-

Consistent, high‑grade, near‑surface intervals at Valley including 347.6 m at 1.0 g/t Au in geotechnical drilling, with the interval ending in mineralization outside the current mine plan

-

Broad zone of lower‑grade mineralization expanded along the eastern margin of the Valley intrusion, with potential for additional higher grades in untested areas

-

Regionally, discovery of new mineralized zone, "Crossroad," on the Cynthia Project, with selective grab samples up to 14.1 g/t Au and 3.5 kg/t Ag along 5 km structural corridor

-

Five regional drill targets tested providing key geological data for focused drill programs and exploration advancement in upcoming 2026 field program.

VANCOUVER, BC / ACCESS Newswire / February 11, 2026 / SNOWLINE GOLD CORP. (TSX:SGD)(OTCQB:SNWGF) (the "Company" or "Snowline") is pleased to report additional analytical results from its 2025 exploration program, including exploratory, infill, geotechnical and condemnation drilling for its Valley deposit ("Valley") on its flagship Rogue Project in the eastern Yukon Territory. Results highlight ongoing resource de-risking through successful infill drilling of higher grade, near-surface mineralization and outline an extensive zone of lower grade mineralization outside of the current resource. Open edges of the system point to untested, prospective areas with the host intrusion for future drill testing. The Company also reports results from five regional drill targets on its Rogue Project and the discovery of a new mineralized target - Crossroads - on its Cynthia Project, where selective grab sampling returned values up to 14.1 g/t Au and 3,505 g/t Ag. Regional drilling and surface results are being used to guide targeting for Snowline's upcoming 2026 exploration program.

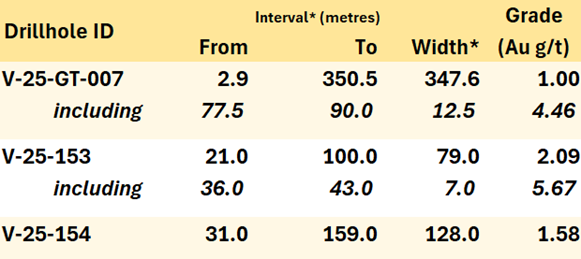

Table 1 - Highlight summary of Snowline's latest assay results from Valley. All three holes begin and end in mineralization. See Tables 2 & 3 and Figure 1 for details. *Interval widths reported.

"We continue to see consistent gold from surface at Valley along with an expanding mineralized footprint to the system," said Scott Berdahl, CEO & Director of Snowline. "Results from infill and geotechnical drilling are expected to inform reclassification of high value, near-surface mineralization for inclusion in our ongoing Prefeasibility Study. Results from exploration holes drilled in the eastern part of the Valley intrusion add significant scale while highlighting the potential for additional high‑grade centres in untested parts of the intrusion. Beyond Valley, regional drilling and the new discovery of mineralization at Crossroad on the Cynthia Project increase the opportunities within our regional exploration pipeline. As we advance Valley through prefeasibility and towards permitting, we aim to build on our exploration progress by confirming multiple mineralized centres in a new Canadian gold district."

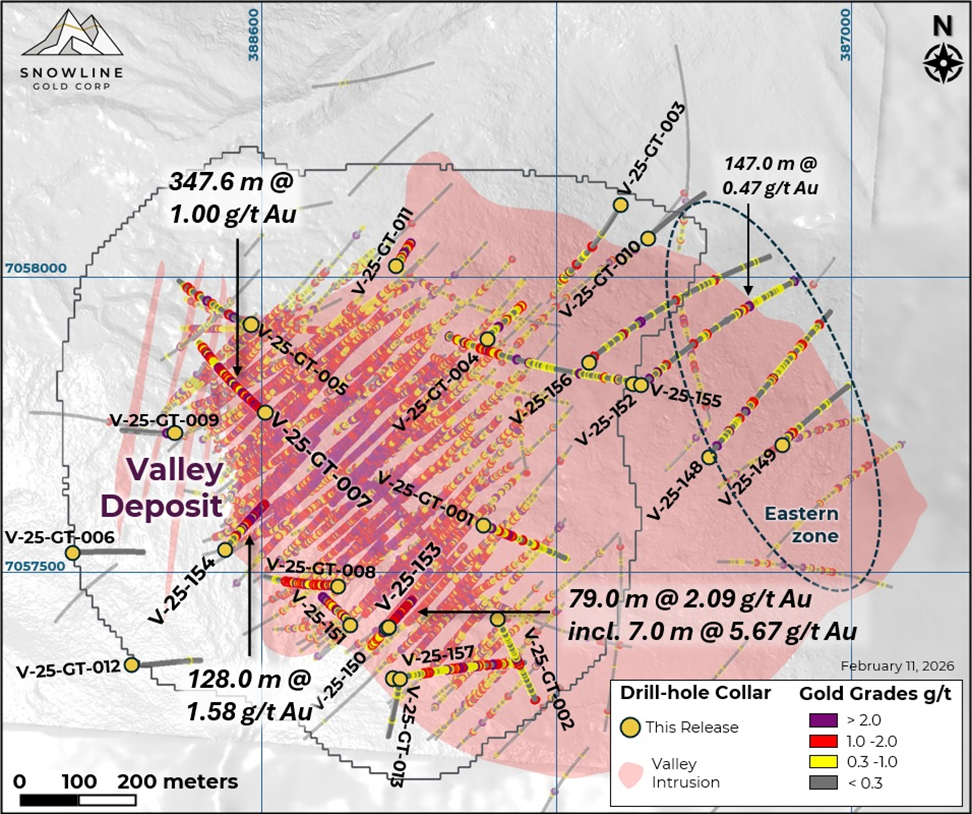

Figure 1 - Plan map of the Valley intrusion showing all drilling to date, including results from the current holes reported for Valley. Note that 2025 holes are plotted above previous results for clarity, regardless of relative depths. The outline of the Valley intrusion corresponds to its expression at surface.

VALLEY DEPOSIT DRILLING, ROGUE PROJECT

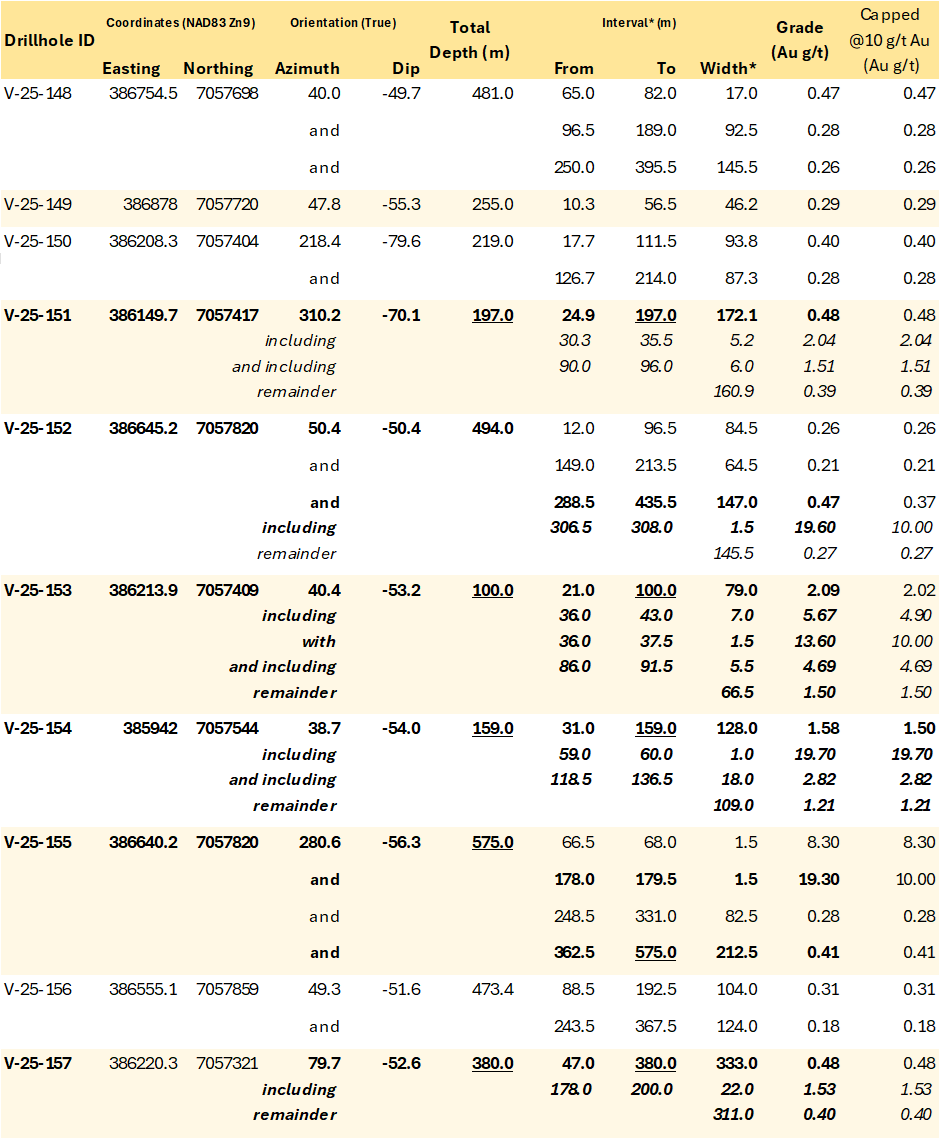

Over 20,000 m of drilling were completed within and near Valley in 2025 1 . Infill drilling at Valley continues to demonstrate strong grade continuity within the near‑surface core of the system. Holes V-25-153 and V-25-154 targeted conversion of higher-grade inferred resources located near surface and thus early and higher value with respect to an open pit mine plan. Both holes encountered strong mineralization throughout. Resource expansion drilling demonstrates a broad, lower-grade halo around the core deposit with open edges of >1 g/t Au mineralization, while indicating potential for additional zones of high-grade mineralization within the Valley intrusion. Prospective opportunities exist where adjacent drill holes end in mineralization, such as at the bottom of V-25-155. The latest results from Valley bolster confidence in both geological modeling and ongoing resource evaluation, which will be used to inform the upcoming Prefeasibility Study (PFS) for Valley.

New Eastern Zone: Snowline drilled eight holes in 2025 into a new zone of mineralization discovered near the eastern edge of the Valley intrusion in 2024. Mineralized intervals reported from these holes as well as 2024 drillhole V-24-115 span an open volume of roughly 700 x 400 x 200 m (length x height x width) located several hundred metres from the edge of the current Valley resource (Figure 1), with a weighted average grade across these intervals of 0.34 g/t Au, not including barren zones between intervals. The extent, continuity and significance of this zone of mineralization is still to be determined, as well as the potential for continuity of mineralization between this distal zone and the main Valley deposit. The Company interprets this mineralization as an indicator of potential additional centres of higher-grade mineralization within the Valley intrusion.

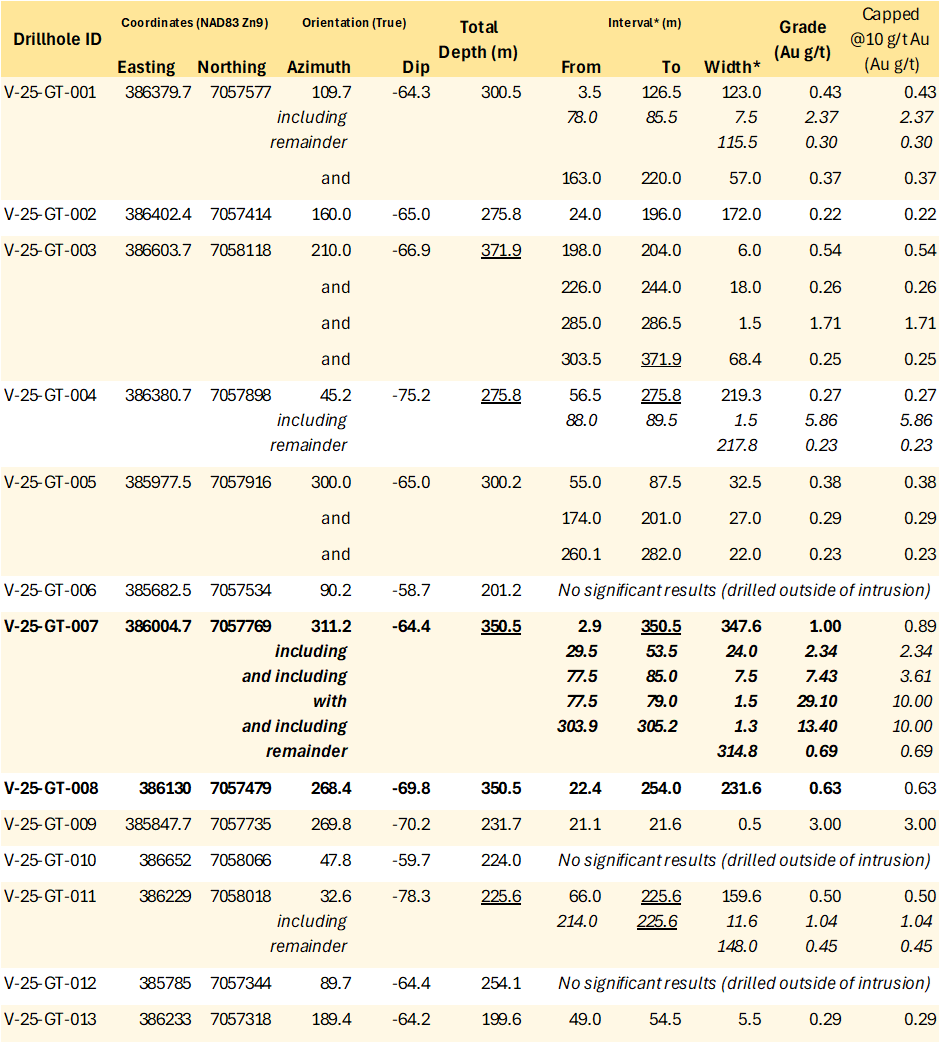

Geotechnical and Condemnation Drilling: The 2025 geotechnical program at Valley successfully collected data that support mine planning scenarios under evaluation while increasing confidence for future resource estimation. Analytical results for gold are presented in Table 3. Notably, geotechnical hole V-25-GT-007 returned 1.00 g/t Au over its entire 347.6 m length from bedrock surface, ending near a prospective, open zone of mineralization on the northwestern edge of the Valley deposit.

Condemnation drilling near potential infrastructure sites returned no significant mineralization, increasing confidence in the suitability of these areas for future development considerations (Table 4).

Table 2 - Anomalous gold intervals in drillholes V-25-148 through V-25-157 from the Valley deposit. Underlined numbers indicate end-of-hole values within mineralized intervals. Holes V-25-148, 149, 152 & 156 are from the new zone of mineralization on the eastern side of the Valley intrusion. *Interval widths shown.

Table 3 - Anomalous gold intervals in 2025 geotechnical drillholes drilled within and near the Valley deposit to assess pit characteristics. Underlined numbers indicate end-of-hole values within mineralized intervals. Beyond their utility for engineering, geotechnical holes will support increased confidence in resource modelling. *Interval widths shown.

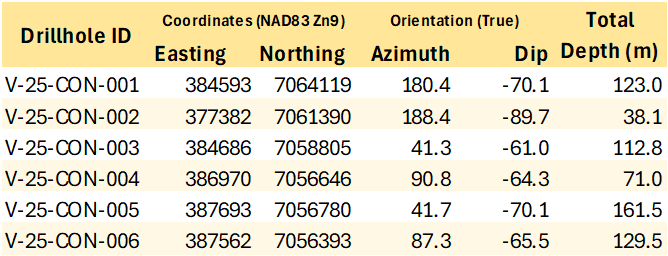

Table 4 - Location details for Snowline's 2025 condemnation drill program. No significant gold mineralization was encountered in any of the holes.

REGIONAL EXPLORATION

Roughly 10,000 m of drilling was completed in 2025 outside of Valley on the Rogue and Einarson projects, on nine additional targets across a 40 x 80 km region (Figure 4). Visible gold has been encountered in drilling in seven of these nine targets, demonstrating district-scale gold fertility. Analytical results from five targets (Aurelius, Charlotte, Cujo, Gracie, Ramsey) are presented herein (Table 5); geological results from drilling will be used to reprioritize and guide upcoming regional exploration and drill programs. In addition to drilling, baseline prospecting and mapping as well as geochemical and geophysical surveying continue to build out the Company's district-scale pipeline, with the discovery of the prospective new Crossroad target on the Cynthia Project.

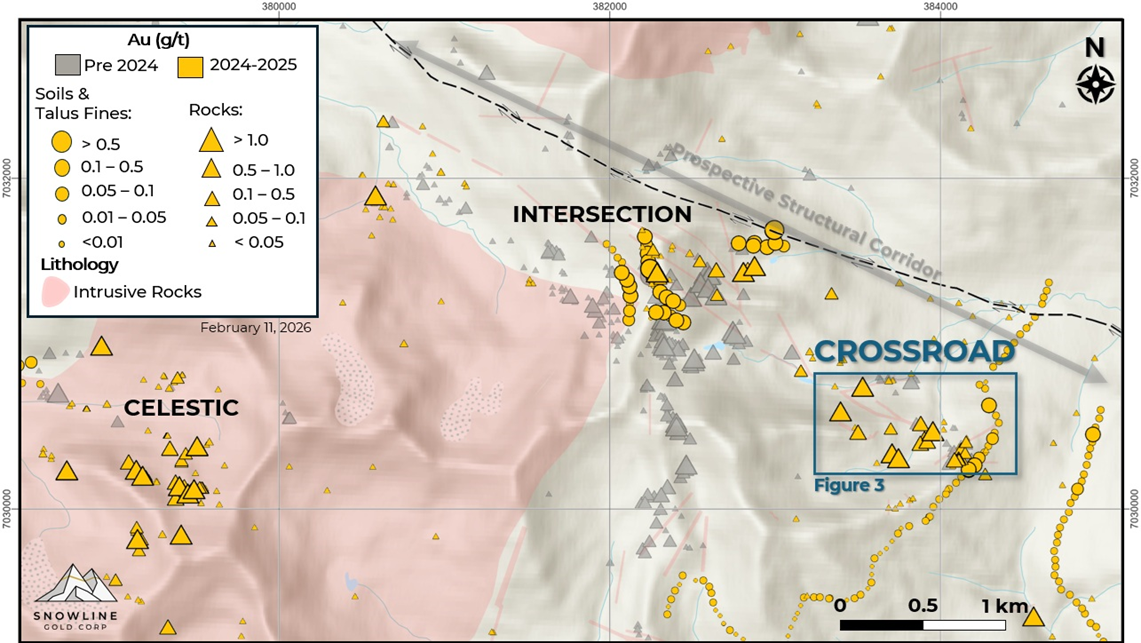

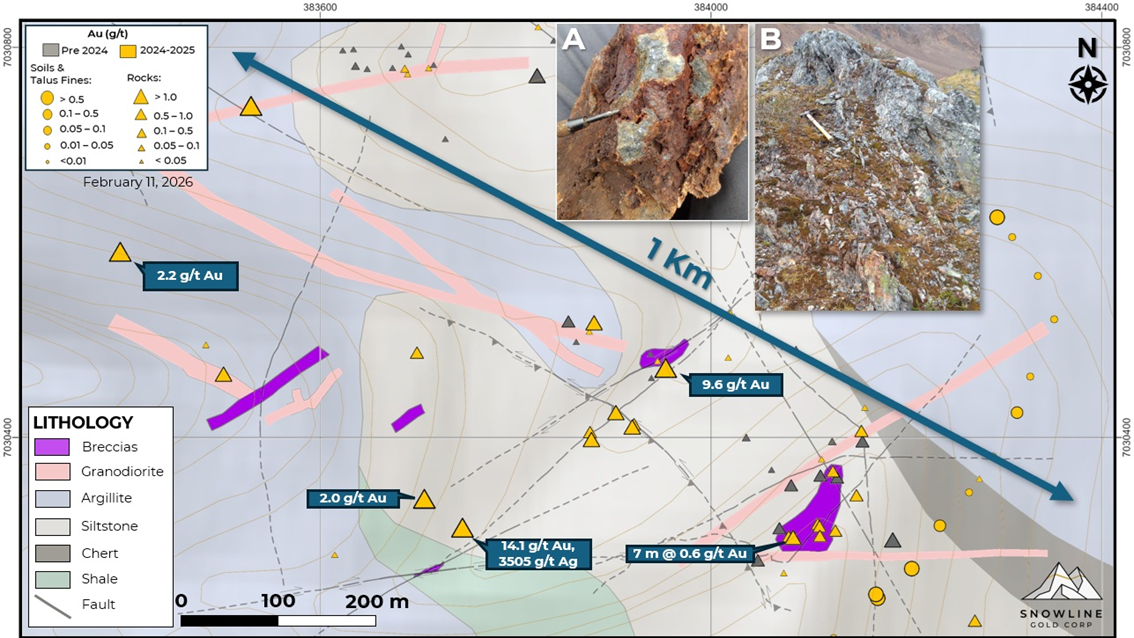

Crossroad Target: Reconnaissance prospecting, soil sampling and mapping on the Cynthia Project led to the discovery of a new mineralized zone named the Crossroad target, located roughly 27 km south of Valley and 10 km from the Plata Winter Trail (Figures 2 and 4). Gold mineralization has been encountered in surface samples from an area of 1,000 x 300 m, with selective grab samples returning up to 14.1 g/t Au and 3,505 g/t Ag (including elevated Bi, Cu, Fe, Pb, Sn, Te & Zn values), along with a chip sample across a 7.0 m outcrop which returned 0.6 g/t Au. Mineralization is hosted within altered siltstones and argillites as well as hydrothermal breccia units and granodioritic dykes. The Crossroad target is located along the same structural corridor as Snowline's "Intersection" target, also on the Cynthia Project, along a prospective five-kilometer trend with multiple outcrops showing reduced intrusion-related mineralization. The Company will continue surface evaluation of Crossroads and the broader corridor in 2026 to define potential drill targets.

Figure 2 - Location of the Crossroad Target, Cynthia Project , relative to nearby Celestic and Intersection targets. Crossroad sits on a prospective WNW-ESE structural corridor along with the Intersection target, near two mid-Cretaceous reduced intrusions with associated gold mineralization, including the intrusion hosting Celestic.

Figure 3 - Geological map of Crossroad target, Cynthia Project , showing the results of initial prospecting performed to date. Insets: A) Distal intrusion-related mineralization returning 14.1 g/t Au and 3,505 g/t Ag. B) Thrust deformation associated with replacement-style mineralization.

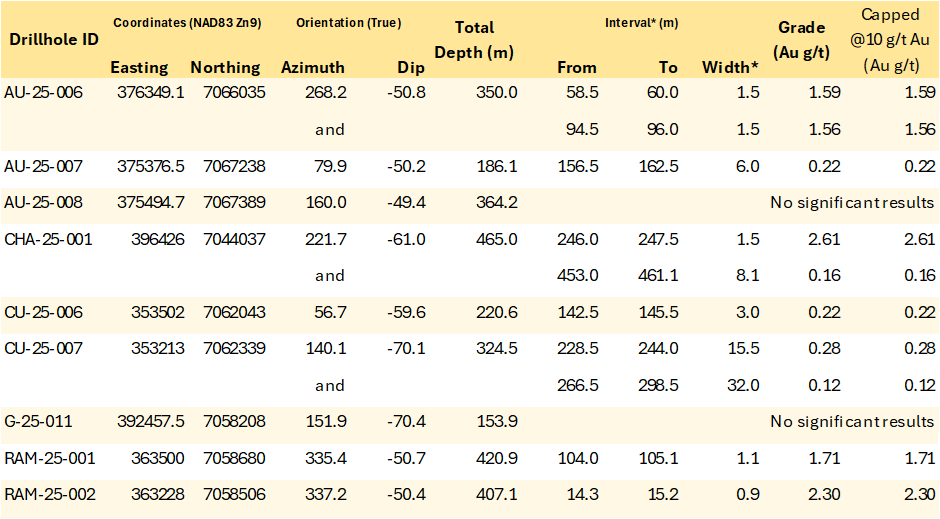

Table 5 - Anomalous gold intervals in regional drill holes from the Aurelius (AU), Charlotte (CHA), Gracie (G) and Ramsey (RAM) targets. *Interval widths shown.

Figure 4 - Project location map for Snowline's eastern Selwyn Basin projects: Rogue, Einarson, Ursa, Cynthia and Olympus, highlighting the location of the new Crossroad target on the Cynthia Project along with regional targets drilled during Snowline's 2025 exploration campaign.

QA/QC

On receipt from the drill site NQ2-sized drill core was systematically logged for geological attributes, photographed and sampled at Snowline's Forks camp. Sample lengths as small as 0.5 m were used to isolate features of interest, but most samples within moderate to strong mineralization were 1.0 m in length; otherwise, a default 1.5 m downhole sample length was used. Core was cut in half lengthwise along a pre-determined line, with one half (same half, consistently, dictated by orientation line where present or by dominant vein orientation where absent) collected for analysis and one half stored as a record. Field duplicates were collected at regular intervals as ¼ core samples by splitting the ½ core sent for sampling, leaving a consistent record of half core material from duplicate and non-duplicate samples alike. Standard reference materials and blanks were inserted by Snowline personnel at regular intervals into the sample stream. Bagged samples were sealed with security tags to ensure integrity during transport. They were delivered by expeditor to Bureau Veritas' preparatory facility in Whitehorse, Yukon. Sample preparation was completed in Whitehorse, with analyses completed in Vancouver.

Bureau Veritas is accredited to ISO/IEC 17025 and ISO9001 for quality management. Samples were crushed by BV to >85% passing below 2 mm and split using a riffle splitter. 250 g splits were pulverized to >85% passing below 75 microns. A four-acid digest with an inductively coupled plasma mass spectroscopy (ICP-MS) finish was used for 59-element analysis on 0.25 g sample pulps (BV code: MA250). All samples were analysed for gold content by fire assay with an atomic absorption spectroscopy (AAS) finish on 30 g samples (BV code: FA430). Any sample returning >10 g/t Au was reanalysed by fire assay with a gravimetric finish on a 30 g sample (BV code: FA530).

ABOUT SNOWLINE GOLD CORP.

Snowline Gold Corp. is a Yukon Territory gold exploration and development company focused on advancing its 100% owned Valley gold deposit on its flagship Rogue Project, while unlocking the district upside of its 360,000 ha (3,600 km 2 ) mineral tenure in the highly prospective yet underexplored Selwyn Basin.

Valley is a large, low-strip, near surface, >1 g/t Au bulk tonnage gold system hosting an open MRE of 7.94 million ounces gold at 1.21 g/t Au Measured & Indicated (in 204.0 million tonnes) 2 and an additional 0.89 million ounces gold Inferred at 0.62 g/t Au (in 44.5 million tonnes) 3 , with a cut-off grade of 0.3 g/t Au. Results of a Preliminary Economic Assessment ("PEA") for Valley suggest the potential to support a long-life mining operation with a strong production profile and low production costs. The MRE and PEA are detailed in the recent technical report for Rogue, prepared in accordance with NI 43-101 standards, entitled "Independent Preliminary Economic Assessment for the Rogue Project Yukon, Canada," dated August 27, 2025, with an effective date of March 1, 2025, and available on SEDAR+ and the Company's website.

Snowline's project portfolio sits within the prolific Tintina Gold Province, host to multiple million-ounce-plus gold mines and deposits across the central Yukon and Alaska. The Company's comprehensive first-mover position and extensive exploration database provide a distinct competitive advantage and a unique opportunity for investors to be part of multiple discoveries, the advancement of a significant gold deposit, and the creation of a new gold district.

QUALIFIED PERSON

Information in this release has been prepared under supervision of and approved by Sergio Gamonal, M.Sc., P. Geo., Chief Geologist for Snowline Gold Corp, as Qualified Person for the purposes of National Instrument 43-101.

ON BEHALF OF THE BOARD

Scott Berdahl

CEO & Director

For further information, please contact:

Snowline Gold Corp.

+1 778 650 5485

info@snowlinegold.com

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This news release contains certain forward-looking statements, including statements about the Company's work programs, results, surface work, advancement of studies and permitting, the completion of a potential PFS, the significance of visible gold in drill core, the presence of mineralized intrusions, potential styles of mineralization, expansion and upgrading of mineral resource estimates, projected mining plans, continued exploration and 2026 exploration plans, the establishment of multiple mineralized centres, and the creation of a new gold district. Wherever possible, words such as "may", "will", "should", "could", "expect", "plan", "intend", "anticipate", "believe", "estimate", "predict" or "potential" or the negative or other variations of these words, or similar words or phrases, have been used to identify these forward-looking statements. These statements reflect management's current beliefs and are based on information currently available to management as at the date hereof.

Forward-looking statements involve significant risk, uncertainties and assumptions. Many factors could cause actual results, performance or achievements to differ materially from the results discussed or implied in the forward-looking statements. Such factors include, among other things: risks related to uncertainties inherent in drill results and the estimation of mineral resources; and risks associated with executing the Company's plans and intentions. These factors should be considered carefully, and readers should not place undue reliance on the forward-looking statements. Although the forward-looking statements contained in this news release are based upon what management believes to be reasonable assumptions, the Company cannot assure readers that actual results will be consistent with these forward-looking statements. These forward-looking statements are made as of the date of this news release, and the Company assumes no obligation to update or revise them to reflect new events or circumstances, except as required by law.

1 See news releases dated August 7, 2025, September 24, 2025, November 24, 2025 available on the Company's website www.snowlinegold.com and under the Company's profile on SEDAR+ at www.sedarplus.ca for full details of previously released 2025 drill results at the Rogue and Einarson projects.

2 Comprising 3.15 million ounces at 1.41 g/t Au in Measured and 4.79 million ounces at 1.11 g/t Au in Indicated.

3 Mineral resources are not mineral reserves and do not have demonstrated economic viability. The estimate of mineral resources may be materially affected by metal prices, economic factors, environmental, permitting, legal, title, or other relevant issues.

SOURCE: Snowline Gold Corp.

View the original press release on ACCESS Newswire