Toronto, Ontario--(Newsfile Corp. - December 15, 2025) - C3 Metals Inc. (TSXV: CCCM) (OTCQB: CUAUF) ("C3 Metals" or the "Company") is pleased to announce that the first hole ever drilled at its 100%-owned Khaleesi copper project ("Khaleesi" or "the Project") in southern Peru intersected 269.0m at 0.30% copper, including 60.4m at 0.41% copper from 346.0m downhole (approximately 250.0m vertical depth).

Khaleesi is a highly compelling greenfield copper project that the Company is currently testing for the first time using two diamond drill rigs and a minimum of 6,000m of drilling (see press release dated September 30, 2025).

Initial results demonstrate the potential for a large, well-mineralized magnetite and garnet skarn body interfingered with multiple intrusive bodies. The mineralized skarn-intrusive contact zone appears well defined by coincident strong chargeability and magnetic anomalies. Importantly, drilling confirms that copper mineralization continues under an extensive area of shallow glacial till cover.

Dan Symons, President and CEO, stated, "To intersect a broad zone of copper mineralization in the first ever hole drilled on a greenfield project like Khaleesi is a tremendous result. The porphyry and skarn systems along the Andahuaylas-Yauri belt can typically host very large tonnages. Based on size and strength of the alteration, mineralization, geophysical footprints, and the geology we are seeing in drilling, Khaleesi clearly demonstrates the potential for a large copper system analogous to some of the large nearby deposits. Additionally, copper grades in this first hole are consistent with mine grades in the district1. Importantly, we have now confirmed that copper mineralization extends under an extensive area of thin glacial till cover, which significantly increases the drill target area of the Khaleesi system. More drilling will be required before we can determine the ultimate size of the Khaleesi system, but with the results of this first ever hole, we are off to a great start."

Khaleesi First Ever Drill Hole Highlights

-

Drill hole KHZ5800-001 was drilled to a depth of 626.1m and ended in copper mineralization.

-

A broad zone of near-surface, skarn- and porphyry-style copper-molybdenum mineralization reported a downhole intersection of 269.0m at 0.30% copper, including 60.4m at 0.41% copper. Mineralization remains open in all directions and at depth.

-

High-grade garnet exoskarn copper-gold-silver mineralization was intersected at the top of hole, reporting 4.0m at 2.03% Cu, 0.17g/t Au and 12.14g/t Ag.

-

KHZ5800-001 was collared to test below a small area of outcropping magnetite skarn coincident with large magnetic and chargeability anomalies. Importantly, the holeconfirmed copper mineralization extends at least 100m beneath an area of thin glacial till cover.

-

Follow-up drill holes are planned to extend and test this mineralization along strike, near surface and at depth, including under the thin glacial till cover.

-

Highly anomalousmolybdenum (20 samples > 100 ppm), cobalt (47 samples > 200 ppm), silver (11 samples > 2 g/t Ag) and gold (9 samples > 0.1 g/t Au) were also reported in this first hole.

-

An epithermal vein, similar to those occurring at surface in the area, cross cut the magnetite skarn in drill core and assayed2.3mat 0.77% Cu, 0.495 g/t Au, 92.10 g/t Ag, 0.18% Zn and > 1% Pb (Pb overlimit value still pending).

Table 1: Significant assays in first Khaleesi drill hole KHZ5800-001

| Hole ID | From

(m) |

To

(m) |

Length

(m) |

Cu

(%) |

Mo

(ppm) |

Au

(g/t) |

Ag

(g/t) |

Pb

(%) |

Zn

(%) |

| KHZ5800-001 | 15.70 | 19.70 | 4.00 | 2.03 | 28 | 0.171 | 12.14 | NSA | 0.07 |

| Including | 15.70 | 17.70 | 2.00 | 3.77 | 56 | 0.326 | 22.05 | NSA | 0.10 |

|

|

252.20 | 272.20 | 20.00 | 0.32 | 17 | 0.037 | 1.08 | NSA | NSA |

|

|

284.70 | 322.00 | 37.30 | 0.19 | 15 | 0.025 | 0.80 | NSA | NSA |

|

|

346.00 | 615.00 | 269.00 | 0.30 | 65 | 0.037 | 1.50 | NSA | NSA |

| Including | 393.80 | 396.10 | 2.30 | 0.77 | 48 | 0.495 | 92.10 | >1% | 0.18 |

|

|

444.00 | 497.35 | 53.35 | 0.36 | 20 | 0.046 | 0.80 | NSA | NSA |

|

|

544.80 | 605.20 | 60.40 | 0.41 | 191 | 0.025 | 0.72 | NSA | NSA |

| Notes

NSA = No Significant Assays. Composite intervals are calculated using length weighted averages based on a combination of lithological breaks and copper assay values according to a 0.15% Cu cutoff and include a maximum of 12 meters of internal dilution. All intervals reported are down hole core lengths, and true thicknesses have yet to be determined. Mineral resource modeling is required before true thicknesses can be estimated. |

|||||||||

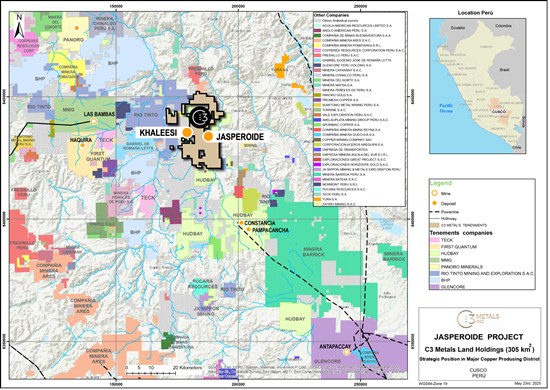

The Khaleesi project is located in the Andahuaylas-Yauri Belt in southeastern Peru, home to large copper skarn and porphyry deposits and operating mines such as Las Bambas (MMG), Constancia (Hudbay Minerals), Antapaccay (Glencore), and others (Figure 1).

Figure 1: Regional map showing C3 Metals' mineral concession package in relation to other large-scale operations, development projects and exploration projects.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/278011_d71bb86084d90b00_001full.jpg

Khaleesi is located 8km west of the Company's Jasperoide Project, where the Company confirmed 13 skarn prospects along a 28km iron-skarn belt. Montana de Cobre ("MCZ") is the only skarn along the 28km iron-skarn belt that the Company has systematically drill tested to date, yielding a near surface Measured and Indicated Mineral Resource of 51.9 million tonnes at 0.50% total copper and 0.20 g/t gold for 569.1 million pounds of copper and 326,800 ounces of gold.2

Within the Khaleesi project area is a favorable limestone-batholith contact that strikes north-northeast, and is largely covered in shallow, glacial till. Drilling at the western project area is testing a zone with sporadic outcrops of massive magnetite, garnet, pyroxene and calc-silicate skarns with primary (chalcopyrite, bornite) and secondary (malachite, azurite, chrysocolla and copper wad) copper mineralization observed in these outcrops. At the eastern project area, drilling is testing a diorite batholith cut by thin sulfide and quartz-sulfide veinlets with chalcopyrite, molybdenite and minor bornite mineralization. Thicker, polymetallic epithermal veins locally crosscut the batholith and marble/limestone.

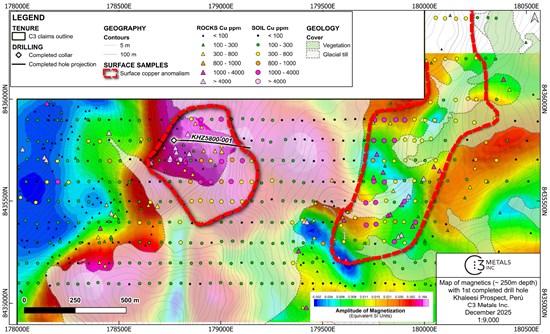

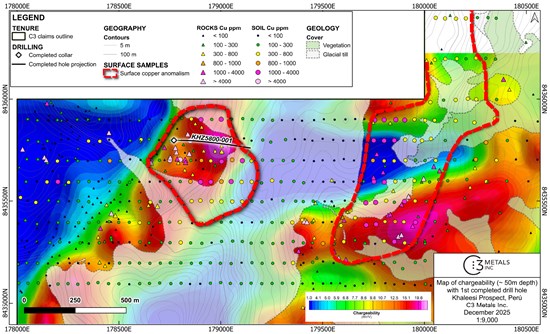

Geochemical results from previous soil and rock sampling campaigns have highlighted anomalous copper values at surface in an apparent 400m x 470m zone in the west project area at the skarn-marble outcrops and a 1,900m x 650m anomalous zone in the east project area within the diorite batholith (see press release dated February 19, 2025). Shallow glacial till cover occurs between the two zones, potentially masking a larger geochemical footprint. Geophysical survey results from earlier this year (see press release dated August 6, 2025), likewise highlight a 3D, anomalous zone of high magnetics and chargeability (Figures 2 and 3).

Figure 2: MVI Magnetic Inversion: Amplitude of Magnetization, depth slice 250m showing a large irregular shaped magnetic anomaly that is coincident with a zone of outcropping skarn. Red dashed lines highlight zones of copper anomalism at surface.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/278011_d71bb86084d90b00_002full.jpg

Figure 3: IP Chargeability Map: Depth slice 50m showing a northeast trending chargeability anomaly that is coincident with a zone of outcropping skarn in the western project area. In the eastern project area is a large chargeability anomaly coincident with strong copper in soil anomalism (red dashed lines).

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/278011_d71bb86084d90b00_003full.jpg

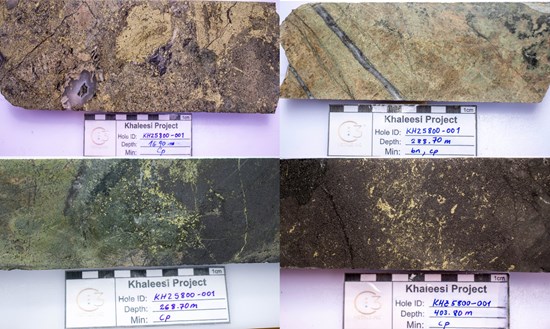

The first ever drill hole at Khaleesi, KHZ5800-001, was collared near a marble-diorite contact and targeted a large coincident chargeable and magnetic 3D high. The drill hole was designed to test under outcropping, oxidized (limonitic) magnetite skarn at surface and successfully intersected different styles of copper mineralization interpreted to be both skarn style and potentially porphyry style. KHZ5800-001 encountered near surface garnet exoskarn and endoskarn, with local massive chalcopyrite in the exoskarn (Figure 4). The upper skarn interval was followed downhole by a large body of weakly mineralized, chlorite-altered diorite (Figure 5).

Following the weakly mineralized diorite, the main mineralized zone started at approximately 200m downhole (approximately 170m vertical depth) and comprises an approximate 170m interval of garnet endoskarn and diorite with thin sulfide (chalcopyrite > pyrite ± chlorite ± magnetite) veinlets and quartz + chalcopyrite ± bornite ± molybdenite veinlets, locally with higher densities, and reminiscent of porphyry-style mineralization (Figures 4 and 5). Downhole of the garnet endoskarn and diorite is a large, massive magnetite skarn with smaller intervals of fine-grained, light green pyroxene skarn and diorite dikes (Figure 5). Mineralization in the magnetite and pyroxene skarn is dominantly thinly banded (bedding parallel), patchy and disseminated chalcopyrite + pyrite, and lesser pyrrhotite and bornite (Figure 4). Local quartz veinlets crosscut near the lower intervals, and several zones have higher molybdenite and bornite content.

Figure 4: (Top Left) Garnet-diopside exoskarn with coarse chalcopyrite assayed 1.05m at 6.3% Cu, 0.54g/t Au and 37.7g/t Ag, (Top Right) Garnet-diopside endoskarn cut by quartz-chalcopyrite-bornite veinlets assayed 2.00m at 0.22% Cu, (Bottom Left) Contact between garnet and magnetite skarns with coarse chalcopyrite mineralization assayed 1.6m at 0.33% Cu and 1.24 g/t Ag, (Bottom Right) Massive magnetite skarn with coarse chalcopyrite mineralization assayed 2.4m at 0.44% Cu and 1.35 g/t Ag.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/278011_d71bb86084d90b00_004full.jpg

Figure 5: Cross section through KHZ5800-001, the first hole ever drilled at Khaleesi.

To view an enhanced version of this graphic, please visit:

https://images.newsfilecorp.com/files/2661/278011_d71bb86084d90b00_005full.jpg

Next Steps

Geology, alteration, geochemical and structural data is being collected from all drill holes and are being incorporated into a comprehensive 3D geological block model. The 3D model will be utilized in conjunction with the 3D geophysics data to further refine drill targeting. An expanded drill program above and beyond the planned 14-hole, 6,300m initial program is under strong consideration based on the results of KHZ5800-001 and visual observations of other drill holes that are either completed and pending assay, or in progress.

For additional information, contact:

| Dan Symons

President and CEO +1 416 716 6466 dsymons@c3metals.com |

|

ABOUT C3 METALS INC.

C3 Metals Inc. is a mineral exploration company focused on creating substantive value for its shareholders through the discovery and development of large copper and gold deposits. The Company holds approximately 31,000 hectares located in the prolific high-grade Andahuaylas-Yauri Porphyry-Skarn belt of Southern Peru, which contain the Company's Jasperoide and Khaleesi projects. Mineralization at Jasperoide is hosted in a similar geological setting to the nearby major mining operations at Las Bambas (MMG), Constancia (Hudbay) and Antapaccay (Glencore). At Jasperoide, the Company has identified over 13 skarn prospects and an outcropping porphyry system over two parallel 28km belts. The Company has published a maiden resource estimate on the first of these skarn targets, which contained Measured & Indicated Resources of 52Mt at 0.5% copper and 0.2 g/t gold3. The Company is also actively exploring in Jamaica where it has identified 16 porphyry, 40 epithermal and multiple volcanic redbed copper prospects over a 30km strike extent. The Company holds a 100% interest in 17,855 hectares of exploration licenses, of which Freeport-McMoRan Exploration Corporation, a wholly-owned affiliate of Freeport-McMoRan Inc. (NYSE: FCX), has the option on 13,020 hectares to earn up to a 75% interest by funding up to US$75 million of exploration and project related expenditures. The Company also holds a 50% interest in 9,870 hectares in a joint venture with Geophsyx Jamaica Ltd, the largest mineral tenure holder in the country. Barrick Mining Corp. announced on May 1, 2024 that it had entered into an earn-in agreement with Geophysx Jamaica Ltd. on approximately 400,000 hectares of exploration licenses, several of which surround C3 Metals' mineral concessions. Mining is currently the second largest industry in Jamaica, and historical mining dates back to the colonial eras of the 1500s (Spanish) and 1800s (British).

Related Link: www.c3metals.com

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

QP Statement

Stephen Hughes, P.Geo. is Vice President Exploration and a Director for C3 Metals and is a Qualified Person as defined by National Instrument 43-101. Mr. Hughes has reviewed the technical information in this news release and approves the written disclosure contained herein.

Technical Program

C3 Metals adheres to a strict QA/QC protocol for handling, sampling, sample transportation and analyses. Chain-of-custody protocols are designed to ensure security of samples until their delivery at the laboratory.

Samples were cut at C3 Metals' Khaleesi Project camp, Cusco Region, Perú, by Company personnel. Before entering the cutting room, the drill core samples are marked lengthwise with a yellow line, and the core saw followed these lines to cut each sample. Diamond drill core was sampled in maximum 3-metre intervals, stopping at geological boundaries, and using a rock saw. Core diameter is a mix of PQ3 and HQ3, depending on the depth of the drill hole. Samples were bagged, tagged and packaged for shipment via local freight transport service to the ALS preparation laboratory in Arequipa, Arequipa Region, Perú. Entire samples were dried and weighed, then crushed to 85% passing 10 mesh (2mm). From this, a 1.5 kg split was pulverized to 90% passing 200 mesh (75µm).

The prepared, pulp samples were sent via ALS to the ALS assay laboratory in Lima, Lima Region, Perú, for copper, gold and multi-element analysis. ALS is an accredited laboratory which is independent of the Company. Gold assays were done by fire assay fusion (Au-AA23) with AAS finish on a 30g sample. Copper was assayed by ICP-AES following a 4-acid digestion via the ME-MS61r package for a suite of 60 elements. Any copper sample over detection limit (i.e., greater than 10,000ppm or 1% Cu) was additionally assayed via ICP-AES using the package ME-OG62. High and low copper, gold and iron standards, as well as blanks and duplicates (coarse crush split and pulp), were randomly inserted into the sampling sequence for quality control. On average, 11% of the submitted samples are quality control samples. No data quality problems were indicated by the QA/QC program.

Caution Regarding Forward Looking Statements

Certain statements contained in this press release constitute forward-looking information. These statements relate to future events or future performance. The use of any of the words "could", "intend", "expect", "believe", "will", "projected", "estimated" and similar expressions and statements relating to matters that are not historical facts are intended to identify forward-looking information and are based on the Company's current belief or assumptions as to the outcome and timing of such future events. Actual future results may differ materially. Although such statements are based on reasonable assumptions of the Company's management, there can be no assurance that any conclusions or forecasts will prove to be accurate.

While the Company considers these assumptions to be reasonable based on information currently available, they may prove to be incorrect. Forward looking information involves known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information. Such factors include risks inherent in the exploration and development of mineral deposits, including risks relating to changes in project parameters as plans continue to be redefined, risks relating to variations in grade or recovery rates, risks relating to changes in mineral prices and the worldwide demand for and supply of minerals, risks related to increased competition and current global financial conditions, access and supply risks, reliance on key personnel, operational risks, and regulatory risks, including risks relating to the acquisition of the necessary licenses and permits, financing, capitalization and liquidity risks.

The forward-looking information contained in this release is made as of the date hereof, and the Company is not obligated to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, except as required by applicable securities laws. Because of the risks, uncertainties and assumptions contained herein, investors should not place undue reliance on forward-looking information. The foregoing statements expressly qualify any forward-looking information contained herein.

________________________

1 Khaleesi is a greenfield exploration project. While the strength of alteration, mineralization styles, geophysical anomaly footprints, geology and grade of mineralization encountered in the first ever drill hole are consistent with other large, nearby copper deposits, given the limited technical data collected to date at Khaleesi, this information is not necessarily indicative of mineralization on the issuer's own mineral project.

2 Based on the assumptions and parameters outlined in the NI 43-101 Technical Report titled Jasperoide Copper-Gold Project Cusco Region, Peru dated July 5, 2023.

3 Based on the assumptions and parameters outlined in the NI 43-101 Technical Report titled Jasperoide Copper-Gold Project Cusco Region, Peru dated July 5, 2023.

To view the source version of this press release, please visit https://www.newsfilecorp.com/release/278011