Date: 2026-01-22

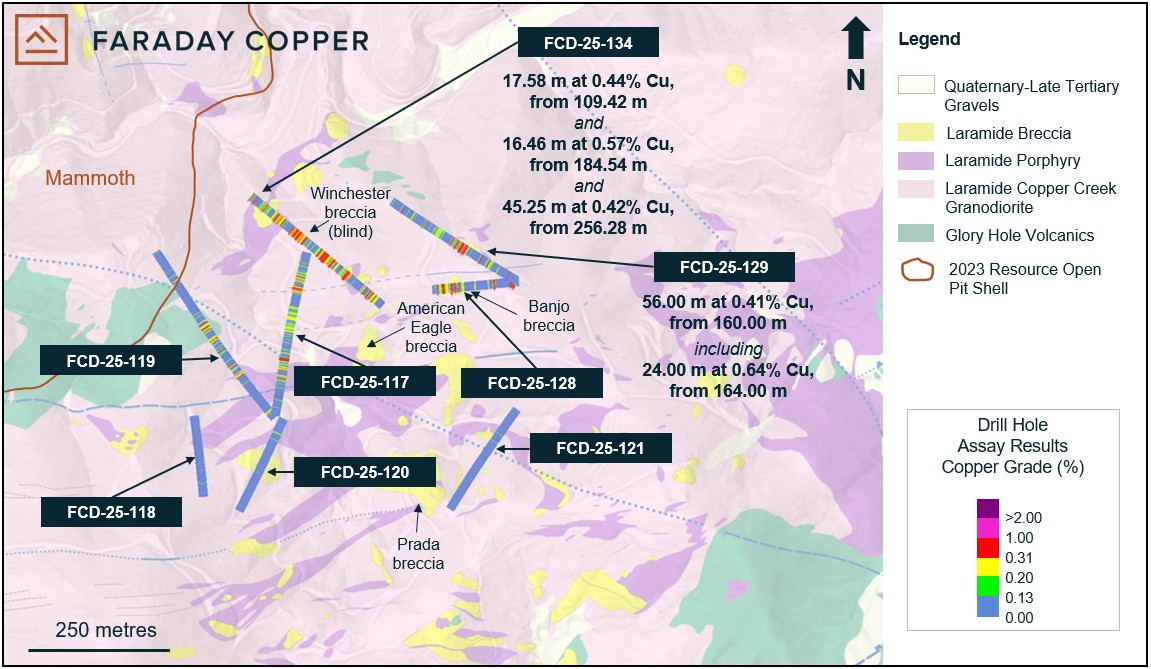

Faraday Copper Intersects Near-Surface Copper Mineralization from Five Drill Holes in the American Eagle Area

Faraday Copper Intersects Near-Surface Copper Mineralization from Five Drill Holes in the American Eagle AreaVANCOUVER, BC / ACCESS Newswire / January 22, 2026 / Faraday Copper Corp. (" Faraday " or the ...

--------------------------------

Date: 2025-11-13

Faraday Copper Reports Third Quarter 2025 Financial ResultsVANCOUVER, BC / ACCESS Newswire / November 13, 2025 / Faraday Copper Corp. (" Faraday " or the...

--------------------------------

Date: 2025-11-13

52-109F2 - Certification of interim filings - CEO--------------------------------

Date: 2025-11-13

52-109F2 - Certification of interim filings - CFO--------------------------------

Date: 2025-11-13

Interim MD&A--------------------------------

Date: 2025-11-13

Interim financial statements/report--------------------------------

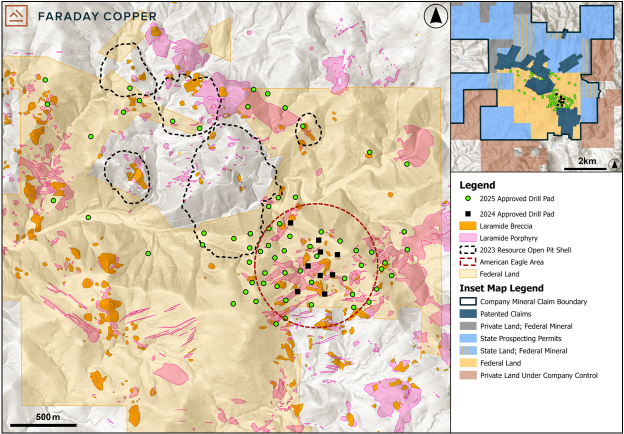

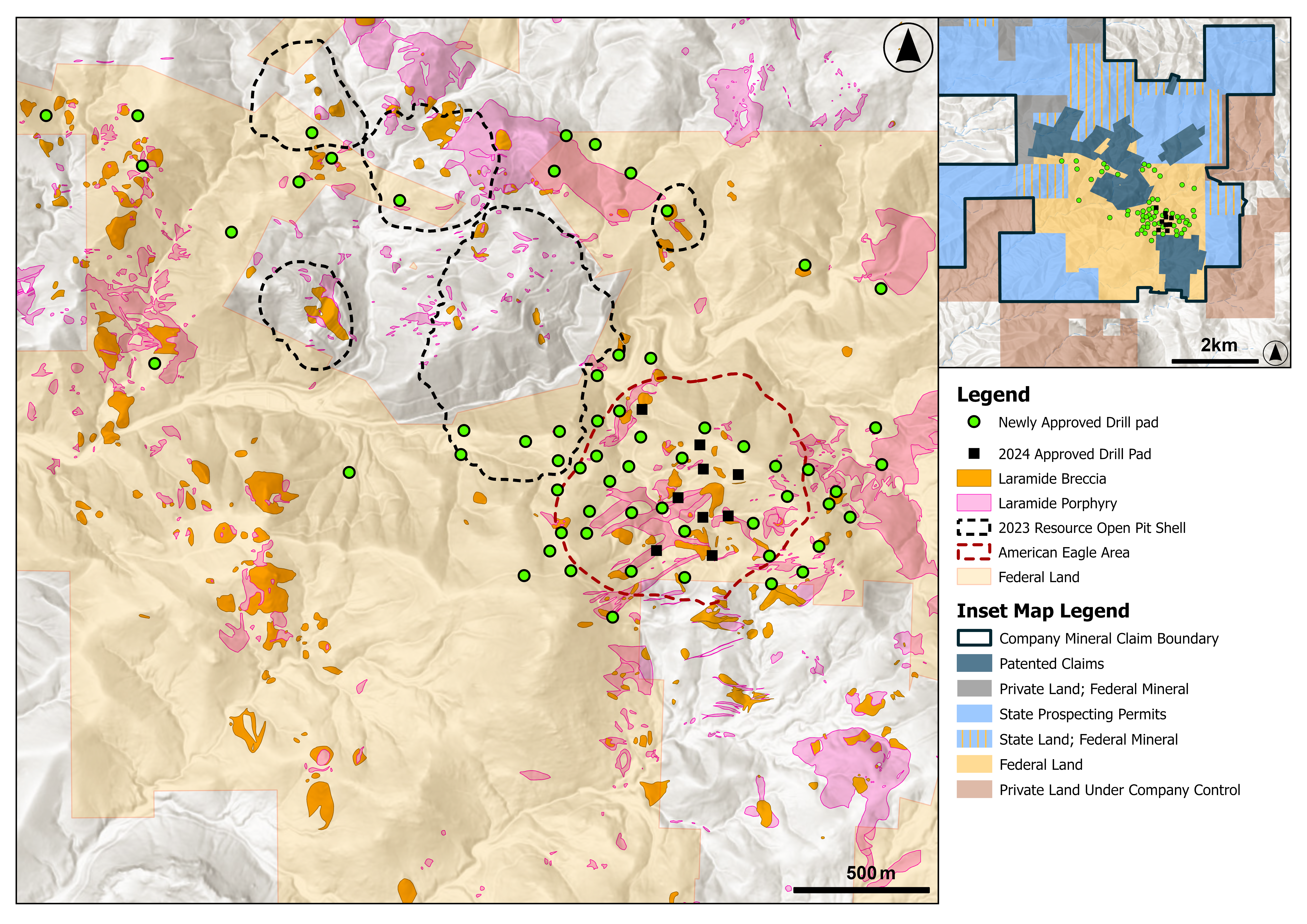

Date: 2025-09-18

Faraday Copper Initiates Largest Ever Drill Program at the Copper Creek Project in Arizona

Faraday Copper Initiates Largest Ever Drill Program at the Copper Creek Project in ArizonaVANCOUVER, BC / ACCESS Newswire / September 18, 2025 / Faraday Copper Corp. (" Faraday " or ...

--------------------------------

Date: 2025-08-11

Faraday Copper Reports Second Quarter 2025 Financial ResultsVANCOUVER, BC / ACCESS Newswire / August 11, 2025 / Faraday Copper Corp. (" Faraday " or the "...

--------------------------------

Date: 2025-08-11

52-109F2 - Certification of interim filings - CFO--------------------------------

Date: 2025-08-11

52-109F2 - Certification of interim filings - CEO--------------------------------

Date: 2025-08-11

Interim MD&A--------------------------------

Date: 2025-08-11

Interim financial statements/report--------------------------------

Date: 2025-08-07

Expected Canadian Company Earnings on Thursday, August 7th, 2025Calfrac Well Services Ltd. (CFW:CA) is expected to report $0.14 for Q2 2025 Jamieson Wellness...

--------------------------------

Date: 2025-08-07

Expected earnings - Faraday Copper Corp.Faraday Copper Corp. (FDY:CA) is expected to report for Q2 2025

--------------------------------

Date: 2025-08-06

Material change report--------------------------------

Date: 2025-08-06

Report of exempt distribution (45-106F1)--------------------------------

Date: 2025-07-29

Faraday Copper Announces Closing of C$49 Million FinancingNOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES...

--------------------------------

Date: 2025-07-15

Offering document (amended)--------------------------------

Date: 2025-07-15

Faraday Copper Upsizes Financing to C$45 MillionNOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES...

--------------------------------

Date: 2025-07-14

Offering document--------------------------------

Date: 2025-07-14

Faraday Copper Announces C$30 Million FinancingNOT FOR DISTRIBUTION TO UNITED STATES NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES...

--------------------------------

Date: 2025-07-02

Faraday Copper Receives Bureau of Land Management Approval for Exploration Plan of Operations at its Copper Creek Project

Faraday Copper Receives Bureau of Land Management Approval for Exploration Plan of Operations at its Copper Creek ProjectVANCOUVER, BC / ACCESS Newswire / July 2, 2025 / Faraday Copper Corp. (" Faraday " or the " Co...

--------------------------------

Investment Disclosure

Many of the companies on this website and in our videos are clients of Mine$tockers Inc. The information is disseminated on behalf of the companies and Mine$tockers as its employees may own or purchase the company's securities from time to time. Mine$tockers Inc.is neither an investment adviser nor a broker-dealer and accordingly is not registered as an investment adviser or a broker-dealer under applicable law. The Mine$tockers website provides readers with general, non-personalized information regarding private and publicly traded companies and why we may have become retail investors. The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada

kevin@MineStockers.com

Phone

+1 (905) 967-2519