorers. To validate and refine this interpreted geophysical chargeability feature Precipitate and Matrix completed a follow-up deep-penetrating and high-resolution IP survey utilizing combined 2D pole-dipole and gradient arrays over the prospective area at Pueblo Grande Norte. The survey consisted of three north-south, two-kilometer-long IP lines spaced at about 220 metre intervals. Using Matrix's proprietary Quantitative Section methodologies, which generates discrete two dimensional ("2D") Quantitative Vertical IP Sections, the new IP survey successfully confirmed the presence, depth, and extent of the inferred chargeability feature, and ultimately refined new chargeability high targets for potential future drill testing. The interpreted shape of the clustered chargeability high anomalies measures about 800 metres north-south by more than 450 metres east-west and is loosely centred at depths ranging from 100 to 330 metres vertically from surface. The chargeability anomaly remains open in both the east and west directions. The chargeability anomalies likely reflects an epithermal alteration system having a shallow south dipping 'alteration blanket' or 'lithocap' (> 25 mv/v threshold), with perhaps up to three semi-discrete strong internal east-west tending sub horizontal lobes (> 30 mv/v readings, up to 50 mv/v locally) and possible underlying vertical 'feeder structures', as delineated by both moderate to strong chargeability and resistivity readings. These newly delineated geophysical features are overlain at surface by favourable rock types often displaying alteration styles commonly associated with high-sulphidation epithermal style gold mineralization, including strong silica with advance argillic alteration. Importantly, no historical or recent drill holes have tested any of the newly identified priority chargeability high anomalies, with only two holes passing through the vertical projection of geophysical survey line 2. Past drill holes APV11-41 and PGN24-09 yielded nil gold values as they bisected Line 2 outside of the newly identified priority high chargeability anomalies.

Matrix has successfully conducted numerous similar surveys for Precipitate throughout the Dominican Republic, including recently reported geophysical results from the Company's Juan de Herrera project where IP geophysical surveying at multiple zones throughout the project assisted in delineating numerous potential drill targets.

The induced polarization/resistivity survey was carried out by Matrix Geotechnologies Ltd of Toronto Ontario, using a 10 kW generator Time Domain IP system using the Elrec Pro 10 channel receiver with a receiver dipole spacing of 25 metres, (pole-dipole array), which provides quality subsurface resolution for 2D Quantitative Sections, two separate vertically separated gradient arrays and 3D voxel modelling for exploration drill targeting. The figures accompanying this release shows a plan view of interpreted gradient and 2D pole-dipole IP vertical section chargeability.

For reference: g/t = grams per tonne, Au = gold, m = metres, millivolts per volt = mv/v, IP = induced polarization

The scientific and technical information contained in this news release has been reviewed and approved by Michael Moore, P. Geo., Vice President, Exploration of Precipitate Gold Corporation, a Qualified Person ("QP") as defined by National Instrument 43-101 - Standards of Disclosure for Mineral Projects. Mr. Moore is not independent of the Company within the meaning of NI 43-101. The QP has verified the data disclosed in this news release, including sampling, analytical and test data underlying the information.

About Precipitate Gold:

Precipitate Gold Corp. is a mineral exploration company focused on exploring and advancing its mineral property interests in the Dominican Republic, including its 100% owned Juan de Herrera project located immediately adjacent to GoldQuest Mining's Romero Project, its 100% owned Pueblo Grande project located immediately adjacent to the Pueblo Viejo mine operated by Barrick Mining, and its 100% owned Ponton project located 30km east of the Pueblo Viejo mine. Precipitate is also actively evaluating additional high-impact property acquisitions with the potential to expand the Company's portfolio and increase shareholder value, in other favourable jurisdictions.

Additional information can be viewed at the Company's website www.precipitategold.com.

On Behalf of the Board of Directors of Precipitate Gold Corp.,

"Jeffrey Wilson"

President & CEO

For further information, please contact:

Tel: 604-558-0335 Toll Free: 855-558-0335 investor@precipitategold.com

Neither the TSX Venture Exchange nor its Regulation Service Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release may contain "forward-looking information" within the meaning of applicable Canadian securities legislation. All statements, other than statements of historical fact, included herein are forward looking information. Generally, forward-looking information may be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "proposed", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases, or by the use of words or phrases which state that certain actions, events or results may, could, would, or might occur or be achieved. This forward-looking information reflects Precipitate Gold Corp.'s ("Precipitate" or the "Company") current beliefs and is based on information currently available to Company and on assumptions it believes are reasonable. Forward-looking information is subject to known and unknown risks, uncertainties and other factors that may cause the actual results, level of activity, performance or achievements of Precipitate to be materially different from those expressed or implied by such forward-looking information. Such risks and other factors may include, but are not limited to: the exploration concessions may not be granted on terms acceptable to the Company, or at all; general business, economic, competitive, political and social uncertainties; the concessions acquired by the Company may not have attributes similar to those of surrounding properties; delay or failure to receive governmental or regulatory approvals; changes in legislation, including environmental legislation affecting mining; timing and availability of external financing on acceptable terms; conclusions of economic evaluations; and lack of qualified, skilled labour or loss of key individuals. Although Precipitate has attempted to identify important factors that could cause actual results to differ materially from those contained in forward-looking information, there may be other factors that cause results not to be as anticipated, estimated or intended. Accordingly, readers should not place undue reliance on forward-looking information. Precipitate does not undertake to update any forward-looking information, except in accordance with applicable securities laws.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/281178