Date: 2026-02-05

Statement of acquisition of beneficial ownership by individuals - Form SCHEDULE 13GStatement of acquisition of beneficial ownership by individuals - Form SCHEDULE 13G

--------------------------------

Date: 2026-01-29

Canadian Companies Moving the Markets, Morning editionThu, Jan 29, 2026 as of 10.00 am ET

A look at the top 10 most actives in Canada Vanguard Mining Corp. (UUU) rose 31.0% to $0.55 on ...

--------------------------------

Date: 2026-01-27

This Junior Miner Just Locked Up a Gold-Silver Property Near a Major Deposit2026-01-27 16:44:39 ET British Columbia's Golden Triangle and surrounding mineral belts con...

--------------------------------

Date: 2026-01-22

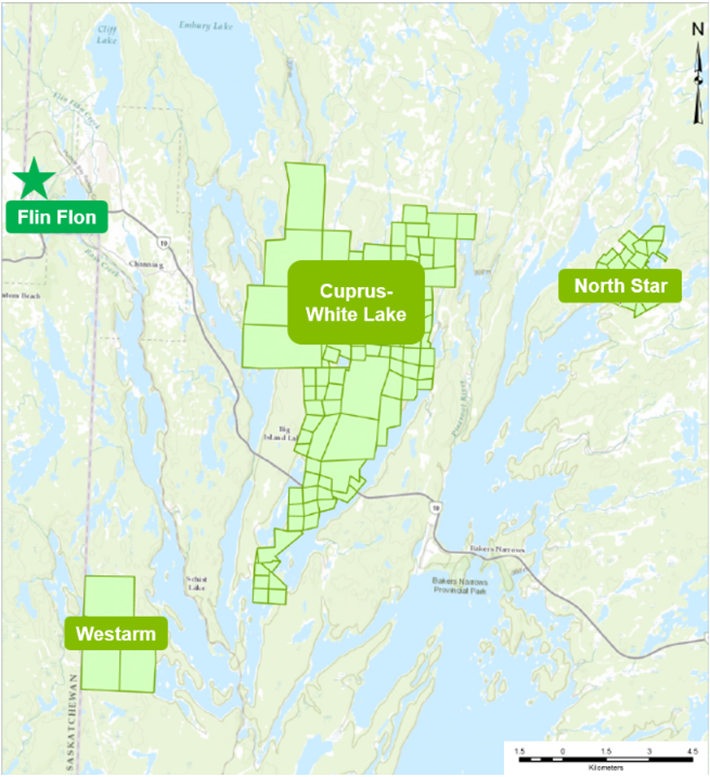

Hudbay and JOGMEC Sign Option Agreement to Expand the Existing Flin Flon Exploration Partnership with Marubeni

Hudbay and JOGMEC Sign Option Agreement to Expand the Existing Flin Flon Exploration Partnership with MarubeniTORONTO, Jan. 22, 2026 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the &...

--------------------------------

Date: 2026-01-21

[Amend] Statement of acquisition of beneficial ownership by individuals - Form SCHEDULE 13G/A[Amend] Statement of acquisition of beneficial ownership by individuals - Form SCHEDULE 13G/A

--------------------------------

Date: 2026-01-20

Hudbay Minerals: Low-Cost Copper Exposure With Copper World Upside2026-01-20 16:46:17 ET Introduction Hudbay Minerals Inc. ( HBM ) is a copper mi...

--------------------------------

Date: 2026-01-16

Report of foreign private issuer pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934 - Form 6-KReport of foreign private issuer pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange ...

--------------------------------

Date: 2026-01-16

Hudbay Announces Preliminary 2025 Production Results and Achieves 2025 Consolidated Copper and Gold Production Guidance

Hudbay Announces Preliminary 2025 Production Results and Achieves 2025 Consolidated Copper and Gold Production GuidanceTORONTO, Jan. 16, 2026 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the &...

--------------------------------

Date: 2026-01-13

Canadian Companies Moving the Markets, Morning editionTue, Jan 13, 2026 as of 10.00 am ET

A look at the top 10 most actives in Canada Vanguard Mining Corp. (UUU) fell 4.8% to $0.2 on vo...

--------------------------------

Date: 2026-01-13

Semiconductor sales jump 21% Y/Y backed by AI surge, Gartner says2026-01-13 02:39:25 ET More on semiconductors SMH: Micron Boosts AI Momentum Beyond...

--------------------------------

Date: 2026-01-12

Hudbay Announces Closing of $600 Million Strategic Investment from Mitsubishi Corporation for 30% Joint Venture Interest in Copper World

Hudbay Announces Closing of $600 Million Strategic Investment from Mitsubishi Corporation for 30% Joint Venture Interest in Copper WorldTORONTO, Jan. 12, 2026 (GLOBE NEWSWIRE) -- Hudbay Minerals Inc. (“Hudbay” or the &...

--------------------------------

Date: 2026-01-02

Micron's Quiet Pricing Power Is Reshaping The AI Boom2026-01-02 14:04:46 ET Elevator Thesis Micron Technology, Inc. ( MU ) stock has...

--------------------------------

Date: 2025-12-25

As Copper Prices Soar, Hudbay Minerals Has The Look Of A Winner2025-12-25 11:18:37 ET Back in April, I initiated coverage on Hudbay Minerals ( HBM ...

--------------------------------

Date: 2025-12-22

Copper roars toward $12,000 in 2025 record rally-meet the stocks riding the boom2025-12-22 06:00:48 ET Read the full article on Seeking Alpha For further details s...

--------------------------------

Date: 2025-12-16

Report of foreign private issuer pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934 - Form 6-KReport of foreign private issuer pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange ...

--------------------------------

Date: 2025-12-16

Copper Price Breakout: 4 Stocks Riding The Red Metal Rally2025-12-16 05:00:00 ET ... Read the full article on Seeking Alpha For further d...

--------------------------------

Date: 2025-12-15

Report of exempt distribution (45-106F1)--------------------------------

Date: 2025-12-12

Capital Demands Soar For New Copper Supply2025-12-12 04:10:00 ET ... Read the full article on Seeking Alpha For further d...

--------------------------------

Date: 2025-12-03

Notice of proposed sale of securities pursuant to Rule 144 - Form 144Notice of proposed sale of securities pursuant to Rule 144 - Form 144

--------------------------------

Date: 2025-12-03

Eby's 'Look West' Turns Blind Eye to the Similkameen; BC Ignores First Nations in Rushed New Ingerbelle Mine Decision Beside and Below RiverEby's 'Look West' Turns Blind Eye to the Similkameen; BC Ignores First Nations in Rushed New Inge...

--------------------------------

Date: 2025-12-01

Hudbay Minerals: A Cyclical Copper Player With Strong Fundamentals2025-12-01 05:20:50 ET Hudbay Minerals ( HBM ) had painful Q3 and from the ...

--------------------------------

Date: 2025-11-20

Invesco Small Cap Value Fund Q3 2025 Performance Review2025-11-20 10:19:00 ET ... Read the full article on Seeking Alpha For further d...

--------------------------------

Date: 2025-11-19

Notice of proposed sale of securities pursuant to Rule 144 - Form 144Notice of proposed sale of securities pursuant to Rule 144 - Form 144

--------------------------------

Date: 2025-11-14

[Amend] Statement of acquisition of beneficial ownership by individuals - Form SCHEDULE 13G/A[Amend] Statement of acquisition of beneficial ownership by individuals - Form SCHEDULE 13G/A

--------------------------------

Date: 2025-11-13

Report of foreign private issuer pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange Act of 1934 - Form 6-KReport of foreign private issuer pursuant to Rule 13a-16 or 15d-16 under the Securities Exchange ...

--------------------------------

Date: 2025-11-12

Hudbay Minerals Inc. (HBM:CA) Q3 2025 Earnings Call Transcript2025-11-12 17:41:32 ET Hudbay Minerals Inc. (HBM:CA) Q3 2025 Earnings Call November 12, 202...

--------------------------------

Date: 2025-11-12

Hudbay Minerals earnings follo2025-11-12 12:58:40 ET More on Hudbay Minerals Hudbay Minerals Presents at Goldman ...

--------------------------------

Date: 2025-11-12

52-109F2 - Certification of interim filings - CFO--------------------------------

Investment Disclosure

Many of the companies on this website and in our videos are clients of Mine$tockers Inc. The information is disseminated on behalf of the companies and Mine$tockers as its employees may own or purchase the company's securities from time to time. Mine$tockers Inc.is neither an investment adviser nor a broker-dealer and accordingly is not registered as an investment adviser or a broker-dealer under applicable law. The Mine$tockers website provides readers with general, non-personalized information regarding private and publicly traded companies and why we may have become retail investors. The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada

kevin@MineStockers.com

Phone

+1 (905) 967-2519