THIS NEWS RELEASE IS INTENDED FOR DISTRIBUTION IN CANADA ONLY AND IS NOT INTENDED FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES NOR FOR DISSEMINATION IN THE UNITED STATES.

Vancouver, British Columbia--(Newsfile Corp. - February 25, 2026) - Tincorp Metals Inc. (TSXV: TIN) ("Tincorp" or the "Company") is pleased to announce that on February 24, 2026, it entered into a share purchase agreement (the "Agreement") with Silvercorp Metals Inc. (TSX: SVM) (NYSE American: SVM) ("Silvercorp") and its wholly-owned subsidiary, Adventus Mining Corporation ("Adventus", together with Silvercorp, the "Vendors"). Pursuant to the Agreement, the Company will acquire the Santa Barbara Gold-Copper Project (the "Project"), located in the Zamora Copper-Gold Belt in southeastern Ecuador, through the acquisition of the Vendors' wholly-owned subsidiary, Santa Barbara Metals Inc. (the "Holding Company"), as further described below.

Victor Feng, Interim CEO of Tincorp, commented,"We are excited to be acquiring this large gold-copper asset. This is a beneficial transaction for our shareholders, providing exposure to both gold and copper in Ecuador, one of the world's most prolific and emerging mining jurisdictions. We look forward to closing this transaction and moving quickly to upgrade and expand the known resource through future drill programs, creating meaningful value for all stakeholders."

Santa Barbara Gold-Copper Project Overview

Location and Access

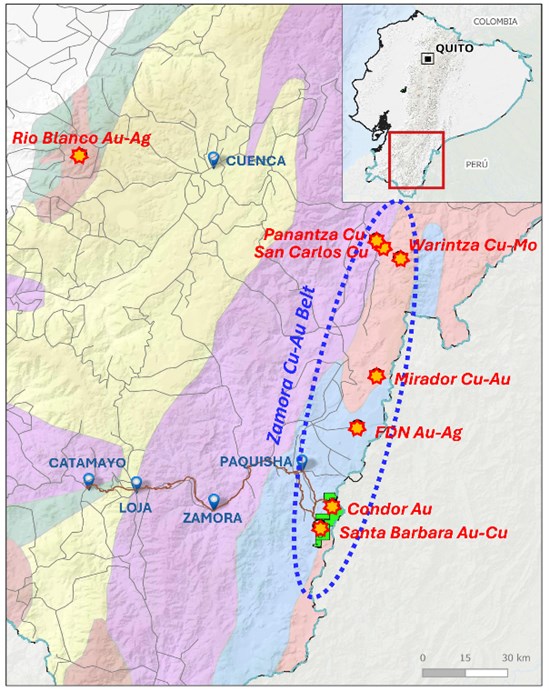

The Project is located in the Zamora-Chinchipe Province in southeastern Ecuador, approximately 76 kilometers ("km") east of the city of Zamora, at a low elevation of 1,000-1,100 metres ("m") (Figure 1). Access to the Project is roughly a four-hour drive from the nearest airport at Catamayo city over 161 km of paved road and 13 km of year-round dirt road. The Project holds a valid environmental permit allowing for exploration and drilling activities across six concessions covering an area of 52 square kilometres ("km2").

The Project is 10 km south of Silvercorp's Condor Project, 36 km south of Lundin Gold Inc.'s Fruta Del Norte Mine, 56 km south of CRCC-Tongguan Investment (Canada) Co., Ltd.'s Mirador Mine, and 96 km south of Solaris Resources Inc.'s Warintza Project.

Figure 1: Map of Project Location

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7553/285335_db9469f054a53ab4_003full.jpg

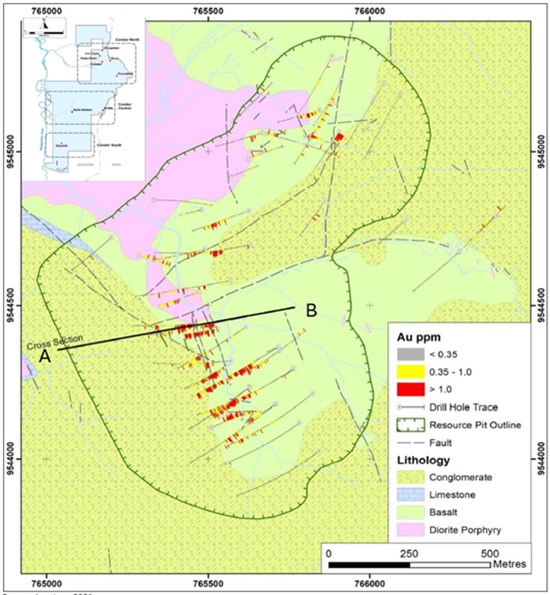

Historical Mineral Resource Estimate

Multiple mineral resource estimates were completed following staged drilling programs by previous companies, which outlined a bulk tonnage gold-dominated porphyry gold-copper deposit. The latest mineral resource estimate(1)(2) for the Project was completed in 2021 by a previous owner, Luminex Resources, summarized in the table below.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7553/285335_db9469f054a53ab4_004full.jpg

(1) The historical mineral resource estimate is derived from the technical report titled "Condor Project NI 43-101 Technical Report on Preliminary Economic Assessment" prepared by MTB Enterprises Inc. in accordance National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), for Luminex Resources, with an effective date of July 28, 2021 (the "Historical Report"). The historical mineral resource estimate reports resources within an optimized open-pit shell using a cut-off grade of 0.37 g/t gold equivalent ("AuEq") with assumptions of metal price: US$1,500/oz Au, US$18/oz Ag, US$3.0/lb Cu, mining cost $2.0/t, process cost $11.5/t, G&A $2.0/t, gold process recovery 87%, silver process recovery 70% and copper process recovery 80%, pit slope 45 degrees. AuEq = Au g/t + (Ag g/t × 0.012) + (Cu% x 1.371). The block models for the Santa Barbara deposits use a nominal block size measuring 10 ×10 × 10 m. Grade estimates for gold and silver and copper at Santa Barbara (Condor Central) were estimated using ordinary kriging (OK).

(2) The Company considers the historical estimates to be relevant as they provide an indication of the potential of the Project. However, a qualified person of Tincorp has not done sufficient work to classify these historical estimates as current mineral resources, and Tincorp is not treating these historical estimates as current mineral resources or mineral reserves. Tincorp has not verified this information and is not relying on it. To verify the historical mineral resource estimate, Tincorp will prepare an updated mineral resource estimate and technical report in accordance with NI 43-101 with respect to the Project (the "New Report"). Tincorp is currently preparing the New Report and intends to file it on SEDAR+ upon the completion of the Proposed Acquisition in accordance with the policies of the TSX Venture Exchange and applicable securities laws.

Geology and Mineralization3

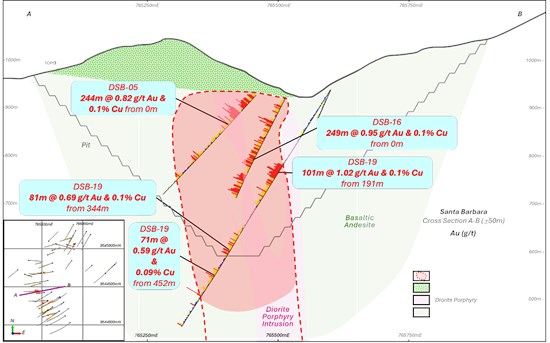

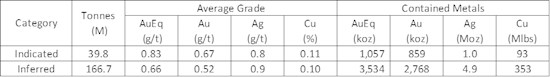

The Project is located within the Zamora Copper-Gold Metallogeny Belt which hosts numerous significant deposits such as the Fruta del Norte epithermal gold deposit, the Mirador porphyry copper-gold deposit, the Warintza copper-moly deposit, and the Condor epithermal gold deposit. At Santa Barbara, gold and copper mineralization is hosted in alkalic basaltic andesite and porphyritic diorite dykes. The age of the basaltic andesite is unknown but likely belongs to the Piuntza Formation of Triassic-Lower Jurassic age, which also hosts epithermal gold mineralization at the Fruta del Norte Mine.

The mineralized zone defined to date has dimensions of 1.2 km north-south, 500 m east-west, and extends to a depth of more than 500 m. The Project remains open in all directions and at depth. Figure 2 shows a plan view of Santa Barbara highlighting the local geology and gold intercepts from past drilling. Figure 3 shows an east-west oriented vertical cross-section looking towards the north.

Figure 2: Plan Map of Santa Barbara

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7553/285335_db9469f054a53ab4_005full.jpg

Figure 3: East-West Cross Section at Santa Barbara

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7553/285335_db9469f054a53ab4_006full.jpg

Exploration History3

Modern mineral exploration at the Project began in the late 1980s. Between 1988 and 2018, previous owners conducted extensive surface programs including geological mapping, soil and stream sediment sampling, outcrop rock chip sampling, surface trenching, and ground magnetic and induced polarization surveys. This work led to the discovery of the majority of the prospects and deposits now known within the Project area and surrounding region.

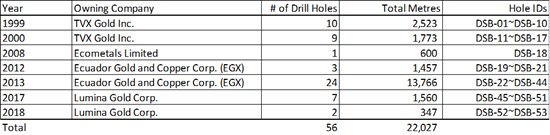

A total of 22,027 m of diamond drilling in 56 holes were completed by various owners from 1999 until 2018. The table below provides a summary of all drilling completed at the Project to date.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/7553/285335_db9469f054a53ab4_007full.jpg

(3) The technical information describing the geology and exploration history is derived from the technical report titled "Condor Project NI 43-101 Technical Report on Preliminary Economic Assessment" prepared by MTB Enterprises Inc. in accordance National Instrument 43-101 - Standards of Disclosure for Mineral Projects ("NI 43-101"), for Luminex Resources, with an effective date of July 28, 2021 (the "Historical Report").

Opportunities and Plan for Next Steps

The Company believes historical drill results justify further drilling to upgrade the known mineralized zones and to test new targets evidenced by historical surface geochemical sampling results. The Company anticipates that the gold and copper mineral resources at Santa Barbara have the potential to be upgraded and expanded with continued exploration and drilling campaigns.

The Company plans to mobilize three drill rigs to conduct a 10,000 m phase 1 drill program upon closing of the Proposed Acquisition ("Acquisition Closing") to:

- Confirm historical drill results,

- Complete infill drilling to upgrade existing mineral resources, and

- Obtain fresh drill core to further understand the mineralization controls and metallurgy at Santa Barbara.

Transaction Structure and Related-Party Disclosure

Under the terms of the Agreement and subject to the approval of the TSX Venture Exchange ("TSXV"), Tincorp will acquire all of the shares of the Holding Company (the "Proposed Acquisition") in consideration for Tincorp issuing to the Vendors 15,000,000 common shares of Tincorp at a deemed price of C$0.40 per share at Acquisition Closing, representing consideration of C$6,000,000 (the "Consideration Shares") and paying an additional US$13.5M to the Vendors in four installments as follows: 1) US$1.5M cash upon Acquisition Closing, 2) US$2.5M cash on the first-year anniversary of the Acquisition Closing date, 3) US$4.0M cash on the second-year anniversary of the Acquisition Closing date, and 4) US$5.5M in cash or shares at the Vendors' election on the third-year anniversary of the Acquisition Closing date, with any share issuance subject to a minimum price of C$0.40 per common share and TSXV approval at the time of issuance. The maximum number of common shares of the Company issuable to the Vendors under the Agreement is 33,848,500 shares. The Consideration Shares are expected to be subject to applicable resale restrictions and will be subject to the escrow requirements, if any, as determined by the TSXV. As part of the Agreement, the Vendors will also receive a 1.5% net smelter return (NSR) royalty on the Project pursuant to a royalty agreement to be entered into upon Acquisition Closing. Tincorp will have the option to repurchase two-thirds of this NSR royalty (a 1% NSR royalty) in exchange for US$10 million. As security for the deferred purchase price payments and the NSR royalty, Tincorp will grant the Vendors a pledge over the shares of the Holding Company and a security interest on the mining concessions comprising the Project, in each case pursuant to a security agreement to be entered into at Acquisition Closing. Immediately prior to Acquisition Closing, the Holding Company will be the indirect beneficial owner of the mining concessions comprising the Project. The transfer of concessions is subject to Ecuadorian regulatory approval.

The Agreement provides that completion of the Proposed Acquisition is subject to several conditions including, among other things:

-

completion of a concurrent financing as described below;

-

receipt of all regulatory approvals and third-party consents, including TSXV approval;

-

receipt of required shareholder approvals; and

-

completion of customary closing conditions.

The Proposed Acquisition will be considered a "related-party transaction" within the meaning of TSXV Policy 5.9 – Protection of Minority Security Holders in Special Transactions and Multilateral Instrument 61-101 – Protection of Minority Security Holders in Special Transactions ("MI 61-101"). The Proposed Acquisition will also require the approval of shareholders under TSXV Policy 5.3 – Acquisitions and Dispositions of Non-Cash Assets. See "Shareholder Approval" below.

The Company intends to hold a special meeting of shareholders (the "Meeting") to obtain the Minority Approval and Disinterested Shareholder Approval (each as defined below). Details of the Proposed Acquisition and the Meeting will be set out in Tincorp's management information circular and proxy statement to be prepared in respect of the Meeting which will be mailed to Tincorp's shareholders and will be available on the Company's SEDAR+ profile at sedarplus.ca. A copy of the Agreement will also be available on the Company's SEDAR+ profile at sedarplus.ca. Shareholders should refer to those documents for additional details with respect to the Proposed Acquisition.

Completion of the Proposed Acquisition is currently expected by the end of April 2026 subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including the approval of the TSXV.

Concurrent C$16M Private Placement

The Company further announces that it has entered into an agreement with Raymond James Ltd. ("Raymond James"), as sole bookrunner and lead Agent, on behalf of a syndicate of Agents including ATB Cormark Capital Markets (collectively the "Agents") in connection with a "best efforts" private placement of up to 25,000,000 subscription receipts of the Company (the "Subscription Receipts") at a price of C$0.40 per Subscription Receipt (the "Issue Price") for aggregate gross proceeds to the Company of up to C$10,000,000 (the "Brokered Offering"). In addition, the Company plans to complete a concurrent non-brokered financing of Subscription Receipts on the same terms as the Brokered Offering for aggregate gross proceeds of approximately C$6,000,000 for a combined total gross proceeds of up to C$16,000,000 (the "Non Brokered Offering", together with the Brokered Offering, referred to as the "Offering"). The Offering is being conducted in conjunction with the Company's Proposed Acquisition. The Company does not expect that the Offering will result in the creation of any new control person of the Company.

Each Subscription Receipt shall, upon satisfaction of the Escrow Release Conditions (as defined below) and without the payment of any additional consideration and with no further action on behalf of the holder, automatically convert into one unit of the Company (a "Unit"). Each Unit will consist of one common share of the Company (each, a "Common Share") and one-half of one Common Share purchase warrant (each whole warrant, a "Warrant"). Each Warrant will entitle the holder to acquire one Common Share (each, a "Warrant Share") at an exercise price of C$0.65 per Common Share at any time up to 24 months from the closing date of the Offering.

The Company has also granted the Agents an option to sell up to an additional 15% of the number of Subscription Receipts sold pursuant to the Offering at the Issue Price for additional gross proceeds in whole or in part at any time up to 48 hours prior to the closing date of the Brokered Offering.

The gross proceeds of the Offering less (i) 50% of the Commission (as defined below) to be paid upon closing of the Brokered Offering and (ii) certain expenses of the Agents (such net amount, the "Escrowed Proceeds"), will be placed into escrow and released to the Company, subject to the receipt of all required corporate, shareholder and regulatory approvals in connection with the Proposed Acquisition and the completion or satisfaction of all escrow release conditions (collectively, the "Escrow Release Conditions") as set out in the agency agreement to be entered into among the Company and the Agents in connection with the Brokered Offering. Escrow Release Conditions include:

- the completion, satisfaction or waiver all conditions precedent to the completion of the Acquisition in accordance with the Agreement, other than any condition precedent requiring the release of the escrowed funds and such conditions precedent that by their nature are to be satisfied at the closing of the Acquisition;

- all necessary approvals or consents for the completion of the Acquisition and the Offering, including the issuance of the Common Shares and Warrants upon the exchange of the Subscription Receipts, and the issuance of the Warrant Shares upon due exercise of the Warrants, having been obtained;

- delivery of customary legal opinions;

- the Company has available to it all other funds required to complete the Company's obligations under the Agreement in connection with the Acquisition Closing; and

- the Company and Raymond James having delivered a joint notice to the Subscription Receipt Agent confirming that the conditions set forth above have been satisfied or waived.

Provided that the Escrow Release Conditions are satisfied or waived (where permitted) prior to 5:00 p.m. (Toronto time) on the date that is 120 days after closing of the Offering (the "Release Deadline"), the remaining 50% of the Commission (and any interest earned thereon) and certain expenses of the Agents will be released to the Agents from the Escrowed Proceeds, and the balance of the Escrowed Proceeds (together with interest earned thereon) will be released to the Company. However, in the event that the Escrow Release Conditions are not satisfied by the Release Deadline, or if prior to such time, the Company advises the Agents or announces to the public that it does not intend to satisfy the Escrow Release Conditions, an amount equal to the aggregate Issue Price of the Subscription Receipts together with the pro rata portion of any interest earned thereon (net of any applicable withholding tax) will be returned to the holders of the Subscription Receipts and the Subscription Receipts and Compensation Warrants will be cancelled.

The Company intends to use the net proceeds from the Offering as set out in the table below:

| Item | Percentage of Net Proceeds of Offering to be Used |

| Santa Barbara Project Phase 1 Drill Program | 25% |

| Santa Barbara Project Potential Phase 2 Drill Program | 25% |

| 1st Year Anniversary Cash Payment to the Vendors pursuant to the Agreement | 23% |

| Upfront Cash Payment to the Vendors pursuant to the Agreement | 13% |

| General & Administrative | 8% |

| Ecuador Operations | 5% |

| Acquisition Related Expenses | 1% |

The Offering is expected to close by mid-March 2026 (the "Offering Closing Date") and is subject to certain conditions including, but not limited to, the receipt of all necessary approvals, including the approval of the TSXV.

In connection with the Brokered Offering, the Agents will receive a cash commission equal to 6% of the gross proceeds (the "Commission"), 50% of which will be payable on the Offering Closing Date and 50% of which will form part of the Escrowed Proceeds payable only upon satisfaction of the Escrow Release Conditions. The Company will also issue upon satisfaction of the Escrow Release Conditions that number of compensation warrants to the Agents equal to 6% of the aggregate number of Subscription Receipts sold pursuant to the Brokered Offering (the "Compensation Warrants"). Each Compensation Warrant will be exercisable for one Common Share at the Issue Price of the Subscription Receipts for a period of 24 months following the conversion of the Subscription Receipts. The Compensation Warrants issued to the Agents are non-transferable.

In connection with the Non-Brokered Offering, the Company may pay a finder's fee in respect of those purchasers under the Non-Brokered Offering introduced to the Company by certain eligible persons (each a "Finder"). Each Finder will receive a cash payment up to 6% of the gross proceeds received by the Company from purchasers under the Non-Brokered Offering who were introduced to the Company by such Finder. 50% of any fees payable to the Finders will be paid at closing of the Non-Brokered Offering and the remaining 50% of the fees payable to the Finders will form part of the Escrowed Proceeds payable only upon satisfaction of the Escrow Release Conditions.

The Subscription Receipts, the Common Shares and the Common Shares issuable upon exercise of the Warrants and the Compensation Options shall be subject to a hold period ending on the date that is four months and one day following the Offering Closing Date as set out in National Instrument 45-102 – Resale of Securities.

Shareholder Approval

The Proposed Acquisition and the Private Placement will each be considered a "related-party transaction" within the meaning of TSXV Policy 5.9 – Protection of Minority Security Holders in Special Transactions and MI 61-101. In particular, the Proposed Acquisition is a "related party transaction" under MI 61-101 as (a) Silvercorp is a control person of the Company as Silvercorp currently owns an approximate 29.1% interest in the Company, on a non-diluted basis and (b) Mr. Rui Feng is the Chief Executive Officer and Chairman of Silvercorp and director of the Company. The Private Placement is a "related party transaction" under MI 61-101 as a result of the Private Placement being considered a "connected transaction" to the Proposed Acquisition under MI 61-101 and certain insiders of the Company are expected to subscribe for Subscription Receipts pursuant to the Offering. The Company intends to rely on the exemption from the formal valuation requirements of MI 61-101 provided under section 5.5(b) of MI 61-101 on the basis that no securities of the Company are listed or quoted on certain specified exchanges and the Company intends on seeking "minority approval" of the Proposed Acquisition and Offering as required by Section 5.6 of MI 61-101 (the "Minority Approval") at the Meeting. For the purposes of determining Minority Approval at the Meeting, the Proposed Acquisition and Offering must be approved by a majority of the votes cast by holders of Common Shares at the Meeting (present in person or by proxy), excluding the voting of any shares held by Silvercorp and its insiders and those insiders of the Company who participate in the Offering.

Disinterested shareholder approval ("Disinterested Shareholder Approval") is also required in connection with the Proposed Acquisition under TSXV Policy 5.3 – Acquisitions and Dispositions of Non-Cash Assets since (a) the issuance to the Vendors of the Consideration Shares will exceed 10% of the Company's outstanding shares on a non-diluted basis prior to the Proposed Acquisition; and (b) the Company has not provided evidence of value to the TSXV in method prescribed by the TSXV in respect of the value of the Santa Barbara Project in connection with the Proposed Acquisition. Accordingly, the Company will seek Disinterested Shareholder Approval of the Proposed Acquisition at the Meeting. For the purposes of determining Disinterested Shareholder Approval at the Meeting, the Proposed Acquisition must be approved by a majority of the votes cast by holders of Common Shares at the Meeting (present in person or by proxy) excluding the voting of any shares held by "Non-Arm's Length Parties" (as defined in the policies of the TSXV) to the Company, being Silvercorp and any Associates or Affiliates of Silvercorp (each as defined in the policies of the TSXV).

Securities Not Registered Under the US Securities Act

The securities described herein have not been, and will not be, registered under the United States Securities Act of 1933, as amended (the "U.S. Securities Act"), or any United States state securities laws, and accordingly, may not be offered or sold within the United States or to U.S. persons except in compliance with the registration requirements of the U.S. Securities Act and applicable state securities requirements or pursuant to exemptions therefrom. This press release is not an offer or a solicitation of an offer of securities for sale in the United States, nor will there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful.

Qualified Person

This news release has been reviewed and approved by Alex Zhang, Director of the Company who is the designated qualified person for the Company.

About Tincorp

Tincorp Metals Inc. is a mineral exploration company which has entered into a definitive agreement with Silvercorp to acquire Santa Barbara Metals Inc. which holds a 100% interest in the Santa Barbara Gold-Copper Project in the Zamora Copper-Gold Belt of southeastern Ecuador. The Company also owns 100% of the Porvenir Project and has signed an agreement to acquire a 100% interest in the nearby SF Project, both located 70 km southeast of Oruro, Bolivia.

On Behalf of Tincorp Metals Inc.

signed "Victor Feng"

Victor Feng, Interim CEO

For further information, please contact:

Victor Feng

Interim CEO

Phone: +1 (604)-336-5919

Email: info@tincorp.com

www.tincorp.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this news release.

Cautionary Note Regarding Forward-Looking Statements

This news release contains forward-looking statements and forward-looking information (collective, "forward looking statements") within the meaning of applicable Canadian and U.S. securities legislation. All statements, other than statements of historical fact included in this release, including, without limitation, statements regarding the completion of the Proposed Acquisition; the expected benefits of the Proposed Acquisition to Tincorp; future exploration and development activities; the filing and acceptance of an updated NI 43-101 technical report; shareholder approval of the Proposed Acquisition; statements relating to the Meeting; statements regarding the Offering and the expected use of proceeds of the Offering; the payment of finder's fees; approval of the TSXV; the expected timing of closing of the Proposed Acquisition and Offering and the participation by insiders in the Offering.

Forward-looking statements are often, but not always, identified by words or phrases such as "expects", "is expected", "anticipates", "believes", "plans", "projects", "estimates", "assumes", "intends", "strategies", "targets", "goals", "forecasts", "objectives", "budgets", "schedules", "potential" or variations thereof or stating that certain actions, events or results "may", "could", "would", "might" or "will" be taken, occur or be achieved, or the negative of any of these terms and similar expressions. Forward-looking statements are based on the opinions, assumptions, factors and estimates of management considered reasonable at the date the statements are made. The opinions, assumptions, factors and estimates which may prove to be incorrect, include, but are not limited to: that the Company will be able to obtain and maintain governmental approvals, permits and licenses in connection with its current and planned operations, development and exploration activities, including at the Project; that the Company will receive shareholder and TSXV approval for the Proposed Acquisition in a timely manner; that the conditions to the Proposed Acquisition will be satisfied or waived; that the Escrow Release Conditions will be met; the state of the equity financing markets in Canada; and other exploration, development, operating, financial market and regulatory factors.

Forward-looking statements involve known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of the Company to differ materially from any future results, performance or achievements expressed or implied by the forward-looking information. Forward-looking information is provided herein for the purpose of giving information about the Proposed Acquisition referred and its expected impact. Readers are cautioned that such information may not be appropriate for other purposes. Although the Company has attempted to identify important factors that could cause actual actions, events or results to differ from those described in forward-looking statements, there may be other factors that cause such actions, events or results to differ materially from those anticipated. There can be no assurance that forward-looking statements will prove to be accurate and accordingly readers are cautioned not to place undue reliance on forward-looking statements.

Readers are cautioned not to place undue reliance on forward-looking statements. The Company undertakes no obligation to update any of the forward-looking statements in this news release or incorporated by reference herein, except as otherwise required by law.

Additional information in relation to the Company, including the Company's most recent management discussion & analysis, can be obtained under the Company's profile on SEDAR+ at www.sedarplus.ca and on the Company's website at www.tincorp.com.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/285335