Highlights:

-

Large, centrally located magnetic body with overlapping IP and gravity anomalies at the High Life target

-

Clear concentric geophysical zonation typical of major copper-gold porphyry system

-

Strong evidence for a preserved intrusive center with potential mineralization at depth

-

Previous shallow drilling at Tower Gold is now interpreted as testing the upper, altered cap of a larger mineralized system

-

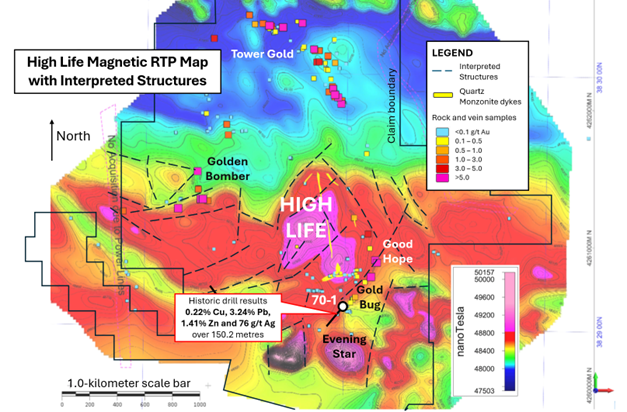

Historic drilling returning 0.22% Cu, 3.24% Pb, 1.41% Zn and 76 g/t Ag* over 150.2 metres now a strong focus on its association with recently completed geophysical surveys

VANCOUVER, BC / ACCESS Newswire / January 15, 2026 / SKY GOLD CORP. ("Sky" or the "Company") (TSX.V:SKYG)(OTC PINK:SRKZF) is pleased to report results from recent geophysical and integrated geological surveys completed at its flagship Evening Star property ("Property"), located in the prolific Walker Lane Gold Trend in Nevada.

High Life Target:

Results from recent magnetic and Induced Polarization (IP) surveys completed on the Property reveal a geophysical footprint consistent with a gold-copper porphyry system at the High Life target.

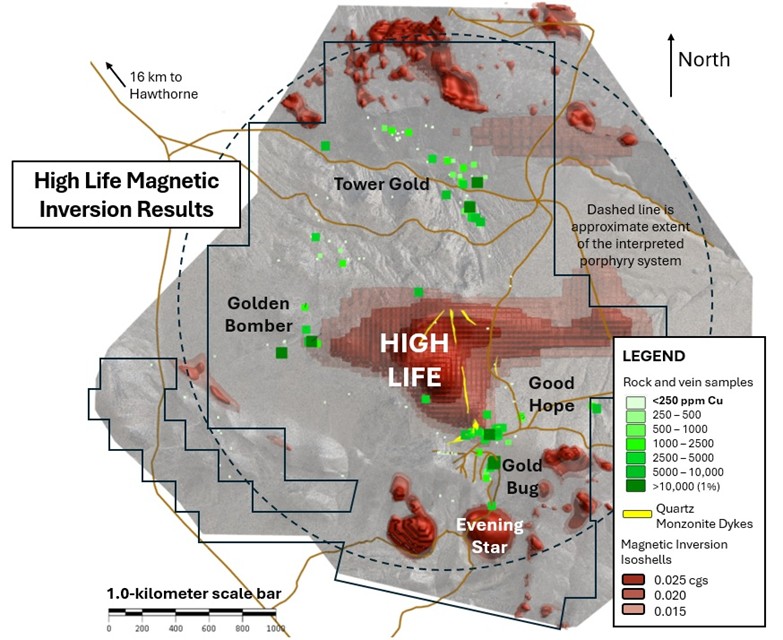

The surveys outline a large (approximately 1 km diameter), single positive magnetic anomaly (See Figure 1). Three-dimensional processing reveals a robust, deeply rooted magnetic body, interpreted as the potassic core of a porphyry system (Figure 2).

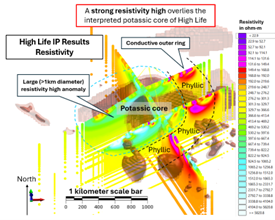

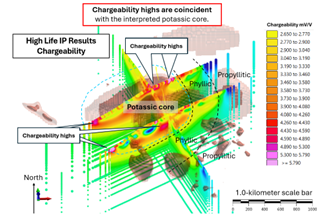

Three IP lines were completed across the High Life area and the associated magnetic anomaly. Results show overlapping resistivity and chargeability highs (Figure 3). The IP data also display strong geophysical zonation, characterized by an outer conductive ring surrounding an inner resistive core.

Additionally, the results of a gravity survey conducted across High Life and Gold Bug in 2020, reveals that the High Life magnetic anomaly exhibits a rare coincident geophysical response, comprising a gravity high, resistivity high, and chargeability high. This combination significantly enhances the prospectivity of the target and supports interpretation of a large, intact porphyry system.

CRD Potential in Historic Hole at Gold Bug:

Carbonate replacement deposit (CRD)-style mineralization comprising galena and sphalerite in carbonate rocks were intersected in a historic hole drilled south of Gold Bug in 1970, returning 0.22% Cu, 3.24% Pb, 1.41% Zn and 76 g/t Ag over 150.2 metres* (See News Release Dec 01, 2016). It was not assayed for gold. Within this broader intercept are higher-grade sections including 0.60% Cu, 14.88% Pb, 4.70% Zn and 408 g/t Ag over 6.10 metres*.

Results from the magnetic survey over the area of Gold Bug and Evening Star targets show discrete magnetic anomalies that may represent skarn mineralization. This area of historic hole 70-1 (see Figure 1) will be followed up with drill testing to verify the CRD style and presence of skarn.

Mike England, CEO of Sky Gold Corp. states: "Taken as a whole, the geophysical and geological surveys provide compelling evidence that suggest we may be sitting on a substantial copper-gold porphyry system."

Figure 1. Magnetic Reduced to Pole (RTP) map showing a large central positive anomaly at High Life. Note position of historic hole 70-1 between Gold Bug and Evening Star.

*Assay results for historic drill hole 70-1 come from H. Agnerian 1970 Geological Report on the Digmore Claims, Garfield hills, Mineral County, Nevada, for Rose Pass Mines Ltd Calgary, Alberta. 22 pp. Assay results are historical and have not been verified.

Figure 2. 3D magnetic model highlighting the size and depth of the intrusive centre.

Figure 3. Concentric IP results over High Life. On the left, results for resistivity. On the right are chargeability results.

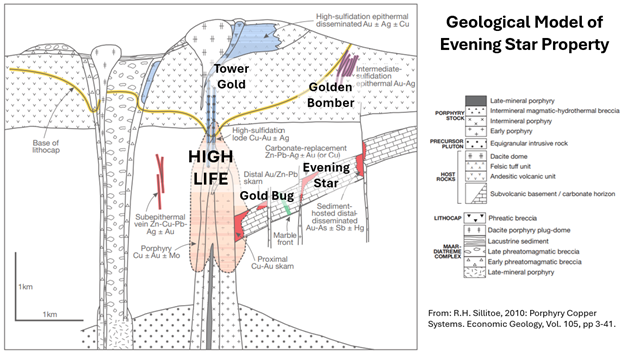

Figure 4. Sillitoe's 2010 copper-gold porphyry model showing position of Evening Star gold and copper targets within the greater context of the porphyry system.

Evening Star, Tower Gold, Golden Bomber and Gold Bug Targets:

Surrounding High Life are copper-gold vein targets at Tower Gold, Golden Bomber and Gold Bug, which are interpreted as shallower or peripheral expressions of the same system (Figure 4). Recent drilling at Tower Gold consisted of four short holes totaling 381 metres (average depth 76 metres) and is now interpreted to have tested the upper, oxidized portion of the system rather than the primary mineralized zone.

At Golden Bomber surface sampling returned strong copper and high-grade gold up to 25.9 g/t Au and 1.01% Cu (News Release September 15, 2025). Recent additional trenching has exposed several subparallel chalcedonic quartz veins (assays pending), suggesting a well-developed epithermal vein system.

Bottom of Form

Collectively, both geological observations and geophysical data highlight the coherence of a large, concentrically zoned mineral system, defined by a solitary magnetic high at its centre.

This integrated dataset reinforces the exploration model and provides a strong technical basis for ongoing drill testing at High Life and across the project area.

Qualified Person

The scientific and technical information contained in this news release has been reviewed and approved by Danae Voormeij, MSc, PGeo, a Director of Sky Gold Corp. and a Qualified Person under National Instrument 43-101 - Standards of Disclosure for Mineral Projects.

About Sky Gold Corp.

Sky Gold Corp. is a mineral exploration company focused on advancing precious and base metal projects in North America. The Company's flagship Evening Star Property, located in the prolific Walker Lane Gold Trend, hosts multiple high-priority gold and copper targets, including Tower Gold, High Life, Gold Bug, and Evening Star. The project site has excellent infrastructure.

ON BEHALF OF THE BOARD

Mike England

CEO, PRESIDENT & DIRECTOR

FOR FURTHER INFORMATION PLEASE CONTACT

Tel: 1-604-683-3995

Toll Free: 1-888-945-4770

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Forward Looking Statements

Certain statements in this release are forward-looking statements, which reflect the expectations of management regarding the matters described herein. Forward-looking statements consist of statements that are not purely historical, including any statements regarding beliefs, plans, expectations, or intentions regarding the future. Such statements are subject to risks and uncertainties that may cause actual results, performance, or developments to differ materially from those contained in the statements, including with respect to the completion of the Consolidation or the identification or acquisition of additional mineral assets. No assurance can be given that any of the events anticipated by the forward-looking statements will occur or, if they do occur, what benefits the Company will obtain from them. These forward-looking statements reflect management's current views and are based on certain expectations, estimates and assumptions which may prove to be incorrect. A number of risks and uncertainties could cause our actual results to differ materially from those expressed or implied by the forward-looking statements, including factors beyond the Company's control. These forward-looking statements are made as of the date of this news release.

SOURCE: Sky Gold Corp.

View the original press release on ACCESS Newswire