Writer: Kevin Dwyer CEO,Head Trader

Writer: Kevin Dwyer CEO,Head Trader January 23, 2024

Stock Chart Pegasus Resources Inc

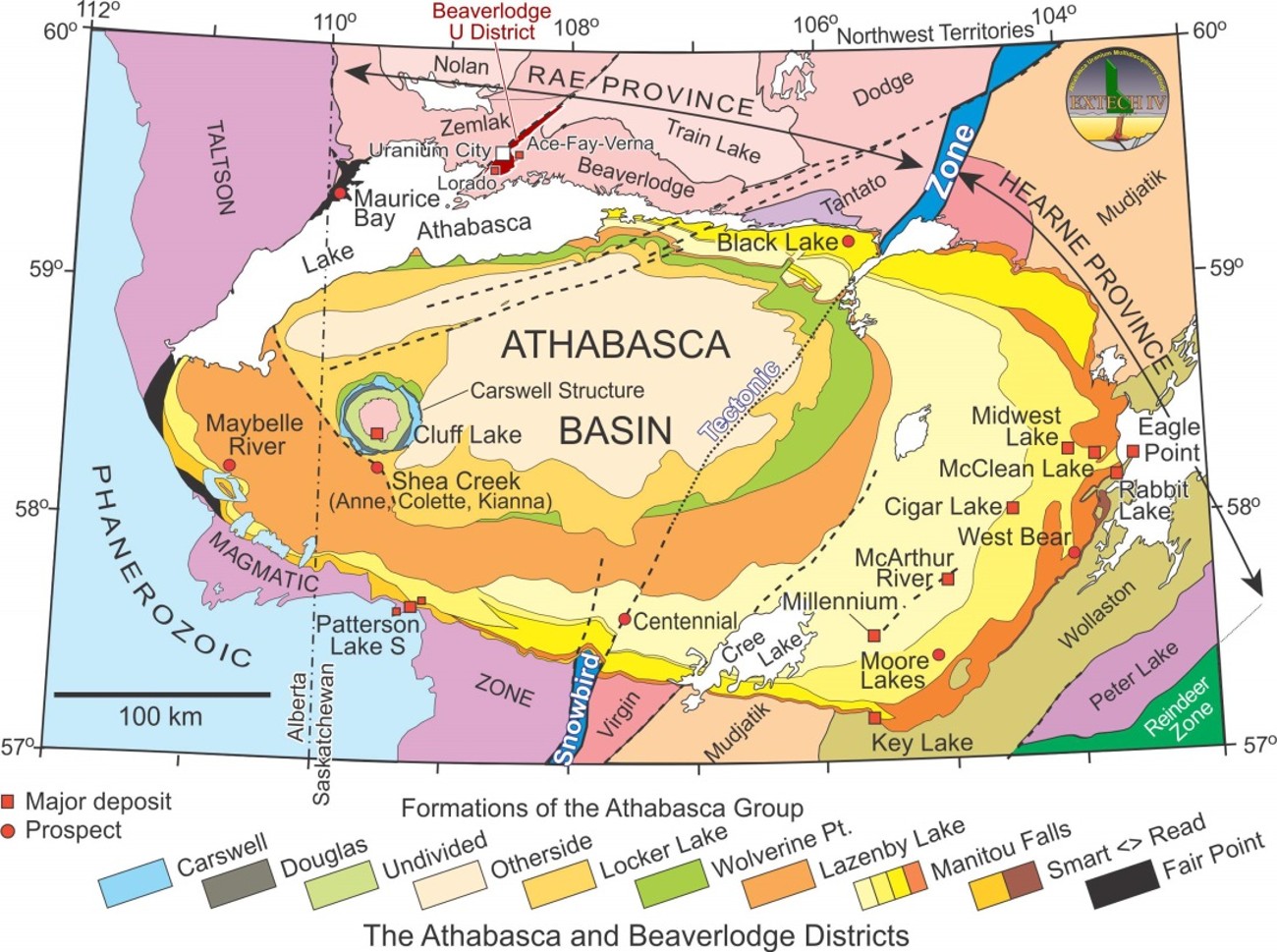

UNCOVERING THE URANIUM WEALTH OF THE ATHABASCA BASIN

Nestled in the northern reaches of Saskatchewan and Alberta in Canada, the Athabasca Basin is an emblem of the intricate dance between natural resource extraction and environmental stewardship. Known primarily for its rich uranium deposits, this region has played a pivotal role in the world of nuclear energy since the mid-20th century.

THE DAWN OF URANIUM MINING

The landscape of the Athabasca Basin morphed significantly with the discovery of uranium in the 1940s. It wasn't long before ventures like Eldorado Mining and Refining Limited, which later evolved into the illustrious Cameco Corporation, heralded the nascent uranium industry into a new era. These initial steps laid the framework for a sector that would burgeon into a global powerhouse, aiding in the generation of nuclear power across the globe.

A PRECIOUS DISCOVERY

By the early 1970s, the unveiling of high-grade uranium ore transformed the Athabasca Basin into a hotbed of exploration and commercial mining titans. The McArthur River Mine and Cigar Lake Mine stand out as monuments to this expansion, both being chief contributors to the region's output and operated significantly by Cameco. These sites underline the scale of development that has propelled the Athabasca Basin to be synonymous with premier uranium reserves.

THE LIFEBLOOD OF NUCLEAR ENERGY

The uranium extracted from the heart of the Athabasca Basin is not simply a local commodity; its reach extends far beyond, integrating itself into the nuclear energy infrastructure worldwide. This Canadian region underpins a significant portion of the international nuclear power generation capacity through crucial exports, underscoring the basin's influence on the modern energy landscape.

NAVIGATING THROUGH CHALLENGES

The journey from mineral discovery to finished nuclear fuel is not without its trials. The Athabasca Basin's mining endeavours have drawn scrutiny due to the imperatives of environmental conservation and meticulous regulatory frameworks. The stakeholders in this uranium-rich territory are constantly balancing the efficient harnessing of this resource with the principles of ecological responsibility and safety, ensuring mining procedures comply with stringent standards.

A HAVEN FOR WILDLIFE AND WONDERS

The unique geography of the Athabasca Basin dotted with an array of wildlife, dunes, and the scars of a meteorite collision, further accentuate the significance of regulatory prudence. Approximately 20 percent of the world's supply of uranium originates from this Canadian treasure trove, a testament to its unparalleled bounty. Resources are readily available for those yearning to delve deeper into the history and current state of The Athabasca Basin's mining landscape. Wikipedia provides an encyclopedic account of the region's geology and ecology. In contrast, DigiGeoData offers insightful summaries of past and present exploration activities, complete with timelines and maps charting the course of this industrious locale. In summary, the Athabasca Basin is not merely a ground of extraction; it is a crucible of careful progress, where the forces of industry, environment, and innovation coalesce, forging the future of energy one atom at a time.

Investment Disclosure

The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada