- Expanded Treasure Island to over 90km of strike length through the acquisition of 113 additional mineral claims along the Valentine Lake Fault Zone

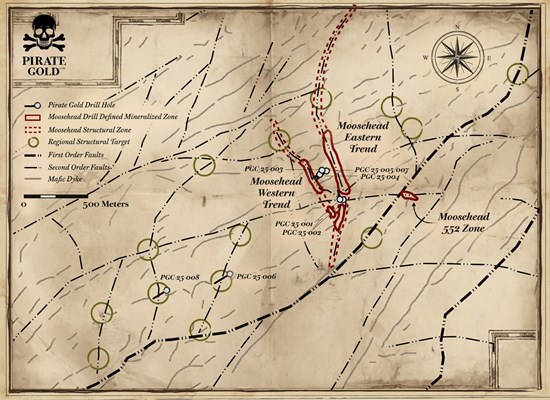

- Advanced the 50,000m drill program with two active rigs, early visual mineralization at Moosehead, and initial testing of regional geophysical targets

- Episode 2 of Pirate Gold Treasure Hunters now airing: https://youtu.be/JCqFsiE_9Eo

St. John's, Newfoundland and Labrador--(Newsfile Corp. - December 19, 2025) - Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) ("Pirate Gold" or the "Company") is pleased to announce that it has added an additional 113 mineral claims to its wholly owned Treasure Island Project in central Newfoundland. The Treasure Island Project now covers over 90km of strike along the Valentine Lake Fault Zone in Canada's newest gold district.

Drilling Program Update

- Two diamond drills are currently active at the Treasure Island Project with a third drill anticipated to mobilize in early 2026

- One drill is focused on the expansion of the Moosehead Eastern and Western trends and has completed six holes to date

- The second drill rig is conducting regional exploration drilling localized within several kilometres of the Moosehead Zone and has completed two holes to date

- Initial visual observations from completed drill holes are summarized below:

| Drill Hole | Target | Visual Observations |

| PGC-25-001 | Moosehead

Eastern Trend |

Intersected the Eastern Trend structural zone from 15 to 24m including a 15cm stylolitic quartz vein at 24m depth, mineralization consists of arsenopyrite, boulangerite, sphalerite and visible gold |

| PGC-25-002 | Moosehead

Eastern Trend |

Intersected the Eastern Trend structural zone from 26m to 34m followed by a second structural zone from 45.5-46.5m which included a 20cm stylolitic quartz vein, mineralization consists of arsenopyrite, sphalerite and visible gold |

| PGC-25-003 | Moosehead

Western Trend |

Intersected the Western Trend structural zone with structural intervals from 80m to 85m and 102 to 105m including stylolitic veins up to 10cm, mineralization consists of arsenopyrite, boulangerite and sphalerite |

| PGC-25-004 | Moosehead

Western Trend |

Intersected the Western Trend structural zone from 65m to 69.5m including a 300cm brecciated and stylolitic quartz veined zone. Mineralization consists of arsenopyrite, boulangerite, sphalerite and visible gold |

| PGC-25-005 | Moosehead

Western Trend |

Intersected the Western Trend structural zone from 110m to 124m including quartz veins ranging in size from 5 to 140cm. Mineralization consists of arsenopyrite, boulangerite, sphalerite and visible gold |

| PGC-25-006 | Regional

Geophysical Target |

Between 14 and 120m downhole depth intersected intermittent zones of high sulphide mineralization associated with quartz veins and alteration of the surrounding host rock. Mineralization consists of arsenopyrite and pyrite |

| PGC-25-007 | Moosehead

Western Trend |

Intersected the Western Trend structural zone from 116.2m to 120m including a stylolitic quartz vein from 119.3 to 120m. Mineralization consists of arsenopyrite, boulangerite, chalcopyrite, sphalerite and visible gold |

| PGC-25-008 | Regional

Geophysical Target |

Intersected mostly sandstone and minor segments of mafic dyke. No significant mineralization was encountered |

Table 1 - Visual Observations of Drill Core from Hole PGC-25-001 through PGC-25-008

The Company cautions that the presence of visible gold mineralization is not indicative of high gold assay grades and that drill core samples will or have been submitted to a certified laboratory for analysis of gold content. Assay values for the discussed intervals will be released when available. All intervals are downhole depths, and true widths are not known at this time.

| Drill Hole | Easting | Northing | Azimuth | Dip | Length (m) |

| PGC-25-001 | 613829 | 5428281 | 347 | -50 | 110 |

| PGC-25-002 | 613856 | 5428278 | 315 | -50 | 86 |

| PGC-25-003 | 613685 | 5428515 | 226 | -59 | 152 |

| PGC-25-004 | 613667 | 5428481 | 243 | -48 | 92 |

| PGC-25-005 | 613722 | 5428508 | 230 | -45 | 158 |

| PGC-25-006 | 612947 | 5427681 | 240 | -45 | 203 |

| PGC-25-007 | 613722 | 5428508 | 237 | -54 | 149 |

| PGC-25-008 | 612440 | 5427550 | 240 | -45 | 178 |

Table 2 - Drill Hole Information for PGC-25-001 through PGC-25-008

Fig. 1 - Map Showing the Moosehead Mineralized Zones, Structural Corridor, Interpreted

Faults and Regional Structural Drill Targets

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/278665_b3d4f04d5425a9b9_001full.jpg

Pirate Gold Treasure Hunters - Episode 2: Drilling Underway at Treasure Island

Episode 2 of Pirate Gold Treasure Hunters provides shareholders with a behind-the-scenes look at the early stages of the drilling campaign and features:

- Visual updates from the first drill holes at Moosehead

- Initial drilling insights from regional geophysical targets

- An overview of the expanding exploration team and regional strategy

Cannot view this video? Visit:

https://www.youtube.com/watch?v=JCqFsiE_9Eo

Viewers are encouraged to join the hunt by subscribing to the Pirate Gold YouTube channel: https://www.youtube.com/@PirateGoldCorp

Drill Core Featured in the Pirate Gold Treasure Hunters Video Series

Fig. 2 - Image of Drill core from PGC-25-005 Showing Veined Zone in the Moosehead Western Trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/278665_b3d4f04d5425a9b9_002full.jpg

Fig. 3 - Image of Drill core from PGC-25-006 Showing Segment of the Veined Zone at the Regional Target

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/278665_b3d4f04d5425a9b9_003full.jpg

Fig. 4 - Image of Drill core from PGC-25-007 Showing Veined Zone in the Moosehead Western Trend

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/278665_b3d4f04d5425a9b9_004full.jpg

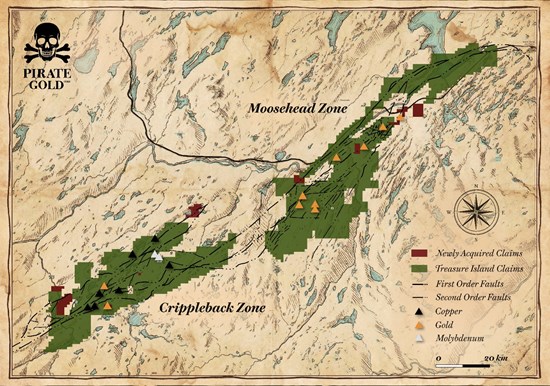

Mineral Claims Addition

- Three separate mineral license purchase agreements have been executed to acquire 77 mineral claims covering 1,925 hectares

- Recent staking has added an additional 36 mineral claims covering 900 hectares

"The consolidation of a fragmented mineral tenure along the Valentine Lake Fault corridor has been one the key first steps for the company to build value in this district. Starting with its advanced-stage Moosehead Project the company has grown its exploration focus to cover over 90km of strike length along the prospective fault corridor. Today's announcement continues to build that regional scale project.

"The initial focus of our 50,000m drilling program has been to explore both within and around the immediate vicinity of the Moosehead Zone looking for other similar gold bearing structures. Our exploration ethos has been that Moosehead shouldn't be a singular high-grade structure and that it fits into a larger mineral system as seen in other orogenic gold deposits. Our acquisition of the Stony Lake project south of Moosehead in October includes historical drilling results up to *1.88g/t Au over 27.35m and 1.52g/t over 31.75m located just 5 km south of the Moosehead fault structure which indicates there is much more to learn about the gold mineralization in this part of the Treasure Island Project," said Greg Matheson, VP Exploration of Pirate Gold.

* The Qualified Person has not done sufficient work to verify the drilling results published by K9 Gold Corp. K9 Gold Corp, Oct 18, 2022, K9 Gold Confirms Continuity of Gold Mineralization; Intersects 1.52g/t Gold over 31.75m at Stony Lake. https://www.sedarplus.ca/csa-party/records/document.html?id=160f518a52577fa127426f087fcb5548cc5b2a969a3e5ee1213bc90d5797c71f

Fig. 5 - Map Showing the Consolidated Mineral Licenses and Newly Acquired Claims of the Treasure Island Project

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/6079/278665_b3d4f04d5425a9b9_005full.jpg

Pirate Gold has entered into an agreement with Paradigm Minerals, Ian Farrell ("Farrell"), Rebecca Heathcote ("Heathcote") and Katie Lewis ("Lewis") to acquire a 100% interest in and to four mineral licences. In consideration the Company will, subject to TSX Venture Exchange ("TSXV") approval, make a one-time cash payment of $400 to Farrell, $2,000 to Heathcote, $9,960 to Lewis and issue 20,000 common shares to Farrell, 50,000 common shares to Heathcote, 230,000 common shares to Lewis, and grant a 1.5% NSR royalty to Lewis, one half of which Pirate Gold can purchase for $1,000,000.

The Company has also entered in an agreement with Kevin Keats and 91112 Newfoundland and Labrador Inc. ("91112") to acquire a 100% interest in and to one mineral license. In consideration the Company will, subject to TSXV approval, make a one-time cash payment of $10,000 and issue 250,000 common shares, and grant a 1.0% NSR royalty, one half of which Pirate Gold can purchase for $1,000,000.

The Company has entered in an agreement with Brian Jones ("Jones") and Gary Rowsell ("Rowsell") to acquire a 100% interest in and to one mineral license. In consideration the Company will, subject to TSXV approval, make a one-time cash payment of $2,500 to Jones, $2,500 to Rowsell and issue 50,000 common shares to Jones, 50,000 common shares to Rowsell, and grant a 1.0% NSR royalty allocated 50% to Jones and 50% to Rowsell, one half of which Pirate Gold can purchase for $1,000,000.

Qualified Person

Greg Matheson, P.Geo., VP Exploration for Pirate Gold, a "Qualified Person" under National Instrument 43-101, has reviewed and approved the scientific and technical information in this press release.

About Pirate Gold Corp.

Pirate Gold Corp. (TSXV: YARR) (OTCQB: SICNF) is led by an experienced management team and is the dominant explorer along the Valentine Lake Fault Zone in Newfoundland, Canada's newest gold district. The Company's primary focus is its 100% owned district-scale Treasure Island Gold Project, along with a portfolio of gold projects, including the district-scale Fleur de Lys Project.

For more information, please contact:

Denis Laviolette, Executive Chairman, CEO & Director

E: denis@pirategold.ca

Cathy Hume, VP Corporate Development & Director

T: 416-868-1079 x 251

E: cathy@chfir.com

Website: www.pirategold.ca

YouTube: @PirateGoldCorp

Twitter: @PirateGoldCorp

Facebook: @PirateGoldCorp

LinkedIn: @PirateGoldCorp

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

Investors are cautioned that trading in the securities of the Company should be considered highly speculative. This news release contains "forward-looking statements" within the meaning of the applicable Canadian securities legislation that are based on expectations, estimates, assumptions, geological theories, and projections as at the date of this news release. The information in this news release about any information herein that is not a historical fact may be "forward-looking statements." Actual results may differ materially. Any statement that involves discussions with respect to predictions, expectations, beliefs, plans, projections, objectives, assumptions, future events or performance (which may, but not always, include phrases such as "anticipates", "plans", "scheduled", "believed" or "intends" or variations of such words and phrases or stating that certain actions, events or results "may" or "could", "would", "might" or "will" be taken to occur or be achieved) including statements regarding the Company's plans with respect to the Company's projects and the timing related thereto, the merits of the Company's projects, the Company's objectives, plans and strategies, and other matters are not statements of historical fact and may be forward-looking statements and are intended to identify forward-looking statements. Factors that may cause results to vary include delays in obtaining necessary approvals, changes in the market for the Company's securities, results of exploration, loss of title to properties, delays in obtaining permits or access to mineral properties, including as a result of adverse weather, fire or flood, changes to the Tax Act, rejection of expenditures as Qualifying Expenditures, and factors included in the documents filed from time to time with the Canadian securities regulatory authorities by Pirate Gold Corp. Pirate Gold Corp. will not update these forward-looking statements to reflect events or circumstances after the date hereof, except as required by law.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278665