Date: 2026-01-30

Nuvau Minerals Announces up to $20 Million Brokered Private Placement

Nuvau Minerals Announces up to $20 Million Brokered Private PlacementNOT FOR DISTRIBUTION TO U.S. NEWSWIRE SERVICES OR FOR DISSEMINATION IN THE UNITED STATES TORON...

--------------------------------

Date: 2026-01-30

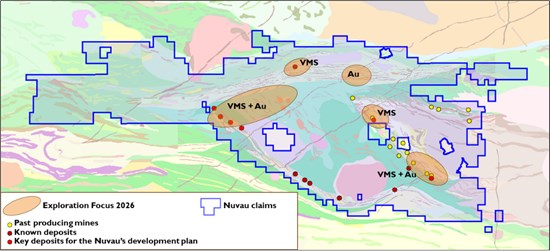

Nuvau Provides Corporate Update and Strategy for 2026

Nuvau Provides Corporate Update and Strategy for 2026Building on exploration success at flagship Matagami project Toronto, Ontario--(Newsfile Corp. -...

--------------------------------

Date: 2026-01-14

Newmont, Freeport-McMoRan, Corteva lead Seeking Alpha quant picks going into Q4 earnings2026-01-14 06:14:10 ET More on basic materials, Where To Find Outperformance In 202...

--------------------------------

Date: 2026-01-13

VFMO: Reasonably Valued And Very Diversified Momentum ETF2026-01-13 11:14:48 ET VFMO strategy Vanguard U.S. Momentum Factor ETF ( VFMO )...

--------------------------------

Date: 2026-01-13

Materials stocks with strongest earnings momentum heading into reporting season2026-01-13 10:16:32 ET More on Materials Where To Find Outperformance In 2026 ...

--------------------------------

Date: 2026-01-13

Undercovered Dozen: Chevron, Coherent, Barrick Mining And More2026-01-13 08:13:05 ET The Undercovered Dozen is a weekly Seeking Alpha editor-curated ...

--------------------------------

Date: 2026-01-12

Gold skies to new all-time high as Federal Reserve threat rattles markets2026-01-12 07:38:36 ET More on gold and silver Gold's Been On A Tear - If You're Go...

--------------------------------

Date: 2026-01-08

Gold Mining Stocks: Winners And Losers At The Start Of 20262026-01-08 14:57:55 ET ... Read the full article on Seeking Alpha For further d...

--------------------------------

Date: 2026-01-08

One Of My 2026 Top Picks: Newmont, A Gold And Copper Miner2026-01-08 03:21:18 ET Investment Thesis It is no secret now, gold has been in a bu...

--------------------------------

Date: 2026-01-07

BofA's stocks for the January 'dash to trash'2026-01-07 08:51:19 ET More on iShares MSCI USA Quality Factor ETF QUAL Is High Qua...

--------------------------------

Date: 2026-01-06

Barrick Mining: Rating It A Hold With One Better Alternative2026-01-06 14:52:22 ET Investment Thesis I currently don’t hold any gold, nor do...

--------------------------------

Date: 2026-01-06

VAW: A Materials ETF With An Edge2026-01-06 00:02:46 ET Fast Facts Vanguard Materials Index Fund ETF Shares ( ...

--------------------------------

Date: 2026-01-03

GDX: All-In Sustaining Margins Are The Story2026-01-03 07:53:35 ET What a year it was for gold in 2025. The metal gained 65% for th...

--------------------------------

Date: 2026-01-02

SPYM: S&P 500 Monthly Dashboard For January2026-01-02 07:47:25 ET Fast facts on SPYM Read the full article on Seeking Al...

--------------------------------

Date: 2025-12-31

S&P 500 finishes with +16% gains in 2025, U.S. stocks see double-gains YTD2025-12-31 16:07:57 ET More on the markets Our Readers' Expectations Of A Stock Mar...

--------------------------------

Date: 2025-12-31

Stocks open little changed on the last day of 2025 trading2025-12-31 09:44:25 ET More on the markets Our Readers' Expectations Of A Stock Mar...

--------------------------------

Date: 2025-12-30

Newmont: Average On The Cost Curve, But Above Average Upside Potential2025-12-30 12:53:28 ET Gold is the main thing that drives Newmont's business ...

--------------------------------

Date: 2025-12-29

U.S. stocks end lower to start the New Year's shortened week2025-12-29 16:03:00 ET More on the markets The Market Risk In 2026 If Growth Projec...

--------------------------------

Date: 2025-12-29

Wall Street opens lower to start the New Year's shortened week2025-12-29 09:40:16 ET More on the markets The Market Risk In 2026 If Growth Projec...

--------------------------------

Date: 2025-12-28

NUGT: A Good Supplement To GDX, But Not A Long-Term Holding2025-12-28 11:17:17 ET The Direxion Daily Gold Miners Index Bull 2X Shares ETF ( NUGT...

--------------------------------

Date: 2025-12-27

SA Asks: What's the best gold play right now for investors?2025-12-27 12:00:42 ET More on SPDR® Gold Shares ETF Magnificent Metals ...

--------------------------------

Date: 2025-12-24

China's Jiangxi Copper to buy SolGold in $1 billion deal2025-12-24 09:48:09 ET More on Jiangxi Copper Company, SolGold SolGold surges after...

--------------------------------

Date: 2025-12-21

Galiano Gold: Abore Might Be A Game Changer, Hold For Now2025-12-21 22:03:07 ET Galiano Gold ( GAU ) is one of those companies that looks mo...

--------------------------------

Date: 2025-12-19

BCX: Mining Companies Outperform In 2025, Poised To Continue In 20262025-12-19 14:36:53 ET ... Read the full article on Seeking Alpha For further d...

--------------------------------

Date: 2025-12-18

Top 30 gold stocks YTD as investors continue to be bullish on the safe haven into 20262025-12-18 12:24:20 ET More on SPDR® Gold Shares ETF India Gold Market Update:...

--------------------------------

Date: 2025-12-18

Materials have been a sluggish sector in 2025 but these 10 stocks have stood out2025-12-18 10:12:42 ET More on markets Apollo highlights stagflation concerns as th...

--------------------------------

Date: 2025-12-18

Gold soared 65% this year-here are the stocks that rode the rally2025-12-18 06:08:11 ET Read the full article on Seeking Alpha For further details s...

--------------------------------

Investment Disclosure

Many of the companies on this website and in our videos are clients of Mine$tockers Inc. The information is disseminated on behalf of the companies and Mine$tockers as its employees may own or purchase the company's securities from time to time. Mine$tockers Inc.is neither an investment adviser nor a broker-dealer and accordingly is not registered as an investment adviser or a broker-dealer under applicable law. The Mine$tockers website provides readers with general, non-personalized information regarding private and publicly traded companies and why we may have become retail investors. The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada

kevin@MineStockers.com

Phone

+1 (905) 967-2519