SUDBURY, Ontario, Dec. 16, 2025 (GLOBE NEWSWIRE) -- Magna Mining Inc. (TSXV: NICU) (OTCQX: MGMNF) (FSE: 8YD) (“Magna& or the “Company&) is pleased to announce that Technica Mining Inc. (“Technica&) has been engaged by the Company to complete a pre-feasibility study (“PFS&) on its 100% owned Crean Hill Project (the "Project") located in Sudbury, Ontario, Canada.

Jason Jessup, Magna&s CEO, stated, “Our Crean Hill Project demonstrates an attractive combination of base and precious metals, and we have engaged Technica to complete a PFS on the Project, which will build on the Preliminary Economic Assessment (“PEA&) that was completed in 2024. The 2024 PEA demonstrated the potential for a 13 year mine life, modest pre-production capital costs and a high internal rate of return using conservative precious metals prices. While Crean Hill has been a lower priority during 2025 while we integrated the portfolio of properties acquired from KGHM in March, we have continued to advance the Project towards a construction decision. During 2025 we have moved forward with engineering at Crean Hill for both a connection to grid power and a permanent dewatering system, both of which will be of huge benefit as we update and evaluate the economics of the project during 2026. The Crean Hill PFS will be completed in parallel with the PEA study on our Levack Mine, and the decision to commence the PFS at this time supports Magna&s vision of becoming a multi-mine producer in the Sudbury Basin over the coming years.&

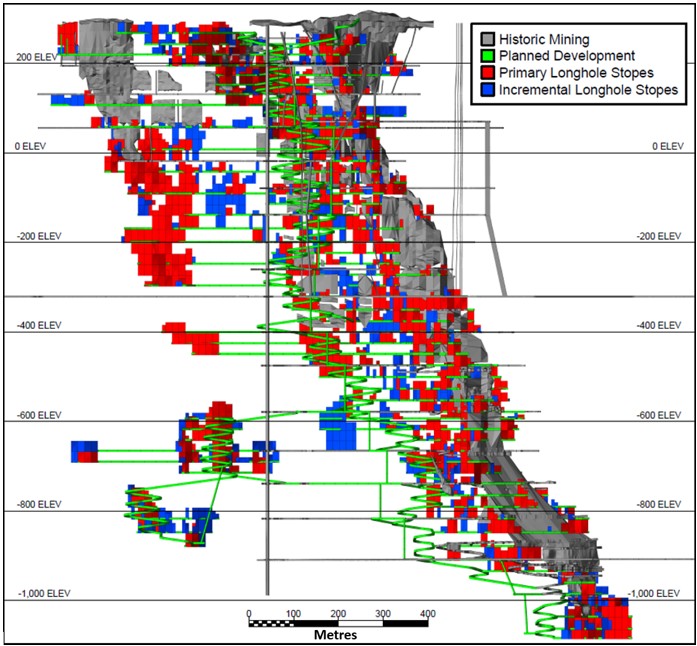

The PFS will commence in January 2026 and is expected to be completed in Q3 2026. It will build on the September 2024 PEA (see news release dated September 17, 2024) and incorporate additional work completed including the results from the 20,000 tonne bulk sample program that was executed in the second half 2024 (see news release dated October 7, 2024). The 2024 PEA envisioned an underground mining operation, with the Life of Mine (“LOM&) potentially mineable resources (a subset of the current Crean Hill Mineral Resource Inventory, see Table 1) being sold to an existing third-party mill in Sudbury. The PEA stated that underground mining would be initiated with a 15-month Advanced Exploration (“AdEx&) program followed by a 12-month pre-production ramp-up period and 13 years of commercial production. Initial mining is contemplated by ramp access via a new surface portal with the eventual rehabilitation and re-establishment of the historic #2 shaft for personnel access and ore hoisting as mining progresses deeper (Figure 2). Permits for the commencement of AdEx at Crean Hill are in hand.

Note: All dollar values are reported in Canadian Dollars unless otherwise stated.

2024 PEA Highlights

- Low pre-production capital cost of $27.7 million, following the AdEx period with projected AdEx capital cost of $48.5 million and revenues of $16.4 million;

- Payback of pre-production period capital within the first year of commercial production, and payback of all capital including AdEx period capital within the second year of commercial production;

- An average underground production rate of 2,200 tonnes per day at an average LOM operating cost of $158 per tonne;

- A 13 year mine life with LOM mineable resource sales of 195.5 million pounds nickel, 169.5 million pounds copper, 313,000 oz platinum, 359,000 oz palladium, and 117,000 oz gold;

- An after-tax Net Present Value (“NPV&) (8%) of $194.1 million, with an Internal Rate of Return (“IRR&) of 129% at conservative copper and precious metal prices (US$8.50/lb nickel, US$4.00/lb copper, US$13.00/lb cobalt, US$900/oz platinum, US$1,000/oz palladium, US$2,150/oz gold, and a 1.35 C$/US$ exchange rate).

Mineral Resources and Exploration Potential

The 2024 PEA is based on the current Crean Hill Mineral Resource Inventory completed by SGS Geological Services with an effective date April 15th, 2024 (Table 1). Mr. Allan Armitage, Ph.D., P. Geo. of SGS Geological Services is an independent Qualified Person as defined by NI 43-101 and is responsible for the current Crean Hill Mineral Resource Estimate.

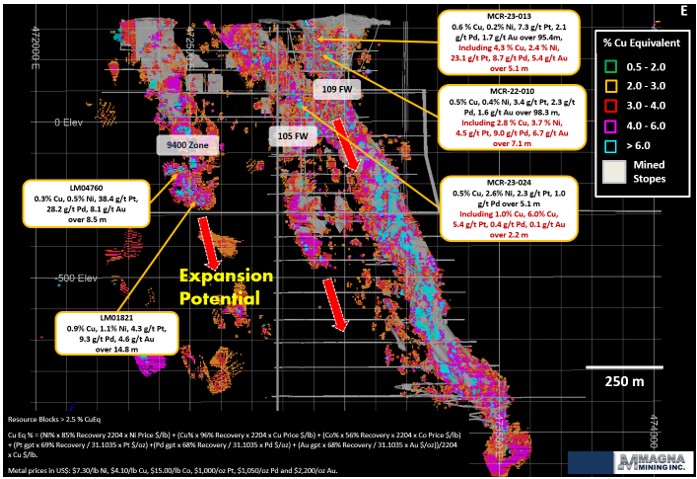

The majority of Mineral Resources at Crean Hill are contact nickel (“Ni&)-copper (“Cu&) zones but also include lesser amounts of Footwall (“FW&) Cu-Ni-precious metals including platinum (“Pt), palladium (“Pd&), gold (“Au) and silver (“Ag&) resources such as the 109 FW and 9400 Zones. At Crean Hill, the footwall Cu-precious metal systems consist of semi-massive vein to stringer and disseminated chalcopyrite rich sulphides within a Sudbury Breccia host rock extending into the footwall environment. The footwall mineralization is enriched in copper and precious metals in comparison to the contact Ni-Cu zones. Example footwall intersections include MCR-22-013 in the 109 FW Zone Mineral Resource which intersected 0.6% Cu, 0.2% Ni, 11.0 g/t Pt+Pd+Au over 95.4 metres, including a high grade massive sulphide interval grading 4.3% Cu, 2.4% Ni, 23.1 g/t Pt, 8.7 g/t Pd and 5.4 g/t Au over 5.1 metres, and drillhole LM04760 intersecting 0.3% Cu, 0.5% Ni, 38.4 g/t Pt, 28.2 g/t Pd, 8.1 g/t Au over 8.5 metres in the 9400 FW zone (Figure 3). Both the 109 FW Zone and the 9400 FW Zone have been drill-tested in the near surface environment above approximately the 600 metre level and remain open for expansion down-plunge.

Table 1: Crean Hill Project Underground Mineral Resource Estimate, April 15, 2024

| Classification | Cut-off Grade | Tonnes | Cu (%) | Ni (%) | Co (%) | Pt (g/t) | Pd (g/t) | Au (g/t) | NiEq % |

| Indicated | 1.1% NiEq | 18,444,000 | 0.87 | 1.01 | 0.035 | 0.98 | 1.12 | 0.37 | 1.96 |

| Inferred | 1.1% NiEq | 989,000 | 0.53 | 0.70 | 0.026 | 0.98 | 1.66 | 0.29 | 1.56 |

Please see notes on Mineral Resource assumptions, at the end of this release, including metal prices and recoveries used. The underground cut-off grade of 1.10% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1100/oz Pd and $1,950/oz Au, metal recoveries of 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au, a mining cost of US$80.00/t rock and processing, treatment and refining, transportation and G&A cost of US$42.50/t mineralized material.

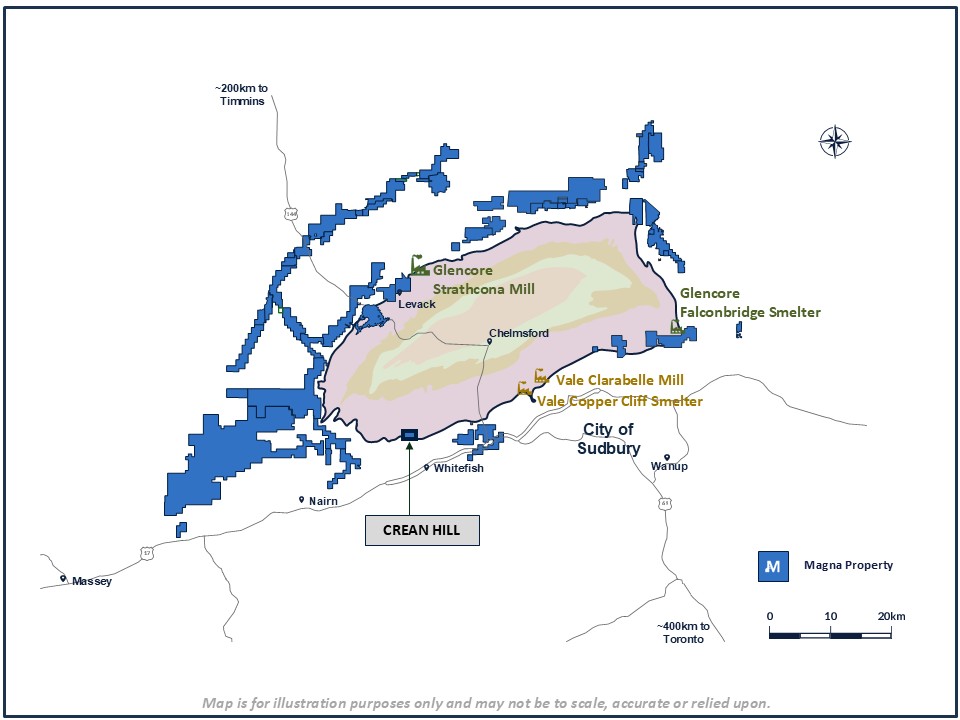

Figure 1: Location of Magna Mining&s Properties, Including the Crean Hill Project and Key Sudbury Infrastructure

Figure 2: Crean Hill Longitudinal Section Showing the 2024 PEA Underground Design

Figure 3: Longitudinal Section Showing the Crean Hill Mineral Resource, Example Footwall Diamond Drilling Intersections and Exploration Potential

Qualified Persons for PEA

The following Qualified Persons (QPs) oversaw the completion of the work in preparation of the PEA and are responsible for the contents:

Independent QP for Geology and Mineral Resource Estimates

Mr. Allan Armitage, Ph.D., P.Geo., of SGS Geological Services.

Mr. Armitage conducted personal inspection of the site on May 25-26, 2022, July 25, 2023, July 02, 2024 and July 25, 2024.

Independent QP for Underground Mining and Financial Analysis

Mr. Henri Gouin, P.Eng., of SGS Geological Services.

Mr. Gouin last conducted a personal inspection of the site on May 13, 2024.

Independent QP for Underground Mining, Financial Analysis, Permitting and Environmental

Mr. William van Breugel, P.Eng., B.A.Sc. Geological Engineering, of SGS Geological Services.

Independent QP for Processing and Recovery

Mr. Dominic Fragomeni, P.Eng., of Frago-Met Solution Ltd.

Crean Hill Property Mineral Resource Estimate Notes:

- The effective date of the Crean Hill Property Mineral Resource Estimate (MRE) is April 15, 2024. This is the close out date for the final mineral resource models and mine out models (as-builts).

- Allan Armitage, Ph.D., P. Geo. of SGS Geological Services is an independent Qualified Person as defined by NI 43-101 and is responsible for the current Crean Hill MRE. Armitage conducted multiple site visits to the Crean Hill Property including on May 25-26, 2022, July 25, 2023, July 02, 2024 and July 25, 2024.

- The classification of the current MRE into Indicated and Inferred mineral resources is consistent with current 2014 CIM Definition Standards - For Mineral Resources and Mineral Reserves.

- All figures are rounded to reflect the relative accuracy of the estimate and numbers may not add due to rounding.

- The mineral resource is presented undiluted and in situ, constrained by 3D grade control resource models, and are considered to have reasonable prospects for eventual economic extraction. The mineral resource is exclusive of mined out material.

- Mineral resources which are not mineral reserves do not have demonstrated economic viability. An Inferred Mineral Resource has a lower level of confidence than that applying to an Indicated Mineral Resource and must not be converted to a Mineral Reserve. It is reasonably expected that most Inferred Mineral Resources could be upgraded to Indicated Mineral Resources with continued exploration.

- The Crean Hill mineral resource estimate is based on a validated drill hole database which includes data from 4,646 surface and underground diamond drill holes completed between 1951 and March 2024. The drilling totals 739,448 m. The resource database totals 103,952 assay intervals representing 290,253 m of data.

- The mineral resource estimate is based on a three-dimensional (“3D&) resource model of the main mineralization and a broader dilution envelope. 3D models of mined out areas were used to exclude mined out material from the current MRE.

- Grades for Ni, Cu, Co, Pt, Pd, Ag and Au are estimated for each mineralization domain using ~2.0 m capped composites assigned to that domain. To generate grade within the blocks, the inverse distance squared (ID2) interpolation method was used for all domains.

- Specific gravity values were assigned to each block based on a regression formula defined by a database of 32,592 samples. SG=(0.2057xNi%+2.88).

- Based on the size, shape, and orientation of the Crean Hill Deposit, it is envisioned that the deposits may be mined using both bulk and selective mining methods including Longhole Stoping.

- The MRE is reported at a base case cut-off grade of 1.10% NiEq. The mineral resource grade blocks are quantified above the base case cut-off grade and within the constraining mineralized wireframes (considered mineable shapes).

- The underground cut-off grade of 1.10% NiEq considers metal prices of $8.50/lb Ni, $3.75/lb Cu, $17.00/lb Co, $950/oz Pt, $1100/oz Pd and $1,950/oz Au, metal recoveries of 78% for Ni, 95.5% for Cu, 56% for Co, 69.2% for Pt, 68% for Pd and 67.7% for Au (Ag is not considered), a mining cost of US$80.00/t rock and processing, treatment and refining, transportation and G&A cost of US$42.50/t mineralized material.

- The estimate of Mineral Resources may be materially affected by environmental, permitting, legal, title, taxation, socio-political, marketing, or other relevant issues.

Qualified Person for News Release

The scientific and technical information in this press release has been reviewed and approved by David King, M.Sc., P.Geo. Mr. King is the Senior Vice President, Exploration and Geoscience for Magna Mining Inc. and is a qualified person under Canadian National Instrument 43-101.

Cautionary Statement

All statements, other than statements of historical fact, contained or incorporated by reference in this press release constitute “forward-looking statements& and “forward-looking information& (collectively, “forward-looking statements&) within the meaning of applicable securities laws. Generally, these forward-looking statements can be identified by the use of forward-looking terminology, such as “may&, “might&, “potential&, “expect&, “anticipate&, “estimate&, “believe&, “can&, “could&, “should&, “would&, “will&, “interpreted&, “continue&, “intend&, “plan&, “forecast&, “prospective&, “significant& or other similar words or phrases or variations thereof. Forward-looking statements are necessarily based upon a number of assumptions that, while considered reasonable by management, are inherently subject to business, market, economic, technical and other risks, uncertainties and contingencies that may cause actual results, performance or achievements to be materially different from those expressed or implied by forward-looking statements, including risks and uncertainties relating to the failure to commence, or complete, the prefeasibility study as expected, the failure of the completed prefeasibility study to confirm the preliminary, indicative economic and other findings or conclusions in the currently filed preliminary economic assessment for the Crean Hill Project, such as those pertaining to net present value, internal rate of return, capital expenditure, or mine life, and other risks disclosed in the Company&s annual management discussion and analysis, available on the SEDAR+ website (at: www.sedarplus.ca). Although the Company has attempted to identify important risks, uncertainties, contingencies and factors that could cause actual results to differ materially from those expressed or implied in forward-looking statements, there can be no certainty or assurance that the Company has accurately or adequately captured, accounted for or disclosed all such risks, uncertainties, contingencies or factors. Readers should place no reliance on forward-looking statements as actual results, performance or achievements may be materially different from those expressed or implied by such statements. Resource exploration and development, and mining operations, are highly speculative, characterized by several significant risks, which even a combination of careful evaluation, experience and knowledge will not eliminate. Forward-looking statements speak only as of the date they are made. The Company does not undertake to update any forward-looking statements, whether as a result of new information or future events or otherwise, except in accordance with applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accept responsibility for the adequacy or accuracy of this press release.

About Magna Mining Inc.

Magna Mining is an exploration and development company focused on nickel, copper and PGM projects in the Sudbury region of Ontario, Canada. The Company&s flagship assets are the past producing Shakespeare and Crean Hill Mines. The Shakespeare Mine is a feasibility stage project which has major permits for the construction of a 4,500 tonne per day open pit mine, processing plant and tailings storage facility and is surrounded by a contiguous 180km2 prospective land package. Crean Hill is a past producing nickel, copper and PGM mine, with a technical report dated September 2024. Additional information about the Company is available on SEDAR+ (www.sedarplus.com) and on the Company&s website (www.magnamining.com).

For further information, please contact:

Jason Jessup

Chief Executive Officer

or

Paul Fowler, CFA

Executive Vice President

705-482-9667

Email: info@magnamining.com

Photos accompanying this announcement are available at https://www.globenewswire.com/NewsRoom/AttachmentNg/2dc763da-f07c-46fa-8601-dac08a44f302

https://www.globenewswire.com/NewsRoom/AttachmentNg/591aabc4-d409-4a2b-ab60-4c9e5bd98b3d

https://www.globenewswire.com/NewsRoom/AttachmentNg/bf6077b2-958f-4fc3-948a-7fa2ab0c5570