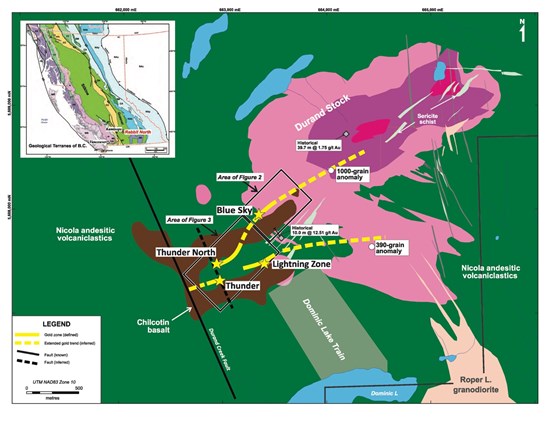

Vancouver, British Columbia--(Newsfile Corp. - February 19, 2026) - Tower Resources Ltd. (TSXV: TWR) ("Tower" or the "Company") is pleased to report that it has received assays for six of the eleven holes drilled in late 2025 on its Rabbit North property in the heart of the Kamloops porphyry Cu mining district (see Fig. 1).

Five of the six holes - Nos. RN25-063 to 067 - targeted the Blue Sky gold trend and one - No. 069 - stepped eastward 100 m from the Thunder North zone toward Blue Sky with the goal of further closing the 500-m gap between these zones which is almost completely covered by 30 to 40 m of young Chilcotin basalt lava flows and thin, underlying alluvial gravels.

Figure 1 - Geology of the central part of the Rabbit North property showing the major shear structures controlling Tower's gold discoveries. These shear zones are roughly coincident with more recent graben fault valleys that have been infilled by Chilcotin basalt flows.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5023/284445_1a3b2bdae4bbdb5b_002full.jpg

Highlights

While every hole returned multiple Au intersections greater than 1 g/t (See Table 1), Blue Sky's No. 064 and Thunder North's No. 069 yielded highlight intersections that vividly illustrate the pervasiveness, strength and near-surface economic potential of the Rabbit North orogenic gold system.

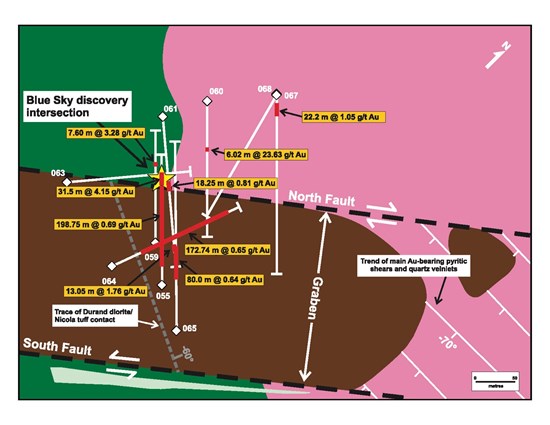

Hole 064 at Blue Sky intersected 172.74 m of shallow, diorite-hosted mineralization averaging 0.65 g/t Au (see Table 1) in the Durand Stock beginning immediately below 40 m of cover rocks (see Fig. 2). This intersection, together with other long intersections of a similar grade in Hole 065 (80.0 m of 0.64 g/t Au; see Table 1) and the section of discovery Hole 055 above the Blue Sky zone (198.75 m of 0.69 g/t Au; see December 23, 2024 press release), outlines a near-surface, open-pit-friendly resource footprint near the diorite-volcanic contact measuring approximately 120 x 140 metres horizontally. Similar mineralization breaches the bedrock surface, and thus is reflected by highly anomalous gold grain counts in the overlying glacial till (see November 3, 2025 press release), ~200 m to the northeast where Hole 067 intersected 22.0 m of 1.05 g/t Au beginning just 17 m down-hole.

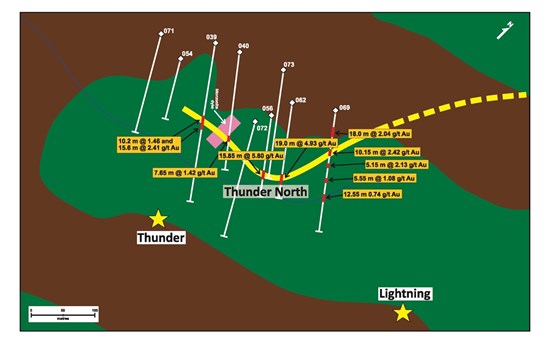

Hole 069 at Thunder North intersected three shallow (starting just 30 m below surface), wide (18.0, 10.15 and 5.15m), closely spaced (within a 97 m core span), bands of typical Thunder North-style mineralization averaging 2.04, 2.42 and 2.13 g/t, respectively (see Table 1 and Fig. 3). Importantly, the positions of these intersections indicate either bending or faulting of the Thunder North zone northward under the cover rocks, directly in line with and only 400 m from Blue Sky. Hence, step-out drilling to the northeast through the cover rocks can reasonably be expected to establish continuity between the two gold zones.

Joe Dhami, Tower's CEO and President, commented: "Our drilling is process driven and analytically focused to model and de-risk an economic, near-surface gold resource with a predictable strike and dip within our 2-km-long mineralized trend."

|

|

|

|

|

|

Total

Depth (m) |

|

Mineralized Interval(s) | Average

Au Grade (g/t) |

|||

| Hole

No. |

Easting

(m) |

Northing

(m) |

Azimuth

(°) |

Dip

(°) |

Mineralized

Zone(s) |

From

(m) |

To

(m) |

Length

(m) |

|||

| RN-25-063 | 663255 | 5607859 | 040.0 | -61.8 | 333.00 | Blue Sky Trend | 121.10 | 127.00 | 5.90 | 1.12 | |

|

|

|

|

|

|

|

Blue Sky Trend | 172.40 | 173.30 | 0.90 | 1.17 | |

|

|

|

|

|

|

|

Blue Sky Trend | 179.50 | 184.12 | 4.62 | 1.17 | |

|

|

|

|

|

|

|

Blue Sky Trend | 272.80 | 276.00 | 3.20 | 1.05 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| RN-25-064 | 663371 | 5607824 | 020.0 | -45.0 | 252.00 | Blue Sky Trend | 56.70 | 229.44 | 172.74 | 0.65 | |

|

|

|

|

|

|

|

Including | 97.80 | 100.75 | 2.95 | 0.94 | |

|

|

|

|

|

|

|

and | 109.50 | 115.15 | 5.65 | 1.49 | |

|

|

|

|

|

|

|

and | 129.50 | 130.00 | 0.50 | 3.40 | |

|

|

|

|

|

|

|

and | 139.60 | 140.10 | 0.50 | 1.91 | |

|

|

|

|

|

|

|

and | 147.00 | 154.65 | 7.65 | 1.06 | |

|

|

|

|

|

|

|

and | 162.00 | 171.00 | 9.00 | 1.39 | |

|

|

|

|

|

|

|

and | 179.47 | 182.00 | 2.53 | 1.39 | |

|

|

|

|

|

|

|

and | 187.20 | 206.03 | 18.83 | 1.21 | |

|

|

|

|

|

|

|

which includes | 187.20 | 193.60 | 6.40 | 2.52 | |

|

|

|

|

|

|

|

which further includes | 191.45 | 192.00 | 0.55 | 15.40 | |

|

|

|

|

|

|

|

and | 218.00 | 220.30 | 2.30 | 2.11 | |

|

|

|

|

|

|

|

and | 223.90 | 279.44 | 5.44 | 3.24 | |

|

|

|

|

|

|

|

which includes | 223.90 | 224.50 | 0.60 | 17.50 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| RN-25-065 | 663487 | 5607824 | 314.5 | -58.0 | 454.00 | Blue Sky Trend | 48.00 | 51.00 | 3.00 | 1.06 | |

|

|

|

|

|

|

|

Blue Sky Trend | 63.00 | 65.00 | 2.00 | 1.41 | |

|

|

|

|

|

|

|

Blue Sky Trend | 99.50 | 101.10 | 1.60 | 1.98 | |

|

|

|

|

|

|

|

Blue Sky Trend | 122.65 | 202.65 | 80.00 | 0.64 | |

|

|

|

|

|

|

|

Including | 122.65 | 124.00 | 1.35 | 2.38 | |

|

|

|

|

|

|

|

Including | 129.35 | 132,00 | 2.65 | 0.96 | |

|

|

|

|

|

|

|

Including | 139.80 | 145.00 | 5.20 | 0.78 | |

|

|

|

|

|

|

|

Including | 157.00 | 160.00 | 3.00 | 2.11 | |

|

|

|

|

|

|

|

Including | 163.70 | 166.55 | 2.35 | 2.18 | |

|

|

|

|

|

|

|

Including | 169.00 | 170.00 | 1.00 | 1.08 | |

|

|

|

|

|

|

|

Including | 171.30 | 172.00 | 0.70 | 2.11 | |

|

|

|

|

|

|

|

Including | 178.15 | 183.00 | 4.85 | 1.44 | |

|

|

|

|

|

|

|

Including | 196.00 | 202.65 | 6.65 | 1.09 | |

|

|

|

|

|

|

|

Blue Sky Trend | 207.25 | 207.85 | 0.60 | 1.77 | |

|

|

|

|

|

|

|

Blue Sky Trend | 229.45 | 233.00 | 3.55 | 3.22 | |

|

|

|

|

|

|

|

Blue Sky Trend | 252.00 | 253.00 | 1.00 | 1.32 | |

|

|

|

|

|

|

|

Blue Sky Trend | 256.65 | 258.20 | 1.55 | 2.23 | |

|

|

|

|

|

|

|

Blue Sky Trend | 296.00 | 297.00 | 1.00 | 1.21 | |

|

|

|

|

|

|

|

Blue Sky Trend | 304.35 | 311.00 | 6.65 | 1.38 | |

|

|

|

|

|

|

|

Blue Sky Trend | 323.70 | 324.20 | 0.50 | 16.90 | |

|

|

|

|

|

|

|

Blue Sky Trend | 333.45 | 335.00 | 1.55 | 1.52 | |

|

|

|

|

|

|

|

Blue Sky Trend | 382.15 | 384.00 | 1.85 | 1.76 | |

|

|

|

|

|

|

|

Blue Sky Trend | 441.80 | 442.30 | 0.50 | 2.78 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| RN-25-066 | 663307 | 5608062 | 135.4 | -70.0 | 231.00 | Blue Sky Trend | 45.00 | 46.00 | 1.00 | 1.22 | |

|

|

|

|

|

|

|

Blue Sky Trend | 51.00 | 51.50 | 0.50 | 2.49 | |

|

|

|

|

|

|

|

Blue Sky Trend | 91.85 | 93.30 | 1.45 | 4.51 | |

|

|

|

|

|

|

|

Blue Sky Trend | 118.00 | 119.00 | 1.00 | 3.00 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| RN-25-067 | 663364 | 5608127 | 135.0 | -45.0 | 324.00 | Blue Sky Trend | 16.80 | 39.00 | 22.20 | 1.05 | |

|

|

|

|

|

|

|

Blue Sky Trend | 104.50 | 108.70 | 4.20 | 2.32 | |

|

|

|

|

|

|

|

Blue Sky Trend | 192.20 | 193.50 | 1.30 | 4.89 | |

|

|

|

|

|

|

|

Blue Sky Trend | 259.35 | 262.50 | 3.15 | 1.66 | |

|

|

|

|

|

|

|

Blue Sky Trend | 274.60 | 275.30 | 0.70 | 1.66 | |

|

|

|

|

|

|

|

|

|

|

|

|

|

| RN-25-068 | 663365 | 5608126 | 165.0 | -45.0 | 252.00 | Assays pending |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| RN-25-069 | 663080 | 5607621 | 142.9 | -50.1 | 300.00 | Thunder North | 43.00 | 63.00 | 20.00 | 1.93 | |

|

|

|

|

|

|

|

Including | 45.00 | 63.00 | 18.00 | 2.04 | |

|

|

|

|

|

|

|

Thunder North | 96.50 | 110.15 | 13.65 | 1.92 | |

|

|

|

|

|

|

|

Including | 100.00 | 110.15 | 10.15 | 2.42 | |

|

|

|

|

|

|

|

Thunder North | 134.10 | 140.00 | 5.90 | 1.95 | |

|

|

|

|

|

|

|

Including | 134.85 | 140.00 | 5.15 | 2.13 | |

|

|

|

|

|

|

|

Lightning | 171.50 | 177.05 | 5.55 | 1.08 | |

|

|

|

|

|

|

|

Lightning | 211.20 | 223.75 | 12.55 | 0.74 | |

Table 1 - Significant gold intercepts of the shear-hosted orogenic type from Rabbit North Holes 063 to 067 and 069. Intercepts of older porphyry Cu-Au mineralization are excluded. The minimum zone threshold is 1 g/t Au over 1.0 m, or equivalent. Gold values are uncut. Samples with Au grades greater than 15 g/t are shown individually. True widths have not been determined.

Figure 2 - Significant gold intersections from new holes 063 to 067 in the Blue Sky area in relation to previous intersections and interpreted structural trends.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5023/284445_1a3b2bdae4bbdb5b_003full.jpg

Figure 3 - Significant gold intersections in Hole 069 relative to previous intersections of the Thunder North zone. See Figure 1 for legend.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/5023/284445_1a3b2bdae4bbdb5b_004full.jpg

Key Structural Determinations

The original Blue Sky discovery in Hole 055 (31.5 m grading 4.15 g/t Au; see December 23, 2024 press release) was made in a structurally complex area along the western diorite-volcanic contact. As the only outcrops in this area are of cover rocks, the first holes of the present program were designed primarily to unravel structural and stratigraphic relationships in the basement rocks to guide future drill targeting.

The first two holes, Nos. 063 and 064, were drilled through the cover basalt in a northeasterly direction and hence were orthogonal to the NW trending contact of the Durand Stock, subparallel to the main ENE shear trend and perpendicular to Tower's previous four previous Blue Sky drill holes, Nos. 055 and 059 to 061. Despite being parallel and collared only 150 m apart, the two holes encountered completely different rocks beneath the basalt, with Hole 063 intersecting only Nicola tuffs and Hole 064 intersecting only Durand diorite, indicating that the contact of the stock has been offset ~100 m to the southwest between these drill holes. Hole 063 entered the fault zone directly below the cover rocks and remained in it for over 100 m, indicating that the fault is vertical.

The Au results were equally disparate, with Hole 063 intersecting only four weak, widely separated gold zones (see Table 1) while Hole 064 intersected ten more evenly spaced zones that together define the 172.74-m-long section that averaged 0.65 g/t Au. Further examination of the drill core and Au results from these and neighbouring drill holes revealed other telling patterns. For example, both Holes 065 and 066 weaved in and out of diorite and tuff, indicating that they followed the contact of the Durand Stock and thus can be used to determine its approximate strike and dip in the areas where these holes were drilled.

Most importantly, holes drilled either northeast (like No. 064) or northwest (like Hole 65 and earlier discovery Hole 055) through the diorite at a flat, -45○ dip intersected numerous, closely spaced Au zones, typically separated by lower-grade, 0.1 to 0.3 g/t mineralization that contributes significantly to the overall resource grade and correspondingly lowers the strip ratio, whereas holes drilled to the southeast (like Hole 067 and earlier Hole 061) through the same diorite misleadingly intersected far fewer and more widely-spaced gold zones. Furthermore, the disparity in gold grades worsens for holes like Hole 066 that were drilled southeast at a dip steeper than -45○.

The following structural model is inferred from the above patterns:

-

The Durand Stock was tilted westward during accretion of its parental island arc to the Western Cordillera such that its western contact now dips inward (eastward) at roughly -60○ (see Fig. 2) and the formerly overlying Nicola tuffs are now overlain by the diorite.

-

The Chilcotin basalt cover flows, which are only about 5 million years old, erupted in a 250 m wide, ENE striking, fault-bounded graben valley. The bounding faults were vertical and must have extended to a depth of at least 40 km to tap the mantle-derived olivine basalt melt. Approximately 200 m of down-drop occurred between the faults, thereby shifting the east-dipping diorite-tuff contact ~100 m to the west.

-

The graben faults are only the latest manifestation of a long-lived structure similar to the Red Line of B.C.'s Golden Triangle and the Porcupine-Destor and Cadillac-Larder Lake Faults of the Abitibi Greenstone Belt. Approximately 147 million years ago the same structural corridor was the focus of the shear deformation, fluid flow and QFP dyke emplacement that produced the orogenic Au-pyrite mineralization. Also, prior to accretion of the Durand stratovolcano to the Cordillera, the fault may also have plumbed the diorite magma and associated porphyry Cu-Au mineralization of the ~215 Ma Durand Stock.

-

The main set of pyritized, Au-bearing shears and quartz veinlets within the graben fault block strikes roughly E-W and dips south at minus 60-70○ such that the mineralized zones are intersected effectively in holes drilled either to the northeast (e.g. Hole 064) or northwest (e.g. Holes 055 and 065) but less effectively in holes drilled to the southeast (e.g. Hole 068) especially if these holes are drilled at dips steeper than -45○ like Hole 066 which was drilled at -70○ beneath and from the same pad as earlier Hole 060 to obtain a deeper cut of the high-grade gold zone (6.02 m of 23.63 g/t Au; see Fig. 2) intersected in that -45○ hole but was too steep to ever reach the zone regardless of the hole depth.

Next Steps

Assays are awaited for the remaining five drill holes and will be released after they have been compiled and reviewed. Drilling is expected to resume in March. Wherever terrain conditions permit along the Blue Sky trend, holes will be drilled to the northwest to cut the gold zones in the most representative direction as determined from the present program.

Methods and Qualified Person

The drill core was logged at Tower's leased, fully equipped core facility near Kamloops by and/or under the direction Matthew Husslage, P.Geo. Mr. Husslage has managed or co-managed all of Tower's Rabbit North diamond drilling programs since the discovery of the Lightning Zone in December 2021.

Split samples of the core, generally 1.0 or 1.5 m in length, were delivered directly to Activation Laboratories (ActLabs) in Kamloops, BC, a laboratory certified as ISO/IEC 17025 Accredited (Lab 790) by the Standards Council of Canada. QA/QC samples including blanks and standards were inserted regularly into the sample sequence at a ratio of approximately 1:20.

The samples were analyzed for Au by fire assay and ICP-OES and for Ag and 36 additional elements by ICP-OES using a four-acid, near-total digestion. Any over-limit (>5 g/t) Au analyses were repeated using the same fire assay procedure but with a gravimetric rather than ICP finish.

The technical content of this news release has been reviewed and approved by Stuart Averill, P.Geo., a director of the Company and a Qualified Person as defined by National Instrument 43-101.

Other News

On December 19, 2025, the Company provided a corporate update, announcing that it had entered into into a marketing making agreement with ICP Securities Inc. ("ICP") and a capital markets consulting agreement with Insight Capital Partners Inc., an entity related to ICP ("Insight"), dated December 17, 2025 (collecitlvey the "Agreements"), subject to approval by the TSX Venture Exchange (the "Exchange"). Under the Agreements, Insight will provide capital markets consulting services and ICP will provide market-making services in accordance with Exchange policies, trading shares of the Company on the Exchange and other trading venues with the objective of maintaining an orderly market and improving the liquidity of Tower's common shares. Insight will receive $3,500 per month and ICP will receive $7,500.00 per month. The Agreements have an initial four-month term and will automatically renew for successive one-month periods unless terminated by either party with 30 days' notice. The Agreements contain no performance-based factors, and neither Insight nor ICP will receive shares or options as compensation. Insight and ICP are unrelated and unaffiliated entities to the Company, and at the time of the Agreements, neither Insight nor ICP or its principals hold any direct or indirect interest in the securities of the Company.

About Tower Resources

Tower is a Canadian based mineral exploration company focused on the discovery and advancement of economic mineral projects in the Americas. The Company's key exploration assets, all in B.C., are the Rabbit North orogenic gold and porphyry copper-gold project located between the New Afton copper-gold and Highland Valley copper mines in the Kamloops mining district, the Nechako porphyry-associated gold-silver project near Artemis' Blackwater project and the More Creek epithermal gold project on the critical "red line" structural zone connecting the mineral deposits of the Golden Triangle.

On behalf of the Board of Directors

Tower Resources Ltd.

Joe Dhami, President and CEO

(778) 996-4730

www.towerresources.ca

Reader Advisory

This news release may contain statements which constitute "forward-looking information", including statements regarding the plans, intentions, beliefs and current expectations of the Company, its directors, or its officers with respect to the future business activities of the Company. The words "may", "would", "could", "will", "intend", "plan", "anticipate", "believe", "estimate", "expect" and similar expressions, as they relate to the Company, or its management, are intended to identify such forward-looking statements. Investors are cautioned that any such forward-looking statements are not guarantees of future business activities and involve risks and uncertainties, and that the Company's future business activities may differ materially from those in the forward-looking statements as a result of various factors, including, but not limited to, fluctuations in market prices, successes of the operations of the Company, continued availability of capital and financing and general economic, market or business conditions. There can be no assurances that such information will prove accurate and, therefore, readers are advised to rely on their own evaluation of such uncertainties. The Company does not assume any obligation to update any forward-looking information except as required under the applicable securities laws.

Neither TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/284445