Program Confirms Near-Surface Economics, Advances Crucial Data Collection and Further Defines High Grade Core

West Vancouver, British Columbia--(Newsfile Corp. - February 25, 2026) - Surge Battery Metals Inc. (TSXV: NILI) (OTCQX: NILIF) (FSE: DJ5) (the "Company" or "Surge") is pleased to announce that Nevada North Lithium LLC ("NNL"), the joint venture formed by Surge and Evolution Mining Limited ("Evolution"), has reported the second and final batch of assay results from its 2025 core drilling program at the Nevada North Lithium Project ("NNLP").

Following the successful step-out results reported in Part 1 (see news release dated February 17, 2026), these final five holes focused on infill drilling to support the upcoming Pre-Feasibility Study ("PFS"). The results confirm the continuity and high grade of the deposit's core.

Highlights from the Final 5 Holes:

-

Significant High-Grade Intercepts: Hole NNL-030 intersected a cumulative thickness of 116 meters (381 ft) averaging 3,752 ppm Lithium (Li), including a high-grade upper zone of 32.1 meters (105 ft) grading 4,521 ppm Li.

-

Deposit Continuity: Hole NNL-036 confirmed the robustness of the resource, returning 78.6 meters (258 ft) averaging 3,141 ppm Li, including a deep, high-grade basal zone grading 4,580 ppm Li.

-

Critical Hydrogeological Data: Hole NNL-035, strategically positioned near Texas Spring, provided essential groundwater monitoring data. While this hole intersected a high-energy fluvial channel (resulting in naturally eroded clay horizons), it successfully installed Vibrating Wire Piezometers (VWPs) to model the basin's hydrology-a key requirement for the PFS and permitting.

-

Critical Geotechnical Data: Successfully captured high-resolution televiewer data and completed geotechnical logging across all 2025 drill holes, ensuring precise modeling of fault structures. Representative samples from every lithological unit are now undergoing rock strength testing to define safe pit wall angles for the PFS.

-

Strategic By-Product Potential: Infill drilling consistently returns consistently elevated concentrations of Cesium (up to 163 ppm) and Rubidium (up to 349 ppm) directly associated with the lithium core. The Company is actively evaluating the deportment of these high-value critical minerals in the ongoing metallurgical study, representing an opportunity for the project's value proposition.

Table 1. NNLP 2025 core drilling, total mineralization

| Hole ID | Thickness (m) | Thickness (ft) | Li (ppm) | Cs (ppm) | Rb (ppm) |

| NNL-030 | 116.04 | 380.7 | 3752 | 122 | 290 |

| NNL-032 | 82.29 | 270 | 3664 | 98 | 287 |

| NNL-033 | 44.12 | 144.8 | 3285 | 102 | 247 |

| NNL-035 | 23.06 | 75.7 | 1743 | 45 | 102 |

| NNL-036 | 78.63 | 258 | 3141 | 94 | 237 |

| 1250 ppm cutoff grade |

|

|

|||

True Thickness and Interval Calculation

Sample intervals were determined based on easily identified lithological contacts, such as the distinct tuff/clay boundary. While nominal sample lengths were typically 5 feet (1.52 meters), some intervals were adjusted to respect these geological contacts. All reported composite grades account for these variations and are length weighted. All drill holes in this program are vertical. Because the local geology generally dips at approximately 20 degrees to the west, the true thickness of the mineralized intervals is estimated to be approximately 94% of the reported drilled thicknesses.

Drill Results Discussion

High-Grade Infill (NNL-030, NNL-031, NNL-032, NNL-036)

The primary objective of these holes was to convert Inferred Resources to the Indicated and Measured categories. The results exceeded expectations, with consistent mineralization intersected across significant widths.

Hole NNL-030 stands out as a top-tier intercept, returning nearly 120 meters averaging >3,700 ppm Li, confirming the presence of a thick, ultra-high-grade core that will likely drive early-year economics in the mine plan.

Hole NNL-032, in the center of the current resource, bolsters the high Li grades and thicknesses of horizons in the center of the deposit.

Hole NNL-033 fills in a critical area in the north of the resource, connecting the two-hole pad in the northeast to the rest of the mineralized sequence.

Hole NNL-035 targeted a strategic hydrogeological location near Texas Spring. Drilling encountered a localized fluvial scour zone, resulting in a thinner mineralized interval (23.1m @ 1,743 ppm Li). Crucially, the hole was successfully completed as a monitoring well with Vibrating Wire Piezometers (VWPs) . This installation provides the essential groundwater data required to calibrate the regional model and de-risk the environmental permitting timeline.

Hole NNL-036 demonstrated that high-grade mineralization persists at depth, intersecting a 9.4-meter zone of 4,580 ppm Li near the bottom of the hole (422-453 ft).

Table 2. Mineralized intercepts

| Hole ID | From (m) | To (m) | Thick (m) | From (ft) | To (ft) | Thick (ft) | Li (ppm) | Cs (ppm) | Rb(ppm) |

| NNL-030 | 28.22 | 60.35 | 32.1 | 92.6 | 198 | 105.4 | 4521 | 163 | 346 |

| NNL-030 | 69.49 | 90.52 | 21.0 | 228 | 297 | 69 | 3788 | 109 | 288 |

| NNL-030 | 98.81 | 160.47 | 61.7 | 324.2 | 526.5 | 202.3 | 3365 | 105 | 264 |

| NNL-030 | 163.97 | 165.19 | 1.22 | 538 | 542 | 4 | 2380 | 122 | 168.5 |

| NNL-030 | Total | 116.04 | Total | 380.7 | 3752 | 122 | 290 | ||

|

|

|

|

|

|

|

|

|

|

|

| Hole ID | From (m) | To (m) | Thick (m) | From (ft) | To (ft) | Thick (ft) | Li (ppm) | Cs (ppm) | Rb(ppm) |

| NNL-032 | 8.23 | 24.99 | 16.8 | 27 | 82 | 55 | 4081 | 124 | 333 |

| NNL-032 | 32.61 | 96.62 | 64.0 | 107 | 317 | 210 | 3610 | 92 | 280 |

| NNL-032 | 105.15 | 106.67 | 1.5 | 345 | 350 | 5 | 1335 | 72 | 92 |

| NNL-032 | Total | 82.29 | Total | 270 | 3664 | 98 | 287 | ||

|

|

|

|

|

|

|

|

|

|

|

| Hole ID | From (m) | To (m) | Thick (m) | From (ft) | To (ft) | Thick (ft) | Li (ppm) | Cs (ppm) | Rb(ppm) |

| NNL-033 | 17.07 | 41.45 | 24.4 | 56 | 136 | 80 | 4386 | 137 | 300 |

| NNL-033 | 55.78 | 65.53 | 9.8 | 183 | 215 | 32 | 2137 | 59 | 147 |

| NNL-033 | 85.1 | 95.09 | 10.0 | 279.2 | 312 | 32.8 | 1719 | 60 | 214 |

| NNL-033 | Total | 44.12 | Total | 144.8 | 3285 | 102 | 247 | ||

|

|

|

|

|

|

|

|

|

||

| Hole ID | From (m) | To (m) | Thick (m) | From (ft) | To (ft) | Thick (ft) | Li (ppm) | Cs (ppm) | Rb(ppm) |

| NNL-035 | 6.71 | 9.75 | 3.04 | 22 | 32 | 10 | 1190 | 36 | 80 |

| NNL-035 | 46.17 | 56.99 | 10.8 | 151.5 | 187 | 35.5 | 2022 | 69 | 146 |

| NNL-035 | 61.57 | 64.61 | 3.04 | 202 | 212 | 10 | 1170 | 29.3 | 53.5 |

| NNL-035 | 86.8 | 92.96 | 6.16 | 284.8 | 305 | 20.2 | 1810 | 17 | 62 |

| NNL-035 | Total | 23.06 | Total | 75.7 | 1743 | 45 | 102 | ||

|

|

|

|

|

|

|

|

|

||

| Hole ID | From (m) | To (m) | Thick (m) | From (ft) | To (ft) | Thick (ft) | Li (ppm) | Cs (ppm) | Rb(ppm) |

| NNL-036 | 34.14 | 63.09 | 29.0 | 112 | 207 | 95 | 3907 | 134 | 271 |

| NNL-036 | 71.93 | 85.95 | 14.0 | 236 | 282 | 46 | 2593 | 71 | 180 |

| NNL-036 | 99.66 | 115.21 | 15.6 | 327 | 378 | 51 | 2291 | 62 | 202 |

| NNL-036 | 116.43 | 121 | 4.6 | 382 | 397 | 15 | 1985 | 71 | 235 |

| NNL-036 | 128.6256 | 138.0744 | 9.4 | 422 | 453 | 31 | 4580 | 105 | 362 |

| NNL-036 | 139.29 | 145.38 | 6.09 | 457 | 477 | 20 | 1567 | 42 | 99 |

| NNL-036 | Total | 78.63 | Total | 258 | 3141 | 94 | 237 | ||

Mr. Greg Reimer, President & Chief Executive Officer and Director of Surge, commented, "This infill drilling is doing exactly what it was designed to do: upgrade the resource, confirm continuity of some of our best lithium intercepts and de-risk the early years of a potential mine plan at Nevada North. Coupled with a robust PEA economic profile, we believe Nevada North is strongly positioned as we move forward with the development of our PFS. We look forward to updating the Mineral Resource Estimate as our next key milestone."

Sample Custody and Handling, QA/QC:

For the 2025 drilling program, Surge geologists implemented a rigorous quality assurance and quality control (QA/QC) protocol. Drill core (drilled at PQ size) was logged, photographed, split, and sampled at the Company's secure sample processing facility in Twin Falls, ID. Sample intervals were typically set at 5 feet (1.52m), adjusted for lithological contacts to ensure representative sampling. To preserve material for future metallurgical testing and library core, clay intervals were sampled as quarter-core (¼), which is deemed representative due to the strong lateral continuity of the lakebed deposit. Where duplicates were required, two quarter-core samples were submitted. Tuff (non-mineralized) intervals were sampled as half-core (½). Core was cut using a diamond saw for competent rock or manually for softer clay-rich intervals to ensure representative sampling.

Samples were placed in barcode-labeled standard 20"x24" polyester Heavy Sentry bags and transported to ALS Global's preparation laboratory in Twin Falls, ID (located 3.3 miles from Surge's core facility). Following preparation, pulps were securely shipped to the ALS Global laboratory in Vancouver, BC, for analysis. ALS Global is an independent, ISO/IEC 17025 certified laboratory. Samples were analyzed using the ME-MS41 method (ultra-trace aqua regia digestion with an ICP-MS finish).

For the entire 2025 drill program, 134 out of 806 QA/QC samples were submitted, representing approximately 16.6% of the 806 total samples analyzed. This included the systematic insertion of certified reference materials (MEG standards), blanks, and quarter-core duplicates.

-

Blanks: 43 blank samples were inserted. All but one returned values < 50 ppm Li, consistent with background levels for the blank material used. One outlier was reported at 81.8 ppm Li.

-

Standards: 47 lithium standards were inserted, comprising three certified grades (approximately 720 ppm, 1606 ppm, and 2536 ppm Li). All standards performed within acceptable limits, demonstrating high analytical accuracy across the grade range.

-

Note: This program introduced a new site-specific standard grading 2,536 ppm Li, developed directly from NNLP mineralized material to ensure matrix-matched analytical accuracy.

-

-

Duplicates: 44 duplicate samples were analyzed. All duplicates fell within 10% tolerance, confirming consistent reproducibility of the sampling and analytical methods.

Qualified Person:

Alan J. Morris, MSc, CPG of Spring Creek, Nevada, Geological Advisor to the Company, and a Qualified Person as defined under National Instrument 43-101, has reviewed and approved the technical aspects of this news release. Mr. Morris has verified the data disclosed respecting the drill program by reviewing all available information. There were no limitations on the verification process.

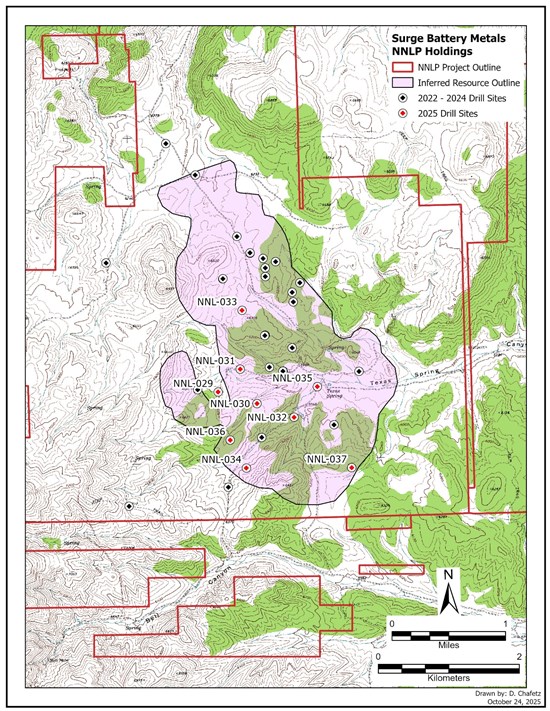

Figure 1. Drill Hole Location Map for 2025 Program

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/9838/285195_b55878f3c493c89f_001full.jpg

About Surge Battery Metals Inc.

Surge Battery Metals Inc., a Canadian-based mineral exploration company, is at the forefront of securing the supply of domestic lithium through its active engagement in the Nevada North Lithium Project. The project focuses on development of high-grade lithium energy metals in Nevada, USA, a crucial element for powering battery electric storage and electric vehicles. With a primary listing on the TSX Venture Exchange in Canada and a listing on the OTCQX Market in the USA, Surge Battery Metals Inc. is strategically positioned as a key player in advancing lithium exploration.

About Evolution Mining Limited

Evolution Mining is a leading, globally relevant gold miner. Evolution operates six mines, comprising five wholly-owned mines - Cowal in New South Wales, Ernest Henry and Mt Rawdon in Queensland, Mungari in Western Australia, and Red Lake in Ontario, Canada, and an 80% share in Northparkes in New South Wales.

About Nevada North Lithium LLC

Nevada North Lithium LLC owns the Nevada North Lithium Project southeast of Jackpot, Nevada about 73 km north-northeast of Wells, Elko County. The first three rounds of drilling at the project identified a strongly mineralized zone of lithium bearing clays occupying a strike length of more than 4,300 meters and a known width of greater than 1,500 meters. Highly anomalous soil values and geophysical surveys suggest there is potential for the clay horizons to be much greater in extent. The Nevada North Lithium Project has a pit-constrained Inferred Resource containing an estimated 11.24 Mt of Lithium Carbonate Equivalent (LCE) grading 3010 ppm Li at a 1,250-ppm cutoff. The recently completed PEA for the project reported an after-tax NPV8% US $9.17 Billion and after-tax IRR of 22.8% at $24,000/t LCE and an OPEX of US $5,243/t LCE.

On behalf of the Board of Directors

"Greg Reimer"

Greg Reimer,

Director, President & CEO

Contact Information

Email: info@surgebatterymetals.com

Phone: 604-662-8184

Website: surgebatterymetals.com

Keep up-to-date with Surge Battery Metals: Twitter, Facebook, LinkedIn, Instagram and YouTube.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

This document may contain certain "Forward-Looking Statements" within the meaning of the United States Private Securities Litigation Reform Act of 1995 and applicable Canadian securities laws. When used in this news release, the words "anticipate", "believe", "estimate", "expect", "target, "plan" or "planned", "possible", "potential", "forecast", "intend", "may", "schedule" and similar words or expressions identify forward-looking statements or information. These forward-looking statements or information may relate to future prices of commodities including lithium and nickel, the accuracy of mineral or resource exploration activity, reserves or resources, regulatory or government requirements or approvals including approvals of title and mining rights or licenses and environmental, local community or indigenous community approvals, the reliability of third party information, continued access to mineral properties or infrastructure or water, changes in laws, rules and regulations including in the United States, Nevada or California or any other jurisdiction which may impact upon the Company or its properties or the commercial exploitation of those properties, currency risks including the exchange rate of USD$ for Cdn$ or other currencies, fluctuations in the market for lithium related products, changes in exploration costs and government royalties, export policies or taxes in the United States or any other jurisdiction and other factors or information. The Company's current plans, expectations, and intentions with respect to development of its business and of its Nevada properties may be impacted by economic uncertainties arising out of any pandemic or by the impact of current financial and other market conditions (including US government subsidies or incentives) on its ability to secure further financing or funding of its Nevada properties. Such statements represent the Company's current views with respect to future events and are necessarily based upon several assumptions and estimates that, while considered reasonable by the Company, are inherently subject to significant business, economic, competitive, political, environmental (including endangered species, habitat preservation and water related risks) and social risks, contingencies, and uncertainties. Many factors, both known and unknown, could cause results, performance, or achievements to be materially different from the results, performance or achievements that are or may be expressed or implied by such forward-looking statements. The Company does not intend, and does not assume any obligation, to update these forward-looking statements or information to reflect changes in assumptions or changes in circumstances or any other events affecting such statements and information other than as required by applicable laws, rules, and regulations.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285195