Gold, Silver and Critical Elements in the Mineral-Rich Province of New Brunswick, Canada

MIRAMICHI, NB / ACCESS Newswire / March 2, 2026 / SLAM Exploration Ltd. (TSXV:SXL) ("SLAM" or the "Company") is pleased to announce gold assays up to 0.466 g/t gold from 766 soil samples collected on a detailed grid around its recent gold discovery at Jake Lee. The samples were collected on a 50 by 25 meter grid in the area around the recently discovered No. 1 gold vein. SLAM recently reported channel samples grading up to 40.5 g/t gold and 63.30 g/t silver over 0.40 meters.

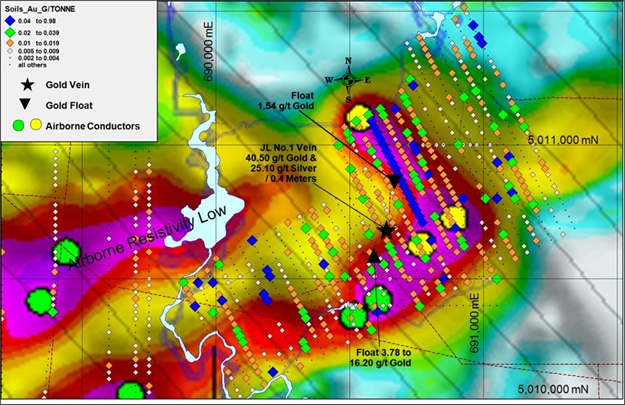

Figure 1 is a thematic view of the soil results and gold occurrences superimposed on a resistivity and airborne conductor map derived from an airborne survey flown by previous workers. Anomalous gold soil areas include the 200 meter by 400 meter area east of the JL No. 1 vein that appears to be related to an airborne conductor.

Figure 1 Jake Lee No.1 Vein - Soils Gold g/t - Airborne Resistivity - DIGHEM Conductors

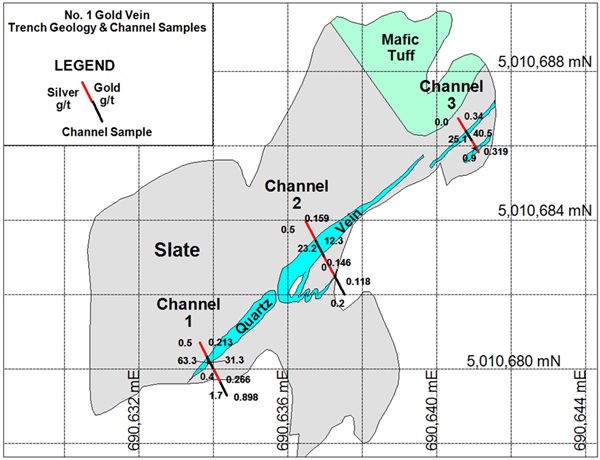

The Company has plotted the results of channel samples cut across the No. 1 vein. Eleven samples each 0.40 meters in length were cut in 3 channels that cross the vein and extend into the wall rock on both sides. Assays of the vein are 31.3 g/t gold, 12.3 g/t gold and 40.5 g/t gold plotted on the right side of the channel along with 63.30 g/t silver, 23.2 g/t silver and 25.1 g/t silver plotted on the left side of each channel as shown on Figure 2.

Figure 2: The No. 1 Vein, Geology, Channel Samples

The Jake Lee claims are located 25 kilometers southeast of the Clarence Stream gold deposit where Galway Metals Inc. Clarence Stream is host to a 12.4M tonne indicated resource of 922,000 ounces at a grade of 2.31 g/t gold plus an inferred resource of 16.1m tonnes with 1,334,000 ounces at a grade of 2.60 g/t gold. (Reference: "Updated Mineral Resource Statement, Clarence Stream Deposits, New Brunswick, Canada, by SLR Consulting (Canada) Ltd., March 31, 2022"). SLAM's exploration team recently mobilized back to Jake Lee.

QA-QC Procedures: After cleaning and washing, 3 channels were sawn across the No. 1 vein and into the wallrock. Channel JLCS2 and channel JLCS3 were spaced 3 and 4 meters respectively meters east of channel JLCS1. Eleven channel samples were collected and delivered directly to Actlabs in Fredericton, New Brunswick for analysis. In addition, 750 soil samples were collected and submitted. Actlabs analyzed all the samples for gold using procedure 1A2 (fire assay with atomic absorption finish) and 1A3 (gravimetric finish) for over-limit samples. Actlabs also used the ICP 1E3 method to analyze all the samples for multiple elements.

NBJMAP Program: The Company wishes to thank the Province and the New Brunswick Department of Natural Resources & Energy for the award of $45,000 under the New Brunswick Junior Mining Assistance Program in support of the work program completed at Jake Lee in 2025-26. An initial payment of 40% was received in 2025 and the final payment of 6% is expected once the NBJMAP report is filed.

About SLAM Exploration Ltd: SLAM Exploration Ltd. is a publicly listed resource company with a 40,000-hectare portfolio of mineral claim holdings in the mineral-rich province of New Brunswick. This portfolio is built around the Goodwin Copper Nickel Cobalt project in the Bathurst Mining Camp ("BMC") of New Brunswick. The Company drilled 10 holes in the 2025 diamond drilling campaign on the Goodwin copper-nickel-cobalt project. This followed significant copper, nickel and cobalt intercepts from 15 diamond drill holes reported by the Company in 2024. These include a 64.90 meter core interval, grading 0.73% copper, 0.64% nickel and 0.05% cobalt for 2.19% Cu-Eq (copper-nickel-cobalt), including 1.11% copper, 0.95% nickel, 0 0.07% cobalt for 3.84% Cu-Eq over a 31.20 meter core interval from hole GW24-02 as reported in a news release August 7, 2024. Significant gold values were also reported with up to 3.31 grams per tonne over 0.5m in hole GW24-01.

The Company is a project generator and expects to receive significant cash and share payments in 2026. SLAM received 1,200,000 shares plus cash from Nine Mile Metals Inc. (NINE) in 2025 pursuant to the Wedge project agreement. Also in 2025, the Company received a cash payment of $60,000 as well as 180,000 shares of a private company pursuant to the Ramsay gold agreement. The Company holds NSR royalties and expects to receive additional cash and share payments on the Wedge copper zinc project and on the Ramsay gold project.

To view SLAM's corporate presentation, click SXL-Presentation. Additional information is available on SLAM's website and on SEDAR+ at www.sedarplus.ca. Follow us on X @SLAMGold.Join our company newsletter by clicking SXL-News to receive timely company updates and press releases relating to SLAM Exploration.

Qualifying Statements: Mike Taylor P.Geo, President and CEO of SLAM Exploration Ltd., is a qualified person as defined by National Instrument 43-101, and has approved the contents of this news release.

CONTACT INFORMATION:

Mike Taylor, President & CEO

Contact: 506-623-8960

mike@slamexploration.com

Jimmy Gravel, Vice-President

Contact 902-273-2387

jimmy@slamexploration.com

SEDAR+: 00012459

Forward-Looking Statements

This news release contains "forward-looking statements" and "forward-looking information" within the meaning of applicable Canadian securities laws. Forward-looking statements are not historical facts but instead represent management's expectations, estimates and projections regarding future events or circumstances. Forward-looking statements are often, but not always, identified by words such as "expects," "plans," "anticipates," "believes," "intends," "estimates," "projects," "potential," "may," "could," "would," "might," or "will," and similar expressions.

Forward-looking statements in this news release include, but are not limited to: statements regarding the exploration potential of the Harry Brook gold-antimony project; the significance of historical gold and antimony occurrences; the interpretation of geological, geochemical, and geophysical data; the identification and prioritization of exploration targets; the anticipated receipt and significance of pending assay results from the Jake Lee Project; the continuity and extent of mineralized structures at Jake Lee and Menneval; the timing and scope of future exploration programs; the Company's ability to advance its mineral projects; and the potential for future exploration success..

Forward-looking statements are based on reasonable assumptions made by the Company as of the date of this news release, including, without limitation: that historical exploration results, mineral occurrences, and publicly reported third-party mineral resources are relevant for regional and exploration context; that geological interpretations and targeting models are reasonable; that pending assay results will be received within anticipated timeframes; that planned exploration activities can be executed as expected; that contractors, equipment, personnel, and supplies will be available on acceptable terms; that commodity prices and market conditions will remain generally supportive; and that required permits, approvals, and access rights will be obtained in a timely manner.

Forward-looking statements involve known and unknown risks, uncertainties, and other factors that may cause actual results, performance, or achievements to differ materially from those expressed or implied by such statements. These risks and uncertainties include, without limitation: the speculative nature of mineral exploration; the risk that exploration results, including pending assay results, may not confirm historical data or current interpretations; uncertainty regarding the continuity, grade, and extent of mineralization; delays or changes to exploration programs; availability and cost of labour, equipment, and contractors; fluctuations in commodity prices; availability of financing on acceptable terms; regulatory, environmental, and permitting risks; operating hazards; and general economic, market, and business conditions. Additional risk factors are described in the Company's most recently filed Management's Discussion and Analysis and other continuous disclosure documents available under the Company's profile on SEDAR+.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company does not undertake to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: SLAM Exploration Ltd.

View the original press release on ACCESS Newswire