The Growcer

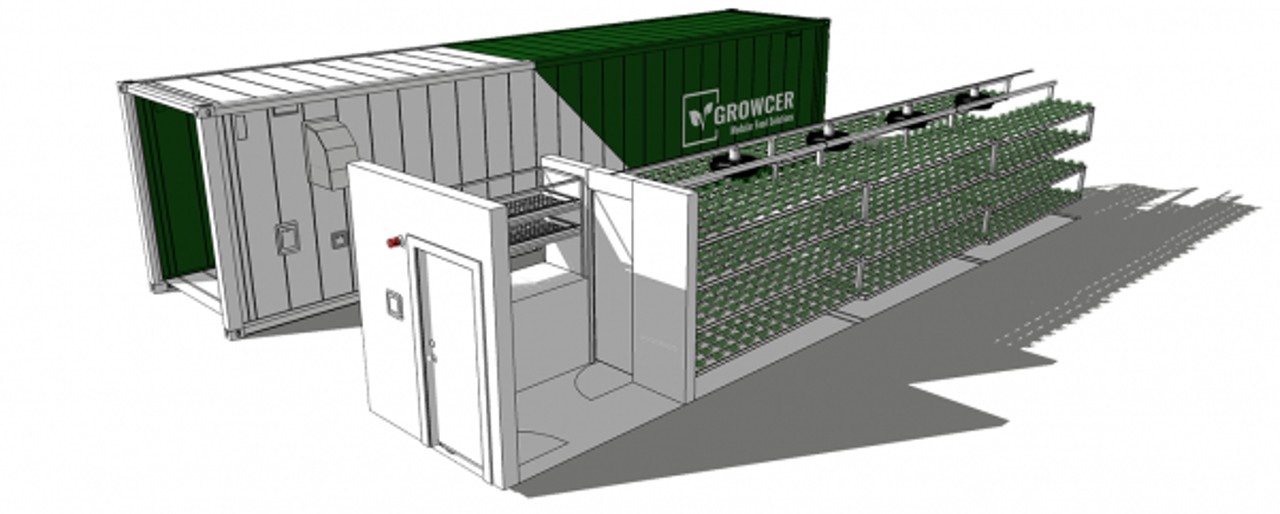

Ottawa-based company Growcer, founded by Alida Burke and Corey Ellis, aims to tackle the high cost and poor quality of produce in remote areas. They have developed hydroponic farms housed in 40-foot containers that can adapt to a range of climates, from Arctic tundra to urban parking lots. These innovative systems use just 5% of the water needed in traditional farming and can produce enough vegetables to feed up to 110 people a day. The company's network has already grown about 5 million servings of vegetables as of June 2023. The hydroponic farms serve multiple purposes, from providing fresh produce in isolated communities to helping existing farmers diversify their income. They have also attracted interest from small grocery chains, which have set up these container farms in their parking lots to reduce transportation costs and prices for consumers. Community groups are using the technology to engage youth, reintegrate marginalized individuals, and stock local food banks with fresh produce. Initially bootstrapped and later backed by Business Development Bank of Canada (BDC), Growcer has evolved from licensing another company's technology to developing its original product. The company has been cautious in its financial planning, even turning down a $250,000 investment offer from CBC’s Dragons' Den in 2019. By 2022, however, they had attracted 25 angel investors and expanded into new farming technologies. The primary challenge Growcer faces is the $300,000 financial barrier for prospective clients, as the technology doesn’t fit easily into traditional financing categories. Despite this, the founders remain committed to their mission of reducing food insecurity in remote communities, and they expect that the technology will become more financially accessible as it gains broader recognition.Investment Disclosure

The content provided on this website and in Mine$tockers episodes is for informational purposes only and should not be considered as an offer, solicitation, recommendation, or determination by Mine$tockers Inc. for the sale of any financial product or service or the suitability of an investment strategy for any investor.

Investors are advised to consult a financial professional to determine the appropriateness of an investment strategy based on their objectives, financial situation, investment horizon, and individual needs. This information is not intended to serve as financial, tax, legal, accounting, or other professional advice, as such advice should always be tailored to individual circumstances.

The products discussed herein are not insured by any government agency and carry risks, including the potential loss of the principal amount invested. Any information provided is based on both internal and external sources and should not be construed as an endorsement or conclusion regarding a company's financial prospects, resources, or management. Opinions expressed may change and should not be relied upon. It is crucial to seek personalized investment advice for your unique situation.

Natural resources investments are generally volatile, with higher headline risk than other sectors. They tend to be more sensitive to economic data, political and regulatory events, and underlying commodity prices. The prices of natural resources investments are influenced by factors such as the costs of underlying commodities like oil, gas, metals, and coal. These investments may trade on various exchanges and experience price fluctuations due to short-term demand, supply, and investment flows.

Natural resource investments often respond more sensitively to global events and economic data, including natural disasters, political turmoil, pandemics, or the release of employment data.

Investing in foreign markets may carry greater risks than domestic markets, including political, currency, economic, and market risks. It is essential to evaluate if trading in low-priced and international securities is appropriate for your circumstances and financial resources. Past performance does not guarantee future results.

Mine$tockers Inc., its affiliates, family, friends, employees, associates, and others may hold positions in the securities it covers. Some of the companies covered may be paying clients of the production.

No investment process is risk-free, and profitability is not guaranteed; investors may lose their entire investment. No investment strategy or risk management technique can guarantee returns or eliminate risk in any market environment. Diversification does not ensure a profit or protect against loss. Investing in foreign securities involves risks not associated with domestic investments, such as currency fluctuations, political and economic instability, and differing accounting standards, potentially leading to greater share price volatility. The prices of small- and mid-cap company stocks generally experience higher volatility than large-company stocks and may involve higher risks. Smaller companies may lack the management expertise, financial resources, product diversification, and competitive strengths needed to withstand adverse economic conditions.

Studio

Toronto Ontario Canada

info@MineStockers.com

Phone

+1 (905) 967-2519