(TheNewswire)

|

|||||||||

|

|

|

|

||||||

Vancouver, BC – TheNewswire - October 30, 2025 – Global Stocks News - Sponsored content disseminated on behalf of West Red Lake Gold. On October 28, 2025, West Red Lake Gold Mines (TSXV: WRLG) (OTCQB: WRLGF) announced that it is launching a fully funded infill and conversion drilling program at its 100% owned Rowan Project located in the Red Lake Gold District of Northwestern Ontario, Canada.

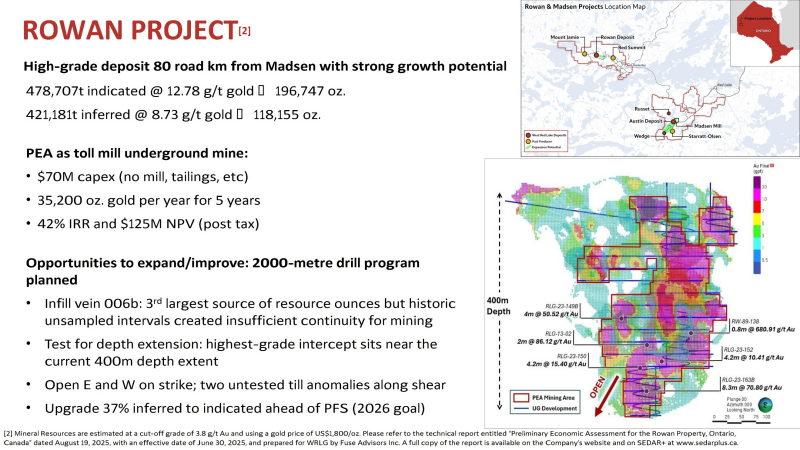

The Rowan Project is 80 kilometers by road from the operating Madsen Mine and mill. Rowan is a high-grade, relatively wide, nearly vertical deposit that starts at surface.

A Preliminary Economic Assessment (PEA) filed on August 19, 2025 captures how Rowan&s designed-for-mining characteristics promote strong economics. [1.]

Rowan Select PEA Highlights:

-

High-Grade Efficient Mine: Average diluted head grade of 8.0 grams per tonne.

-

Notable Production: 35,230 oz. average annual gold production over the 5-year mine life from an average mining rate of 385 tonnes per day.

-

Strong Value: Post-tax NPV rises to $239M at US$3,250 per oz gold.

-

Low Costs: US$1,408/oz all-in sustaining cost (AISC).

-

Strong Returns: IRR of 81.7% at a US$3,250/oz gold price.

-

High Confidence Inventory: PEA mine design includes 63% of mined tonnes and 72% of mined ounces from the Indicated category.

-

Simple Metallurgy: Free gold-dominant mineralization resulting in 75.8% to 94.9% gold recovery through gravity processing.

-

Modest Initial Capital: Opportunity to develop Rowan as a toll milling operation with initial capital of just over $70 million.

The July 2025 Rowan PEA used a conservative long-term gold price of USD$2,500/ounce – about $1,500/ounce lower than the current price.

In a YouTube video posted on October 29, 2025, West Red Lake Gold VP of Communications, Gwen Preston, explained the significance of the announced Rowan drill program.

“We are comfortable that Madsen will operate in 2026 as the high-grade mine that we had planned, and that it will deliver something like 50,000 ounces of gold per year,& stated Preston in the explainer video.

“Our goal has always been to grow rapidly as a producer in this gold market. Going from zero to 50,000 ounces is a great start. But we are looking ahead.&

“The July PEA on Rowan, with that initial mine, showed Rowan could be turned into a mine producing 32,500 ounces of gold annually, at a capital cost of $70 million, tapping a high-grade deposit.&

“We have almost three years of baseline environmental data collected at Rowan,& continued Preston. “We're not planning a mill or a tailings facility. This is just a mine, a camp, a water treatment plant with the associated equipment. We are in a province that is focused right now on speeding up mine-permitting timelines.&

“Assuming studies and permits go the way that we expect, we believe we could start developing the underground at Rowan in 2027, and have that project in production in 2028.&

“By then, Madsen will be getting to a depth where the ounces of gold per vertical meter are quite a bit higher. We&ll get into the good stuff, so to speak. Getting closer to the high-grade 8-zone, which is one prize that we currently know about at depth.&

“Adding 32,000 ounces of gold annually from the Rowan mine, in that context, on top of what we have going on at Madison in 2028, that lays a path for West Red Lake gold to be producing 90,000 to 100,000 ounces of gold a year in 2028. That's the kind of production growth that can really grab investors' attention in a rising gold market.&

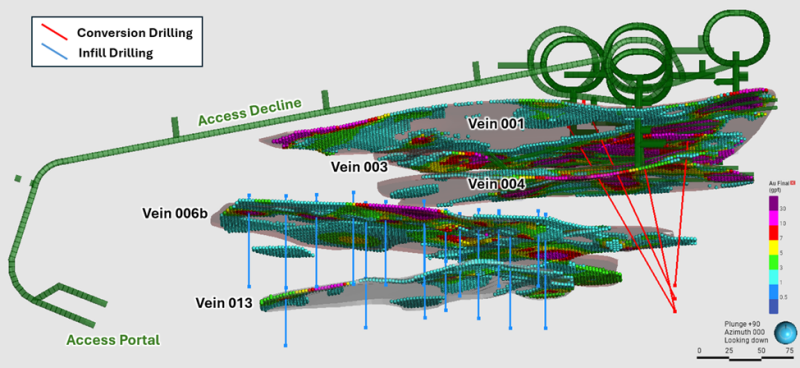

The Rowan 5,000-metre HQ diameter diamond drill program announced October 28, 2025 is designed to do three things.

“The first goal is to infill drill the parts of the resource that are currently in an inferred category,& said Preston. “The goal is to upgrade those inferred ounces to indicated status so that they can be included in a pre-feasibility mine-plan.&

“The second goal is to drill two veins, 006b and 013, that did not make it into the mine plan, because they are informed by primarily historic drill holes that were sparsely assayed. Those two veins sit between the planned portal and where the rest of the mine is. They're in an efficient location in terms of development.&

“The third goal is to collect more rock material so that we can do the next round of metallurgical work. This will feed into the pre-feasibility study, which is planned as a joint study for Madsen and Rowan. This joint study will outline how tons mined at Rowan could be processed at Madsen.&

“The mill at Madsen already has the capacity to handle those additional tonnes from Rowan, but we would need to increase the permitted throughput at Madsen. That would require an approved permit for new tailings and water management. Those are the pieces that are in play as we try to create this integrated plan, then permit it and put it into action,& concluded Preston in the explainer video. [2] [3] [4]

“The Rowan project, according to the PEA, is projected to produce 35,000 ounces of gold a year,& confirmed Shane Williams, President and CEO, in the October 28 press release. “Success in advancing Rowan through permitting and development could position WRLG to target a combined production rate of up to 100,000 ounces per year gold [5] in Red Lake in the coming years.&

“The drilling at Rowan not only aims to increase confidence in the existing mineral resource but will also provide the physical core material needed to complete advanced metallurgical and geotechnical studies ahead of the planned combined PFS.&

“With gold prices continuing to trade around all-time highs, we anticipate strong economics in the combined PFS, which is expected to be completed by Q3 2026. This study will be a significant milestone for WRLG, establishing a valuation benchmark for our total Red Lake assets.&

“The study will also inform our permit applications; based on our discussions with permitting authorities in Ontario, we are encouraged that the new One Project, One Process permitting framework has the potential to truly expedite permitting of projects like Rowan,& concluded Williams.

Figure 1. Plan view showing Rowan Veins 001, 003, 004, 006b and 013 with proposed infill and conversion drilling and current PEA underground mine design [1].

[1] Mineral resources are estimated at a cut-off grade of 3.80 g/t Au and a gold price of US$1,800/oz. Please refer to the technical report entitled “Rowan Project NI 43-101 Technical Report and Preliminary Economic Assessment, Ontario, Canada&, prepared by Fuse Advisors Inc., and dated June 30, 2025. A full copy of the report is available on the Company&s website and on SEDAR+ at www.sedarplus.ca.

The technical information presented in this news release has been reviewed and approved by Will Robinson, P.Geo., Vice President of Exploration for West Red Lake Gold and the Qualified Person for technical disclosure at the West Red Lake Project, as defined by NI 43-101 “Standards of Disclosure for Mineral Projects&. Contact: guy.bennett@globalstocksnews.com

Disclaimer: West Red Lake Gold paid Global Stocks News (GSN) $1,750 for the research, writing and dissemination of this content.

Full Disclaimer: GSN researches and fact-checks diligently, but we cannot ensure our publications are free from error. Investing in publicly traded stocks is speculative and carries a high degree of risk. GSN publications may contain forward-looking statements such as “project,& “anticipate,& “expect,& which are based on reasonable expectations, but these statements are imperfect predictors of future events. When compensation has been paid to GSN, the amount and nature of the compensation will be disclosed clearly.

References:

[1] The PEA is preliminary in nature; it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves; there is no certainty that the PEA results will be realized.

[2] There can be no assurance that drilling at Rowan will result in the conversion of Inferred resources to Indicated; any such upgrade will depend on the results of the drill program and subsequent resource estimation by a Qualified Person.

[3] There can be no assurance that the planned combined PFS will support the development of the Madsen Mine and Rowan projects as a single operation or using common infrastructure. Any such determination will depend on the outcome of such PFS and subsequent technical and economic studies.

[4] https://news.ontario.ca/en/release/1006621/ontario-implements-one-project-one-process-to-build-mines-faster

[5] The Rowan project production projection is based on the PEA for Rowan. The Madsen Mine is supported by a Pre-Feasibility Study technical report, effective January 7, 2025, prepared in accordance with NI 43-101 and available on SEDAR+. The PEA is preliminary in nature; it includes Inferred mineral resources that are considered too speculative geologically to have the economic considerations applied to them that would enable them to be categorized as mineral reserves. There is no certainty that the PEA results will be realized. Any reference to a combined or target production rate for Rowan and Madsen is show for illustrative purposes only; no combined economic analysis or production schedule has been prepared. The Rowan PEA and Madsen Pre-Feasibility Study are separate studies prepared to different levels of confidence, and their results should not be blended or considered as a single project scenario. There can be no assurance that the projects will be developed using common infrastructure or as a single operation, or that such a rate will be achieved. Any such determination will depend on the outcome of the planned combined PFS and receipt of all necessary approvals.

Copyright (c) 2025 TheNewswire - All rights reserved.