Vancouver, British Columbia--(Newsfile Corp. - February 11, 2026) - Standard Uranium Ltd. (TSXV: STND) (OTCQB: STTDF) (FSE: 9SU0) ("Standard Uranium" or the "Company") is pleased to announce that drilling activities have commenced at the Company's 12,364-hectare Corvo Uranium Project ("Corvo", or the "Project") located near Wollaston Lake in northeastern Saskatchewan (Figure 1). Field crews arrived at the Project on February 6th and drilling commenced on schedule, February 9th.

The Project is currently under a three-year earn-in option agreement (the "Option Agreement") with Aventis Energy Inc. (CSE: AVE) ("Aventis"). Pursuant to the Option Agreement, Aventis has been granted an option (the "Option") to earn a 75% interest in the Project by funding CAD$6M in exploration expenditures over three years. The drill program will be funded by Aventis and operated by Standard Uranium.

Highlights:

-

Drilling Underway: Drilling activities began on February 9, 2026. Approximately 2,500-3,000 metres are planned across eight (8) to ten (10) drill holes targeting shallow high-grade* basement-hosted uranium mineralization, beginning with the Manhattan target area. The program is anticipated to span five (5) to six (6) weeks.

-

Robust & Shallow Drill Targets: Drill plans comprise road accessible skid-supported diamond drilling focused on high-priority uranium targets refined by geophysical work completed by the Company in 2025, bolstered by recent prospecting and confirmation of strong radioactivity at surface (up to 8.10% U3O8 grab samples at Manhattan1) within ideal uranium host rocks.

-

Untapped Uranium Potential: One diamond drill will focus on high-priority target areas along prospective XciteTM electromagnetic ("EM") corridors overlain by high-resolution ground gravity data with the proven exploration thesis of focusing on major conductor trends associated with cross-cutting faults and surficial radioactivity expressions.

-

Fully Funded: Aventis Energy will fund 100% of the program to meet the year-one expenditure requirements under the Option.

"The team and I are thrilled to announce that the drill is spinning on the Corvo project for the first time in more than 40 years, kicking off our winter exploration season," said Sean Hillacre, President & VP Exploration for the Company, "This program also marks the first drill holes ever at the Manhattan showing, which returned uranium grades up to 8.10% U3O8 in surface samples from our prospecting program in 2025."

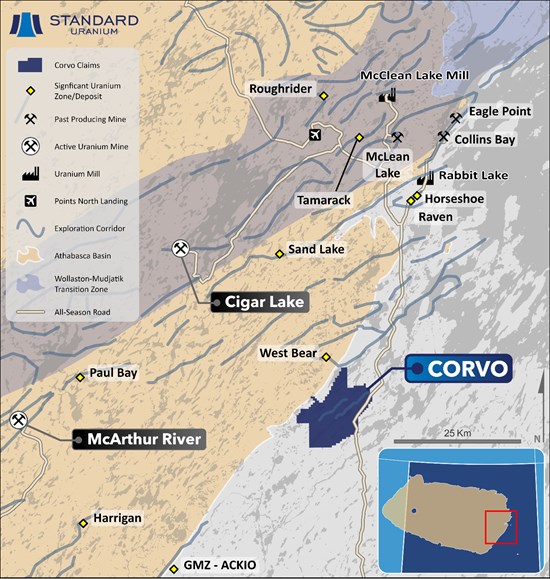

Figure 1. Regional map of the Corvo Project. The Project is located 60 km due east of Cameco's McArthur River mine and 45 km northeast of Atha Energy's Gemini Mineralized Zone ("GMZ").

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/10633/283501_8e51d43d64aaface_003full.jpg

2026 Winter Drill Program

The Standard Uranium team arrived on site February 9, 2026, and diamond drilling on the first hole at Corvo in more than 40 years is currently underway. The winter program will comprise approximately 2,500 to 3,000 metres of drilling at high-priority target areas following completion of TDEM and ground gravity surveys, and geophysical modeling last year. Corvo covers an area of 12,364 hectares across 14 mineral claims, located along highway 905 on the eastern margin of the Athabasca Basin.

Target Selection for 2026 Drill Campaign

Targets were selected and prioritized through an iterative approach working in collaboration with Convolutions Geoscience Corporation. Recent prospecting and mapping across the Project outlined multiple outcrops of favourable uranium host-rocks, including radioactive metasediments and orthogneiss. Structural measurements and radioactivity mapping has further refined drill targets in the 2026 target areas.

Targets are ranked and prioritized based on geophysical signature, geological/structural setting, proximity to surficial uranium occurrences of interest, and the Company's recent prospecting and mapping campaign.

Qualified Person Statement

The scientific and technical information contained in this news release has been reviewed, verified, and approved by Sean Hillacre, P.Geo., President and VP Exploration of the Company and a "qualified person" as defined in NI 43-101 - Standards of Disclosure for Mineral Projects.

Samples collected for analysis were sent to SRC Geoanalytical Laboratories in Saskatoon, Saskatchewan for preparation, processing, and ICP-MS or ICP-OES multi-element analysis using total and partial digestion and boron by fusion. Radioactive samples were tested using the ICP1 uranium multi-element exploration package plus boron. All samples marked as radioactive upon arrival to the lab were also analyzed using the U3O8 assay (reported in wt.%). SRC is an ISO/IEC 17025:2005 and Standards Council of Canada certified analytical laboratory. Blanks, standard reference materials, and repeats were inserted into the sample stream at regular intervals in accordance with Standard Uranium's quality assurance/quality control (QA/QC) protocols. All samples passed internal QA/QC protocols and the results presented in this release are deemed complete, reliable, and repeatable.

Historical data disclosed in this news release relating to sampling results from previous operators are historical in nature. Neither the Company nor a qualified person has yet verified this data and therefore investors should not place undue reliance on such data. The Company's future exploration work may include verification of the data. The Company considers historical results to be relevant as an exploration guide and to assess the mineralization as well as economic potential of exploration projects. Any historical grab samples disclosed are selected samples and may not represent true underlying mineralization.

Natural gamma radiation from rocks reported in this news release was measured in counts per second ("cps") using a handheld RS-125 super-spectrometer and RS-120 super-scintillometer. Readers are cautioned that scintillometer readings are not uniformly or directly related to uranium grades of the rock sample measured and should be treated only as a preliminary indication of the presence of radioactive minerals. The RS-125 and RS-120 units supplied by Radiation Solutions Inc. ("RSI") have been calibrated on specially designed Test Pads by RSI. Standard Uranium maintains an internal QA/QC procedure for calibration and calculation of drift in radioactivity readings through three test pads containing known concentrations of radioactive minerals. Internal test pad radioactivity readings are known and regularly compared to readings measured by the handheld scintillometers for QA/QC purposes.

References

1 News Release: Standard Uranium Confirms High-Grade Uranium Mineralization up to 8.10% U3O8 at Surface on the Corvo Project, https://standarduranium.ca/news-releases/standard-uranium-confirms-high-grade-uranium-mineralization-at-surface-on-the-corvo-project/

*The Company considers uranium mineralization with concentrations greater than 1.0 wt.% U3O8 to be "high-grade".

**The Company considers radioactivity readings greater than 65,535 counts per second (cps) on a handheld RS-125 Super-Spectrometer to be "off-scale".

***The Company considers radioactivity readings greater than 300 counts per second (cps) on a handheld RS-125 Super-Spectrometer to be "anomalous".

About Standard Uranium (TSXV: STND)

We find the fuel to power a clean energy future

Standard Uranium is a uranium exploration company and emerging project generator poised for discovery in one of the world's premier uranium districts. The Company holds interest in over 241,652 acres (97,793 hectares) in the Athabasca Basin in Saskatchewan, Canada. Since its establishment, Standard Uranium has focused on the identification, acquisition, and exploration of Athabasca-style uranium targets with a view to discovery and future development.

Standard Uranium's Davidson River Project, in the southwest part of the Athabasca Basin, Saskatchewan, comprises ten mineral claims over 30,737 hectares. Davidson River is highly prospective for basement-hosted uranium deposits due to its location along trend from recent high-grade uranium discoveries. However, owing to the large project size with multiple targets, it remains broadly under-tested by drilling. Recent intersections of wide, structurally deformed and strongly altered shear zones provide significant confidence in the exploration model and future success is expected.

Standard Uranium's eastern Athabasca projects comprise over 53,166 hectares of prospective land holdings. The eastern basin projects are highly prospective for unconformity related and/or basement hosted uranium deposits based on historical uranium occurrences, recently identified geophysical anomalies, and location along trend from several high-grade uranium discoveries.

Standard Uranium's Sun Dog project, in the northwest part of the Athabasca Basin, Saskatchewan, is comprised of nine mineral claims over 19,603 hectares. The Sun Dog project is highly prospective for basement and unconformity hosted uranium deposits yet remains largely untested by sufficient drilling despite its location proximal to uranium discoveries in the area.

For further information contact:

Jon Bey, Chief Executive Officer, and Chairman

Suite 3123, 595 Burrard Street

Vancouver, British Columbia, V7X 1J1

Tel: 1 (306) 850-6699

E-mail: info@standarduranium.ca

Cautionary Statement Regarding Forward-Looking Statements

This news release contains "forward-looking statements" or "forward-looking information" (collectively, "forward-looking statements") within the meaning of applicable securities legislation. All statements, other than statements of historical fact, are forward-looking statements and are based on expectations, estimates and projections as of the date of this news release. Forward-looking statements include, but are not limited to, statements regarding: the timing and content of upcoming work programs; geological interpretations; timing of the Company's exploration programs; and estimates of market conditions.

Forward-looking statements are subject to a variety of known and unknown risks, uncertainties and other factors that could cause actual events or results to differ from those expressed or implied by forward-looking statements contained herein. There can be no assurance that such statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Certain important factors that could cause actual results, performance or achievements to differ materially from those in the forward-looking statements are highlighted in the "Risks and Uncertainties" in the Company's management discussion and analysis for the fiscal year ended April 30, 2025.

Forward-looking statements are based upon a number of estimates and assumptions that, while considered reasonable by the Company at this time, are inherently subject to significant business, economic and competitive uncertainties and contingencies that may cause the Company's actual financial results, performance, or achievements to be materially different from those expressed or implied herein. Some of the material factors or assumptions used to develop forward-looking statements include, without limitation: that the transaction with Aventis will proceed as planned; the future price of uranium; anticipated costs and the Company's ability to raise additional capital if and when necessary; volatility in the market price of the Company's securities; future sales of the Company's securities; the Company's ability to carry on exploration and development activities; the success of exploration, development and operations activities; the timing and results of drilling programs; the discovery of mineral resources on the Company's mineral properties; the costs of operating and exploration expenditures; the presence of laws and regulations that may impose restrictions on mining; employee relations; relationships with and claims by local communities and indigenous populations; availability of increasing costs associated with mining inputs and labour; the speculative nature of mineral exploration and development (including the risks of obtaining necessary licenses, permits and approvals from government authorities); uncertainties related to title to mineral properties; assessments by taxation authorities; fluctuations in general macroeconomic conditions.

The forward-looking statements contained in this news release are expressly qualified by this cautionary statement. Any forward-looking statements and the assumptions made with respect thereto are made as of the date of this news release and, accordingly, are subject to change after such date. The Company disclaims any obligation to update any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required by applicable securities laws. There can be no assurance that forward-looking statements will prove to be accurate, as actual results and future events could differ materially from those anticipated in such statements. Accordingly, readers should not place undue reliance on forward-looking statements.

Neither the TSX-V nor its Regulation Services Provider (as that term is defined in the policies of the TSX-V) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/283501