(TheNewswire)

|

|||||||||

|

|

|

|

||||||

-

Prospecting and mapping confirms Carbonate Replacement Deposit (“CRD&) potential at Veronica – similar to that found at Coeur Mining&s Silvertip Mine, located 12 km south.

-

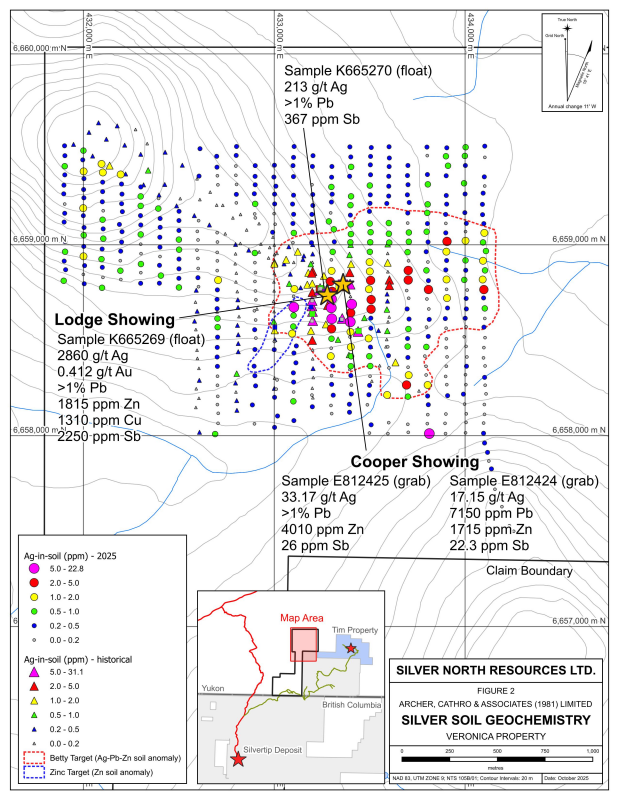

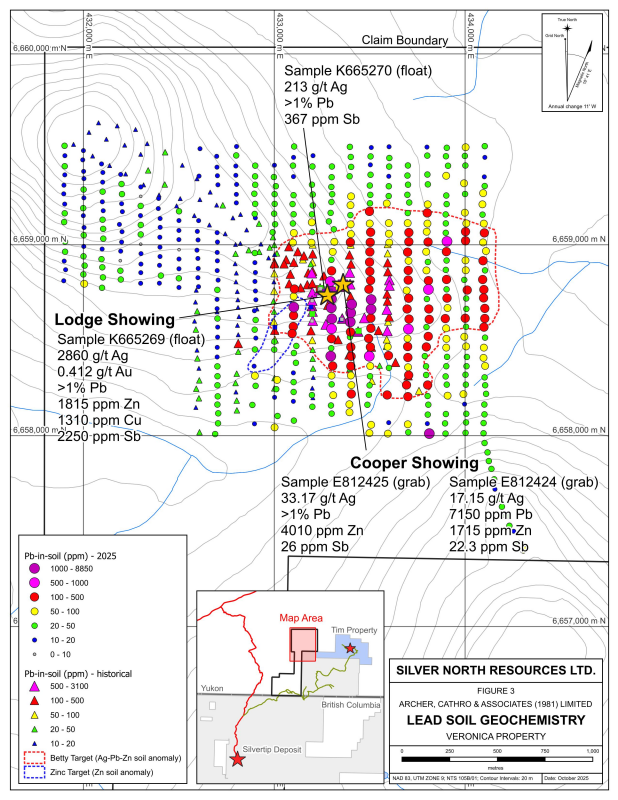

Soil sampling extended the multi-element (silver-lead±zinc) Betty soil geochemical anomaly from 450 m by 450 m to 1000 m by 1000 m, which remains open to the east and south.

-

Prospecting discovered high-grade silver mineralization in float, coincident with the Betty target, including 2,860 g/t silver from a float cobble.

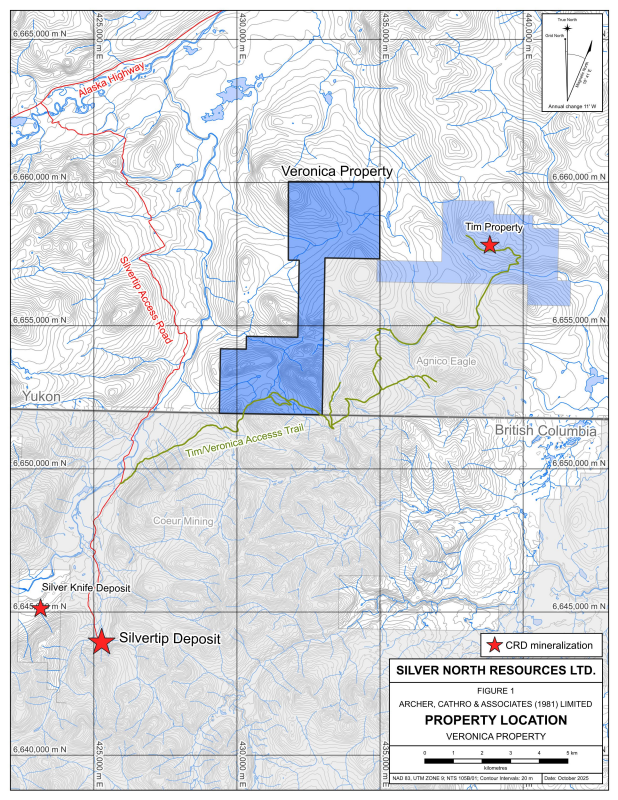

Vancouver, BC – TheNewswire - October 28, 2025 - Silver North Resources Ltd.(TSX-V: SNAG, OTCQB: TARSF) (“Silver North& or the “Company&) is pleased to announce analytical results from the 2025 field exploration program at the Veronica Property, one of three properties comprising the GDR Project in southern Yukon Territory (Figure 1). Results of the program, which included prospecting, geological mapping, soil geochemical sampling and hand trenching include the expansion of the previously identified multi-element soil geochemical anomaly (the Betty target) as well as the discovery of silver-bearing mineralization in float cobbles (2,860 and 213 g/t silver) and in outcrop (33.7 and 17.15 g/t silver). Prior to the 2025 program, no silver-bearing mineralization had been discovered on the Veronica property.

“Our goal with the 2025 program at Veronica was to assess the property&s potential to host Carbonate Replacement Deposit (CRD) style mineralization,& stated Jason Weber, P.Geo., President and CEO of Silver North. “These analytical results, from silver-bearing galena in structurally controlled replacement-style mineralization are a strong positive indicator that Veronica may be another CRD target in this emerging district.&

Previous operators identified a 450 m by 450 m silver-lead±zinc multi-element soil geochemical anomaly in 2016 (according to a filed, but unpublished, assessment report by the property vendors and filed with the Yukon government), which was the focus of the 2025 program. The 2025 program successfully expanded this anomaly to over 1 km by 1 km in size (now termed the “Betty Anomaly& or “Betty Target&). The Betty Anomaly is now defined as a coincident silver (1 ppm to 31.1 ppm), lead (50 ppm to 8850 ppm) and zinc (200 ppm to 3830 ppm) anomaly that remains open to the east, and potentially to the south.

Mapping and prospecting work at the Betty Anomaly discovered the first ever mineralization found at Veronica, consisting of massive galena-bearing cobbles in float, and subsequently, in outcrop. Float cobbles found on surface include a 15-cm wide massive sulphide cobble which returned 2,860 g/t Ag, 0.412 g/t Au, >1% Pb, 0.13% Cu, 0.18% Zn and 2,250 ppm Sb, (Sample K665269) and a cobble uncovered in a hand trench in the same area that returned 213 g/t Ag, >1% Pb and 367 ppm Sb (Sample K665270). These areas collectively make up the Lodge Showing (Figures 2 and 3).

Approximately 100 m to the northeast of the Lodge Showing, an outcropping brecciated and silicified fault zone was discovered, the Cooper Showing, hosting disseminated and blebby galena. Grab samples from the outcropping structure returned 33.17 g/t Ag, greater than 1% lead, 0.4% Zn and 26 ppm Sb (Sample E812425), and 17.15 g/t Ag, 0.71% Pb, 0.17% Zn and 22.3 ppm Sb (E82424) (Figures 2 and 3).

Overlimit analyses for lead are currently underway and will be released once received.

Geological mapping indicates the potential preservation of the prospective stratigraphy known for hosting high grade silver-lead-zinc mineralization at Silvertip.

The 2025 exploration program was undertaken and partially funded under a grant from the Government of Yukon, under its Yukon Mineral Exploration Program (“YMEP&). Under this program, qualifying exploration expenditures can be refunded to the Company in the form of a grant of up to $30,000. The 2025 program was conducted over an eight-day period, consisting of prospecting, mapping, soil geochemical sampling and hand trenching. A total of 453 soil samples and 26 rock samples were collected, while two hand trenches and eight additional hand-excavated pits were completed.

The Veronica claims, part of the recently optioned GDR project, are located adjacent to the Tim Property (under separate option to Coeur Mining), in the Silvertip area of southern Yukon Territory. Exploration in the region is targeting high grade silver-lead-zinc mineralization similar to that found at the Silvertip Mine, approximately 12 km to the southwest of Veronica.

Analytical and Chain of Custody

Following the field program, all samples were secured on site and transported to the office of Archer, Cathro & Associates (1981) Limited before being delivered to ALS Minerals in Whitehorse, Yukon. All samples were prepared at ALS Minerals in Whitehorse before being transported to the ALS laboratory (an independent accredited laboratory) in North Vancouver, British Columbia for analysis.

Rock and soil samples were analyzed using four-acid digestion with an ICP-MS finish (ME-MS61). Gold analysis was by fire assay with atomic absorption finish (Au-ICP21). Over-limit analysis for silver was completed using Ore Grade four acid digestion (ME-OG62) and by fire assay and gravimetric finish (Ag-GRA21 – 30g sample). Over-limit analysis for lead is currently being completed using Ore Grade four acid digestion (ME-OG62).

Grab and float rock samples collected in the program are selective by nature and may not necessarily represent the overall grade of underlying mineralization. Soil geochemical surveys conducted prior to Silver North&s agreement to option the Veronica property consisted of grid (50 m samples on 100 m spaced lines) and ridgeline sampling (approximately) every 100 m. Approximately 453 soil samples were collected in kraft soil bags and analyzed using a 30g fire assay method for gold and standard ICP spectroscopy (Inductively Coupled Plasma) for 50 additional elements. Samples were analyzed at ALS Laboratories.

A brief video update to accompany this news release can be found at:

https://vrify.com/meetings/recordings/55c947d9-5b67-48e2-8c2d-d99d39cb0fa9

Figure 1: Location Map

Figure 2: Compilation – Silver in soil geochemistry

Figure 3: Compilation – Lead in soil geochemistry

About Silver North Resources Ltd.

Silver North&s primary assets are its 100% owned Haldane Silver Project (next to Hecla Mining Inc.&s Keno Hill Mine project), the Tim Silver Project (under option to Coeur Mining, Inc. in the Silvertip/Midway District, BC and Yukon) and the GDR project also in the Silvertip/Midway district. Silver North also plans to acquire additional silver properties in favourable jurisdictions.

The Company is listed on the TSX Venture Exchange under the symbol “SNAG&, trades on the OTCQB market in the United States under the symbol “TARSF&, and under the symbol “I90& on the Frankfurt Stock Exchange.

Qualified Person

Mr. Kelson Willms, P.Geo., of Archer, Cathro and Associates (1981) Limited is a Qualified Person as defined under the terms National Instrument 43-101 and has reviewed and approved the technical information in this news release.

For further information, contact:

Jason Weber, President and CEO

Sandrine Lam, Shareholder Communications

Tel: (604) 807-7217

Fax: (888) 889-4874

To learn more visit:www.silvernorthres.com

X: https://X.com/SilverNorthRes

LinkedIn: https://www.linkedin.com/company/silvernorth-res-ltd/

NEITHER THE TSX VENTURE EXCHANGE NOR ITS REGULATION SERVICES PROVIDER (AS THAT TERM IS DEFINED IN THE POLICIES OF THE TSX VENTURE EXCHANGE) ACCEPTS RESPONSIBILITY FOR THE ADEQUACY OR ACCURACY OF THIS RELEASE. STATEMENTS IN THIS NEWS RELEASE, OTHER THAN PURELY HISTORICAL INFORMATION, INCLUDING STATEMENTS RELATING TO THE COMPANY'S FUTURE PLANS AND OBJECTIVES OR EXPECTED RESULTS, MAY INCLUDE FORWARD-LOOKING STATEMENTS. FORWARD-LOOKING STATEMENTS ARE BASED ON NUMEROUS ASSUMPTIONS AND ARE SUBJECT TO ALL OF THE RISKS AND UNCERTAINTIES INHERENT IN RESOURCE EXPLORATION AND DEVELOPMENT. AS A RESULT, ACTUAL RESULTS MAY VARY MATERIALLY FROM THOSE DESCRIBED IN THE FORWARD- LOOKING STATEMENTS.

Copyright (c) 2025 TheNewswire - All rights reserved.