QUÉBEC CITY, Feb. 12, 2026 (GLOBE NEWSWIRE) -- Robex Resources Inc. (“Robex& or the “Company&) is pleased to announce that it has achieved commercial production at its Kiniero Gold Project in Guinea, having satisfied the commercial production criteria under both its Senior Secured Facility Agreement with Sprott and the Guinea Mining Code.

Commercial production status was achieved following the first shipment of gold on 11 February 2026. The shipment comprised approximately 197 kilograms of gold, equivalent to 6,336 troy ounces.

Under the Guinea Mining Code, the date of first commercial production is defined as the earlier of either the completion of a sustained period of production above a prescribed threshold or the date of the first shipment for commercial purposes. The Company confirms that the shipment constitutes the date of first commercial production for Kiniero under the Code.

In addition, Robex confirms that all relevant commercial production requirements under its senior secured financing arrangements with Sprott have been satisfied.

As at the end of January 2026, and following the successful ramp up of operations, Kiniero had processed approximately 393,000 dry metric tonnes of ore at an average head grade of approximately 1.0 g/t Au. Metallurgical gold recovery averaged approximately 88%, with mill availability of over 92%. Gold recovered totalled approximately 10,900 troy ounces, with approximately 5,550 troy ounces poured, reflecting the normal buildup of gold inventory within the CIL circuit during commissioning and early operations.

CEO Comment

Matthew Wilcox, Managing Director and Chief Executive Officer of Robex, commented:

“The delivery of our first commercial gold shipment marks a major milestone for Robex and reflects the successful ramp-up of operations at Kiniero. The performance of both the processing plant and the operating team has been strong as we transition into commercial production.

With Kiniero now in commercial operation and generating cash flow, the asset is positioned to support the development of Bankan as part of our transformative merger with Predictive Discovery. This milestone reinforces the strategic rationale for the combination and our objective of building a leading multi-asset gold producer.&

Plant Operational Performance

Since commissioning and through to early February, the Kiniero processing plant has demonstrated stable and improving performance as operations progressed through ramp-up.

Key reconciled metrics for the month ended 31 January 2026 are shown below:

| Kiniero Gold Operation, Guinea | Units | Jan-26 |

| Operating metrics | ||

| Ore processed | dmt | 392,678 |

| Average head grade | g/t Au | 0.98 |

| Metallurgical gold recovery | % | 87.9 |

| Mill availability | % | 92.3 |

| Mill operating time | % | 85.6 |

| Gold recovered | oz | 10,931 |

| Gold poured | oz | 5,547 |

| Gold in circuit | oz | 7,725 |

Operational Performance Charts

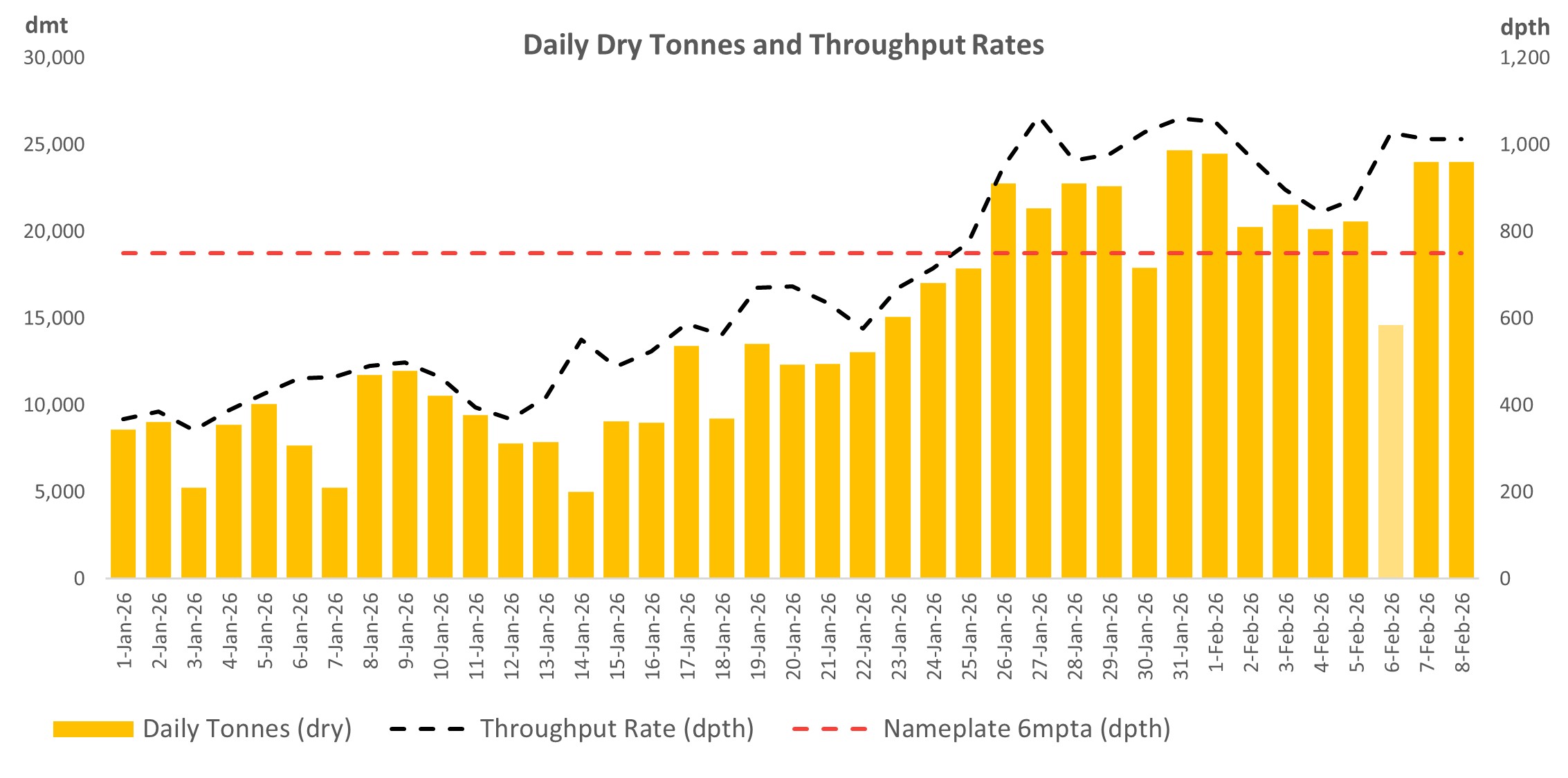

Throughput increased progressively through January, with higher daily processing rates achieved toward month-end following the ball mill coming online in mid-January and reaching sustained operating capacity by 24 January 2026. CIL Train B was brought online on 23 January with active carbon loaded, and by 25 January all circuits were fully operational.

Improved plant stability and increased operating capacity contributed to higher throughput, while short term variability reflects normal commissioning and ramp up conditions.

Figure 1: Daily Dry Tonnes Processed and Throughput Rate

Daily data shown is unreconciled and provided for illustrative purposes only.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This announcement was approved by the Managing Director.

Robex Resources Inc.

Matthew Wilcox, Managing Director and Chief Executive Officer

Alain William, Chief Financial Officer

Email: investor@robexgold.com

www.robexgold.com

Investors and Media:

Nathan Ryan

NWR Communications

+61 420 582 887

nathan.ryan@nwrcommunications.com.au

ABOUT ROBEX RESOURCES INC.

Robex Resources is a Canadian gold mining company listed on the TSX-V and ASX, and headquartered in Quebec, Canada. Robex&s material properties consist of the Nampala Project in Mali and the Kiniero Project in Guinea.

Not an Offer

No securities regulatory authority has either approved or disapproved of the contents of this news release. This news release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in the United States or any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. The securities being offered have not been registered under the U.S. Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States or to, or for the account or benefit of, U.S. persons absent registration or an applicable exemption from U.S. registration requirements and applicable U.S. state securities laws.

Forward-looking Statements

This announcement contains certain forward-looking information and forward-looking statements within the meaning of applicable securities legislation (collectively “Forward-looking Information&). These include statements regarding future outlook and anticipated events, such as the consummation and timing of the Transaction; the timing and receipt of the final order of the Superior Court of Québec; the approval of the TSXV; the satisfaction of the closing conditions under the Arrangement Agreement; and future plans, projections, objectives, estimates and forecasts and the timing related thereto. All statements, other than statements of historical fact, that address circumstances, events, activities or developments that could or may or will occur are Forward-looking Information. Forward-looking Information is generally identified by the use of words like “will&, “create&, “enhance&, “improve&, “potential&, “expect&, “upside&, “growth&, “estimate&, “anticipate& and similar expressions and phrases or statements that certain actions, events or results “may&, “could&, or “should&, or the negative or grammatical variations of such terms, are intended to identify Forward-looking Information. Although Robex believes that the expectations reflected in the Forward-looking Information are reasonable, undue reliance should not be placed on Forward- looking Information since no assurance can be provided that such expectations will prove to be correct. Forward-looking Information is based on information available at the time those statements are made and/or good faith belief of the officers and directors of Robex as of that time with respect to future events and are subject to risks and uncertainties that could cause actual results to differ materially from those expressed in or suggested by the Forward-looking Information. Forward-looking Information involves numerous risks and uncertainties. Such factors may include, but are not limited to, risks related to the closing of the Arrangement, changes in commodity prices, foreign exchange fluctuations and general economic conditions, increased costs and demand for production inputs, the speculative nature of exploration and project development, including the risks of obtaining necessary approvals, licenses and permits and diminishing quantities or grades of reserves, political and social risks (including, but not limited to, in Guinea, Ivory Coast, Mali and West Africa more broadly), changes to the legal and regulatory framework within which Robex operates or may in the future operate, environmental conditions including extreme weather conditions, recruitment and retention of personnel, industrial relations issues and litigation, as well as the risks identified in the section titled “Risk Factors& in Robex&s most recently filed Annual Information Form which is available on SEDAR+ at www.sedarplus.ca. Forward-looking Information is designed to help readers understand Robex' views as of that time with respect to future events and speak only as of the date they are made. Except as required by applicable law, Robex assumes no obligation to update or to publicly announce the results of any change to any Forward-looking Information contained or incorporated by reference herein to reflect actual results, future events or developments, changes in assumptions or changes in other factors affecting the Forward-looking Information. If Robex updates any Forward-looking Information, no inference should be drawn that Robex will make additional updates with respect to such or other Forward-looking Information. All Forward-Looking Information contained in this announcement is expressly qualified in its entirety by this cautionary statement.

Production Targets

The production targets and forecast financial information in respect of Robex&s Kiniero Project was released to ASX on 22 August 2025 in an announcement by Robex titled “Amendment to Kiniero Gold Project Technical Report&, and in respect of the Nampala Project in an ASX announcement by Robex dated 6 May 2025 titled “Replacement Prospectus&. Robex confirms that all the material assumptions underpinning the production targets and forecast financial information derived from the production targets in the relevant market announcement continue to apply and have not materially changed.

A photo accompanying this announcement is available at https://www.globenewswire.com/NewsRoom/AttachmentNg/26392161-1833-4bd9-9873-a24e3111bdb1