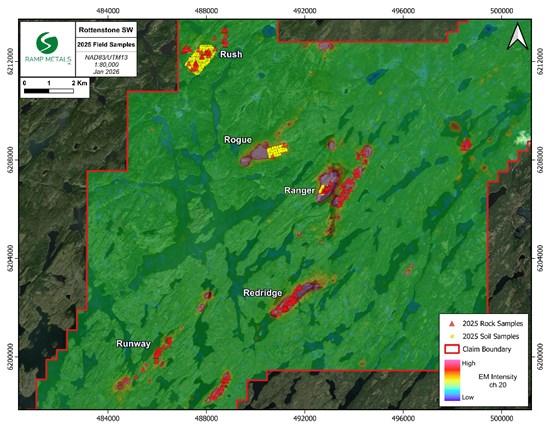

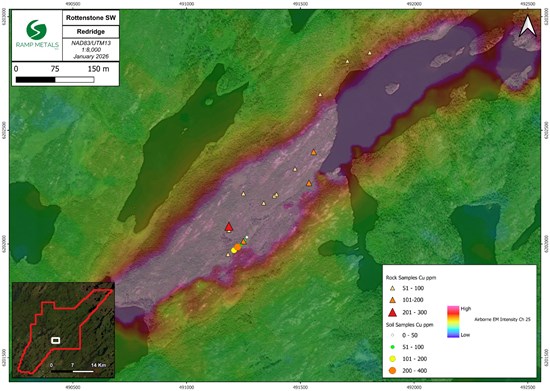

Vancouver, British Columbia--(Newsfile Corp. - January 15, 2026) - Ramp Metals Inc. (TSXV: RAMP) ("Ramp Metals" or the "Company") is pleased to announce the results of the Company's fall 2025 field program at its Rottenstone SW project in Saskatchewan. A mapping and sampling program was undertaken over the new and existing electromagnetic (EM) anomalies highlighted in the most recent HTDEM geophysical survey. During the field program, a total of 213 rock samples and 343 soil samples were taken (Figure 1) and ground FLTEM and borehole EM surveys were completed.

Key Highlights:

Ramp Metals is pleased to share key highlights from its ongoing exploration efforts and upcoming plans at its flagship Rottenstone SW project:

- Mineralization discovered at new targets Redridge and Runaway

- Prominent Cu-Ag-Zn soil anomaly at Rush with additional Satellite target mineralization

- Grab samples returned values up to 0.45% Cu, 3.54% Pb, 105 g/t Ag, and 0.349 g/t Au

- Drill targets defined from Maxwell plate models generated from ground and borehole EM at Rush

- Soil samples up to 245ppm Cu and 852ppb Ag at Redridge target

- Grab sample of 0.183 g/t Pt, 92 ppb Pd, and 825 ppb Ni taken from newly identified "Runway" target

- Fully permitted for additional 30,000m of drilling

- Drill program mobilization expected to begin on February 23, 2026

Figure 1: Samples collected during the Fall 2025 field program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_001full.jpg

Table 1: Rock Sample Highlights from the Fall 2025 Field Program

| Sample Number | Target | Sample Type | Cu

ppm |

Zn

ppm |

Ag g/t | Au g/t | Pb

ppm |

Ni

ppm |

Pd

ppb |

Pt g/t |

| 543549 | Rush | Outcrop | 4550 | 500 | 105.4 | 0.349 | 35400 | 244 | 7 | <0.003 |

| 543552 | Rush | Outcrop | 570 | 700 | 107.5 | 0.515 | 16800 | <2 | <2 | <0.003 |

| 543553 | Rush | Outcrop | 66 | 704 | 10.3 | 0.011 | 8607 | 2 | <2 | <0.003 |

| 543554 | Rush | Outcrop | 32 | 426 | 7.6 | 0.013 | 5176 | 3 | <2 | <0.003 |

| 543578 | Runway | Outcrop | 17 | 196 | <0.5 | <0.002 | <5 | 825 | 92 | 0.183 |

| 543703 | Rush Satellite | Outcrop | 7 | 471 | <0.5 | 0.192 | 12 | 211 | 4 | 0.005 |

Table 2: Highlights from the Winter 2025 Drill Program at Rush

| HOLE ID | From | To | Length (m) | Cu % | Zn % | Ag g/t | Au g/t | Pb % |

| Rush-001 | 61.47 | 65 | 3.53 | 1.21 | 9.34 | 5.59 | 0.03 | 0.02 |

| Rush-002 | 69.3 | 93 | 23.7 | 0.44 | 3.44 | 2.84 | 0.01 | 0.08 |

| Rush-003 | 64 | 65.5 | 1.5 | 0.76 | 5.42 | 4.47 | 0.04 | 0.02 |

| Rush-006 | 161 | 161.41 | 0.41 | 0.004 | 0.06 | 123.6 | 0.06 | 14.54 |

| Rush-007 | 56 | 56.43 | 0.43 | 0.08 | 6.29 | 3.2 | 0.02 | 0.22 |

| Rush-008 | 135 | 136 | 1 | 0.31 | 0.04 | 14 | 0.02 | 1.09 |

| Rush-009 | 115.95 | 118.5 | 2.55 | 1.29 | 12.38 | 7.47 | 0.04 | 0.28 |

| Rush-010 | 18 | 45 | 27 | 0.78 | 1.91 | 12.71 | 0.05 | 0.53 |

* Rush initial discovery results and highlights

(Ramp Metals Confirms VMS Discovery & Ramp Metals Completes Fall Exploration and Discovers New Mineralized Target)

"We are incredibly excited about the results from our fall field program at Rottenstone SW, which have not only validated our existing targets but also uncovered compelling new ones across the property," commented Jordan Black, CEO of Ramp Metals. "Strong copper, silver, and gold signatures at Rush, Redridge, and Ranger have us poised for major breakthroughs in Saskatchewan's emerging copper-gold district. Our fully permitted winter drill program, mobilizing in February, will aggressively test these untested anomalies and Maxwell plate models."

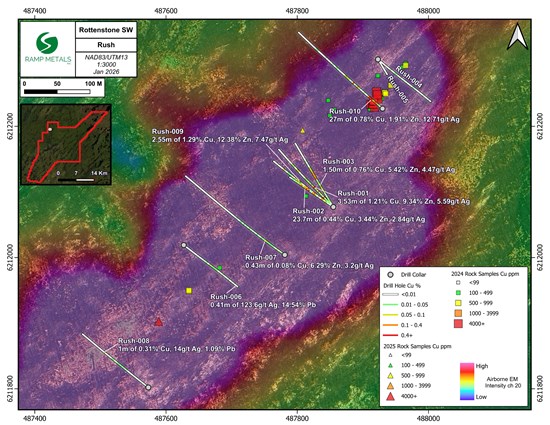

Rush

During the winter 2025 season, the Company completed the first ever drill program at Rush. First pass drilling suggested a robust VMS system at Rush. Cu-Zn-Pb-Ag mineralization was reported in multiple holes along the length of the 1200m conductive anomaly (Figure 2). Table 2 summarizes key drill intercepts at Rush during the winter 2025 drill program.

Figure 2: Winter 2025 Rush drill hole traces with 2024 & 2025 Field Program select rock samples

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_002full.jpg

A soil grid was completed over the entire Rush anomaly at 50m spacing with teams prospecting while completing the soil grid. A total of 276 soil and 18 rock samples were taken over the main Rush anomaly. Additionally, three satellite anomalies located within 1 km of the main Rush anomaly were investigated. These anomalies show comparable rock types and alteration patterns to those observed at the surface of the primary Rush anomaly. A grab sample grading 0.192 g/t Au was taken from the western satellite anomaly during the fall 2025 field program. Rock samples up to 0.45% Cu, 3.54% Pb, 105 g/t Ag, and 0.349 g/t Au were taken over the main Rush anomaly (Table 1).

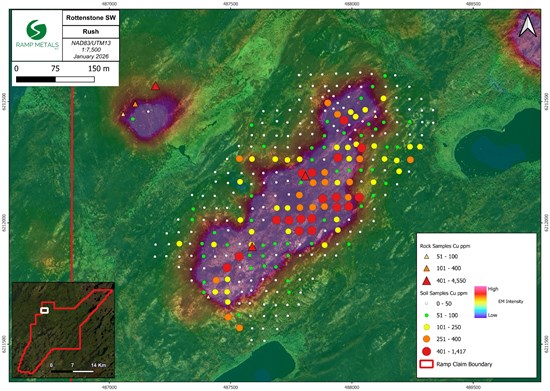

A prominent Cu-Ag-Zn soil anomaly was outlined along the length of the main Rush EM anomaly (Figure 3). The bulk of the high-grade soil samples are located to the east of where the Company drilled during the 2025 season. Rush-001, 002, 003, and 009 (Table 2) drilled at the "Discovery Zone" were collared on the western edge of this new soil anomaly and drilled towards the west. Based on the new soil data, the Company believes that more mineralized units may be located to the east and plans to test these new targets in the upcoming winter drill program.

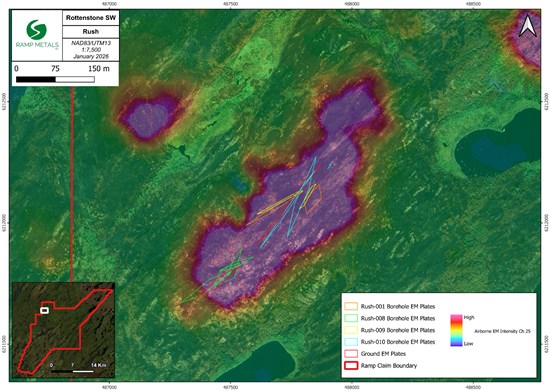

Dias Geophysical completed a ground FLTEM geophysical survey to cover the 1200m long main Rush anomaly. Borehole EM was also completed on Rush-001, 003, 006, 007, 008, 009, and 010. A significant number of Maxwell plate models were generated from the data collected (Figure 4). The plates generated by Rush-001 and Rush-009 borehole surveys correlate well with the mineralized intercepts reported in the 2025 program. The majority of the plates remain untested. The Company intends to use the plate models to refine drill targeting in the upcoming drill program.

Figure 3: Rush soil and rock sample Cu values

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_003full.jpg

Figure 4: Maxwell plate models generated from ground and select borehole EM at Rush

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_004full.jpg

Redridge

Redridge is a newly identified 2.4 km long EM anomaly located approximately 5km south of Ranger (Figure 1). The anomaly was called "Redridge" due to the presence of a highly oxidized outcrop ridge, and red soils found over a portion of the anomaly within an interpreted shear zone. Soil samples taken within the interpreted shear zone returned values of up to 245 ppm Cu and 852 ppb Ag (Figure 5). The Company intends to test the Redridge anomaly during the upcoming drill program.

Figure 5: Redridge soil and rock sample Cu values

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_005full.jpg

Ranger

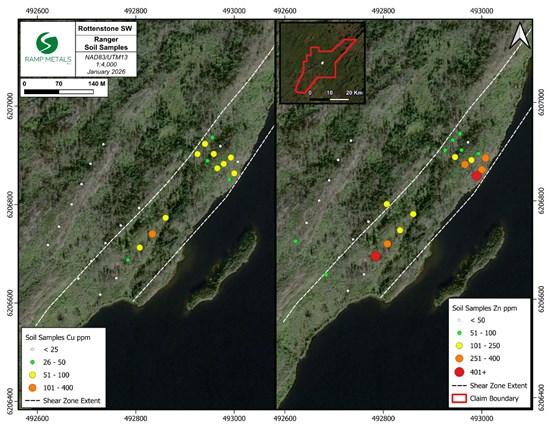

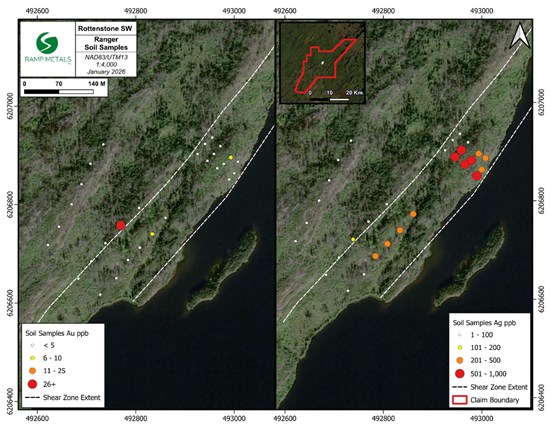

Teams were able to locate and investigate a newly exposed shear zone at Ranger. The NE-SW striking shear zone ranges from 50-70m wide and is covered by heavily oxidized soils with a deep red colour. A total of 30 soil and 29 rock samples were taken at Ranger. Sulphides were noted in strongly altered migmatite and mafic volcanic outcrops throughout the shear zone. A zinc-silver (Zn-Ag) soil anomaly was identified within the shear zone. Quartz veins were also present in this area, with the largest vein measuring up to 1.5 meters in width. Soil sample maps can be seen in Figure 6 and Figure 7.

Figure 6: Ranger soil samples containing Cu & Zn

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_006full.jpg

Figure 7: Ranger soil samples containing Au & Ag

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_007full.jpg

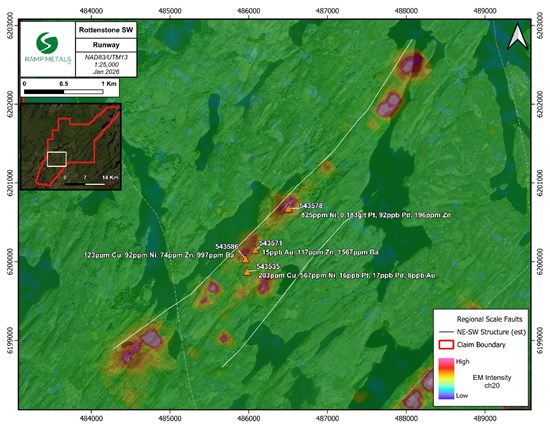

Runway

Runway is a newly identified area of interest, characterized by a series of discrete conductive anomalies which stretch along NE-SW structures over approximately 5.3km. A field team spent a single day conducting first pass prospecting and mapping over select conductive anomalies along the trend. Sample 543578 was taken from a mafic-ultramafic dyke over one of the conductive anomalies. Trace sulphides were noted in the sample which returned values of 0.182 g/t Pt, 92 ppb Pd, and 825 ppm Ni (Table 1). Sample 543535 returned anomalous Cu-Ni values of 203 ppm Cu and 567 ppm Ni (Figure 8). The Company believes that further exploration is warranted at Runway to fully investigate the conductive anomalies along trend.

Figure 8: Runway EM anomalies and select rock samples from the Fall 2025 Field Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/8725/280454_e3c34de9543f0922_008full.jpg

Permits and Drilling

The Company has received permits for an additional 30,000m of drilling and a 24 person temporary work camp in the Keith Lake area. These permits are valid until December 31, 2027. Arrangements have been made with all contractors for a 5,000m drill program which is scheduled to begin on February 23, 2026.

QA/QC and Geochemical Sampling Procedure

All rock and soil samples were taken, described, photographed, and bagged on-site. Control samples consisting of certified reference samples and blank samples were systematically inserted into the sample stream and analyzed as part of the Companies QA/QC protocol at a rate of 1:15 or better. All samples were transported by Manitoulin Transport to Bureau Veritas Commodities Canada Ltd.("BV"), an internationally recognized and ISO 17025:2017 accredited analytical services provider, at its Vancouver, British Columbia laboratory. The Company's QA/QC protocol is in addition to BV's QA/QC standard procedure.

Rock samples were prepared using the PRP70-250 package, where samples are weighed, dried, and crushed to greater than 70% passing a 2mm sieve, then pulverized to greater than 85% passing 75 microns. Samples were then analyzed in accordance with BV's FA330 and MA300 packages, for both gold, platinum and palladium analysis by fire assay (30g fire assay with AAS finish) and multi-element ICP analysis (0.25 g, multi-acid and ICP-ES analysis). Gold returning >10ppm is automatically analyzed by gravimetric method in accordance with BV's standard of practice. Copper, zinc and lead over limits were re-assayed using BV's MA370 package, a multi-acid digestion with ICP-ES finish.

Soil samples were prepared using BV's SS80 package, where samples are dried at 60°C and sieved to depletion to -180 µm (80 mesh). Samples were then analyzed in accordance with BV's AQ251+PGM package, an ultra-trace by ICP-MS analysis where aqua regia digestion is used for low to ultra-low determination on soils followed by a 37 element (including gold) ICP-MS with the platinum, palladium add on for analysis of a 15g sample.

Qualified Person

Brett Williams, P.Geo., VP Operations and Senior Geologist for Ramp Metals, and a "qualified person" under National Instrument 43-101 Standards of Disclosure for Mineral Projects, has reviewed and approved the technical content in this news release.

About Ramp Metals Inc.

Ramp Metals is a grassroots exploration company with a focus on a potential new Saskatchewan copper-gold district. The Company currently has a high-grade gold discovery of 73.55 g/t Au over 7.5m, and a new Cu-Zn-Pb-Ag VMS discovery at its flagship Rottenstone SW property. The Rottenstone SW property comprises 32,715 hectares and is situated in the Rottenstone Domain.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

FORWARD-LOOKING STATEMENTS

This news release contains "forward-looking statements" within the meaning of applicable securities laws. All statements contained herein that are not clearly historical in nature may constitute forward-looking statements. Generally, such forward-looking information or forward-looking statements can be identified by the use of forward-looking terminology such as "plans", "expects" or "does not expect", "is expected", "budget", "scheduled", "estimates", "forecasts", "intends", "anticipates" or "does not anticipate", or "believes", or variations of such words and phrases or may contain statements that certain actions, events or results "may", "could", "would", "might" or "will be taken", "will continue", "will occur" or "will be achieved". The forward-looking information and forward-looking statements contained herein include, but are not limited to, statements regarding the Company's exploration activities.

These statements involve known and unknown risks, uncertainties and other factors, which may cause actual results, performance or achievements to differ materially from those expressed or implied by such statements, including but not limited to: requirements for additional capital; future prices of minerals; changes in general economic conditions; changes in the financial markets and in the demand and market price for commodities; other risks of the mining industry; the inability to obtain any necessary governmental and regulatory approvals; changes in laws, regulations and policies affecting mining operations; hedging practices; and currency fluctuations.

Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ materially from those described in forward-looking statements, there may be other factors that cause actions, events or results to differ from those anticipated, estimated or intended. Accordingly, readers should not place undue reliance on any forward-looking statements or information. No forward-looking statement can be guaranteed. Except as required by applicable securities laws, forward-looking statements speak only as of the date on which they are made and the Company does not undertake any obligation to publicly update or revise any forward-looking statement, whether as a result of new information, future events, or otherwise.

For further information, please contact:

Ramp Metals Inc.

Jordan Black

Chief Executive Officer

jordaneblack@rampmetals.com

Prit Singh

Director

(551)-340-0101

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/280454