(TheNewswire)

|

|||||||||

|

|

|

|

|

|||||

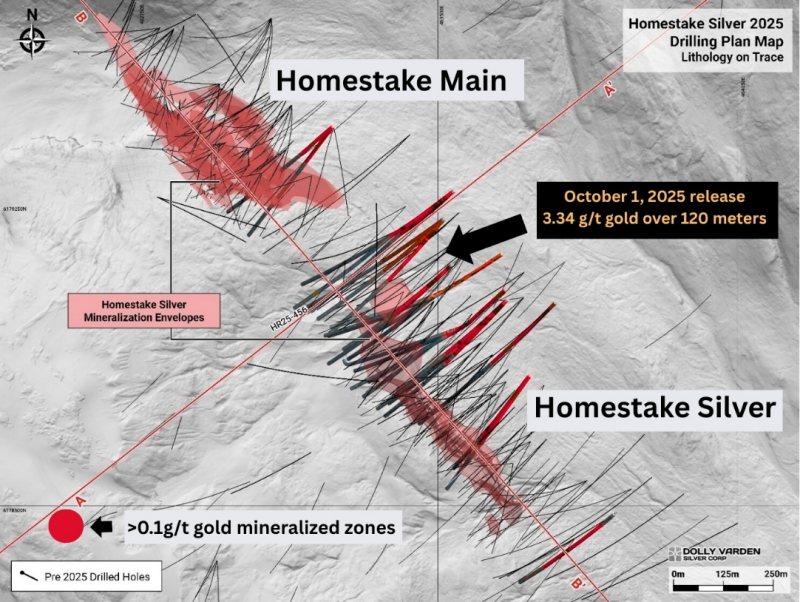

Vancouver, BC – October 7, 2025 – TheNewswire - Global Stocks News - Sponsored content disseminated on behalf of Dolly Varden Silver. On October 1, 2025 Dolly Varden Silver (TSX-V: DV) (NYSE MKT: DVS) (FSE: DVQ) reported a significant gold intercept from a step-out drill hole at the Homestake Silver deposit.

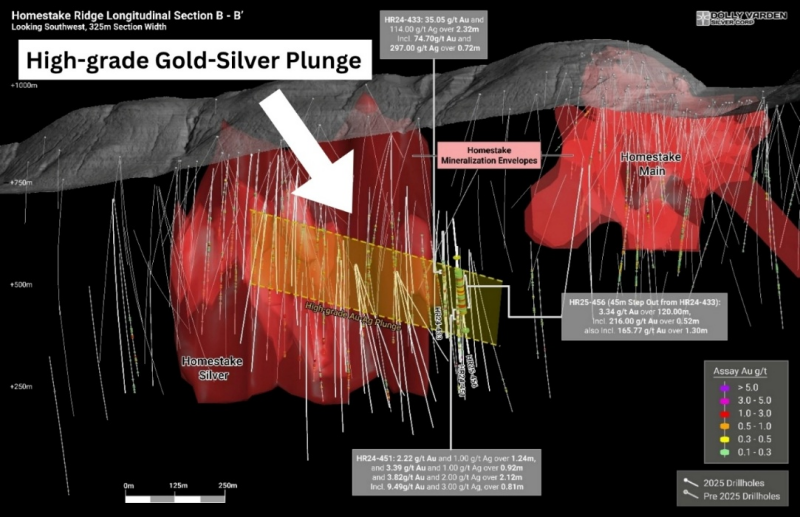

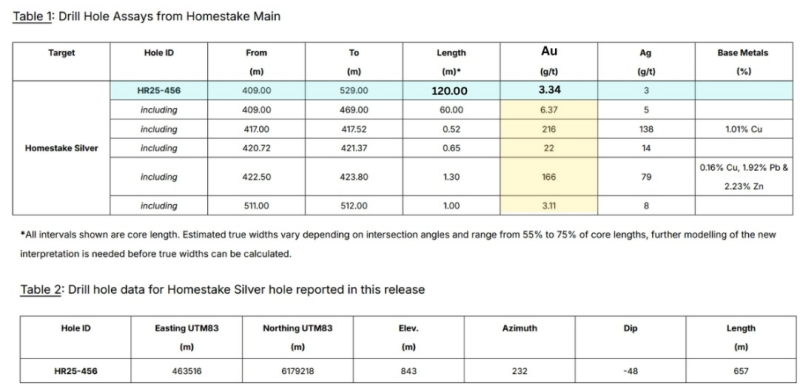

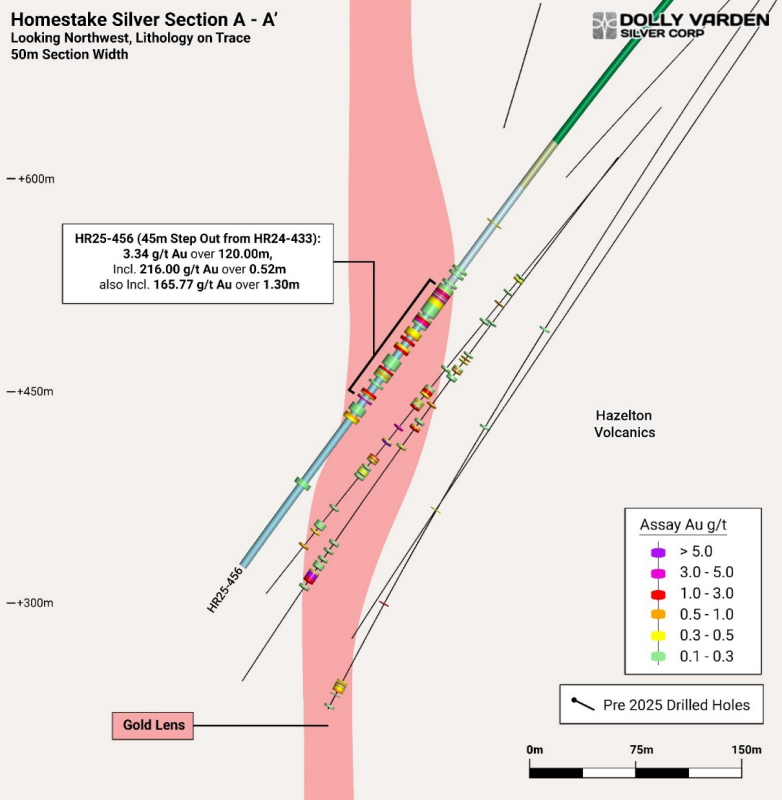

Hole HR25-456 intersected 3.34 g/t Au over 120 meters, including 216 g/t Au over 0.52 meters and 166 g/t Au over 1.3 meters.

The hole is a 45-meter step-out along strike from hole HR24-433 and 30 meters up dip from hole HR24-451.

"These gold results from a step-out hole at the Homestake Silver Deposit confirm that the deposit continues to grow beyond the current mineral resource estimate,& stated Shawn Khunkhun, CEO of Dolly Varden Silver in the October 1, 2025 press release.

“These results demonstrate the strength of the high-grade gold system, potentially a separate and overlapping event from high-grade silver mineralization at the deposit; this deposit is potentially a key driver of future project development,& added Khunkhun.

“We have two lenses that are close to each other,& Rob van Egmond, VP of Exploration, told Guy Bennett, the CEO of Global Stocks News (GSN). “The second phase could overlap the silver-rich mineralization, or it could be a separate lens.&

“Any time you have overlapping events or long-lived fluid conduits, it indicates some of the precious metals may have been deposited during the Jurassic age [160 million years ago], while a second mineralizing event may have occurred in the Eocene age [40 million years ago]&.

“This duo-timeline mineralisation is one deposit is a known characteristic of the Golden Triangle. One of our neighbours has been age-dating their assays, confirming the presence of an Eocene age mineralised system.&

“When you find a regional corridor where Jurassic mineralization has been overprinted by Eocene mineralisation,& added van Egmond, “typically the grade is augmented in that structure. Hole HR25-456 had large flakes of visible gold.&

“When we purchased this asset,& van Egmond told GSN. “Homestake Silver had a higher ratio of silver to gold than Homestake Main. But we&re thinking about changing the name, because at investor conferences Shawn and I have to explain that Homestake Silver is now primarily a gold deposit.&

“Geologists are always working to either prove or disprove a model,& added van Egmond. “You collect data, assess it, and make modifications to the model as necessary. Hole HR25-456 is adding confidence to the current model.&

Five diamond drills are nearing completion of the 2025 drill program across the Kitsault Valley and Big Bulk Projects. At Homestake Silver, drilling has focused on expanding and infilling areas of high-grade gold mineralisation.

DV is also testing outside the current resource. Additional results from the Homestake Silver gold zone, Wolf Vein silver mineralization extension, Big Bulk copper-gold porphyry system, as well as other exploration targets, will be reported as assays are received.

DV Silver is using directional drilling technology to precisely target areas for step-out and infill holes at Homestake Silver.

“Directional drilling allows you to position the drill bit exactly where you want it to be, without re-drilling hundreds of meters from the surface,& van Egmond told GSN. “It&s an ideal technique for us to explore Homestake Silver.&

This animated video by Horizontal Technology gives a technical overview of directional drilling.

“A skilled driller can direct the course of the drill bit along a pre-planned path over great distances,& confirms Horizontal Technology.

HR25-456 is one of three holes drilled from the same pad, designed to extend the wide, high-grade plunging zone and test outside the current mineral resource model. The drill hole is approximately a 45-meter step-out along strike from previous intersects.

Approximately 40% of the 2025 season's 55,000-meter planned drill program at DV&s 100% owned Kitsault Valley Silver and Gold Project targeted the Homestake Silver Deposit to expand and infill zones of high-grade gold mineralization.

The deposit remains open for expansion, with gold mineralization vectoring to the Homestake Main Deposit, along strike to the north of the Homestake Silver Deposit.

On October 01, 2025 Dolly Varden Silver announced a $30 Million Bought-Deal Financing featuring 2,300,000 @ $6.50/share; 750,000 flow-through shares @ $9.42/share and 990,000 flow-through shares at $8.10 per share.

“Flow-through shares enable public companies to transfer exploration expenditures to investors who can take advantage of the corresponding tax incentives, thereby ‘flowing their benefits through& to the shareholder,& writes CG Wealth Management.

“Investors in a high tax bracket can use the tax credits from flow-through investments to bring down their personal tax owing,& added CG Wealth.

Pursuant to existing agreements, Hecla Canada and Fury Gold Mines will be entitled to acquire shares @ $6.50/share to maintain their respective pro rata equity interests in DV Silver.

DV&s metal inventory value is now approximately a 50/50 split between silver and gold.

“With gold selling for CND $5,400/ounce,& van Egmond told GSN, “our team is encouraged to hit 120 meters of3.34 g/t gold at Homestake Silver.

Rob van Egmond, P.Geo., Vice-President Exploration for Dolly Varden Silver, the “Qualified Person& as defined by NI43-101, has reviewed, validated and approved the scientific and technical information contained in this GSN release.

Disclaimer: Dolly Varden Silver paid GSN $1,750 for the research, creation and dissemination of this content.

Contact: guy.bennett@globalstocksnews.com

Full Disclaimer: Global Stocks News (GSN) researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN makes no recommendation to purchase any individual stock. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly. GSN publications may contain forward-looking statements such as “project,& “anticipate,& “expect,& which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

Copyright (c) 2025 TheNewswire - All rights reserved.