Pilot-scale validation confirms commercial-grade TiO2 production, enhanced revenue capture through multi-metal recovery, material cost reductions and establishes a global licensing and partnership pathway.

Highlights

-

Temas is advancing its Regenerative Chloride Leach ("RCL") processing technology, an innovative platform for the recovery of critical and precious metals .

-

RCL platform comprises 11 granted process patents , 100% owned by Temas following the acquisition of ORF Technologies Inc. 1

-

Extensive bench-scale and pilot-scale metallurgical testing completed using mineralized material from the Company's 100% owned La Blache titanium-vanadium Project, Quebec have defined optimal operating conditions for TiO 2 and Fe 2 O 3 recovery .

-

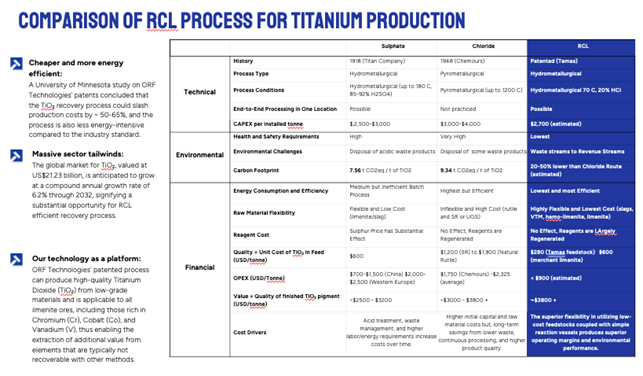

Pilot-scale testing and associated process evaluation have independently demonstrated cost reductions of greater than 65% for TiO 2 processing relative to conventional methods, driven by co-product capture, closed loop reagent recycling, simplified flowsheets and reduced energy intensity 2 .

-

Key outcomes of the testing included 3 :

-

Processing of approximately 830 kg La Blache deposit material, producing 88 kgs of optimised ultra-low impurity TiO 2 powder grading 99.8%.

-

Two-stage leach yielding 80-85% titanium recovery and ~95% iron recovery, with further improvements expected through scale-up and closed-loop circulation.

-

Solvent strip extraction demonstrates rapid and selective separation, removing 99.9% of iron from solution .

-

Planned pyrohydrolysis testing to yield a premium Fe 2 O 3 product (> 99% pure) targeting high-end pigment and battery grade specifications.

-

-

Core from Temas's 2022 and 2025 drill programs (4,915m total), together with 36,844m of historic drill core, is currently being evaluated using the RCL platform, with additional metallurgical results expected from later this quarter, including a focus on Gallium and Scandium (previously overlooked).

-

The RCL technology is commodity-agnostic and scalable and is currently being evaluated by multiple third-party mining companies for applicability to treat complex mineral deposits, supporting potential licensing and joint venture opportunities.

VANCOUVER, BC / ACCESS Newswire / January 29, 2026 / Temas Resources Corp. (" Temas " or the " Company ") (CSE:TMAS)(ASX:TIO)(OTCQB:TMASF)(FSE:26P0) is pleased to provide an update on the advancement and commercialisation of its patented Regenerative Chloride Leach ("RCL") metallurgical platform.

As announced on October 30, 2025, Temas acquired 100% ownership of ORF Technologies Inc., securing a portfolio of eleven (11) granted patents covering a novel mixed-chloride hydrometallurgical processing platform developed over more than 50 years within a Government of Canada-funded research organisation. Temas refers to this platform technology as RCL.

The Company is advancing RCL as a standalone, technology-led business, intended to generate value through licensing, joint ventures and internal deployment, while also enhancing the economics of Temas' wholly owned titanium-vanadium projects in Quebec, Canada.

The Company views RCL as a scalable metallurgical platform with the potential to generate value through both internal application and external commercialisation across multiple commodities.

RCL Platform Overview

RCL is an innovative, advanced hydrometallurgical platform designed for the efficient extraction of metals from complex mineralization, concentrates, slags and tailings in an environmentally responsible manner.

Key attributes of the RCL platform include:

-

Ability to process low-quality feedstocks and render high-value end products.

-

Atmospheric pressure and lower-temperature operation relative to conventional chloride or sulphide routes.

-

Closed-loop reagent recycling delivering materially lower operating costs and reduced environmental footprint.

-

Enhance the recovery of critical metals, battery metals, platinum group minerals, precious and base metals and rare earth elements.

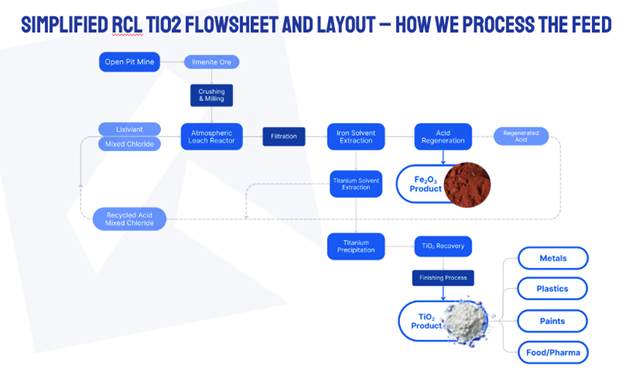

Figure 1: Simplified RCL TiO 2 flowsheet and layout - how we process the feed

Pilot-Scale Validation and Metallurgical Results 3

Temas has completed extensive bench-scale and pilot-scale testing of the RCL platform using material from its La Blache titanium-vanadium project in Quebec, Canada.

Key outcomes include:

-

Processing of approximately 830 kg La Blache deposit material, producing 88 kgs of optimised TiO 2 powder grading 99.8% purity.

-

Two-stage leach yielding 80-85% titanium recovery and ~95% iron recovery, with further improvements expected through scale-up and closed-loop circulation.

-

Solvent strip extraction demonstrates rapid and selective separation, removing 99.9% of iron from solution .

-

Planned pyrohydrolysis testing to yield a premium Fe 2 O 3 product (> 99% pure) targeting high-end pigment and battery grade specifications.

Pilot-scale testing and associated process evaluation have demonstrated operating cost reductions exceeding 65% for TiO 2 production relative to conventional processing routes. These efficiencies are driven by capture of high-value co-products, high reagent recycling rates, reduced energy consumption and simplified process flowsheets and are expected to translate across other commodities and deposit types.

3 Source: Temas Resources Corp. "Pilot Scale Evaluation of Temas La Blache Ilmenite - Final Report PRO 21-16," 24 June 2022

Expanded Metallurgical Program and Near-Term Technology Catalysts for RCL Development

Temas is currently evaluating the HQ Core from the recently completed 2025 drill program4, as well as over 36,800 meters of historic drill core from previous drilling at La Blache, to further enable the optimisation and scale up of the RCL technology.

The material is undergoing further RCL metallurgical testing and optimisation to:

-

enhancing the recovery of vanadium (V 2 O 5 ) from the La Blache massive oxides; and

-

initiating process development for the recovery of Gallium (Ga) and Scandium (Sc) values in the Fe/Ti oxide mineralization at La Blache, which were not previously targeted.

The identification of Gallium and Scandium as critical and strategic minerals in North America has fostered an incentive to re-shore their production into North America. Temas recognises these additional critical and rare earth elements as a potential value enhancement to the La Blache Project and is initiating a program to optimize the recovery of Ga and Sc at La Blache.

This expanded metallurgical program is designed to further optimise recoveries, validate closed-loop circulation and benefits and broaden the application of the RCL platform beyond titanium into additional critical and strategic metals. Outcomes from this work are expected to directly inform both internal project development and external licensing discissions.

Initial results from this program are expected to be available later this quarter, with further updates anticipated into Q1 - Q2 2026.

Technology Commercialisation and Third-Party Evaluation

The RCL platform is currently being evaluated by multiple third-party mining and materials companies globally as a metallurgical solution for complex mineral deposits, with discussions progressing under confidentiality arrangements.

Companies are currently evaluating RCL for mineral processing operations include:

-

Indonesia (Ni/Co/Mg/Fe),

-

Australia (Au/Fe),

-

British Columbia, (Au/Ag/Zn/Pb), and

-

Ontario, Canada (TiO 2 /V/Mg/Fe)

These evaluations are focused on potential technology licensing and/or joint venture opportunities, reinforcing that the Temas RCL technology is not only key to unlocking the value of our own internally generated projects, but it has significant potential to enhance the extraction and recovery of many types of complex mineralised systems around the world.

4 ASX Announcement, 27 Nov 2025 - Temas Completes Drill Program Targeting Critical Minerals and Rare Earth Elements

Mr. Tim Fernback, Temas Chief Executive Officer commented:

"The advancement of the RCL metallurgical processing technology is central to Temas' long-term strategy. Alongside our existing critical mineral assets in North America, we are building a standalone, technology-led business focused on licensing, partnerships, and joint ventures with a strategy to expand our global presence in the world of advanced metallurgical processing.

This capital-light approach has the potential to create scalable, repeatable value while also enhancing the economics of our own projects, which serve as feedstock for the continued development and validation of our processing technology.

As RCL continues to demonstrate its applicability across multiple commodities deposit types, it provides Temas with multiple pathways to growth and value creation."

Mr. David Caldwell, Temas Chief Operating Officer commented :

"The RCL metallurgical platform represents a highly advanced and difficult to replicate solution that has been developed and refined over several decades. What differentiates RCL is not only the depth of Intellectual Property, but the level of demonstrated pilot-scale validation achieved across several deposit types and commodities.

These results demonstrate that RCL can consistently produce high-purity products under comparatively mild operating conditions, with materially lower operating costs and enhanced value creation through the capture of high-value co-products. This combination of technical maturity, economic performance, and scalability positions RCL as a genuinely commercial platform rather than an experimental process."

- ENDS -

Approved for Release by the Board of Directors

For further information, contact:

|

Tim Fernback

|

Jane Morgan

|

Follow us:

https://temasresources.com/

https://x.com/TMASResources

https://www.linkedin.com/company/temas-resources-corp/

Foreign Resource Cautionary Statements

Details regarding the foreign resource estimate, project details and associated exploration results are set out in the Company's Prospectus. The Company confirms that it is not aware of any new information or data that materially affects the information included in the La Blache Project description in the Prospectus. The Company confirms that all material assumptions and technical parameters underpinning the foreign resource estimate and exploration results in this original Prospectus continue to apply and have not materially changed. The estimates of the quantity and grade of mineralisation for the La Blache Project referred to in this document and set out in the La Blache Project in the Prospectus are "foreign estimates" within the meaning of the ASX listing rules and are not reported in accordance with the JORC Code 2012. A competent person has not undertaken sufficient work to classify the foreign estimates as mineral resources in accordance with the JORC Code 2012. It is uncertain that following evaluation and further exploration work that the foreign estimates will be able to be reported as mineral resources in accordance with the JORC Code.

Foreign Resource Cautionary Statements

Details regarding the foreign mineral resource estimate, project details and associated exploration results are set out in the Company's Prospectus dated 29 August 2025 (the "Prospectus"). The Company confirms that it is not aware of any new information or data that materially affects the information included in the La Blache Project description in the Prospectus. The Prospectus is available on the Company's website at www.temasresources.com/investors or through the ASX platform under announcement dated 15 July 2025 .

The Company confirms that it is not aware of any new information or data that materially affects the information included in the La Blache Project description in the Prospectus. The Company confirms that all material assumptions and technical parameters underpinning the foreign resource estimate and exploration results in this original Prospectus continue to apply and have not materially changed. The estimates of the quantity and grade of mineralisation for the La Blache Project are set out in the La Blache Project in the Prospectus and are "foreign estimates" within the meaning of the ASX listing rules and are not reported in accordance with the JORC Code 2012. A competent person has not undertaken sufficient work to classify the foreign estimates as mineral resources in accordance with the JORC Code 2012. It is uncertain that following evaluation and further exploration work that the foreign estimates will be able to be reported as mineral resources in accordance with the JORC Code.

Disclaimer

No representations or warranty, express or implied, is made by the Company that the material contained in this announcement will be achieved or proved correct. Except for the statutory liability which cannot be excluded, each of the Company, its directors, officers, employees, advisors, and agents expressly disclaims any responsibility for the accuracy, fairness, sufficiency or completeness of the material contained in this announcement and excludes all liability whatsoever (including in negligence) for an loss or damage which may be suffered by any person as a consequence of any information in this announcement or any effort or omission therefrom. The Company will not update of keep current the information contained in this announcement or to correct any inaccuracy or omission which may become apparent, or to furnish any person with any further information. Any opinions expressed in the announcement are subject to change without notice.

Competent Person's / Qualified Person's Statement

The information in this announcement that relates to Exploration Results and Mineral Resources for the La Blache and Lac Brûlé Titanium-Vanadium Projects in Québec, Canada, is based on, and fairly represents, information and supporting documentation prepared and compiled by Mr Blake Collins, BSc (Hons), MAIG, and Principal Consultant of Head Exploration Pty Ltd.

Mr Collins is a Member of the Australasian Institute of Geosciences (MAIG). He has sufficient experience that is relevant to the style of mineralisation, the type of deposit under consideration, and the activity being undertaken to qualify as a Competent Person as defined in the 2012 Edition of the Australasian Code for Reporting of Exploration Results, Mineral Resources and Ore Reserves (JORC Code 2012) and as a Qualified Person as defined by NI43-101.

Mr Collins is the Principal Consultant of Head Exploration Pty Ltd, which provides independent geological and technical advisory services to Temas Resources Corp. He has reviewed the information presented in this announcement and consents to the inclusion in the report of the matters based on his information in the form and context in which they appear. Head Exploration Pty Ltd as an independent geological and technical consultancy and has no direct or indirect interest in Temas Resources Corp.

ABOUT TEMAS RESOURCES

Revolutionising Metal Production

Proprietary IP. Global Licensing. Titanium & Critical Minerals.

Temas Resources Corp. (ASX:TIO)(CSE:TMAS)(OTCQB:TMASF)(FRA:26P0) is a technology-driven critical minerals company advancing a dual-business model built around proprietary processing innovation and strategic mineral ownership. The Company's patented Regenerative Chloride Leach (RCL) technology platform delivers significant operational cost reductions - validated at up to 65% lower than traditional processing - while dramatically reducing energy use and environmental impact.

Temas' RCL process is the foundation of its technology licensing and partnership business, enabling global mining and materials companies to adopt sustainable, high-margin metal extraction methods across a range of critical minerals including titanium, vanadium, nickel, and rare earth elements.

Complementing its technology division, Temas also owns 100% of two advanced titanium-vanadium-iron projects in Québec, Canada - La Blache and Lac Brûlé - which are strategically positioned to feed directly into the Company's proprietary processing platform, creating a fully integrated mine-to-market supply chain for Western metals.

Through this combination of innovative IP commercialisation and resource ownership, Temas Resources is positioned to deliver scalable, low-carbon solutions that strengthen Western critical-mineral independence and create long-term value for shareholders.

Benefits the ORF - RCL Technology:

The RCL platform technology involves the hydrometallurgical mineral extraction of concentrates, whole ores, slags and tailings to enhance recovery of critical metals, battery metals, Platinum Group Minerals ("PGMs"), precious and base metals and Rare Earth Element ("REE") recovery at materially higher through-yields and lower capital and operating costs than many of the conventional approaches that are in use traditionally. This novel RCL technology is ideally suited to treat increasingly complex ores in an environmentally sensitive manner.

Pilot Testing Complete: The Company has completed a pilot test of approximately 1 ton of material from its La Blache TiO 2 mineral property yielding 88 kgs of a 99.8% pure TiO 2 commercial grade product. [1]

Validated Cost Reduction: A significant cost reduction of over 65% [2] is validated for TiO 2 processing using the RCL platform technology (e.g., reagent recycling, potentially lower energy use, optimized recovery etc.). These fundamental process efficiencies are expected to translate into economic advantages when applying the platform to Nickel or other target minerals hosted in complex ores.

Environmental Performance: The closed-loop design and high reagent recycling rates are core to the RCL platform, irrespective of the target mineral. Over 69% lower operating costs compared to conventional processing due to its core features operating at near ambient temperatures. [3] This means the reduced environmental footprint and enhanced ESG profile are benefits that extend to ores and minerals previously noted, not just TiO 2 .

High Recovery Potential: Just as we've demonstrated high-quality, 99.8% TiO 2 product from pilot testing1 the RCL platform is engineered for high recovery and purity of all target metals. Our metallurgical expertise focuses on optimizing these recoveries and maximizing margins for each specific mineral.

RCL results in a quicker and more complete liberation of the target metals using atmospheric pressure and lower temperatures than competing methods and improves the selectivity and efficiency of subsequent solvent extraction steps. Management believes that this novel metallurgical process can be applied to many complex resource deposits worldwide, enhancing both extraction and recovery for the operator.

Follow us:

https://temasresources.com/

https://x.com/TMASResources

https://www.linkedin.com/company/temas-resources-corp/

Cautionary Note Regarding Forward-Looking Statements

Neither the Canadian Securities Exchange nor the Market Regulator (as that term is defined in the policies of the Canadian Securities Exchange) accepts responsibility for the adequacy or accuracy of this news release.

This press release contains forward looking statements within the meaning of applicable securities laws. The use of any of the words "anticipate", "plan", "continue", "expect", "estimate", "objective", "may", "will", "project", "should", "predict", "potential" and similar expressions are intended to identify forward looking statements

Although the Company believes that the expectations and assumptions on which the forward-looking statements are based are reasonable, undue reliance should not be placed on the forward-looking statements because the Company cannot give any assurance that they will prove correct. Since forward looking statements address future events and conditions, they involve inherent assumptions, risks and uncertainties. Actual results could differ materially from those currently anticipated due to a number of assumptions, factors and risks. These assumptions and risks include, but are not limited to, assumptions and risks associated with mineral exploration generally and results from anticipated and proposed exploration programs, conditions in the equity financing markets, and assumptions and risks regarding receipt of regulatory and shareholder approvals.

Management has provided the above summary of risks and assumptions related to forward looking statements in this press release in order to provide readers with a more comprehensive perspective on the Company's future operations. The Company's actual results, performance or achievement could differ materially from those expressed in, or implied by, these forward-looking statements and, accordingly, no assurance can be given that any of the events anticipated by the forward-looking statements will transpire or occur, or if any of them do so, what benefits the Company will derive from them. These forward-looking statements are made as of the date of this press release, and, other than as required by applicable securities laws, the Company disclaims any intent or obligation to update publicly any forward-looking statements, whether as a result of new information, future events or results or otherwise.

ASX Compliance Statement

This announcement relates solely to metallurgical test work undertaken on previously collected samples. No new exploration results are reported. Accordingly, only Section 3 of JORC Table 1 is applicable. The metallurgical results are based on laboratory and pilot-scale test work and are indicative only. Further work is required to confirm performance at commercial scale.

JORC Table 1 - Section 3

Metallurgical Factors or Assumptions

|

Criteria |

JORC Commentary |

|

Sample selection and representivity |

Metallurgical test work was undertaken on composite bulk samples of ilmenite ore sourced from the La Blache Project. The composite sample weighed approximately 830 kg and was prepared from 11 individual samples, however specific sample location is unknown. The material was homogenised using cone and quartering prior to test work. The samples are considered representative of the dominant mineralised material available for test work; however, they may not reflect the full range of grade or lithological variability across the deposit. |

|

Test work type |

A staged metallurgical program comprising bench-scale test work, mini-pilot testing and large pilot plant operation was completed. Test work included two-stage chloride leaching, solid-liquid separation, oxidation, solvent extraction for iron and titanium, and thermal precipitation of titanium dioxide product. |

|

Scale of test work |

Bench-scale leach tests were followed by a mini-pilot program and a large pilot plant operation processing approximately 830 kg of composite ore. Pilot circuits operated continuously for up to ~650 hours for iron solvent extraction and ~580 hours for titanium solvent extraction. |

|

Processing flowsheet |

The processing route investigated comprises crushing and grinding, two-stage hydrochloric acid leaching, flocculation and filtration, oxidation, solvent extraction for iron removal, solvent extraction for titanium recovery, stripping, and thermal precipitation to produce TiO2. |

|

Grinding and particle size |

Leaching test work utilised feed material ground to approximately 90% passing 65 mesh. |

|

Leach conditions |

Two-stage leaching was conducted at temperatures of approximately 70°C using hydrochloric acid (5.8 N) and magnesium chloride, with pulp densities of approximately 10-15%. |

|

Recovery factors |

Average recoveries achieved during pilot operations were approximately: Ti 75-85%, Fe 93-95%, and V 99-100%. Recovery ranges varied between mini-pilot and large pilot phases. |

|

Product specification |

The titanium solvent extraction circuit produced a titanium-rich strip liquor with average titanium concentrations of approximately 33 g/L, which was subsequently thermally precipitated to produce TiO2 product. Approximately 90 kg of TiO2 product was generated during pilot operations. |

|

Mass balance and recoveries |

Material balances were calculated for leaching and solvent extraction circuits based on solution assays and solids analysis. Recoveries are indicative only and subject to analytical and operational variability. |

|

Impurities and deleterious elements |

Impurity build-up was monitored during pilot operation, including aluminium, calcium, magnesium, manganese, sodium, chromium and sulphur. Scrubbing stages in the titanium solvent extraction circuit were used to reduce impurity levels in final product streams. |

|

Metallurgical domains |

No discrete metallurgical domains have been formally defined. Test work was conducted on a single composite sample representing available bulk material as a preliminary assessment of project material extractability. Variability testing has not yet been completed. |

|

Process optimization |

The flowsheet represents a conceptual process route derived from laboratory and pilot-scale testing. Further optimisation and variability test work is required prior to commercial design. |

|

Reagents |

Hydrochloric acid, magnesium chloride, organic extractants, ammonia for precipitation, and flocculants were used during test work. Reagent consumptions were not optimised for commercial operation. |

|

Environmental considerations |

Environmental, permitting, tailings management and waste disposal considerations have not been assessed as part of the metallurgical program. |

|

Infrastructure requirements |

Infrastructure assumptions, power requirements and water balance have not been assessed at a project scale. |

|

Commercial status |

The metallurgical test work is at laboratory and pilot scale only and does not constitute a feasibility study. Results are indicative and subject to scale-up risk. |

|

Economic implications |

The metallurgical results do not imply economic viability and should not be interpreted as demonstrating commercial or economic extraction. |

|

Limitations |

The results are based on composite material and limited variability. Further metallurgical variability test work is required to assess performance across the full deposit. |

|

Recovery assumptions for resources |

No modifying factors have been applied to any Mineral Resource estimate based on this metallurgical work. |

[1] ASX Announcement, 30 October 2025 - Temas Exercises Option to Purchase 100% of ORF Technologies

[2] These metallurgical test results and cost-reduction data were first reported in the Company's Canadian market announcement dated 13 April 2021, titled "Temas Resources Acquires 50 % of Green Mineral Process Developer ORF Technologies Inc."

[3] Source: Temas Resources Corp. "Pilot Scale Evaluation of Temas La Blache Ilmenite - Final Report PRO 21-16," 24 June 2022

[1] Source: Temas Resources Corp. "Pilot Scale Evaluation of Temas La Blache Ilmenite - Final Report PRO 21-16," 24 June 2022

[2] These metallurgical test results and cost-reduction data were first reported in the Company's Canadian market announcement dated 13 April 2021, titled "Temas Resources Acquires 50 % of Green Mineral Process Developer ORF Technologies Inc."

[3] The cost-reduction figure is supported by independent evaluation conducted by the Natural Resources Research Institute (University of Minnesota, 2017) and subsequent pilot-scale validation by ORF Technologies Inc., as detailed in Temas Resources news releases of 2021 and 2022.

SOURCE: Temas Resources Corp.

View the original press release on ACCESS Newswire