TORONTO, ON / ACCESS Newswire / February 10, 2026 / Revival Gold Inc. (TSXV:RVG)(OTCQX:RVLGF) ("Revival Gold" or the "Company") is pleased to provide the latest drilling results from the 2025 drilling program at the Company's Mercur Gold Project ("Mercur") located in Utah.

Drilling Highlights

-

Assay results have been received from an additional twenty drill holes with the following highlight intersections in near-surface oxide gold mineralization at Mercur:

-

1.0 g/T gold over 30.5 meters width at 25.9 meters downhole in RM25-165;

-

0.74 g/T gold over 38.1 meters width at 16.8 meters downhole in RM25-164; and

-

0.9 g/T gold over 30.5 meters width at 13.7 meters downhole in RM25-163.

-

-

Additionally, drilling has extended gold mineralization outside the known Mineral Resource1 north of the Rover area in holes RM25-155 and RM25-157 with:

-

1.0 g/T gold over 10.7 meters width at 59.4 meters downhole in RM25-155; and

-

1.3 g/T gold over 15.2 meters width at 80.8 meters downhole in RM25-155.

-

-

Continued confirmation of gold occurrence, grade and leachability with 2025 Preliminary Economic Assessment ("PEA") estimates.1

-

Average vertical depth to start of mineralization is about 32 meters for holes released to-date, reflecting the shallow nature of the Mercur mineralization.

1 See "Preliminary Economic Assessment NI 43-101 Technical Report on the Mercur Gold Project, Tooele & Utah Counties, Utah, USA" prepared by Kappes, Cassidy & Associates, and RESPEC Company LLC, dated May 2nd, 2025.

"Revival Gold's 2025 drilling at Mercur was primarily designed to upgrade resources on the project, but we also wanted to test for near resource extensions where possible. Today's results in RM25-155 and RM25-157 drilled below a soil geochem anomaly north of Rover confirms the exciting prospectivity of this area.", said Hugh Agro, President & CEO.

Mr. Agro continued, "Revival Gold holds a 7,200-hectare land package that was previously fractured between past operators Homestake and Barrick. With the project now consolidated, our team is promptly moving Mercur through redevelopment while continuing to demonstrate opportunities for future resource growth ahead."

Mercur Drilling Details

The 2025 drilling program at Mercur finished in December with 115 RC and core holes completed. 86 holes have been released to-date. Data collected will support the Company's planned pre-feasibility study, a major milestone on the path to restarting gold production at Mercur.

Drilling results collected to-date at Mercur are generally consistent with the Inferred Mineral Resource and metallurgical models developed for the Mercur PEA.

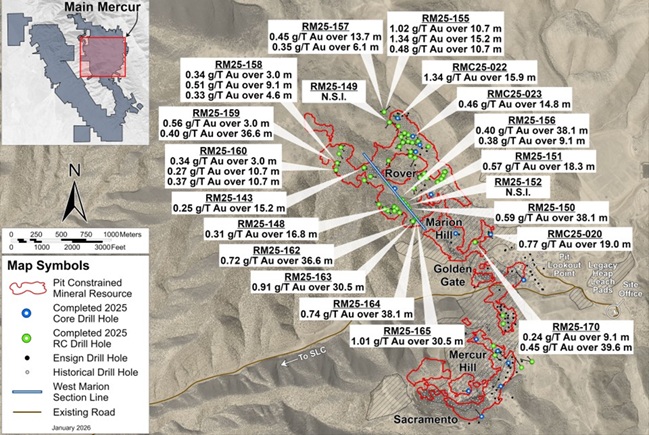

Figure 1 describes drill hole locations for the results released today. Full drill results are presented in Table 1 below.

Figure 1: Main Mercur Drill Plan Map - February 10th, 2026 Results

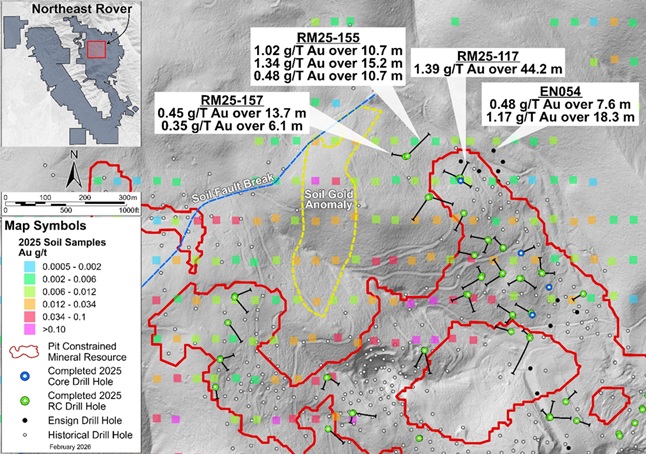

RM25-155 and RM25-157 intercepted multiple zones of oxide mineralization outside the resource pit area to the north of Rover. The mineralization is consistent with a soil anomaly northeast of Rover and could extend further north (see Figure 2 for details). Hole RM-157 bottomed in mineralization after being terminated short of target depth.

Figure 2 - Northeast Rover Target and Highlight Intercepts

Note: Details for drill hole RM25-117 are available in Revival Gold news release dated November 17, 2025, and details for drill hole EN054 are available in the Preliminary Economic Assessment NI 43-101 Technical Report on the Mercur Gold Project, Tooele & Utah Counties, Utah, USA" prepared by Kappes, Cassidy & Associates, and RESPEC Company LLC, dated May 2nd, 2025.

Table 1: Detailed Drill Results

|

Hole Number |

Area |

Azimuth (deg.) |

Dip (deg.) |

From (m) |

To (m) |

Drilled Width (m)1 |

Fire Assay Gold Grade (g/t)2 |

AuCN/AuFA Ratio (%)3 |

|

RM25-143 |

Rover |

120 |

60 |

30.5 |

45.7 |

15.2 |

0.25 |

79 |

|

RM25-148 |

Marion Hill |

330 |

80 |

24.4 |

41.1 |

16.8 |

0.31 |

82 |

|

RM25-149 |

Rover |

215 |

55 |

NSI4 |

||||

|

RM25-150 |

Marion Hill |

150 |

60 |

16.8 |

54.9 |

38.1 |

0.59 |

82 |

|

RM25-151 |

Marion Hill |

150 |

60 |

9.1 |

27.4 |

18.3 |

0.57 |

65 |

|

RM25-1525 |

Marion Hill |

150 |

60 |

NSI4 |

||||

|

RM25-155 |

Rover |

40 |

60 |

59.4 |

70.1 |

10.7 |

1.02 |

79 |

|

80.8 |

96.0 |

15.2 |

1.34 |

56 |

||||

|

141.7 |

152.4 |

10.7 |

0.48 |

62 |

||||

|

RM25-156 |

Marion Hill |

315 |

60 |

12.2 |

50.3 |

38.1 |

0.40 |

89 |

|

117.3 |

126.5 |

9.1 |

0.38 |

91 |

||||

|

RM25-1575 |

Rover |

280 |

50 |

36.6 |

50.3 |

13.7 |

0.45 |

60 |

|

54.9 |

61.0 |

6.1 |

0.35 |

76 |

||||

|

RM25-1586 |

Rover |

145 |

75 |

19.8 |

22.9 |

3.0 |

0.34 |

91 |

|

62.5 |

71.6 |

9.1 |

0.51 |

90 |

||||

|

115.8 |

120.4 |

4.6 |

0.33 |

73 |

||||

|

RM25-1596 |

Rover |

80 |

70 |

19.8 |

22.9 |

3.0 |

0.56 |

94 |

|

71.6 |

108.2 |

36.6 |

0.40 |

80 |

||||

|

RM25-160 |

Rover |

170 |

70 |

13.7 |

16.8 |

3.0 |

0.34 |

93 |

|

48.8 |

59.4 |

10.7 |

0.27 |

94 |

||||

|

67.1 |

77.7 |

10.7 |

0.37 |

87 |

||||

|

RM25-162 |

Marion Hill |

295 |

55 |

4.6 |

41.1 |

36.6 |

0.72 |

81 |

|

RM25-163 |

Marion Hill |

185 |

60 |

13.7 |

44.2 |

30.5 |

0.91 |

76 |

|

RM25-164 |

Marion Hill |

310 |

55 |

16.8 |

54.9 |

38.1 |

0.74 |

86 |

|

RM25-165 |

Marion Hill |

135 |

65 |

25.9 |

56.4 |

30.5 |

1.01 |

84 |

|

RM25-1706 |

Marion Hill |

95 |

65 |

6.1 |

15.2 |

9.1 |

0.24 |

59 |

|

25.9 |

65.5 |

39.6 |

0.45 |

83 |

||||

|

RMC25-020 |

Marion Hill |

0 |

90 |

60.6 |

79.6 |

19.0 |

0.77 |

94 |

|

RMC25-022 |

Rover |

120 |

70 |

53.3 |

69.3 |

15.9 |

1.12 |

83 |

|

RMC25-023 |

Rover |

65 |

70 |

18.4 |

33.2 |

14.8 |

0.46 |

84 |

1 True width for all holes is estimated to be 70-100% of drilled width. Numbers may not add up due to rounding.

2 Mineralized intercepts calculated based on a 0.17 g/t cutoff grade allowing up to 2 intervals of internal dilution.

3 AuCN/AuFA is the ratio of cyanide soluble gold assay to total gold in fire assay and provides an indication of potential heap leach recoverability for the material sampled.

4 NSI stands for no significant intercept above the 0.17 g/t cutoff grade.

5 Drillhole lost short of target stratigraphy

6 No recovery and non-assayed intervals are assigned a 0 value for intercept calculation.

The Mercur property includes interests optioned from Barrick Resources (USA) Inc. and others as summarized in the PEA.

QA/QC Program

Quality Assurance/Quality Control consists of the regular insertion of certified reference materials, duplicate samples, and blanks into the sample stream. Sample results are analyzed immediately upon receipt, and all discrepancies are investigated. Samples are submitted to the ALS Geochemistry sample preparation facility in Elko, Nevada. Gold analyses are performed at the ALS Geochemistry laboratory in Reno, Nevada or Vancouver, British Columbia, and multi-element geochemical analyses are completed at the ALS Minerals laboratory in Vancouver, British Columbia. ALS Minerals is an ISO/IEC 17025:2017 accredited lab.

Gold assays are determined on reverse circulation drill cuttings and quarter-sawn PQ core by fire assay and Atomic Absorption Spectroscopy (AAS) on a 30-gram nominal sample weight (Au-AA23). One quarter of the PQ core samples were submitted for assay, one quarter is kept for sample archive, and one half is preserved for future metallurgical column tests. For samples containing greater than 100 ppb Au as determined by Fire Assay, gold content is also determined by cyanide leach with an AAS finish on a nominal 30-gram sample weight (Au-AA13). Multi-element geochemical analyses are completed on composites samples from selected drill holes using the ME-MS 41 method.

Qualified Persons

Technical information included in this news release was reviewed and approved by Mr. John Meyer, P.Eng., a QP and Vice President, Engineering and Development for the Company, and Mr. Dan Pace, RM SME, a QP and Chief Geologist for the Company.

About Revival Gold Inc.

Revival Gold is one of the largest, pure gold mine developers in the United States. The Company is advancing development of the Mercur Gold Project in Utah and mine permitting preparations and ongoing exploration at the Beartrack-Arnett Gold Project located in Idaho. Revival Gold is listed on the TSX Venture Exchange under the ticker symbol "RVG" and trades on the OTCQX Market under the ticker symbol "RVLGF". The Company is headquartered in Toronto, Canada, with its exploration and development office located in Salmon, Idaho.

For further information, please contact:

Scott Trebilcock, VP, Corporate Development & Investor Relations

Telephone: (416) 366-4100 or Email: info@revival-gold.com

Cautionary Statement

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This press release contains "forward-looking information" within the meaning of applicable Canadian securities legislation and "forward-looking statements" within the meaning of the U.S. Private Securities Litigation Reform Act of 1995 (collectively, "forward-looking statements"). Forward-looking statements are not comprised of historical facts. Forward-looking statements include estimates and statements that describe the Company's future plans, objectives or goals, including words to the effect that the Company or management expects a stated condition or result to occur. Forward-looking statements may be identified by such terms as "believes", "anticipates", "expects", "estimates", "may", "could", "would", "will", or "plan". Since forward-looking statements are based on assumptions and address future events and conditions, by their very nature they involve inherent risks and uncertainties. Although these statements are based on information currently available to the Company, the Company provides no assurance that actual results will meet management's expectations. Risks, uncertainties, and other factors involved with forward-looking statements could cause actual events, results, performance, prospects, and opportunities to differ materially from those expressed or implied by such forward-looking statements. Forward-looking statements in this news release include, but are not limited to: Statements with respect to the Company's exploration, metallurgy, permitting and development activities, the goals and expected outcomes of the planned drilling and development program at Mercur, and the expectation that the Company will proceed with the potential completion of a pre-feasibility study and formal launch of mine permitting on the Project.

Forward-looking statements and information involve significant known and unknown risks and uncertainties, should not be read as guarantees of future performance or results and will not necessarily be accurate indicators of whether or not such results will be achieved. A number of factors could cause actual results to differ materially from the results expressed or implied by such forward-looking statements or information, including, but not limited to: the Company's ability to finance the development of its mineral properties; uncertainty as to whether there will ever be production at the Company's mineral exploration and development properties; risks related to the Company's ability to commence production at the projects and generate material revenues or obtain adequate financing for its planned exploration and development activities; uncertainties relating to the assumptions underlying resource and reserve estimates; mining and development risks, including risks related to infrastructure, accidents, equipment breakdowns, labour disputes, bad weather, non-compliance with environmental and permit requirements or other unanticipated difficulties with or interruptions in development, construction or production; the geology, grade and continuity of the Company's mineral deposits; the uncertainties involving success of exploration, development and mining activities; permitting timelines; government regulation of mining operations; environmental risks; unanticipated reclamation expenses; prices for energy inputs, labour, materials, supplies and services; uncertainties involved in the interpretation of drilling results and geological tests and the estimation of reserves and resources; unexpected cost increases in estimated capital and operating costs; the need to obtain permits and government approvals; material adverse changes, unexpected changes in laws, rules or regulations, or their enforcement by applicable authorities; the failure of parties to contracts with the company to perform as agreed; social or labour unrest; changes in commodity prices; and the failure of exploration programs or studies to deliver anticipated results or results that would justify and support continued exploration, studies, development or operations. For a more detailed discussion of such risks and other factors that could cause actual results to differ materially from those expressed or implied by such forward-looking statements, refer to other risks and uncertainties disclosed in the Company's public filings with Canadian securities regulators, including its most recent annual information form and management's discussion and analysis, available at www.sedarplus.ca. The forward-looking statements contained in this press release are made as of the date of this press release. Except as required by law, the Company disclaims any intention and assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Additionally, the Company undertakes no obligation to comment on the expectations of, or statements made by, third parties in respect of the matters discussed above.

SOURCE: Revival Gold Inc.

View the original press release on ACCESS Newswire